As we discuss in Microeconomics and Economics, Chapter 15, Section 15.6, the U.S. Department of Justice’s Antitrust Division and the Federal Trade Commission have merger guidelines that they typically follow when deciding whether to oppose a merger between two firms in the same industry—these mergers are called horizontal mergers. The guidelines are focused on the effect a potential merger would have on market price of the industry’s output. We know that if the price in a market increases, holding everything else constant, consumer surplus will decline and the deadweight loss in the market will increase. But, as we note in Chapter 15, if a merger increases the efficiency of the merged firms, the result can be a decrease in costs that will lower the price, increase consumer surplus, and reduce the deadweight loss.

The merger guidelines focus on the effect of two firms combining on the merged firms’ market power in the output market. For example, if two book publishers merge, what will be the effect on the price of books? But what if the newly merged firm gains increased market power in input markets and uses that power to force its suppliers to accept lower prices? For example, if two book publishers merge will they be able to use their market power to reduce the royalties they pay to writers? The federal antitrust authorities have traditionally considered market power in the output market—sometimes called monopoly power—but rarely considered market power in the input market—sometimes called monopsony power.

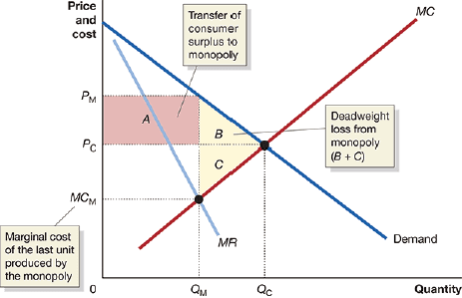

In Chapter 16, Section 16.6, we note that a pure monopsony is the sole buyer of an input, a rare situation that might occur in, for example, a small town in which a lumber mill is the sole employer. A monopoly in an output market in which a single firm is the sole seller of a good is also rare, but many firms have some monopoly power because they have the ability to charge a price higher than marginal cost. Similarly, although monopsonies in input markets are rare, some firms may have monopsony power because they have the ability to pay less than the competitive equilibrium price for an input. For example, as we noted in Chapter 14, Section 14.4, Walmart is large enough in the market for some products, such as detergent and toothpaste, that it is able to insist that suppliers give it discounts below what would otherwise be the competitive price.

Monopsony power was the key issue involved in November 2021 when the Justice Department filed an antitrust lawsuit to keep the book publisher Penguin Random House from buying Simon & Schuster, another one of the five largest publishers. The merged firm would account for 31 percent of books published in the U.S. market. The lawsuit alleged that buying Simon & Schuster would allow “Penguin Random House, which is already the largest book publisher in the world, to exert outsized influence over which books are published in the United States and how much authors are paid for their work.”

We’ve seen that when two large firms propose a merger, they often argue that the merger will allow efficiency gains large enough to result in lower prices despite the merged firm having increased monopoly power. In August 2022, during the antitrust trial over the Penguin–Simon & Schuster merger, Markus Dohle, the CEO of Penguin made a similar argument, but this time in respect to an input market—payments to book authors. He argued that because Penguin had a much better distribution network, sales of Simon & Schuster books would increase, which would lead to increased payments to authors. Authors would be made better off by the merger even though the newly merged firm would have greater monopsony power. Penguin’s attorneys also argued that the market for book publishing was larger than the Justice Department believed. They argued that the relevant book market included not just the five largest publishers but also included Amazon and many medium and small publishers “all capable of competing for [the right to publish] future titles from established and emerging authors.” The CEO of Hachette Book Group, another large book publisher, disagreed, arguing at the trial that the merger between Penguin and Simon & Schuster would result in lower payments to authors.

The antitrust lawsuit against Penguin and Simon & Schuster was an example of the more aggressive antitrust policy being pursued by the Biden administration. (We discussed the Biden administration’s approach to antitrust policy in this earlier blog post.) An article in the New York Times quoted a lawyer for a legal firm that specializes in antitrust cases as arguing that the lawsuit against Penguin and Simon & Schuster was unusual in that the lawsuit “declines to even allege the historically key antitrust harm—increased prices.” The outcome of the Justice Department’s lawsuit against Penguin and Simon & Schuster may provide insight into whether federal courts will look favorably on the Biden administration’s more aggressive approach to antitrust policy.

Sources: Jan Wolfe, “Penguin Random House CEO Defends Publishing Merger at Antitrust Trial,” Wall Street Journal, August 4, 2022; David McCabe, “Justice Dept. and Penguin Random House’s Sparring over Merger Has Begun,” New York Times, August 1, 2022; Eduardo Porter, “A New Legal Tactic to Protect Workers’ Pay,” New York Times, April 14, 2022; Janet H. Cho and Karishma Vanjani, “Justice Department Seeks to Block Penguin Random House Buy of Viacom’s Simon & Schuster,” barrons.com, November 2, 2021; United States Department of Justice, “Justice Department Sues to Block Penguin Random House’s Acquisition of Rival Publisher Simon & Schuster,” justice.gov, November 2, 2021;