Former Federal Reserve Chair Ben Bernanke (now a Distinguished Fellow in Residence at the Brookings Institution in Washington, DC), Douglas Diamond of the University of Chicago, and Philip Dybvig of Washington University in St. Louis shared the 2022 Nobel Prize in Economics (formally called the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel). The prize of 10 million Swedish kronor (about 8.85 million U.S. dollars) was awarded for “significantly [improving] our understanding of the role of banks in the economy, particularly during financial crises.” (The press release from the Nobel committee can be read here.)

In paper published in the American Economic Review in 1983, Bernanke provided an influential interpretation of the role the bank panics of the early 1930s played in worsening the severity of the Great Depression. As we discuss in Macroeconomics, Chapter 14, Section 14.3 (Economics, Chapter 24, Section 24.3), by taking deposits and making loans banks play an important in the money supply process. Milton Friedman and Anna Schwartz in A Monetary History of the United States, 1867-1960, Chapter 7, argued that the bank panics of the early 1930s caused a decline in real GDP and employment largely through the mechanism of reducing the money supply.

Bernanke demonstrated that the bank failures affected output and employment in another important way. As we discuss in Macroeconomics, Chapter 6, Section 6.2 and Chapter 14, Section 14.4 (Economics, Chapter 8, Section 8.2 and Chapter 24, Section 24.4) banks are financial intermediaries who engage in indirect finance. Banks accept deposits and use the funds to make loans to households and firms. Households and most firms can’t raise funds through direct finance by selling bonds or stocks to individual investors because investors don’t have enough information about households or all but the largest firms to know whether these borrowers will repay the funds. Banks get around this information problemby specializing in gathering information on households and firms that allow them to gauge how likely a borrower is to default, or stop paying, on a loan.

Because of the special role banks have in providing credit to households and firms that have difficulty borrowing elsewhere, Bernanke argued that the bank panics of the early 1930s, during which more than 5,000 banks in the United States went out of business, not only caused a reduction in the money supply but restricted the ability of households and firms to borrow. As a result, households and firms decreased their spending, which increased the severity of the Great Depression.

In a 1983 paper published in the Journal of Political Economy, Diamond and Dybvig presented what came to be known as the Diamond and Dybvig model of the economic role of banks. This model, along with later research by Diamond, provided economists with a better understanding of the potential instability of banking. Diamond and Dybvig note that banking involves transforming long-run, illiquid assets—loans—into short-run, liquid assets—deposits. Recall that liquidity is the ease with which an asset can be sold. Households and firms want the loans they receive from a bank to be illiquid in the sense that they don’t want the bank to be able to demand that the funds borrowed be repaid, except on a set schedule. Someone receiving a mortgage loan to buy a house wouldn’t want the bank to be able to insist on being paid back any time the bank chose. But households and firms also want the assets they hold to be liquid so that they can quickly convert the assets into money if they need the funds. By taking in deposits and using the funds to make loans, banks provide a service to households and firms by providing both a source of long-run credit and a source of short-term assets.

But Diamond and Dybvig note that because banks hold long-terms assets that can’t easily be sold, if a large number of people attempt simultaneously to withdraw their deposits, the banks lack the funds to meet these withdrawals. The result is a run on a bank as depositors become aware that unless they quickly withdraw their deposits, they may not receive their funds for a considerable time. If the bank is insolvent—the value of its loans and other assets is less than the value of its deposits and other liabilities—the bank may fail and some households and firms will never receive the full value of their deposits. In the Diamond and Dybvig model, if depositors expect that other depositors will not withdraw their funds, the system can be stable because banks won’t experience runs. But because banks know more about the value of their assets and liabilities than depositors do, depositors may have trouble distinguishing solvent banks from insolvent banks. As a result of this information problem, households and firms may decide to withdraw their deposits even from solvent banks. Households and firms may withdraw their deposits from a bank even if they know with certainty that the bank is solvent if they expect that other households and firms—who may lack this knowledge—will withdraw their deposits. The result will be a bank panic, in which many banks simultaneously experience a bank run.

With many banks closing or refusing to make new loans in order to conserve funds, households and firms that depend on bank loans will be forced to reduce their spending. As a result, production and employment will decline. Falling production and employment may cause more borrowers to stop paying on their loans, which may cause more banks to be insolvent, leading to further runs, and so on. We illustrate this process in Figure 14.3.

Diamond and Dybvig note that a system of deposit insurance—adopted in the United States when Congress established the Federal Deposit Insurance Corporation (FDIC) in 1934—or a central bank acting as a lender of last resort to banks experiencing runs are necessary to stabilize the banking system. When Congress established the Federal Reserve System in 1914, it gave the Fed the ability to act as a lender of last resort by making discount loans to banks that were solvent but experiencing temporary liquidity problems as a result of deposit withdrawals.

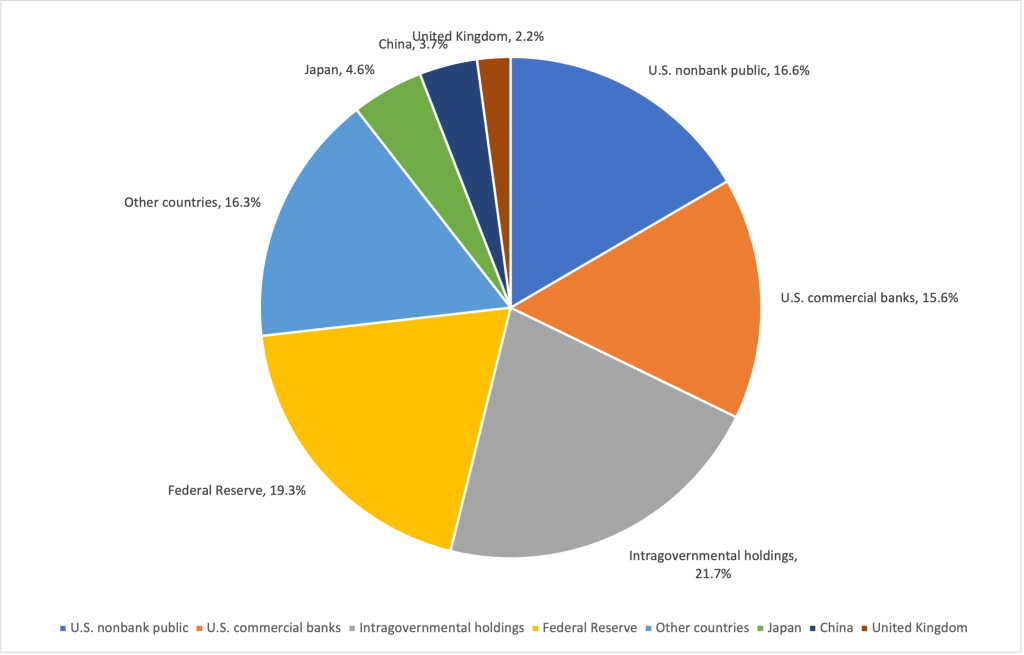

During the Global Financial Crisis that began in 2007 and accelerated following the failure of the Lehman Brothers investment bank in September 2008, it became clear that the financial firms in the shadow banking system could also be subject to runs because, like commercial banks, shadow banks borrow short term to financial long term investments. Included in the shadow banking system are money market mutual funds, investment banks, and insurance companies. By 2008 the size of the shadow banking system had grown substantially relative to the commercial banking system. The shadow banking system turned out to be more fragile than the commercial banking system because those lending to shadow banks by, for instance, buying money market mutual fund shares, do not receive government insurance like bank depositors receive from the FDIC and because prior to 2008 the Fed did not act as a lender of last resort to shadow banks.

Bernanke believes that his study of financial problems the U.S. experienced during the Great Depression helped him as Fed chair to deal with the Global Financial Crisis. In particular, Bernanke concluded from his research that in the early 1930s the Fed had committed a major error in failing to act more vigorously as a lender of last resort to commercial banks. The result was severe problems in the U.S. financial system that substantially worsened the length and severity of the Great Depression. During the financial crisis, under Bernanke’s leadership, the Fed established several lending facilities that allowed the Fed to extend its role as a lender of last resort to parts of the shadow banking system. (In 2020, the Fed under the leadership of Chair Jerome Powell revived and extended these lending facilities.) Bernanke is rare among economists awarded the Nobel Prize in having had the opportunity to implement lessons from his academic research in economic policymaking at the highest level. (Bernanke discusses the relationship between his research and his policymaking in his memoir. A more complete discussion of the financial crises of the 1930s, 2007-2009, and 2020 appears in Chapter 14 of our textbook Money, Banking, and the Financial System, Fourth Edition.)

We should note that Bernanke’s actions at the Fed have been subject to criticism by some economists and policymakers. As a member of the Fed’s Board of Governors beginning in 2002 and then as Fed chair beginning in 2006, Bernanke, like other members of the Fed and most economists, was slow to recognize the problems in the shadow banking system and, particularly, the problems caused by the rapid increase in housing prices and increasing number of mortgages being granted to borrowers who had either poor credit histories or who made small down payments. Some economists and policymakers also argue that Bernanke’s actions during the financial crisis took the Fed beyond the narrow role of stabilizing the commercial banking system spelled out by Congress in the Federal Reserve Act and may have undermined Fed independence. They also argue that by broadening the Fed’s role as a lender of last resort to include shadow banks, Bernanke may have increased the extent of moral hazard in the financial system.

Finally, Laurence Ball of Johns Hopkins University argues that the worst of the financial crisis could have been averted if Bernanke had acted to save the Lehman Brothers investment bank from failing by making loans to Lehman. Bernanke has argued that the Fed couldn’t legally make loans to Lehman because the firm was insolvent but Ball argues that, in fact, the firm was solvent. Decades later, economists continue to debate whether the Fed’s actions in allowing the Bank of United States to fail in 1930 were appropriate and the debate over the Fed’s actions with respect to Lehman may well last as long. (A working paper version of Ball’s argument can be found here. He later extended his argument in a book. Bernanke’s account of his actions during the failure of Lehman Brothers can be found in his memoir cited earlier.)

Sources: Paul Hannon, “Nobel Prize in Economics Winners Include Former Fed Chair Ben Bernanke,” Wall Street Journal, October 10, 2022; David Keyton, Frank Jordans, and Paul Wiseman, “Former Fed Chair Bernanke Shares Nobel for Research on Banks,” apnews.com, October 10, 2022; and Greg Ip, “Most Nobel Laureates Develop Theories; Ben Bernanke Put His Into Practice,” Wall Street Journal, October 10, 2022.