Photo from the Associated Press via the Wall Street Journal.

A tax is progressive if people with lower incomes pay a lower percentage of their income in tax than do people with higher incomes. (We discuss the U.S. tax system in Microeconomics and Economics, Chapter 17, Section 17.2.) Recently, the Joint Committee on Taxation (JCT) of the U.S. Congress released a report, “Overview of the Federal Tax System as in Effect for 2024,” that provides data on the progressivity of the U.S. tax system. (An overview of the role of the JCT can be found here.)

The progressivity of the federal individual income tax is shown in the following figure from the JCT report. The column on the right shows that for each category of taxpayers shown—single people, heads of households (who are unmarried people who financially support at least one other person), and married people—the marginal income tax rate increases with a taxpayer’s income. The marginal tax rate is the rate that someone pays on additional income that they earn. So, for instance, the table shows that an individual who has taxable income of $80,000 faces a marginal tax rate of 22 percent because that is the rate the person pays on the income they earn between $47,150 and $80,000. An individual who has a taxable income of $700,000 faces a marginal tax rate of 37 percent because that is the rate the person pays on the income they earn between $609,350 and $700,000.

In Chapter 17, we use data from the Tax Policy Center to show the average income tax rate paid by different income groups. The average tax rate is computed as the total tax paid divided by taxable income. The marginal tax rate is a better indicator than the average tax rate of how a change in a tax will affect a person’s willingness to work, save, and invest. For instance, if you are considering working more hours in your job or taking on a second job, such driving part time for Uber or Lyft, you want to know what your tax rate is on the additional income you will earn. For that purpose, you should ignore your average tax rate and instead focus on your marginal tax rate.

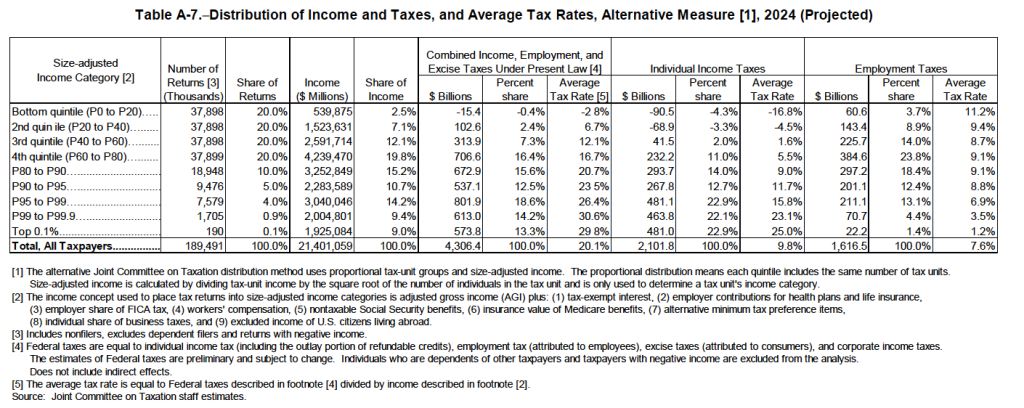

The following table from the JCT report is similar to the table in Chapter 17, which was based on data from the Tax Policy Center. The JCT report has the advantage of direct access to government tax data, which, as a private group, the Tax Policy Center doesn’t have. In addition, the JCT reports on an income group—the top 0.1 percent of income earners—compiled from government data not available to the Tax Policy Center. (Much political discussion has focused on the income earned and taxes paid by the top 1 percent of earners, which is a much larger group than the top 0.1 percent. We discuss the top 1 percent in the Apply the Concept, “Who Are the 1 Percent, and How Do They Earn Their Incomes,” in Microeconomics and Economics, Chaper 17, Section 17.4.)

The table shows data for the first four quntiles (or groups of 20 percent of taxpayers), with the highest quintile divided further. The table shows that the federal individual income tax is highly progressive, with the two lowest income quintiles having negative average tax rates because they receive more in tax credits than they pay in taxes. Employment taxes—primarily the payroll tax used to fund the Social Security and Medicare Systems—are regressive, with the lowest deciles paying a larger percentage of their income in these taxes than do the higher deciles. The regressivity of employment taxes is the result of both payroll taxes being levied on the first dollar of wages and salaries individuals earn and the part of the payroll tax used to fund the Social Security system dropping to zero for incomes above a certain level—$168,600 in 2024. Because income taxes are much larger in total than employment taxes or excise taxes—such as the federal taxes on gasoline, airline tickets, and alcoholic beverages—the total of these three types of federal taxes is progressive, as shown by the fact that the average tax rate rises with income. (Although note that the top 0.1 percent pay taxes at a slightly lower rate than do the other taxpayers included in the top 1 percent.)