Congress has given the Fed a mandate to achieve the goal of price stability. Until 2012, the Fed had never stated explicitly how they would measure whether they had achieved this goal. One interpretation of price stability is that the price level remains constant. But a constant price level would be very difficult to achieve in practice and the Fed has not attempted to do so. In 2012, the Fed, under then Chair Ben Bernanke, announced that it was targeting an inflation rate of 2 percent, which it believed was low enough to be consistent with price stability: “When households and businesses can reasonably expect inflation to remain low and stable, they are able to make sound decisions regarding saving, borrowing, and investment, which contributes to a well-functioning economy.” (We discuss inflation targeting in Macroeconomics, Chapter 15, Section 15.5 and Economics, Chapter 25, Section 25.5.)

In August 2020, the Fed announced a new monetary policy strategy that modified how it interpreted its inflation target: “[T]he Committee seeks to achieve inflation that averages 2 percent over time, and therefore judges that, following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.” The Fed’s new approach is sometimes referred to as average inflation targeting (AIT) because the Fed attempts to achieve its 2 percent target on average over a period of time, although the Fed has not explicitly stated how long the period of time may be. In other words, the Fed hasn’t indicated the time horizon during which it intends inflation to average 2 percent.

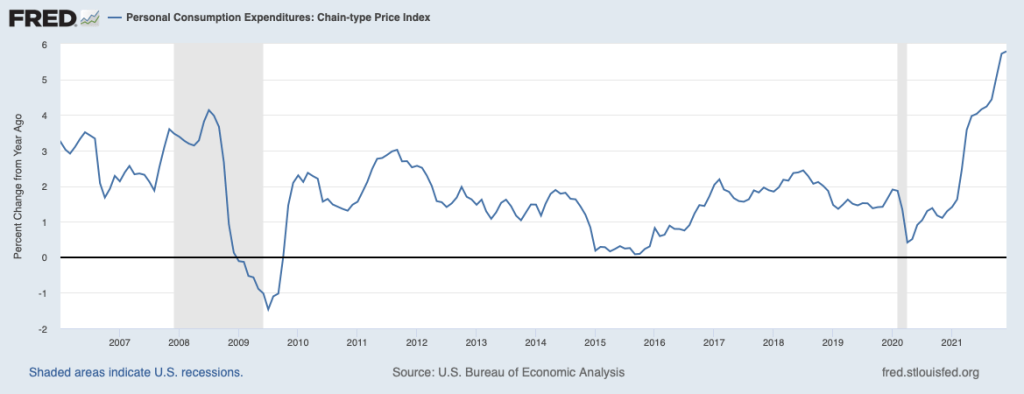

The Fed uses changes in the personal consumption expenditure (PCE) price index to measure inflation, rather than using changes in the consumer price index (CPI). The Fed prefers the PCE to the CPI because the PCE is a broader measure of the price level in that it includes the prices of more consumer goods and services than does the CPI. The following figure shows inflation for the period since 2006 measured by percentage changes in the PCE from the corresponding month in the previous year. (Members of the Fed’s Federal Open Market Committee generally consider changes in the core PCE—which excludes the prices of food and energy—to be the best measure of the underlying rate of inflation. But because the Fed’s inflation target is stated in terms of the PCE rather than the core PCE, we are looking here only at the PCE.) The figure shows that for most of the period from 2012 to early 2021, inflation was less than the Fed’s target of 2 percent.

The figure also shows that since March 2021, inflation has been running above 2 percent and has steadily increased, reaching a rate of 5.8 percent in December 2021. Note that a strict interpretation of AIT would mean that the Fed would have to balance these inflation rates far above 2 percent with future inflation rates well below 2 percent. As Ricardo Reis, an economist at the London School of Economics, noted recently: “If the [Fed’s time] horizon is 3 years, the Fed … will [have to] pursue monetary policy to achieve annual inflation of… −0.5% over the next year and a half. If the horizon is 5 years, the Fed … will [have to] pursue policy to achieve annual inflation of 0.9% over the next 3.5 years.” It seems unlikely that the Fed would want to bring about inflation rates that low because doing so would require raising its target for the federal funds rate to levels likely to cause a recession.

Another interpretation of the Fed’s monetary policy strategy is that involves a flexible average inflation target (FAIT) approach rather than a strictly AIT approach. Former Fed Vice Chair Richard Clarida discussed this interpretation of the Fed’s strategy in a speech in November 2020. He noted that the framework was asymmetric, meaning that inflation rates higher than 2 percent need not be offset with inflation rates lower than 2 percent: “The new framework is asymmetric. …[T]he goal of monetary policy … is to return inflation to its 2 percent longer-run goal, but not to push inflation below 2 percent.” And: “Our framework aims … for inflation to average 2 percent over time, but it does not make a … commitment to achieve … inflation outcomes that average 2 percent under any and all circumstances ….”

Under this interpretation, particularly if Fed policymakers believe that the high inflation rates of 2021 were the result of temporary supply chain problems and other factors caused by the pandemic, it would not need to offset them by forcing inflation to very low levels in order to make the average inflation rate over time equal 2 percent. Critics of the FAIT approach to monetary policy note that the approach doesn’t provide investors, household, and firms with much guidance on what inflation rates the Fed may find acceptable over the short-term of a year or so. In that sense, the Fed is moving away from a rules-based policy, such as the Taylor rule that we discuss in Chapter 15. Or, as a columnist for the Wall Street Journal wrote with respect to FAIT: “Of course, the word ‘flexible’ is there because the Fed doesn’t want to be tied down, so it can do anything.”

The Fed’s actions during 2022 will likely provide a better understanding of how it intends to implement its new monetary policy strategy during conditions of high inflation.

Sources: Board of Governors of the Federal Reserve, “Why does the Federal Reserve aim for inflation of 2 percent over the longer run?” federalreserve.gov, August 27, 2020; Board of Governors of the Federal Reserve, “2020 Statement on Longer-Run Goals and Monetary Policy Strategy,” federalreserve.gov, January 14, 2021; Ricardo Reis’s comments are from this Twitter thread: https://mobile.twitter.com/R2Rsquared/status/1488552608981827590, Richard H. Clarida, “The Federal Reserve’s New Framework: Context and Consequences,” federalreserve.gov, November 16, 2020; and James Mackintosh, “On Inflation Surge, the Fed Is Running Out of Excuses,” Wall Street Journal, November 14, 2021.