Join authors Glenn Hubbard and Tony O’Brien as they review the collapse of Silicon Valley Bank (SVB) in the context of a classic bank run. What lessons can be learned to avoid other bank collapses in this unchartered economic territory? Will this become a contagion? Or, is it simply an example of a bank searching for additional return in an uncertain economic world? Our discussion covers these points but you can also check for updates on our blog post that can be found HERE.

Category: Ch24: Money, Banks, and the Federal Reserve System

An Old-Fashioned Bank Run: The Collapse of Silicon Valley Bank [This post will be updated as new information becomes available. Updated Monday morning March 13.]

Photo from the Wall Street Journal

Rumors spread about the financial state of a bank. Some depositors begin to withdraw funds from their accounts. Suddenly a wave of withdrawals occurs and regulators step in and close the bank. A description of a run on a bank in New York City in the fall of 1930? No. This happened to Silicon Valley Bank, headquartered in Santa Clara, California and the sixteenth largest bank in the United States, on Friday, March 10, 2023.

Background on Bank Runs

In Macroeconomics, Chapter 14, Section 14.4 (Economics, Chapter 24, Section 24.4) we describe the basic reasons why a run on a bank may occur. We describe bank runs in greater detail in Money, Banking, and the Financial System, Chapter 12. We reproduce here a key paragraph on the underlying fragility of commercial banking from Chapter 12 of the money and banking text:

The basic activities of commercial banks are to accept short-term deposits, such as checking account deposits, and use the funds to make loans—including car loans, mortgages, and business loans—and to buy long-term securities, such as municipal bonds. In other words, banks borrow short term from depositors and lend, often long term, to households, firms, and governments. As a result, banks have a maturity mismatch because the maturity of their liabilities—primarily deposits—is much shorter than the maturity of their assets—primarily loans and securities. Banks are relatively illiquid because depositors can demand their money back at any time, while banks may have difficulty selling the loans in which they have invested depositors’ money. Banks, therefore, face liquidity risk because they can have difficulty meeting their depositors’ demands to withdraw their money. If more depositors ask to withdraw their money than a bank has money on hand, the bank has to borrow money, usually from other banks. If banks are unable to borrow to meet deposit withdrawals, then they have to sell assets to raise the funds. If a bank has made loans and bought securities that have declined in value, the bank may be insolvent, which means that the value of its assets is less than the value of its liabilities, so its net worth, or capital, is negative. An insolvent bank may be unable to meet its obligations to pay off its depositors.

The Founding of the Fed and the Establishment of the FDIC as a Response to Bank Runs

The instability of the banking system led to a number of financial crises during the 1800s and early 1900s, culminating in the Panic of 1907. Congress responded by passing the Federal Reserve Act in 1913, establishing the Federal Reserve System. The Fed was given the role of lender of last resort, making discount loans to banks that were experiencing deposit runs but that remained solvent. The failure of the Fed to stop the bank panics of the early 1930s led Congress to establish the Federal Deposit Insurance Corporation (FDIC) to ensure deposits in commercial banks, originally up to a limit of $2,500 per deposit, per bank. The current limit is $250,000.

Deposit insurance reduced the likelihood of runs but increased moral hazard in the banking system by eliminating the incentive insured depositors had to monitor the actions of bank managers. In principle, bank managers still have an incentive to avoid making risky loans and other investments for fear of withdrawals by households and firms with deposits that exceed the dollar deposit limit.

Contagion, Moral Hazard, and the Too-Big-to-Fail Policy

But if these depositors fail to monitor risk taking by bank managers or if a bank’s loans and investments decline in price even though they weren’t excessively risky at the time they were made, the FDIC and the Fed face a dilemma. Allowing banks to fail and large depositors to be only partially paid back may set off a process of contagion that results in runs spreading to other banks. Problems in the banking system can affect the wider economy by making it more difficult for households and firms that depend on bank loans to finance their spending. (We discuss the process of contagion in this post on the Diamond-Dybvig model.)

The Fed and the FDIC can stop the process of contagion if they are willing to ensure that large depositors don’t suffer losses. One mechanism to achieve this result is facilitating a merger between an insolvent bank and another bank that agrees to assume responsibility for meeting depositors withdrawals from the insolvent bank. But stopping contagion in this manner with no depositors suffering losses can be interpreted as amounting to deposit insurance having no dollar limit. The result is a further increase in moral hazard in the banking system. When the federal government does not allow large financial firms to fail for fear of damaging the financial system, it is said to be following a too-big-to-fail policy.

Silicon Valley Bank and VCs

Runs on commercial banks have been rare in recent decades, which is why the run on Silicon Valley Bank (SVB) took many people by surprise. As its name indicates, SVB is located in the heart of California’s Silicon Valley and the bank played an important role in the financing of many startups in the area. As such, SVB provided banking services to many venture capital (VC) firms. As we note in Chapter 9, Section 9.2 of the money and banking text, venture capital firms play an important role in providing funding to startup firms:

VCs such as Sequoia Capital, Accel, and Andreessen Horowitz raise funds from investors and invest in small startup firms, often in high-technology industries. In recent years, VCs have raised large amounts from institutional investors, such as pension funds and university endowments. A VC frequently takes a large ownership stake in a startup firm, often placing its own employees on the board of directors or even having them serve as managers. These steps can reduce principal–agent problems because the VC has a greater ability to closely monitor the managers of the firm it’s investing in. The firm’s managers are likely to be attentive to the wishes of a large investor because having a large investor sell its stake in the firm may make it difficult to raise funds from new investors. In addition, a VC avoids the free-rider problem when investing in a firm that is not publicly traded because other investors cannot copy the VC’s investment strategy.

An article on bloomberg.com summarized SVB’s role in Silicon Valley. SVB is

the single most critical financial institution for the nascent tech scene, serving half of all venture-backed companies in the US and 44% of the venture-backed technology and health-care companies that went public last year. And its offerings were vast — ranging from standard checking accounts, to VC investment, to loans, to currency risk management.

Note from this description that SVB acted as a VC—that is, it made investments in startup firms—as well as engaging in conventional commercial banking activities, such as making loans and accepting deposits. The CEO of one startup was quoted in an article in the Wall Street Journal as saying, “For startups, all roads lead to Silicon Valley Bank.” (The Wall Street Journal article describing the run on SVB can be found here. A subscription may be required.)

SVB’s Vulnerability to a Run

As with any commercial bank, the bulk of SVB’s liabilities were short-term deposits whereas the bulk of its assets were long-term loans and other investments. We’ve discussed above that this maturity mismatch means that SVB—like other commercial banks—was vulnerable to a run if depositors withdraw their funds. We’ve also seen that in practice bank runs are very rare in the United States. Why then did SVB experience a run? SVB was particularly vulnerable to a run for two related reasons:

1. Its deposits are more concentrated than is true of a typical bank. Many startups and VCs maintain large checking account balances with SVB. According to the Wall Street Journal, at the end of 2022, SVB had $157 billion in deposits, the bulk of which were in just 37,000 accounts. Startups often initially generate little or no revenue and rely on VC funding to meet their expenses. Most Silicon Valley VCs advised the startups they were invested in to establish checking accounts with SVB.

2. Accordingly, the bulk of the value of deposits at SVB was greater than the $250,000 FDIC insurance limit. Apparently 93 percent to 97 percent of deposits were above the deposit limit as opposed to about 50 percent for most commercial banks.

Economics writer Noah Smith notes that SVB required that startups it was lending to keep their deposits with SVB as a condition for receiving a loan. (Smith’s discussion of SVB can be found on his Substack blog here. A subscription may be required.)

The Reasons for the Run on SVB

When the Fed began increasing its target for the federal funds rate in March 2022 in response to a sharp increase in inflation, longer term interest rates, including interest rates on U.S. Treasury securities, also increased. For example the interest rate on the 10-year Treasury note increased from less than 2 percent in March 2022 to more than 4 percent in March 2023. The interest rate on the 2-year Treasury note increased even more, from 1.5 percent in March 2022 to around 5 percent in March 2023.

As we discuss in the appendix to Macroeconomics, Chapter 6 (Economics, Chapter 8) and in greater detail in Money, Banking, and the Financial System, Chapter 3, the price of a bond or other security equals the present value of the payments the owner of the security will receive. When market interest rates rise, as happened during 2022 and early 2023, the value of the payments received on existing securities—and therefore the prices of these securities—fall. Treasury securities are free from default risk, which is the risk that the Treasury won’t make the interest and principal payments on the security, but are subject to interest-rate risk, which is the risk that the price of security will decrease as market interest rates rise.

As interest rates rose, the value of bonds and other long-term assets that SVB owned fell. The price of an asset on the balance sheet of a firm is said to be marked to market if the price is adjusted to reflect fluctuations in the asset’s market price. However, banking law allows a bank to keep constant the prices of bonds on its balance sheets if it intends to hold the bonds until they mature, at which point the bank will receive a payment equal to the principal of the bond. But if a bank needs to sell bonds, perhaps to meet its liquidity needs as depositors make withdrawals, then the losses on the bonds have to be reflected on the bank’s balance sheet.

SVB’s problems began on Wednesday, March 8 when it surprised Wall Street analysts and the bank’s Silicon Valley clients by announcing that to raise funds it had sold $21 billion in securities at a loss of $1.8 billion. It also announced that it was selling stock to raise additional funds. (SVB’s announcement can be found here.) SVB’s CEO also announced that the bank would borrow an additional $15 billion. Although the CEO stated that the bank was solvent, as an article on fortune.com put it, “Investors didn’t buy it.” In addition to the news that SVB had suffered a loss on its bond sales and had to raise funds, some analysts raised the further concern that the downturn in the technology sector meant that some of the firms that SVB had made loans to might default on the loans.

Problems for SVB compounded the next day, Thursday, March 9, when Peter Theil, a co-founder of PayPal and Founders Fund, a leading VC, advised firms Founders Fund was invested in to withdraw their deposits from SVB. Other VCs began to pull their money from SVB and advised their firms to do the same and a classic bank run was on. Because commercial banks lack the funds to pay off a significant fraction of their depositors over a short period of time, in a run, depositors with funds above the $250,000 deposit insurance limit know that they need to withdraw their funds before other depositors do and the bank is forced to close. This fact makes it difficult for a bank to stop a run once it gets started.

According to an article in the Wall Street Journal, by the end of business on Thursday, depositors had attempted to withdraw $42 billion from SVB. The FDIC took control of SVB the next day, Friday, March 10, before the bank could open for business.

The Government Response to the Collapse of SVB

The FDIC generally handles bank failures in one of two ways: (1) It closes the bank and pays off depositors, or (2) it purchases and assumes control of the bank while finding another bank that is willing to purchase the failed bank. If the FDIC closes a bank, it pays off the insured depositors immediately, using the bank’s assets. If those funds are insufficient, the FDIC makes up the difference from its insurance reserves, which come from payments insured banks make to the FDIC. After the FDIC has compensated insured depositors, any remaining funds are paid to uninsured depositors.

As we write this on Sunday, March 12, leaders of the Fed, the FDIC, and the Treasury Department, were considering what steps to take to avoid a process of contagion that would cause the failure of SVB to lead to deposit withdrawals and potential failures of other banks—in other words, a bank panic like the one that crippled the U.S. economy in the early 1930s, worsening the severity of the Great Depression. These agencies hoped to find another bank that would purchase SVB and assume responsibility for meeting further deposit withdrawals.

Another possibility was that the FDIC would declare that closing SVB, selling the bank’s assets, and forcing depositors above the $250,000 deposit limit to suffer losses would pose a systemic risk to the financial system. In that circumstance, the FDIC could provide insurance to all depositors however large their deposits might be. As discussed earlier, this approach would increase moral hazard in the banking system because it would, in effect, waive the limit on deposit insurance. Although the waiver would apply directly only to this particular case, large depositors in other banks might conclude that if their bank failed, the FDIC would waive the deposit limit again. Under current law, the FDIC could only announce they were waiving the deposit limit if two-thirds of the FDIC’s Board of Directors, two-thirds of the Fed’s Board of Governors, and Treasury Secretary Janet Yellen agreed that failure of SVB would pose a systemic risk to the financial system.

According to an article on wsj.com posted at 4 pm on Sunday afternoon, bank regulators were conducting an auction for SVB in the hopes that a buyer could be found that would assume responsibility for the bank’s uninsured deposits. [Update evening of Monday March 13: The Sunday auction failed when no U.S. banks entered a bid. Late Monday, the FDIC was planning on holding another auction, with potentially better terms available for the acquiring bank.]

Update: At 6:15 pm Sunday, the Treasury, the Fed, and the FDIC issued a statement (you can read it here). As we noted might occur above, by invoking a situation of systemic risk, the FDIC was authorized to allow all depositors–including those with funds above the deposit limit of $250,000–to access their funds on Monday morning. Here is an excerpt from the statement:

“After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.”

[Update Monday morning March 13] As we discussed above, one of the problems SVB faced was a decline in the prices of its bond holdings. As a result, when it sold bonds to help meet deposit outflows, it suffered a $2.1 billion loss. Most commercial banks have invested some of their deposits in Treasury bonds and so potentially face the same problem of having to suffer losses if they need to sell the bonds to meet deposit outflows.

To deal with this issue, Sunday night the Fed announced that it was establishing the Bank Term Funding Program (BTFP). Banks and other depository institutions, such as savings and loans and credit unions, can use the BTFP to borrow against their holdings of Treasury and mortgage-backed securities and agency debt. (Agency debt consists of bonds issued by any federal government agency other than the U.S. Treasury. Most agency debt is bonds issued by the Government Sponsored Agencies (GSEs) involved in the mortgage market: Federal National Mortgage Association (Fannie Mae), Government National Mortgage Association (Ginnie Mae), and the Federal Home Loan Mortgage (Freddie Mac).) The Fed explained its reasons for setting up the BTFP: “The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.” You can read the Fed’s statement here.

On Sunday, Signature Bank was closed by New York state banking officials and the FDIC. As with SVB, the Fed, FDIC, and Treasury announced that all depositors, including those whose deposits were above the $250,000 deposit limit, would be able to withdraw the full amount of their deposits.

Shareholders in SVB and Signature Bank lost their investments when the FDIC took control of the banks. On Monday morning, investors were selling shares of a number of regional banks who might also face runs, fearing that their investments would be lost if the FDIC were to seize these banks.

President Biden, speaking from the White House, attempted to reassure the public that the banking system was safe. He stated that he would ask Congress to explore changes in banking regulations to reduce the likelihood of future bank failures.

2/19/23 Podcast – Authors Glenn Hubbard & Tony O’Brien discuss the Fed’s response to economic conditions and their ability to execute a soft-landing.

Join author Glenn Hubbard & Tony O’Brien in their first Sprint 2023 podcast where they revisit inflation as the major topic facing our country, our economy, and our classrooms. Glenn & Tony discuss the Federal Reserve response and the outlook for the economy. While rates have continued to move up, is a soft-landing still possible?

11/17/22 Podcast – Authors Glenn Hubbard & Tony O’Brien discuss inflation, the Fed’s Response, FTX collapse, and also share thoughts on economics themes in holiday movies!

In the Face of Hyperinflation, Some People in Argentina Don’t Save Currency, They Save … Bricks

Argentina’s Argentina’s Economy Minister Sergio Massa coming from a meeting in Washington, DC with the International Monetary Fund to discuss the country’s hyperinflation. Photo from the Wall Street Journal.

Argentina has been through several periods of hyperinflation during with the price level has increased more than 50 percent per month. The following figure shows the inflation rate as measured by the percentage change in the consumer price index from the previous month for since the beginning of 2018. The inflation rate during these years has been volatile, being greater than 50 percent per month during several periods, including staring in the spring of 2022. High rates of inflation have become so routine in Argentina that an article in the Wall Street Journal quoted on store owner as saying, “Here 40% [inflation] is normal. And when we get past 50%, it doesn’t scare us, it simply bothers us.”

As we discuss in Macroeconomics, Chapter 14, Section 14.5 (Economics, Chapter 24, Section 24.5 ), when an economy experiences hyperinflation, consumers and businesses hold the country’s currency for as brief a time as possible because the purchasing power of the currency is declining rapidly. As we noted in the chapter, in some countries experiencing high rates of inflation, consumers and businesses buy and sell goods using U.S. dollars rather than the domestic currency because the purchasing power of the dollar is more stable. This demand for dollars in countries experiencing high inflation rates is one reason why an estimated 80 percent of all $100 bills circulate outside of the United States.

The increased demand for U.S. dollars by people in Argentina is reflected in the exchange rate between the Argentine peso and the U.S. dollar. The following figure shows that at the beginning of 2018, one dollar exchanged for about 18 pesos. By November 2022, one dollar exchanged for about 159 pesos. The exchange rate shown in the figure is the official exchange rate at which people in Argentina can legally exchange pesos for dollars. In practice, it is difficult for many individuals and small firms to buy dollars at the official exchange rate. Instead, they have to use private currency traders who will make the exchange at an unofficial—or “blue”—exchange rate that varies with the demand and supply of pesos for dollars. A reporter for the Economist described his experience during a recent trip to Argentina: “Walk down Calle Lavalle or Calle Florida in the centre of Buenos Aires and every 20 metres someone will call out ‘cambio’ (exchange), offering to buy dollars at a rate that is roughly double the official one.”

People in Argentina are reluctant to deposit their money in banks, partly because the interest rates banks pay typically are lower than the inflation rate, causing the purchasing power of money deposited in banks to decline over time. People are also afraid that the government might keep them from withdrawing their money, which has happened in the past. As an alternative to depositing their money in banks, many people in Argentina buy more goods than they can immediately use and store them, thereby avoiding future price increases on these goods. The Wall Street Journalquoted a university student as saying: “I came to this market and bought as much toilet paper as I could for the month, more than 20 packs. I try to buy all [the goods] I can because I know that next month it will cost more to buy.”

Devon Zuegel, a U.S. software engineer and economics blogger who travels frequently to Argentina, has observed one unusual way that some people in Argentina save while experiencing hyperinflation:

“Bricks—actual bricks, not stacks of cash—are another common savings mechanism, especially for working-class Argentinians. The value of bricks is fairly stable, and they’re useful to a family building out their house. Argentina doesn’t have a mortgage industry, and thus buying a pallet of bricks each time you get a paycheck is an effective way to pay for your home in installments. (Bricks aren’t fully monetized, in that I don’t think people buy bricks and then sell them later, so people only use this method of saving when they actually have something they want to use the bricks for.)”

Sources: “Sergio Massa Is the Only Thing Standing Between Argentina and Chaos,” economist. com, October 13, 2022; Devon Zuegel, “Inside Argentina’s Currency Exchange Black Markets,” devonzuegel.com, September 10, 2022; Silvina Frydlewsky and Juan Forero, “Inflation Got You Down? At Least You Don’t Live in Argentina,” Wall Street Journal, April 25, 2022; and Federal Reserve Bank of St. Louis, FRED data set.

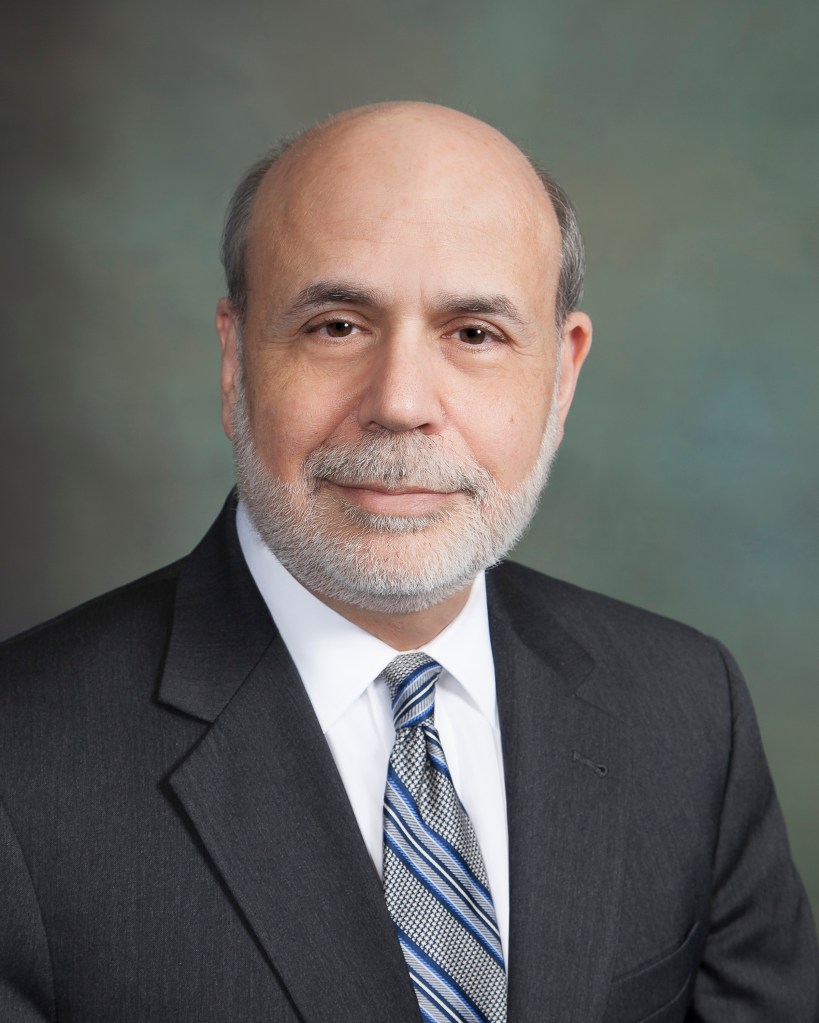

Ben Bernanke, Douglas Diamond, and Philip Dybvig Win the Nobel Prize in Economics

Former Federal Reserve Chair Ben Bernanke (now a Distinguished Fellow in Residence at the Brookings Institution in Washington, DC), Douglas Diamond of the University of Chicago, and Philip Dybvig of Washington University in St. Louis shared the 2022 Nobel Prize in Economics (formally called the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel). The prize of 10 million Swedish kronor (about 8.85 million U.S. dollars) was awarded for “significantly [improving] our understanding of the role of banks in the economy, particularly during financial crises.” (The press release from the Nobel committee can be read here.)

In paper published in the American Economic Review in 1983, Bernanke provided an influential interpretation of the role the bank panics of the early 1930s played in worsening the severity of the Great Depression. As we discuss in Macroeconomics, Chapter 14, Section 14.3 (Economics, Chapter 24, Section 24.3), by taking deposits and making loans banks play an important in the money supply process. Milton Friedman and Anna Schwartz in A Monetary History of the United States, 1867-1960, Chapter 7, argued that the bank panics of the early 1930s caused a decline in real GDP and employment largely through the mechanism of reducing the money supply.

Bernanke demonstrated that the bank failures affected output and employment in another important way. As we discuss in Macroeconomics, Chapter 6, Section 6.2 and Chapter 14, Section 14.4 (Economics, Chapter 8, Section 8.2 and Chapter 24, Section 24.4) banks are financial intermediaries who engage in indirect finance. Banks accept deposits and use the funds to make loans to households and firms. Households and most firms can’t raise funds through direct finance by selling bonds or stocks to individual investors because investors don’t have enough information about households or all but the largest firms to know whether these borrowers will repay the funds. Banks get around this information problemby specializing in gathering information on households and firms that allow them to gauge how likely a borrower is to default, or stop paying, on a loan.

Because of the special role banks have in providing credit to households and firms that have difficulty borrowing elsewhere, Bernanke argued that the bank panics of the early 1930s, during which more than 5,000 banks in the United States went out of business, not only caused a reduction in the money supply but restricted the ability of households and firms to borrow. As a result, households and firms decreased their spending, which increased the severity of the Great Depression.

In a 1983 paper published in the Journal of Political Economy, Diamond and Dybvig presented what came to be known as the Diamond and Dybvig model of the economic role of banks. This model, along with later research by Diamond, provided economists with a better understanding of the potential instability of banking. Diamond and Dybvig note that banking involves transforming long-run, illiquid assets—loans—into short-run, liquid assets—deposits. Recall that liquidity is the ease with which an asset can be sold. Households and firms want the loans they receive from a bank to be illiquid in the sense that they don’t want the bank to be able to demand that the funds borrowed be repaid, except on a set schedule. Someone receiving a mortgage loan to buy a house wouldn’t want the bank to be able to insist on being paid back any time the bank chose. But households and firms also want the assets they hold to be liquid so that they can quickly convert the assets into money if they need the funds. By taking in deposits and using the funds to make loans, banks provide a service to households and firms by providing both a source of long-run credit and a source of short-term assets.

But Diamond and Dybvig note that because banks hold long-terms assets that can’t easily be sold, if a large number of people attempt simultaneously to withdraw their deposits, the banks lack the funds to meet these withdrawals. The result is a run on a bank as depositors become aware that unless they quickly withdraw their deposits, they may not receive their funds for a considerable time. If the bank is insolvent—the value of its loans and other assets is less than the value of its deposits and other liabilities—the bank may fail and some households and firms will never receive the full value of their deposits. In the Diamond and Dybvig model, if depositors expect that other depositors will not withdraw their funds, the system can be stable because banks won’t experience runs. But because banks know more about the value of their assets and liabilities than depositors do, depositors may have trouble distinguishing solvent banks from insolvent banks. As a result of this information problem, households and firms may decide to withdraw their deposits even from solvent banks. Households and firms may withdraw their deposits from a bank even if they know with certainty that the bank is solvent if they expect that other households and firms—who may lack this knowledge—will withdraw their deposits. The result will be a bank panic, in which many banks simultaneously experience a bank run.

With many banks closing or refusing to make new loans in order to conserve funds, households and firms that depend on bank loans will be forced to reduce their spending. As a result, production and employment will decline. Falling production and employment may cause more borrowers to stop paying on their loans, which may cause more banks to be insolvent, leading to further runs, and so on. We illustrate this process in Figure 14.3.

Diamond and Dybvig note that a system of deposit insurance—adopted in the United States when Congress established the Federal Deposit Insurance Corporation (FDIC) in 1934—or a central bank acting as a lender of last resort to banks experiencing runs are necessary to stabilize the banking system. When Congress established the Federal Reserve System in 1914, it gave the Fed the ability to act as a lender of last resort by making discount loans to banks that were solvent but experiencing temporary liquidity problems as a result of deposit withdrawals.

During the Global Financial Crisis that began in 2007 and accelerated following the failure of the Lehman Brothers investment bank in September 2008, it became clear that the financial firms in the shadow banking system could also be subject to runs because, like commercial banks, shadow banks borrow short term to financial long term investments. Included in the shadow banking system are money market mutual funds, investment banks, and insurance companies. By 2008 the size of the shadow banking system had grown substantially relative to the commercial banking system. The shadow banking system turned out to be more fragile than the commercial banking system because those lending to shadow banks by, for instance, buying money market mutual fund shares, do not receive government insurance like bank depositors receive from the FDIC and because prior to 2008 the Fed did not act as a lender of last resort to shadow banks.

Bernanke believes that his study of financial problems the U.S. experienced during the Great Depression helped him as Fed chair to deal with the Global Financial Crisis. In particular, Bernanke concluded from his research that in the early 1930s the Fed had committed a major error in failing to act more vigorously as a lender of last resort to commercial banks. The result was severe problems in the U.S. financial system that substantially worsened the length and severity of the Great Depression. During the financial crisis, under Bernanke’s leadership, the Fed established several lending facilities that allowed the Fed to extend its role as a lender of last resort to parts of the shadow banking system. (In 2020, the Fed under the leadership of Chair Jerome Powell revived and extended these lending facilities.) Bernanke is rare among economists awarded the Nobel Prize in having had the opportunity to implement lessons from his academic research in economic policymaking at the highest level. (Bernanke discusses the relationship between his research and his policymaking in his memoir. A more complete discussion of the financial crises of the 1930s, 2007-2009, and 2020 appears in Chapter 14 of our textbook Money, Banking, and the Financial System, Fourth Edition.)

We should note that Bernanke’s actions at the Fed have been subject to criticism by some economists and policymakers. As a member of the Fed’s Board of Governors beginning in 2002 and then as Fed chair beginning in 2006, Bernanke, like other members of the Fed and most economists, was slow to recognize the problems in the shadow banking system and, particularly, the problems caused by the rapid increase in housing prices and increasing number of mortgages being granted to borrowers who had either poor credit histories or who made small down payments. Some economists and policymakers also argue that Bernanke’s actions during the financial crisis took the Fed beyond the narrow role of stabilizing the commercial banking system spelled out by Congress in the Federal Reserve Act and may have undermined Fed independence. They also argue that by broadening the Fed’s role as a lender of last resort to include shadow banks, Bernanke may have increased the extent of moral hazard in the financial system.

Finally, Laurence Ball of Johns Hopkins University argues that the worst of the financial crisis could have been averted if Bernanke had acted to save the Lehman Brothers investment bank from failing by making loans to Lehman. Bernanke has argued that the Fed couldn’t legally make loans to Lehman because the firm was insolvent but Ball argues that, in fact, the firm was solvent. Decades later, economists continue to debate whether the Fed’s actions in allowing the Bank of United States to fail in 1930 were appropriate and the debate over the Fed’s actions with respect to Lehman may well last as long. (A working paper version of Ball’s argument can be found here. He later extended his argument in a book. Bernanke’s account of his actions during the failure of Lehman Brothers can be found in his memoir cited earlier.)

Sources: Paul Hannon, “Nobel Prize in Economics Winners Include Former Fed Chair Ben Bernanke,” Wall Street Journal, October 10, 2022; David Keyton, Frank Jordans, and Paul Wiseman, “Former Fed Chair Bernanke Shares Nobel for Research on Banks,” apnews.com, October 10, 2022; and Greg Ip, “Most Nobel Laureates Develop Theories; Ben Bernanke Put His Into Practice,” Wall Street Journal, October 10, 2022.

The Federal Open Market Committee’s September 2022 Meeting and the Question of Whether the Fed Should Focus Only on Price Stability

In the Federal Reserve Act, Congress charged the Federal Reserve with conducting monetary policy so as to achieve both “maximum employment” and “stable prices.” These two goals are referred to as the Fed’s dual mandate. (We discuss the dual mandate in Macroeconomics, Chapter 15, Section 15.1, Economics, Chapter 25, Section 25.1, and Money, Banking, and the Financial System, Chapter 15, Section 15.1.) Accordingly, when Fed chairs give their semiannual Monetary Policy Reports to Congress, they reaffirm that they are acting consistently with the dual mandate. For example, when testifying before the U.S. Senate Committee on Banking, Housing, and Urban Affairs in June 2022, Fed Chair Jerome Powell stated that: “The Fed’s monetary policy actions are guided by our mandate to promote maximum employment and stable prices for the American people.”

Despite statements of that kind, some economists argue that in practice during some periods the Fed’s policymaking Federal Open Market Committee (FOMC) acts as if it were more concerned with one of the two mandates. In particular, in the decades following the Great Inflation of the 1970s, FOMC members appear to have put more emphasis on price stability than on maximum employment. These economists argue that during these years, FOMC members were typically reluctant to pursue a monetary policy sufficiently expansionary to lead to maximum employment if the result would be to cause the inflation rate to rise above the Fed’s target of an annual target of 2 percent. (Although the Fed didn’t announce a formal inflation target of 2 percent until 2012, the FOMC agreed to set a 2 percent inflation target in 1996, although they didn’t publicly announce at the time. Implicitly, the FOMC had been acting as if it had a 2 percent target since at least the mid–1980s.)

In July 2019, the FOMC responded to a slowdown in economic growth in late 2018 and early 2019 but cutting its target for the federal funds rate. It made further cuts to the target rate in September and October 2019. These cuts helped push the unemployment rate to low levels even as the inflation rate remained below the Fed’s 2 percent target. The failure of inflation to increase despite the unemployment rate falling to low levels, provides background to the new monetary policy strategy the Fed announced in August 2020. The new monetary policy, in effect, abandoned the Fed’s previous policy of attempting to preempt a rise in the inflation rate by raising the target for the federal funds rate whenever data on unemployment and real GDP growth indicated that inflation was likely to rise. (We discussed aspects of the Fed’s new monetary policy in previous blog posts, including here, here, and here.)

In particular, the FOMC would no longer see the natural rate of unemployment as the maximum level of employment—which Congress has mandated the Fed to achieve—and, therefore, wouldn’t necessarily begin increasing its target for the federal funds rate when the unemployment rate dropped by below the natural rate. As Fed Chair Powell explained at the time, “the maximum level of employment is not directly measurable and [it] changes over time for reasons unrelated to monetary policy. The significant shifts in estimates of the natural rate of unemployment over the past decade reinforce this point.”

Many economists interpreted the Fed’s new monetary strategy and the remarks that FOMC members made concerning the strategy as an indication that the Fed had turned from focusing on the inflation rate to focusing on unemployment. Of course, given that Congress has mandated the Fed to achieve both stable prices and maximum employment, neither the Fed chair nor other members of the FOMC can state directly that they are focusing on one mandate more than the other.

The sharp acceleration in inflation that began in the spring of 2021 and continued into the fall of 2022 (shown in the following figure) has caused members of the FOMC to speak more forcefully about the need for monetary policy to bring inflation back to the Fed’s target rate of 2 percent. For example, in a speech at the Federal Reserve Bank of Kansas City’s annual monetary policy conference held in Jackson Hole, Wyoming, Fed Chair Powell spoke very directly: “The Federal Open Market Committee’s (FOMC) overarching focus right now is to bring inflation back down to our 2 percent goal.” According to an article in the Wall Street Journal, Powell had originally planned a longer speech discussing broader issues concerning monetary policy and the state of the economy—typical of the speeches that Fed chairs give at this conference—before deciding to deliver a short speech focused directly on inflation.

Members of the FOMC were concerned that a prolonged period of high inflation rates might lead workers, firms, and investors to no longer expect that the inflation rate would return to 2 percent in the near future. If the expected inflation rate were to increase, the U.S. economy might enter a wage–price spiral in which high inflation rates would lead workers to push for higher wages, which, in turn, would increase firms’ labor costs, leading them to raise prices further, in response to which workers would push for even higher wages, and so on. (We discuss the concept of a wage–price spiral in earlier blog posts here and here.)

With Powell noting in his Jackson Hole speech that the Fed would be willing to run the risk of pushing the economy into a recession if that was required to bring down the inflation rate, it seemed clear that the Fed was giving priority to its mandate for price stability over its mandate for maximum employment. An article in the Wall Street Journal quoted Richard Clarida, who served on the Fed’s Board of Governors from September 2018 until January 2022, as arguing that: “Until inflation comes down a lot, the Fed is really a single mandate central bank.”

This view was reinforced by the FOMC’s meeting on September 21, 2022 at which it raised its target for the federal funds rate by 0.75 percentage points to a range of 3 to 3.25 percent. The median projection of FOMC members was that the target rate would increase to 4.4 percent by the end of 2022, up a full percentage point from the median projection at the FOMC’s June 2022 meeting. The negative reaction of the stock market to the announcement of the FOMC’s decision is an indication that the Fed is pursuing a more contractionary monetary policy than many observers had expected. (We discuss the relationship between stock prices and economic news in this blog post.)

Some economists and policymakers have raised a broader issue concerning the Fed’s mandate: Should Congress amend the Federal Reserve Act to give the Fed the single mandate of achieving price stability? As we’ve already noted, one interpretation of the FOMC’s actions from the mid–1980s until 2019 is that it was already implicitly acting as if price stability were a more important goal than maximum employment. Or as Stanford economist John Cochrane has put it, the Fed was following “its main mandate, which is to ensure price stability.”

The main argument for the Fed having price stability as its only mandate is that most economists believe that in the long run, the Fed can affect the inflation rate but not the level of potential real GDP or the level of employment. In the long run, real GDP is equal to potential GDP, which is determined by the quantity of workers, the capital stock—including factories, office buildings, machinery and equipment, and software—and the available technology. (We discuss this point in Macroeconomics, Chapter 13, Section 13.2 and in Economics, Chapter 23, Section 23.2.) Congress and the president can use fiscal policy to affect potential GDP by, for example, changing the tax code to increase the profitability of investment, thereby increasing the capital stock, or by subsidizing apprentice programs or taking other steps to increase the labor supply. But most economists believe that the Fed lacks the tools to achieve those results.

Economists who support the idea of a single mandate argue that the Fed would be better off focusing on an economic variable they can control in the long run—the inflation rate—rather than on economic variables they can’t control—potential GDP and employment. In addition, these economists point out that some foreign central banks have a single mandate to achieve price stability. These central banks include the European Central Bank, the Bank of Japan, and the Reserve Bank of New Zealand.

Economists and policymakers who oppose having Congress revise the Federal Reserve Act to give the Fed the single mandate to achieve price stability raise several points. First, they note that monetary policy can affect the level of real GDP and employment in the short run. Particularly when the U.S. economy is in a severe recession, the Fed can speed the return to full employment by undertaking an expansionary policy. If maximum employment were no longer part of the Fed’s mandate, the FOMC might be less likely to use policy to increase the pace of economic recovery, thereby avoiding some unemployment.

Second, those opposed to the Fed having single mandate argue that the Fed was overly focused on inflation during some of the period between the mid–1980s and 2019. They argue that the result was unnecessarily low levels of employment during those years. Giving the Fed a single mandate for price stability might make periods of low employment more likely.

Finally, because over the years many members of Congress have stated that the Fed should focus more on maximum employment than price stability, in practical terms it’s unlikely that the Federal Reserve Act will be amended to give the Fed the single mandate of price stability.

In the end, the willingness of Congress to amend the Federal Reserve Act, as it has done many times since initial passage in 1914, depends on the performance of the U.S. economy and the U.S. financial system. It’s possible that if the high inflation rates of 2021–2022 were to persist into 2023 or beyond, Congress might revise the Federal Reserve Act to change the Fed’s approach to fighting inflation either by giving the Fed a single mandate for price stability or in some other way.

Sources: Board of Governors of the Federal Reserve System, “Federal Reserve Issues FOMC Statement,” federalreserve.gov, September 21, 2022; Board of Governors of the Federal Reserve System, “Summary of Economic Projections,” federalreserve.gov, September 21, 2022; Nick Timiraos, “Jerome Powell’s Inflation Whisperer: Paul Volcker,” Wall Street Journal, September 19, 2022; Matthew Boesler and Craig Torres, “Powell Talks Tough, Warning Rates Are Going to Stay High for Some Time,” bloomberg.com, August 26, 2022; Jerome H. Powell, “Semiannual Monetary Policy Report to the Congress,” June 22, 2022, federalreserve.gov; Jerome H. Powell, “Monetary Policy and Price Stability,” speech delivered at “Reassessing Constraints on the Economy and Policy,” an economic policy symposium sponsored by the Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming, federalreserve.gov, August 26, 2022; John H. Cochrane, “Why Isn’t the Fed Doing its Job?” project-syndicate.org, January 19, 2022; Board of Governors of the Federal Reserve System, “Minutes of the Federal Open Market Committee Meeting on July 2–3, 1996,” federalreserve.gov; and Federal Reserve Bank of St. Louis.

Podcasts Back for Fall 2022! – 9/9/22 Podcast – Authors Glenn Hubbard & Tony O’Brien discuss inflation, the Fed’s Response, cryptocurrency, and also briefly touch on labor markets.

Are the Fed’s Forecasts of Inflation and Unemployment Inconsistent?

Four times per year, the members of the Federal Reserve’s Federal Open Market Committee (FOMC) publish their projections, or forecasts, of the values of the inflation rate, the unemployment, and changes in real gross domestic product (GDP) for the current year, each of the following two years, and for the “longer run.” The following table, released following the FOMC meeting held on March 15 and 16, 2022, shows the forecasts the members made at that time.

| Median Forecast | Meidan Forecast | Median Forecast | |||

| 2022 | 2023 | 2024 | Longer run | Actual values, March 2022 | |

| Change in real GDP | 2.8% | 2.2% | 2.2% | 1.8% | 3.5% |

| Unemployment rate | 3.5% | 3.5% | 3.6% | 4.0% | 3.6% |

| PCE inflation | 4.3% | 2.7% | 2.3% | 2.0% | 6.6% |

| Core PCE inflation | 4.1% | 2.6% | 2.3% | No forecast | 5.2% |

Recall that PCE refers to the consumption expenditures price index, which includes the prices of goods and services that are in the consumption category of GDP. Fed policymakers prefer using the PCE to measure inflation rather than the consumer price index (CPI) because the PCE includes the prices of more goods and services. The Fed uses the PCE to measure whether it is hitting its target inflation rate of 2 percent. The core PCE index leaves out the prices of food and energy products, including gasoline. The prices of food and energy products tend to fluctuate for reasons that do not affect the overall long-run inflation rate. So Fed policymakers believe that core PCE gives a better measure of the underlying inflation rate. (We discuss the PCE and the CPI in the Apply the Concept “Should the Fed Worry about the Prices of Food and Gasoline?” in Macroeconomics, Chapter 15, Section 15.5 (Economics, Chapter 25, Section 25.5)).

The values in the table are the median forecasts of the FOMC members, meaning that the forecasts of half the members were higher and half were lower. The members do not make a longer run forecast for core PCE. The final column shows the actual values of each variable in March 2022. The values in that column represent the percentage in each variable from the corresponding month (or quarter in the case of real GDP) in the previous year. Links to the FOMC’s economic projections can be found on this page of the Federal Reserve’s web site.

At its March 2022 meeting, the FOMC began increasing its target for the federal funds rate with the expectation that a less expansionary monetary policy would slow the high rates of inflation the U.S. economy was experiencing. Note that in that month, inflation measured by the PCE was running far above the Fed’s target inflation rate of 2 percent.

In raising its target for the federal funds rate and by also allowing its holdings of U.S. Treasury securities and mortgage-backed securities to decline, Fed Chair Jerome Powell and the other members of the FOMC were attempting to achieve a soft landing for the economy. A soft landing occurs when the FOMC is able to reduce the inflation rate without causing the economy to experience a recession. The forecast values in the table are consistent with a soft landing because they show inflation declining towards the Fed’s target rate of 2 percent while the unemployment rate remains below 4 percent—historically, a very low unemployment rate—and the growth rate of real GDP remains positive. By forecasting that real GDP would continue growing while the unemployment rate would remain below 4 percent, the FOMC was forecasting that no recession would occur.

Some economists see an inconsistency in the FOMC’s forecasts of unemployment and inflation as shown in the table. They argued that to bring down the inflation rate as rapidly as the forecasts indicated, the FOMC would have to cause a significant decline in aggregate demand. But if aggregate demand declined significantly, real GDP would either decline or grow very slowly, resulting in the unemployment rising above 4 percent, possibly well above that rate. For instance, writing in the Economist magazine, Jón Steinsson of the University of California, Berkeley, noted that the FOMC’s “combination of forecasts [of inflation and unemployment] has been dubbed the ‘immaculate disinflation’ because inflation is seen as falling rapidly despite a very tight labor market and a [federal funds] rate that is for the most part negative in real terms (i.e., adjusted for inflation).”

Similarly, writing in the Washington Post, Harvard economist and former Treasury secretary Lawrence Summers noted that “over the past 75 years, every time inflation has exceeded 4 percent and unemployment has been below 5 percent, the U.S. economy has gone into recession within two years.”

In an interview in the Financial Times, Olivier Blanchard, senior fellow at the Peterson Institute for International Economics and former chief economist at the International Monetary Fund, agreed. In their forecasts, the FOMC “had unemployment staying at 3.5 percent throughout the next two years, and they also had inflation coming down nicely to two point something. That just will not happen. …. [E]ither we’ll have a lot more inflation if unemployment remains at 3.5 per cent, or we will have higher unemployment for a while if we are actually to inflation down to two point something.”

While all three of these economists believed that unemployment would have to increase if inflation was to be brought down close to the Fed’s 2 percent target, none were certain that a recession would occur.

What might explain the apparent inconsistency in the FOMC’s forecasts of inflation and unemployment? Here are three possibilities:

- Fed policymakers are relatively optimistic that the factors causing the surge in inflation—including the economic dislocations due to the Covid-19 pandemic and the Russian invasion of Ukraine and the surge in federal spending in early 2021—are likely to resolve themselves without the unemployment rate having to increase significantly. As Steinsson puts it in discussing this possibility (which he believes to be unlikely) “it is entirely possible that inflation will simply return to target as the disturbances associated with Covid-19 and the war in Ukraine dissipate.”

- Fed Chair Powell and other members of the FOMC were convinced that business managers, workers, and investors still expected that the inflation rate would return to 2 percent in the long run. As a result, none of these groups were taking actions that might lead to a wage-price spiral. (We discussed the possibility of a wage-price spiral in earlier blog post.) For instance, at a press conference following the FOMC meeting held on May 3 and 4, 2022, Powell argued that, “And, in fact, inflation expectations [at longer time horizons] come down fairly sharply. Longer-term inflation expectations have been reasonably stable but have moved up to—but only to levels where they were in 2014, by some measures.” If Powell’s assessment was correct that expectations of future inflation remained at about 2 percent, the probability of a soft landing was increased.

- We should mention the possibility that at least some members of the FOMC may have expected that the unemployment rate would increase above 4 percent—possibly well above 4 percent—and that the U.S. economy was likely to enter a recession during the coming months. They may, however, have been unwilling to include this expectation in their published forecasts. If members of the FOMC state that a recession is likely, businesses and households may reduce their spending, which by itself could cause a recession to begin.

Sources: Martin Wolf, “Olivier Blanchard: There’s a for Markets to Focus on the Present and Extrapolate It Forever,” ft.com, May 26, 2022; Lawrence Summers, “My Inflation Warnings Have Spurred Questions. Here Are My Answers,” Washington Post, April 5, 2022; Jón Steinsson, “Jón Steinsson Believes That a Painless Disinflation Is No Longer Plausible,” economist.com, May 13, 2022; Federal Open Market Committee, “Summary of Economic Projections,” federalreserve.gov, March 16, 2022; and Federal Open Market Committee, “Transcript of Chair Powell’s Press Conference May 4, 2022,” federalreserve.gov, May 4, 2022.

4/07/22 Podcast – Authors Glenn Hubbard & Tony O’Brien revisit the role of inflation in today’s economy & likely Fed responses in trying to manage it.

Authors Glenn Hubbard and Tony O’Brien reconsider the role of inflation in today’s economy. They discuss the Fed’s possible responses by considering responses to similar inflation threats in previous generations – notably the Fed’s response led by Paul Volcker that directly led to the early 1980’s recession. The markets are reflecting stark differences in our collective expectations about what will happen next. Listen to find out more about the Fed’s likely next steps.