Photo courtesy of Lena Buonanno.

The latest significant piece of macroeconomic data that will be available to the Federal Reserve’s policy-making Federal Open Market Committee (FOMC) before it concludes its meeting tomorrow is the report on the Employment Cost Index (ECI), released this morning by the Bureau of Labor Statistics (BLS). As we’ve noted in earlier posts, as a measure of the rate of increase in labor costs, the FOMC prefers the ECI to average hourly earnings (AHE) .

The AHE is calculated by adding all of the wages and salaries workers are paid—including overtime and bonus pay—and dividing by the total number of hours worked. As a measure of how wages are increasing or decreasing during a particular period, AHE can suffer from composition effects because AHE data aren’t adjusted for changes in the mix of occupations workers are employed in. For example, during a period in which there is a decline in the number of people working in occupations with higher-than-average wages, perhaps because of a downturn in some technology industries, AHE may show wages falling even though the wages of workers who are still employed have risen. In contrast, the ECI holds constant the mix of occupations in which people are employed. The ECI does have the drawback, that it is only available quarterly whereas the AHE is available monthly.

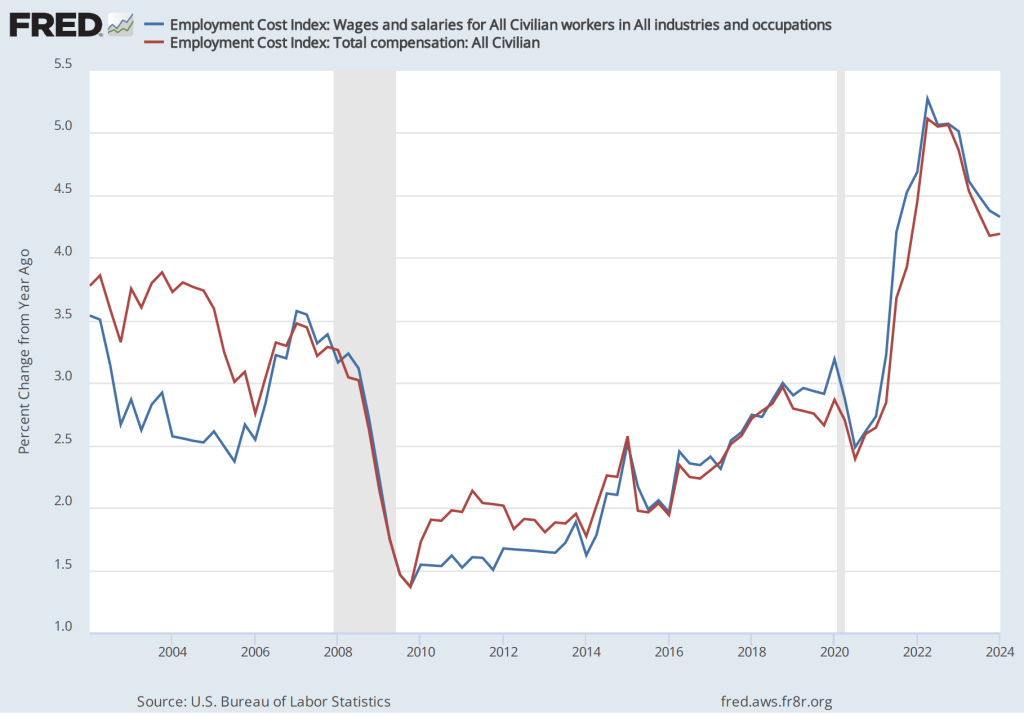

The data released this morning indicate that labor costs continue to increase at a rate that is higher than the rate that is likely needed for the Fed to hit its 2 percent price inflation target. The following figure shows the percentage change in the employment cost index for all civilian workers from the same quarter in 2023. The blue line looks only at wages and salaries while the red line is for total compensation, including non-wage benefits like employer contributions to health insurance. The rate of increase in the wage and salary measure decreased slightly from 4.4 percent in the fourth quarter of 2023 to 4.3 percent in the first quarter of 2024. The rate of increase in compensation was unchanged at 4.2 percent in both quarters.

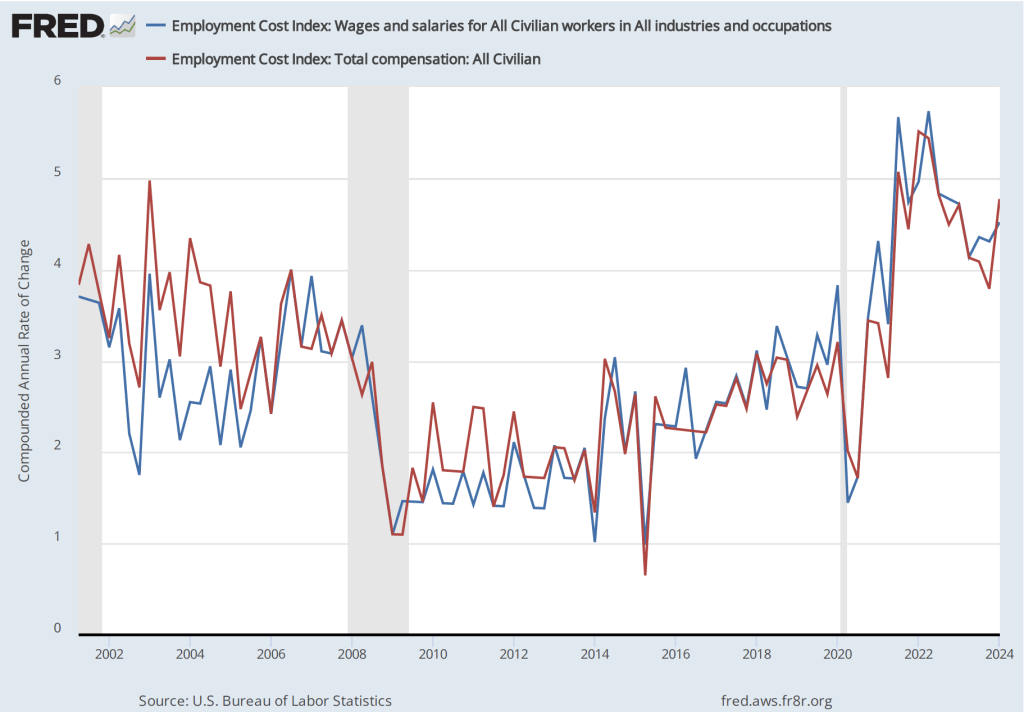

If we look at the compound annual growth rate of the ECI—the annual rate of increase assuming that the rate of growth in the quarter continued for an entire year—we find that the rate of increase in wages and salaries increased from 4.3 percent in the fourth quarter of 2023 to 4.5 percent in the first quarter of 2024. Similarly, the rate of increase in compensation increased from 3.8 percent in the third quarter of 2023 to 4.5 percent in the first quarter of 2024.

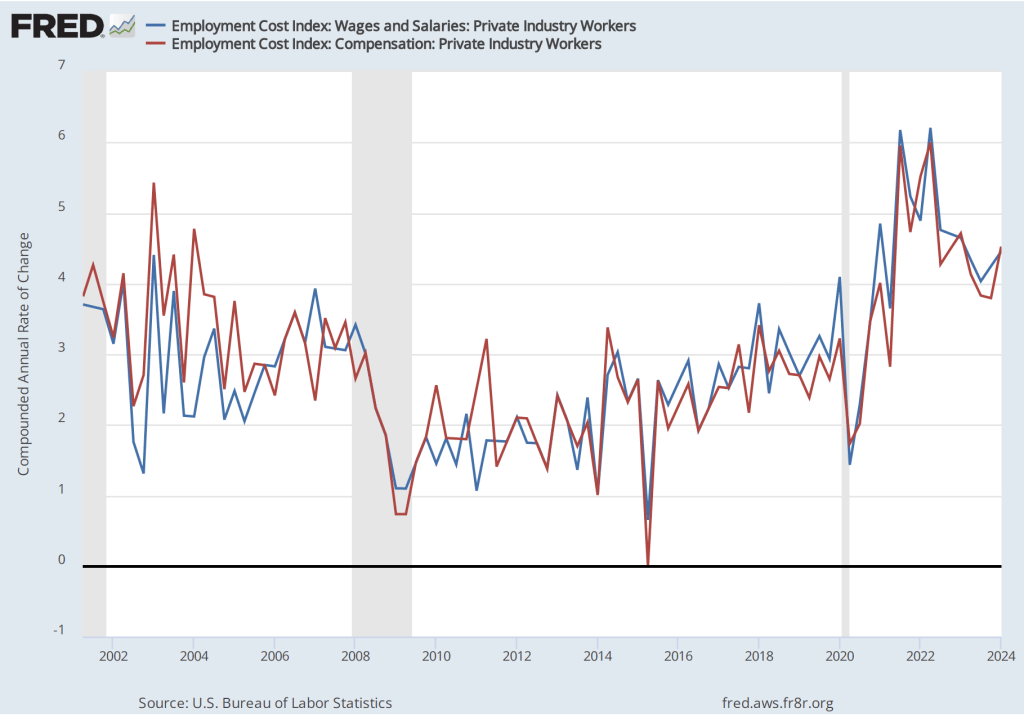

Some economists and policymakers prefer to look at the rate of increase in ECI for private industry workers rather than for all civilian workers because the wages of government workers are less likely to respond to inflationary pressure in the labor market. The first of the following figures shows the rate of increase of wages and salaries and in total compensation for private industry workers measured as the percentage increase from the same quarter in the previous year. The second figure shows the rate of increase calculated as a compound growth rate.

The first figure shows a slight decrease in the rate of growth of labor costs from the fourth quarter of 2023 to the first quarter of 2024, while the second figure shows a fairly sharp increase in the rate of growth.

Taken together, these four figures indicate that there is little sign that the rate of increase in employment costs is falling to a level consistent with a 2 percent inflation rate. At his press conference tomorrow afternoon, following the conclusion of the FOMC’s meeting, Fed Chair Jerome Powell will give his thoughts on the implications for future monetary policy 0f recent macroeconomic data.