Join authors Glenn Hubbard and Tony O’Brien as they discuss the future of small banks in the US financial system in the wake of recent bank failures. With a government that is guaranteeing just about all deposits, what is the role of deposit insurance. Small banks serve a real purpose in our economy and will further government regularly only complicate their mission. Other small business rely on small banks for their intimate knowledge of their market and of their business. However, many may now rely on larger banks that may seem a safer place over the next few years. Our discussion covers these points but you can also check for updates on our blog post that can be found HERE .

Tag: Monetary Policy

Why Don’t Financial Markets Believe the Fed?

Fed Chair Jerome Powell holding a news conference following the March 22 meeting of the FOMC. Photo from Reuters via the Wall Street Journal.

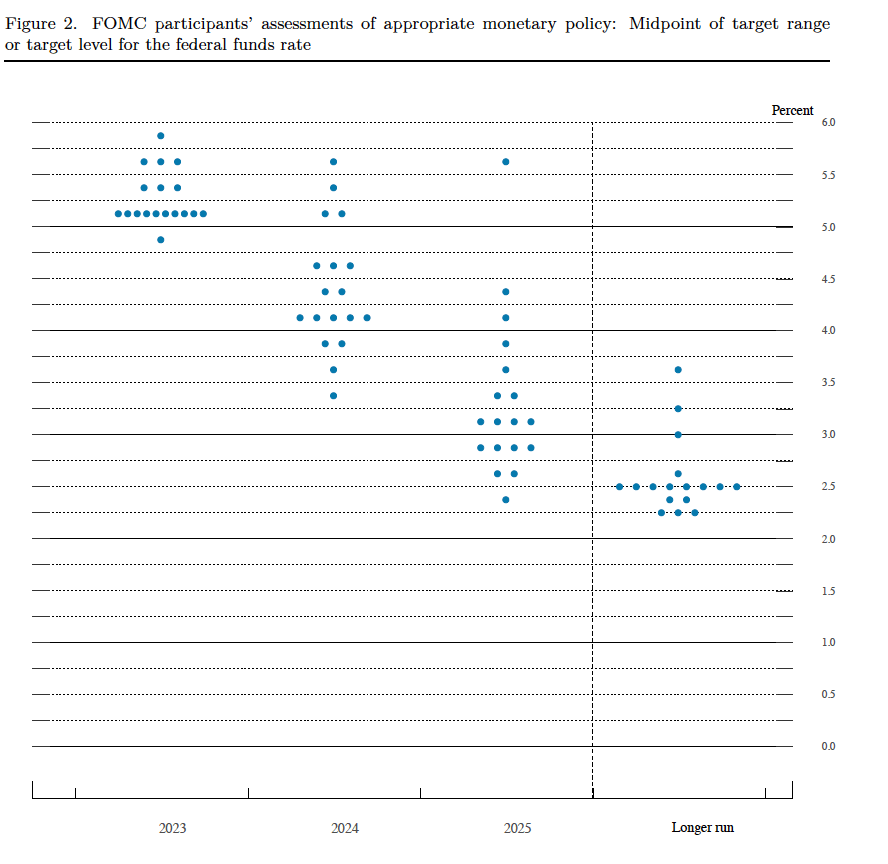

On March 22, the Federal Open Market Committee (FOMC) unanimously voted to raise its target for the federal funds rate by 0.25 percentage point to a range of 4.75 percent to 5.00 percent. The members of the FOMC also made economic projections of the values of certain key economic variables. (We show a table summarizing these projections at the end of this post.) The summary of economic projections includes the following “dot plot” showing each member of the committee’s forecast of the value of the federal funds rate at the end of each of the following years. Each dot represents one member of the committee.

If you focus on the dots above “2023” on the vertical axis, you can see that 17 of the 18 members of the FOMC expect that the federal funds rate will end the year above 5 percent.

In a press conference after the committee meeting, a reporter asked Fed Chair Jerome Powell was asked this question: “Following today’s decision, the [financial] markets have now priced in one more increase in May and then every meeting the rest of this year, they’re pricing in rate cuts.” Powell responded, in part, by saying: “So we published an SEP [Summary of Economic Projections] today, as you will have seen, it shows that basically participants expect relatively slow growth, a gradual rebalancing of supply and demand, and labor market, with inflation moving down gradually. In that most likely case, if that happens, participants don’t see rate cuts this year. They just don’t.” (Emphasis added. The whole transcript of Powell’s press conference can be found here.)

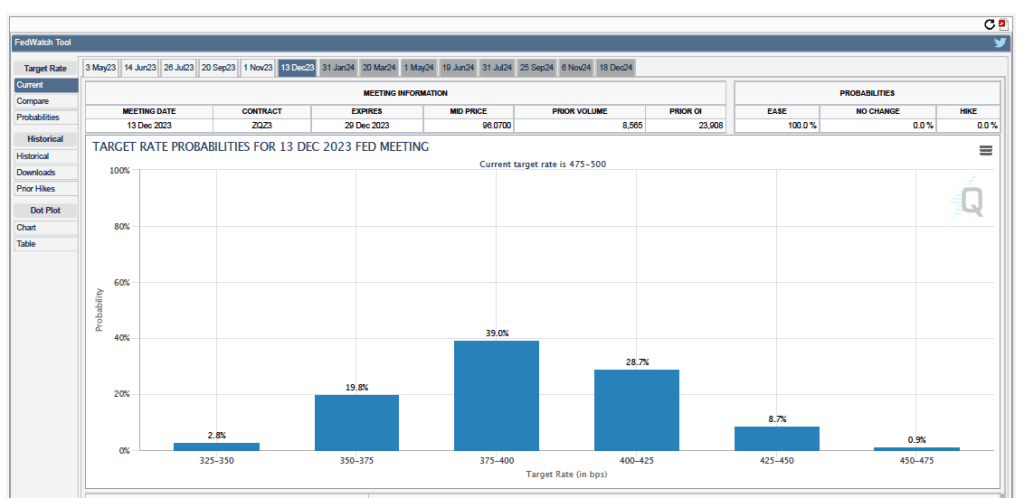

Futures markets allow investors to buy and sell futures contracts on commodities–such as wheat and oil–and on financial assets. Investors can use futures contracts both to hedge against risk–such as a sudden increase in oil prices or in interest rates–and to speculate by, in effect, betting on whether the price of a commodity or financial asset is likely to rise or fall. (We discuss the mechanics of futures markets in Chapter 7, Section 7.3 of Money, Banks, and the Financial System.) The CME Group was formed from several futures markets, including the Chicago Mercantile Exchange, and allows investors to trade federal funds futures contracts. The data that result from trading on the CME indicate what investors in financial markets expect future values of the federal funds rate to be. The following chart shows values after trading of federal funds futures on March 24, 2023.

The chart shows six possible ranges for the federal funds rate after the FOMC’s last meeting in December 2023. Note that the ranges are given in basis points (bps). Each basis point is one hundredth of a percentage point. So, for instance, the range of 375-400 equals a range of 3.75 percent to 4.00 percent. The numbers at the top of the blue rectangles represent the probability that investors place on that range occurring after the FOMC’s December meeting. So, for instance, the probability of the federal funds rate target being 4.00 percent to 4.25 percent is 28.7 percent. The sum of the probabilities equals 1.

Note that the highest target range given on the chart is 4.50 percent to 4.75 percent. In other words, investors in financial markets are assigning a probability of zero to an outcome that the dot plot shows 17 of 18 FOMC members believe will occur: A federal funds rate greater than 5 percent. This is a striking discrepancy between what the FOMC is announcing it will do and what financial markets think the FOMC will actually do.

In other words, financial markets are indicating that actual Fed policy for the remainder of 2023 will be different from the policy that the Fed is indicating it intends to carry out. Why don’t financial markets believe the Fed? It’s impossible to say with certainty but here are two possibilities:

- Markets may believe that the Fed is underestimating the likelihood of an economic recession later this year. If an economic recession occurs, markets assume that the FOMC will have to pivot from increasing its target for the federal funds rate to cutting its target. Markets may be expecting that the banks will cut back more on the credit they offer households and firms as the banks prepare to deal with the possibility that substantial deposit outflows will occur. The resulting credit crunch would likely be enough to push the economy into a recession.

- Markets may believe that members of the FOMC are reluctant to publicly indicate that they are prepared to cut rates later this year. The reluctance may come from a fear that if households, investors, and firms believe that the FOMC will soon cut rates, despite continuing high inflation rates, they may cease to believe that the Fed intends to eventually bring the inflation back to its 2 percent target. In Fed jargon, expectations of inflation would cease to be “anchored” at 2 percent. Once expectations become unanchored, higher inflation rates may become embedded in the economy, making the Fed’s job of bringing inflation back to the 2 percent target much harder.

In late December, we can look back and determine whose forecast of the federal funds rate was more accurate–the market’s or the FOMC’s.

The FOMC Splits the Difference with a 0.25 Percentage Point Rate Increase

Photo from the Wall Street Journal.

At the conclusion of its meeting today (March 22, 2023), the Federal Reserve’s Federal Open Market Committee (FOMC) announced that it was raising its target for the federal funds rate from a range of 4.50 percent to 4.75 percent to a range of 4.75 percent to 5.00 percent. As we discussed in this recent blog post, the FOMC was faced with a dilemma. Because the inflation rate had remained stubbornly high at the beginning of this year and consumer spending and employment had been strongly increasing, until a couple of weeks ago, financial markets and many economists had been expecting a 0.50 percentage point (or 50 basis point) increase in the federal funds rate target at this meeting. As the FOMC noted in the statement released at the end of the meeting: “Job gains have picked up in recent months and are running at a robust pace; the unemployment rate has remained low. Inflation remains elevated.”

But increases in the federal funds rate lead to increases in other interest rates, including the interest rates on the Treasury securities and mortgage-backed securities that most banks own. On Friday, March 10, the Federal Deposit Insurance Corporation (FDIC) was forced to close the Silicon Valley Bank (SVB) because the bank had experienced a deposit run that it was unable to meet. The run on SVB was triggered in part by the bank taking a loss on the Treasury securities it sold to raise the funds needed to cover earlier deposit withdrawals. The FDIC also closed New York-based Signature Bank. San Francisco-based First Republic Bank experienced substantial deposit withdrawals, as we discussed in this blog post. In Europe, the Swiss bank Credit Suisse was only saved from failure when Swiss bank regulators arranged for it to be purchased by UBS, another Swiss bank. These problems in the banking system led some economists to urge that the FOMC keep its target for the federal funds rate unchanged at today’s meeting.

Instead, the FOMC took an intermediate course by raising its target for the federal funds rate by 0.25 percentage point rather than by 0.50 percentage point. In a press conference following the announcement, Fed Chair Jerome Powell reinforced the observation from the FOMC statement that: “Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation.” As banks, particularly medium and small banks, have lost deposits, they’ve reduced their lending. This reduced lending can be a particular problem for small-to medium-sized businesses that depend heavily on bank loans to meet their credit needs. Powell noted that the effect of this decline in bank lending on the economy is the equivalent of an increase in the federal funds rate.

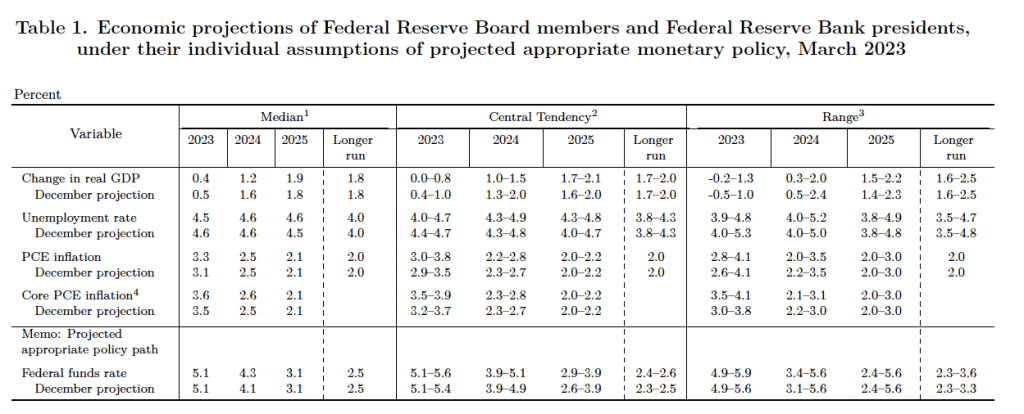

The FOMC also released its Summary of Economic Projections (SEP). As Table 1 shows, committee members’ median forecast for the federal funds rate at the end of 2023 is 5.1 percent, indicating that the members do not anticipate more than a single additional 0.25 percentage point increase in the target for the federal funds rate. The members expect a significant increase in the unemployment rate from the current 3.6 percent to 4.5 percent at the end of 2023 as increases in interest rates slow down the growth of aggregate demand. They expect the unemployment rate to remain in that range through the end of 2025 before declining to the long-run rate of 4.0 percent in later years. The members expect the inflation rate as measured by the personal consumption (PCE) price index to decline from 5.4 percent in January to 3.3 percent in December. They expect the inflation rate to be back close to their 2 percent target by the end of 2025.

3/13/23 Podcast – Authors Glenn Hubbard & Tony O’Brien discuss the collapse of SVB in the context of a classic bank run. Is it? Listen & find out.

Join authors Glenn Hubbard and Tony O’Brien as they review the collapse of Silicon Valley Bank (SVB) in the context of a classic bank run. What lessons can be learned to avoid other bank collapses in this unchartered economic territory? Will this become a contagion? Or, is it simply an example of a bank searching for additional return in an uncertain economic world? Our discussion covers these points but you can also check for updates on our blog post that can be found HERE.

2/19/23 Podcast – Authors Glenn Hubbard & Tony O’Brien discuss the Fed’s response to economic conditions and their ability to execute a soft-landing.

Join author Glenn Hubbard & Tony O’Brien in their first Sprint 2023 podcast where they revisit inflation as the major topic facing our country, our economy, and our classrooms. Glenn & Tony discuss the Federal Reserve response and the outlook for the economy. While rates have continued to move up, is a soft-landing still possible?

11/17/22 Podcast – Authors Glenn Hubbard & Tony O’Brien discuss inflation, the Fed’s Response, FTX collapse, and also share thoughts on economics themes in holiday movies!

Podcasts Back for Fall 2022! – 9/9/22 Podcast – Authors Glenn Hubbard & Tony O’Brien discuss inflation, the Fed’s Response, cryptocurrency, and also briefly touch on labor markets.

Why Might Good News for the Job Market Be Bad News for the Stock Market?

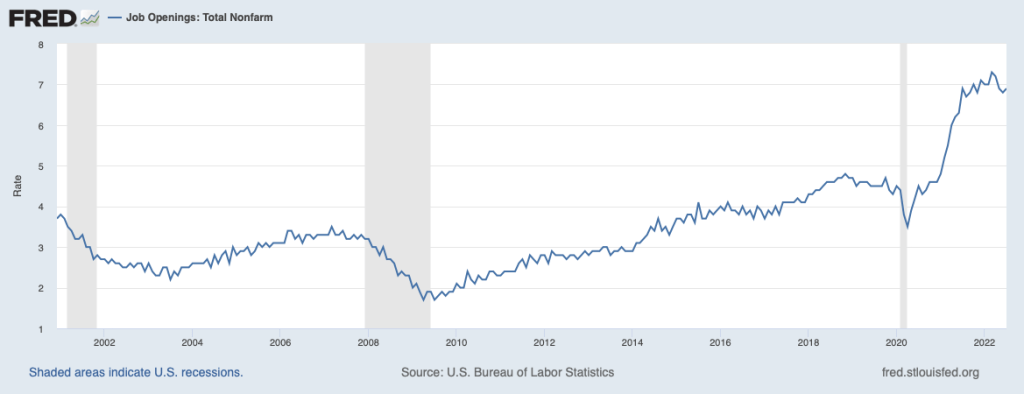

On Tuesday, August 30, 2022, the U.S. Bureau of Labor Statistics (BLS) released its Job Openings and Labor Turnover Survey (JOLTS) report for July 2022. The report indicated that the U.S. labor market remained very strong, even though, according to the Bureau of Economic Analysis (BEA), real gross domestic product (GDP) had declined during the first half of 2022. (In this blog post, we discuss the possibility that during this period the real GDP data may have been a misleading indicator of the actual state of the economy.)

As the following figure shows, the rate of job openings remained very high, even in comparison with the strong labor market of 2019 and early 2020 before the Covid-19 pandemic began disrupting the U.S. economy. The BLS defines a job opening as a full-time or part-time job that a firm is advertising and that will start within 30 days. The rate of job openings is the number of job openings divided by the number of job openings plus the number of employed workers, multiplied by 100.

In the following figure, we compare the total number of job openings to the total number of people unemployed. The figure shows that in July 2022 there were almost two jobs available for each person who was unemployed.

Typically, a strong job market with high rates of job openings indicates that firms are expanding and that they expect their profits to be increasing. As we discuss in Macroeconomics, Chapter 6, Section 6.2 (Microeconomics and Economics, Chapter 8, Section 8.2) the price of a stock is determined by investors’ expectations of the future profitability of the firm issuing the stock. So, we might have expected that on the day the BLS released the July JOLTS report containing good news about the labor market, the stock market indexes like the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite Index would rise. In fact, though the indexes fell, with the Dow Jones Industrial Average declining a substantial 300 points. As a column in the Wall Street Journal put it: “A surprisingly tight U.S. labor market is rotten news for stock investors.” Why did good news about the labor market could cause stock prices to decline? The answer is found in investors’ expectations of the effect the news would have on monetary policy.

In August 2022, Fed Chair Jerome Powell and the other members of the Federal Reserve Open Market Committee (FOMC) were in the process of tightening monetary policy to reduce the very high inflation rates the U.S. economy was experiencing. In July 2022, inflation as measured by the percentage change in the consumer price index (CPI) was 8.5 percent. Inflation as measured by the percentage change in the personal consumption expenditures (PCE) price index—which is the measure of inflation that the Fed uses when evaluating whether it is hitting its target of 2 percent annual inflation—was 6.3 percent. (For a discussion of the Fed’s choice of inflation measure, see the Apply the Concept “Should the Fed Worry about the Prices of Food and Gasoline,” in Macroeconomics, chapter 15, Section 15.5 and in Economics, Chapter 25, Section 25.5.)

To slow inflation, the FOMC was increasing its target for the federal funds rate—the interest rate that banks charge each other on overnight loans—which in turn was leading to increases in other interest rates, such as the interest rate on residential mortgage loans. Higher interest rates would slow increases in aggregate demand, thereby slowing price increases. How high would the FOMC increase its target for the federal funds rate? Fed Chair Powell had made clear that the FOMC would monitor economic data for indications that economic activity was slowing. Members of the FOMC were concerned that unless the inflation rate was brought down quickly, the U.S. economy might enter a wage-price spiral in which high inflation rates would lead workers to push for higher wages, which, in turn, would increase firms’ labor costs, leading them to raise prices further, in response to which workers would push for even higher wages, and so on. (We discuss the concept of a wage-price spiral in this earlier blog post.)

In this context, investors interpretated data showing unexpected strength in the economy—particularly in the labor market—as making it likely that the FOMC would need to make larger increases in its target for the federal fund rate. The higher interest rates go, the more likely that the U.S. economy will enter an economic recession. During recessions, as production, income, and employment decline, firms typically experience lower profits or even suffer losses. So, a good JOLTS report could send stock prices falling because news that the labor market was stronger than expected increased the likelihood that the FOMC’s actions would push the economy into a recession, reducing profits. Or as the Wall Street Journal column quoted earlier put it:

“So Tuesday’s [JOLTS] report was good news for workers, but not such good news for stock investors. It made another 0.75-percentage-point rate increase [in the target for the federal funds rate] from the Fed when policy makers meet next month seem increasingly likely, while also strengthening the case that the Fed will keep raising rates well into next year. Stocks sold off sharply following the report’s release.”

Sources: U.S. Bureau of Labor Statistics, “Job Openings and Labor Turnover–July 2022,” bls.gov, August 30, 2022; Justin Lahart, “Why Stocks Got Jolted,” Wall Street Journal, August 30, 2022; Jerome H. Powell, “Monetary Policy and Price Stability,” speech at “Reassessing Constraints on the Economy and Policy,” an economic policy symposium sponsored by the Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming, August 26, 2022; and Federal Reserve Bank of St. Louis.

Senator Elizabeth Warren vs. Economist Lawrence Summers on Monetary Policy

As we’ve discussed in several previous blog posts, in early 2021 Lawrence Summers, professor of economics at Harvard and secretary of the treasury in the Clinton administration, argued that the Biden administration’s $1.9 trillion American Rescue Plan, enacted in March, was likely to cause a sharp acceleration in inflation. When inflation began to rapidly increase, Summers urged the Federal Reserve to raise its target for the federal funds rate in order to slow the increase in aggregate demand, but the Fed was slow to do so. Some members of the Federal Open Market Committee (FOMC) argued that much of the inflation during 2021 was transitory in that it had been caused by lingering supply chain problems initially caused by the Covid–19 pandemic.

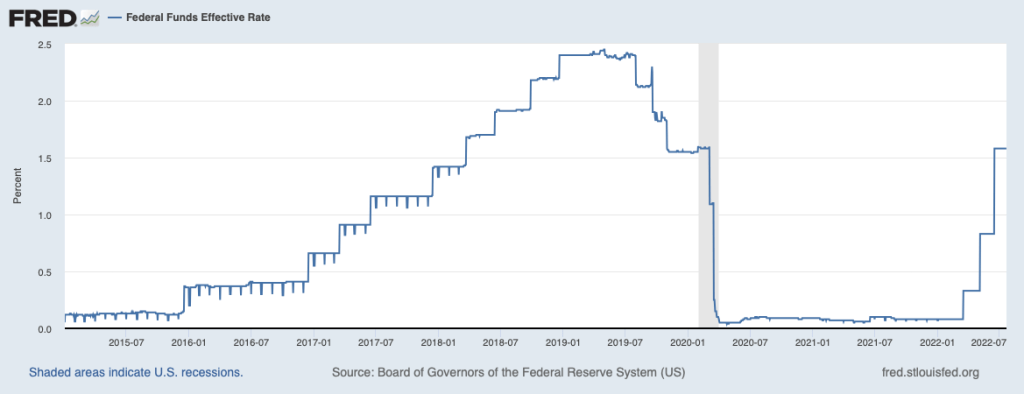

At the beginning of 2022, most members of the FOMC became convinced that in fact increases in aggregate demand were playing an important role in causing high inflation rates. Accordingly, the FOMC began increasing its target for the federal funds rate in March 2022. After two more rate increases, on the eve of the FOMC’s meeting on July 26–27, the federal funds rate target was a range of 1.50 percent to 1.75 percent. The FOMC was expected to raise its target by at least 0.75 percent at the meeting. The following figure shows movements in the effective federal funds rate—which can differ somewhat from the target rate—from January 1, 2015 to July 21, 2022.

In an opinion column in the Wall Street Journal, Massachusetts Senator Elizabeth Warren argued that the FOMC was making a mistake by increasing its target for the federal funds rate. She also criticized Summers for supporting the increases. Warren worried that the rate increases were likely to cause a recession and argued that Congress and President Biden should adopt alternative measures to contain inflation. Warren argued that a better approach to dealing with inflation would be to, among other steps, increase the federal government’s support for child care to enable more parents to work, provide support for strengthening supply chains, and lower prescription drug prices by allowing Medicare to negotiate the prices with pharmaceutical firms. She also urged a “crack down on price gouging by large corporations.” (We discussed the argument that monopoly power is responsible for inflation in this blog post.)

Summers responded to Warren in a Twitter thread. He noted that: “In the 18 months since the massive stimulus policies & easy money that [Senator Warren] has favored & I have opposed, the inflation rate has risen from below 2 to above 9 percent & workers purchasing power has, as a consequence, declined more rapidly than in any year in the last 50.” And “[Senator Warren] opposes restrictive monetary policy or any other measure to cool off total demand. Why does she think at a time when there are twice as many vacancies as jobs that inflation will come down without some drop in total demand?”

Clearly, economists and policymakers continue to hotly debate monetary policy.

Source: Elizabeth Warren, “Jerome Powell’s Fed Pursues a Painful and Ineffective Inflation Cure,” Wall Street Journal, July 24, 2022.

Are the Fed’s Forecasts of Inflation and Unemployment Inconsistent?

Four times per year, the members of the Federal Reserve’s Federal Open Market Committee (FOMC) publish their projections, or forecasts, of the values of the inflation rate, the unemployment, and changes in real gross domestic product (GDP) for the current year, each of the following two years, and for the “longer run.” The following table, released following the FOMC meeting held on March 15 and 16, 2022, shows the forecasts the members made at that time.

| Median Forecast | Meidan Forecast | Median Forecast | |||

| 2022 | 2023 | 2024 | Longer run | Actual values, March 2022 | |

| Change in real GDP | 2.8% | 2.2% | 2.2% | 1.8% | 3.5% |

| Unemployment rate | 3.5% | 3.5% | 3.6% | 4.0% | 3.6% |

| PCE inflation | 4.3% | 2.7% | 2.3% | 2.0% | 6.6% |

| Core PCE inflation | 4.1% | 2.6% | 2.3% | No forecast | 5.2% |

Recall that PCE refers to the consumption expenditures price index, which includes the prices of goods and services that are in the consumption category of GDP. Fed policymakers prefer using the PCE to measure inflation rather than the consumer price index (CPI) because the PCE includes the prices of more goods and services. The Fed uses the PCE to measure whether it is hitting its target inflation rate of 2 percent. The core PCE index leaves out the prices of food and energy products, including gasoline. The prices of food and energy products tend to fluctuate for reasons that do not affect the overall long-run inflation rate. So Fed policymakers believe that core PCE gives a better measure of the underlying inflation rate. (We discuss the PCE and the CPI in the Apply the Concept “Should the Fed Worry about the Prices of Food and Gasoline?” in Macroeconomics, Chapter 15, Section 15.5 (Economics, Chapter 25, Section 25.5)).

The values in the table are the median forecasts of the FOMC members, meaning that the forecasts of half the members were higher and half were lower. The members do not make a longer run forecast for core PCE. The final column shows the actual values of each variable in March 2022. The values in that column represent the percentage in each variable from the corresponding month (or quarter in the case of real GDP) in the previous year. Links to the FOMC’s economic projections can be found on this page of the Federal Reserve’s web site.

At its March 2022 meeting, the FOMC began increasing its target for the federal funds rate with the expectation that a less expansionary monetary policy would slow the high rates of inflation the U.S. economy was experiencing. Note that in that month, inflation measured by the PCE was running far above the Fed’s target inflation rate of 2 percent.

In raising its target for the federal funds rate and by also allowing its holdings of U.S. Treasury securities and mortgage-backed securities to decline, Fed Chair Jerome Powell and the other members of the FOMC were attempting to achieve a soft landing for the economy. A soft landing occurs when the FOMC is able to reduce the inflation rate without causing the economy to experience a recession. The forecast values in the table are consistent with a soft landing because they show inflation declining towards the Fed’s target rate of 2 percent while the unemployment rate remains below 4 percent—historically, a very low unemployment rate—and the growth rate of real GDP remains positive. By forecasting that real GDP would continue growing while the unemployment rate would remain below 4 percent, the FOMC was forecasting that no recession would occur.

Some economists see an inconsistency in the FOMC’s forecasts of unemployment and inflation as shown in the table. They argued that to bring down the inflation rate as rapidly as the forecasts indicated, the FOMC would have to cause a significant decline in aggregate demand. But if aggregate demand declined significantly, real GDP would either decline or grow very slowly, resulting in the unemployment rising above 4 percent, possibly well above that rate. For instance, writing in the Economist magazine, Jón Steinsson of the University of California, Berkeley, noted that the FOMC’s “combination of forecasts [of inflation and unemployment] has been dubbed the ‘immaculate disinflation’ because inflation is seen as falling rapidly despite a very tight labor market and a [federal funds] rate that is for the most part negative in real terms (i.e., adjusted for inflation).”

Similarly, writing in the Washington Post, Harvard economist and former Treasury secretary Lawrence Summers noted that “over the past 75 years, every time inflation has exceeded 4 percent and unemployment has been below 5 percent, the U.S. economy has gone into recession within two years.”

In an interview in the Financial Times, Olivier Blanchard, senior fellow at the Peterson Institute for International Economics and former chief economist at the International Monetary Fund, agreed. In their forecasts, the FOMC “had unemployment staying at 3.5 percent throughout the next two years, and they also had inflation coming down nicely to two point something. That just will not happen. …. [E]ither we’ll have a lot more inflation if unemployment remains at 3.5 per cent, or we will have higher unemployment for a while if we are actually to inflation down to two point something.”

While all three of these economists believed that unemployment would have to increase if inflation was to be brought down close to the Fed’s 2 percent target, none were certain that a recession would occur.

What might explain the apparent inconsistency in the FOMC’s forecasts of inflation and unemployment? Here are three possibilities:

- Fed policymakers are relatively optimistic that the factors causing the surge in inflation—including the economic dislocations due to the Covid-19 pandemic and the Russian invasion of Ukraine and the surge in federal spending in early 2021—are likely to resolve themselves without the unemployment rate having to increase significantly. As Steinsson puts it in discussing this possibility (which he believes to be unlikely) “it is entirely possible that inflation will simply return to target as the disturbances associated with Covid-19 and the war in Ukraine dissipate.”

- Fed Chair Powell and other members of the FOMC were convinced that business managers, workers, and investors still expected that the inflation rate would return to 2 percent in the long run. As a result, none of these groups were taking actions that might lead to a wage-price spiral. (We discussed the possibility of a wage-price spiral in earlier blog post.) For instance, at a press conference following the FOMC meeting held on May 3 and 4, 2022, Powell argued that, “And, in fact, inflation expectations [at longer time horizons] come down fairly sharply. Longer-term inflation expectations have been reasonably stable but have moved up to—but only to levels where they were in 2014, by some measures.” If Powell’s assessment was correct that expectations of future inflation remained at about 2 percent, the probability of a soft landing was increased.

- We should mention the possibility that at least some members of the FOMC may have expected that the unemployment rate would increase above 4 percent—possibly well above 4 percent—and that the U.S. economy was likely to enter a recession during the coming months. They may, however, have been unwilling to include this expectation in their published forecasts. If members of the FOMC state that a recession is likely, businesses and households may reduce their spending, which by itself could cause a recession to begin.

Sources: Martin Wolf, “Olivier Blanchard: There’s a for Markets to Focus on the Present and Extrapolate It Forever,” ft.com, May 26, 2022; Lawrence Summers, “My Inflation Warnings Have Spurred Questions. Here Are My Answers,” Washington Post, April 5, 2022; Jón Steinsson, “Jón Steinsson Believes That a Painless Disinflation Is No Longer Plausible,” economist.com, May 13, 2022; Federal Open Market Committee, “Summary of Economic Projections,” federalreserve.gov, March 16, 2022; and Federal Open Market Committee, “Transcript of Chair Powell’s Press Conference May 4, 2022,” federalreserve.gov, May 4, 2022.