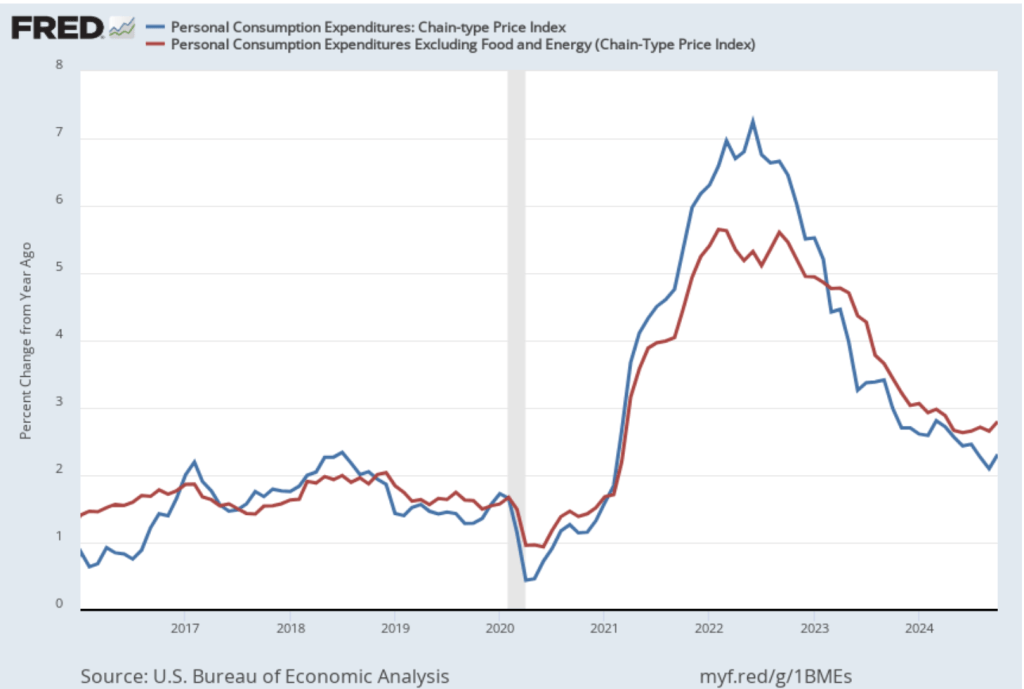

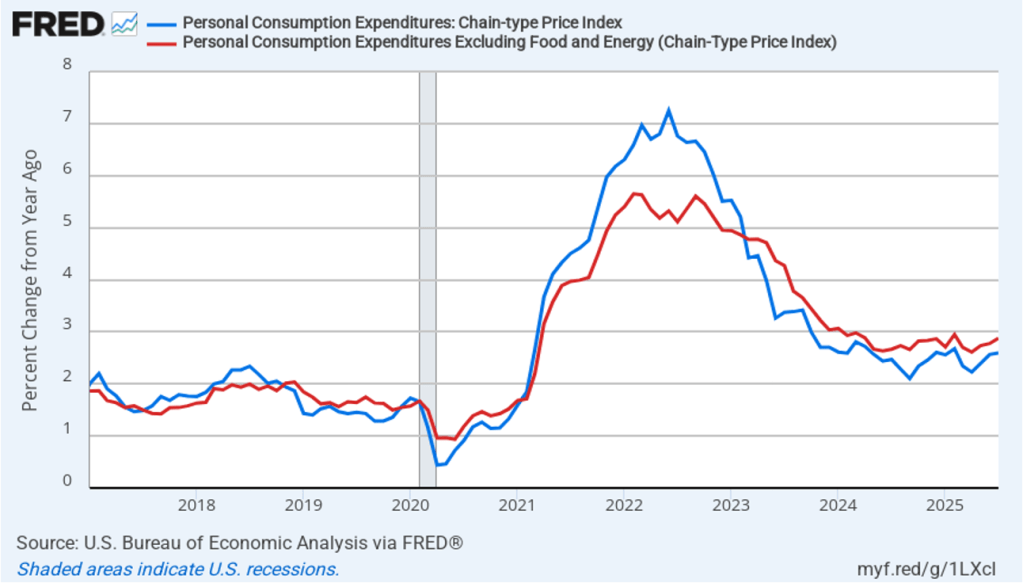

On August 29, the Bureau of Economic Analysis (BEA) released data for July on the personal consumption expenditures (PCE) price index as part of its “Personal Income and Outlays” report. The Fed relies on annual changes in the PCE price index to evaluate whether it’s meeting its 2 percent annual inflation target.

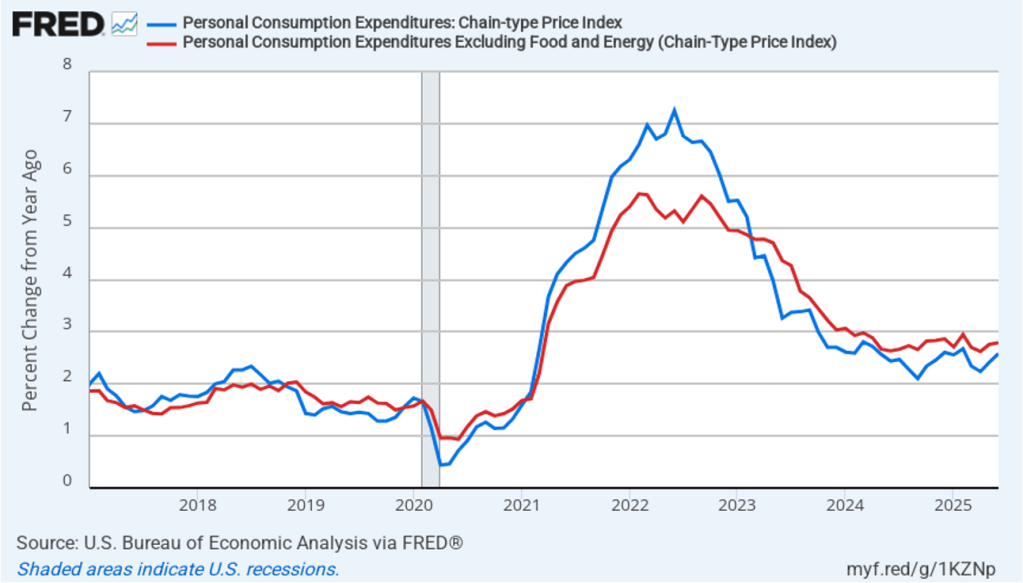

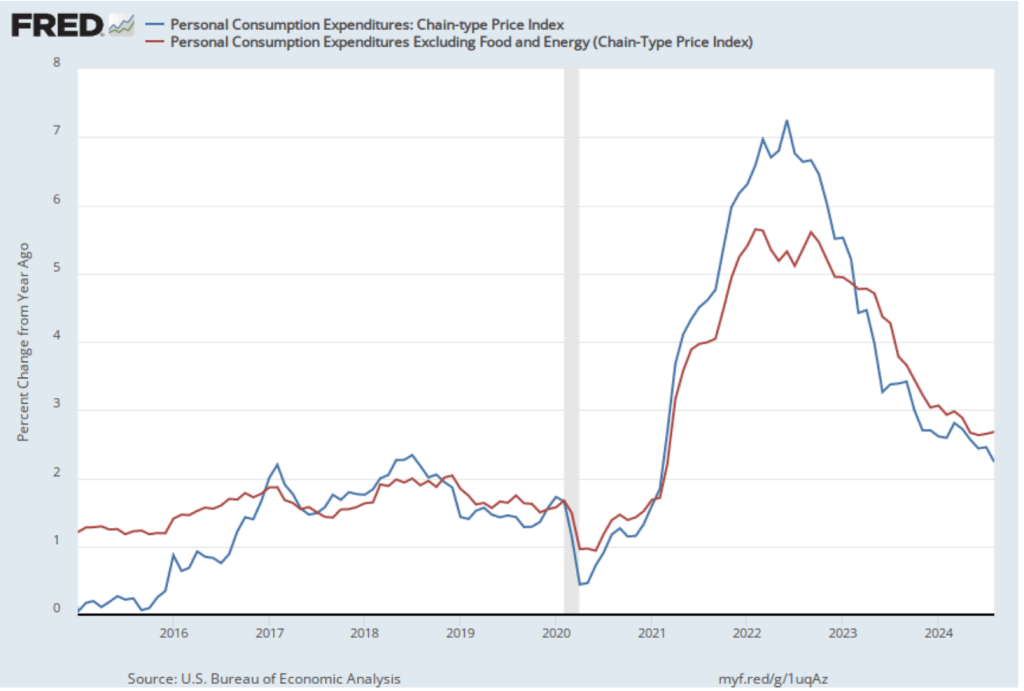

The following figure shows headline PCE inflation (the blue line) and core PCE inflation (the red line)—which excludes energy and food prices—for the period since January 2017, with inflation measured as the percentage change in the PCE from the same month in the previous year. In July, headline PCE inflation was 2.6 percent, unchanged from June. Core PCE inflation in July was 2.9 percent, up slightly from 2.8 percent in June. Headline PCE inflation and core PCE inflation were both equal to what economists surveyed had forecast.

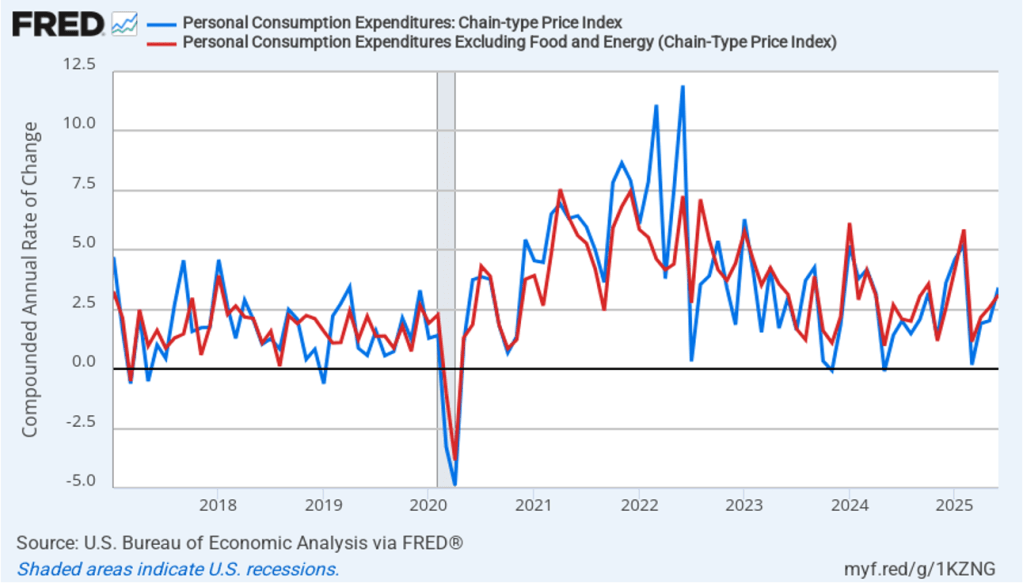

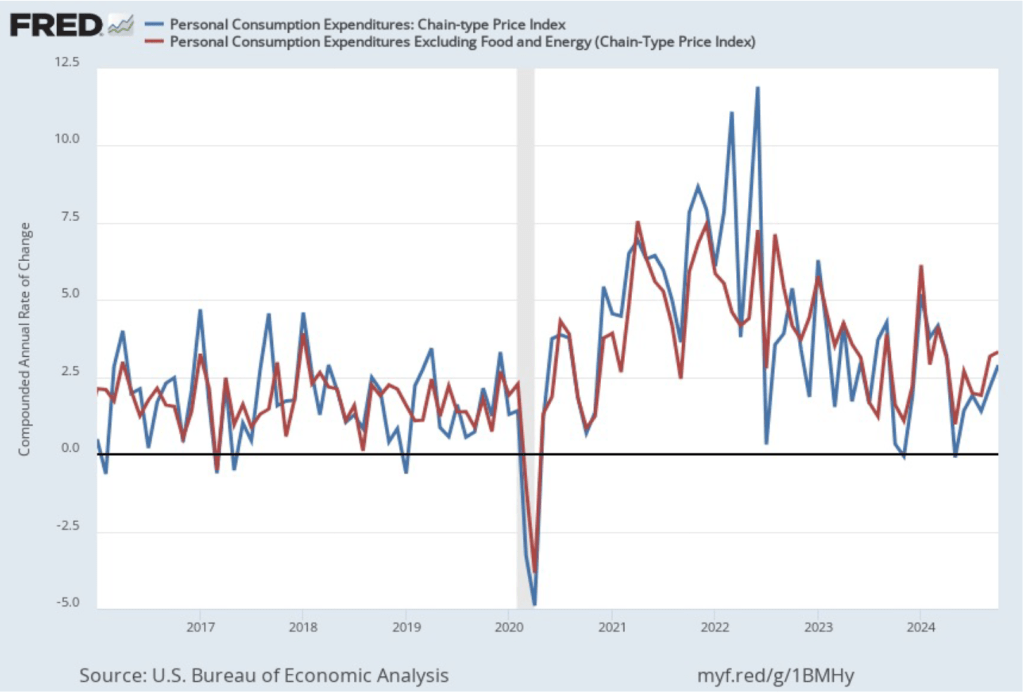

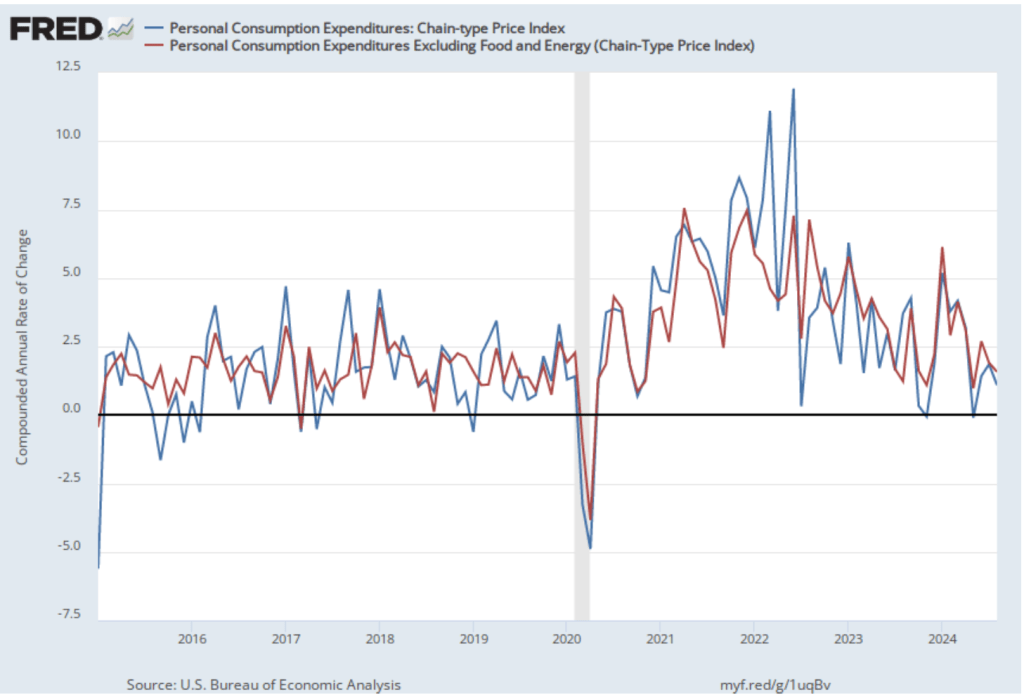

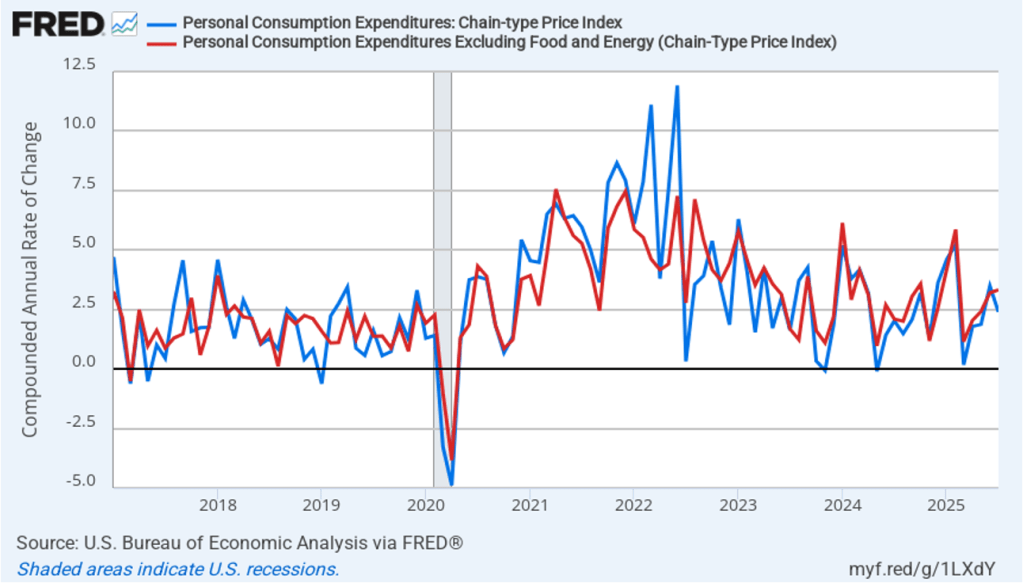

The following figure shows headline PCE inflation and core PCE inflation calculated by compounding the current month’s rate over an entire year. (The figure above shows what is sometimes called 12-month inflation, while this figure shows 1-month inflation.) Measured this way, headline PCE inflation fell from 3.5 percent in June to 2.4 percent in July. Core PCE inflation increased slightly from 3.2 percent in June to 3.3 percent in July. So, both 1-month PCE inflation estimates are above the Fed’s 2 percent target, with 1-month core PCE inflation being well above target. The usual caution applies that 1-month inflation figures are volatile (as can be seen in the figure), so we shouldn’t attempt to draw wider conclusions from one month’s data. In addition, these data may reflect higher prices resulting from the tariff increases the Trump administration has implemented. Once the one-time price increases from tariffs have worked through the economy, inflation may decline. It’s not clear, however, how long that may take and it’s likely that not all the effects of the tariff increases on the price level are reflected in this month’s data.

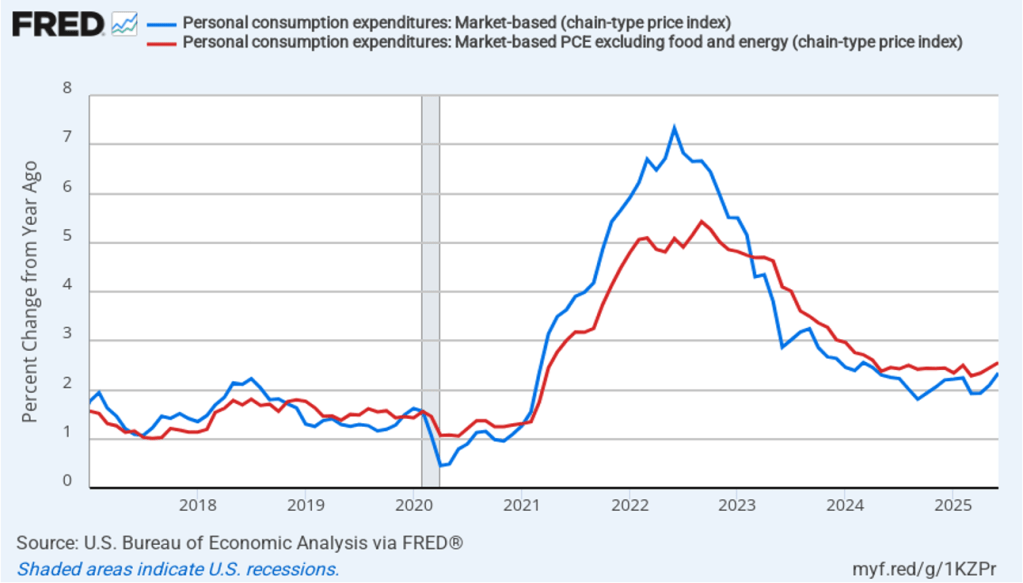

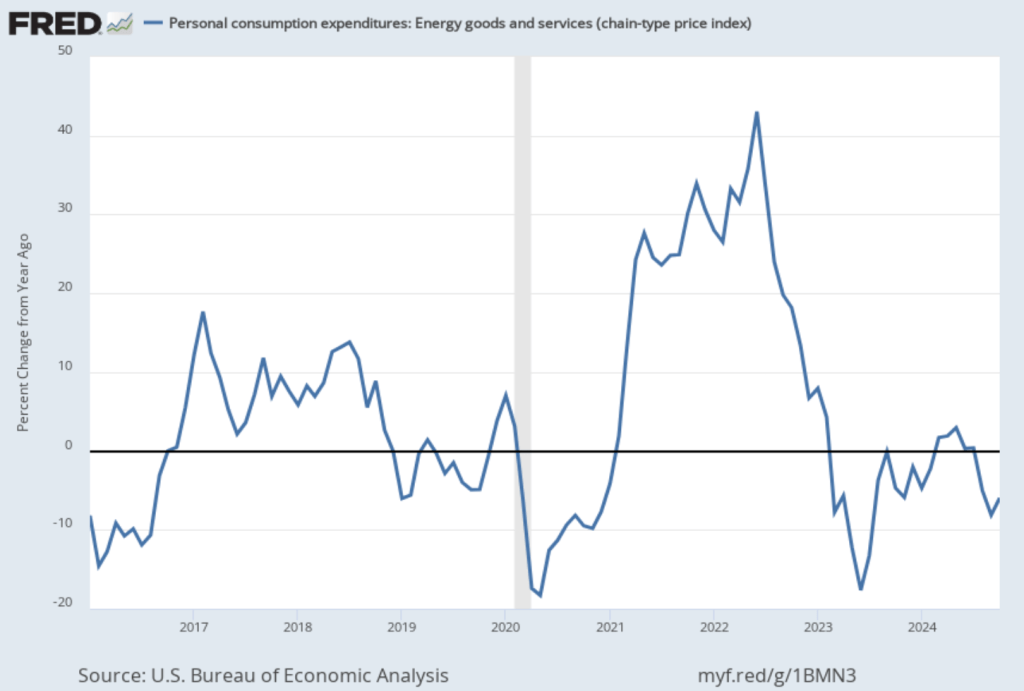

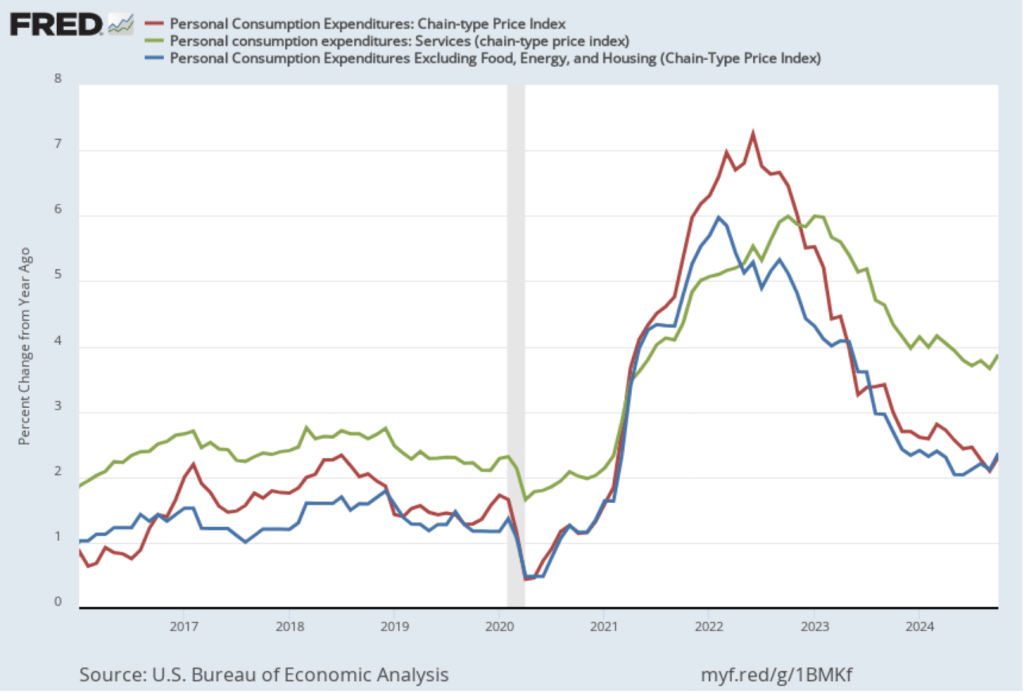

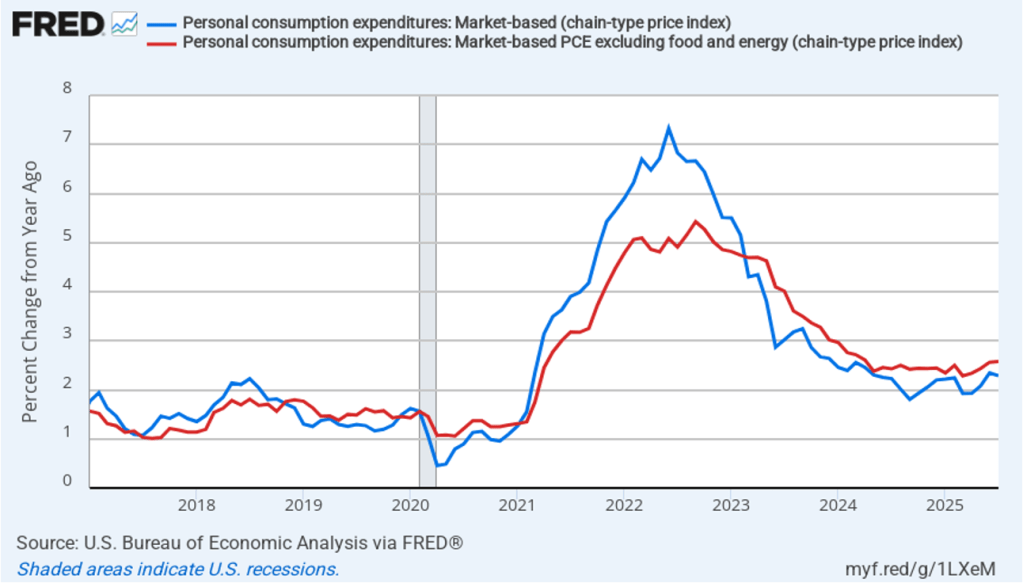

As usual, we need to note that Fed Chair Jerome Powell has frequently mentioned that inflation in non-market services can skew PCE inflation. Non-market services are services whose prices the BEA imputes rather than measures directly. For instance, the BEA assumes that prices of financial services—such as brokerage fees—vary with the prices of financial assets. So that if stock prices fall, the prices of financial services included in the PCE price index also fall. Powell has argued that these imputed prices “don’t really tell us much about … tightness in the economy. They don’t really reflect that.” The following figure shows 12-month headline inflation (the blue line) and 12-month core inflation (the red line) for market-based PCE. (The BEA explains the market-based PCE measure here.)

Headline market-based PCE inflation was 2.3 percent in July, unchanged from June. Core market-based PCE inflation was 2.6 percent in July, also unchanged from June. So, both market-based measures show inflation as stable but above the Fed’s 2 percent target.

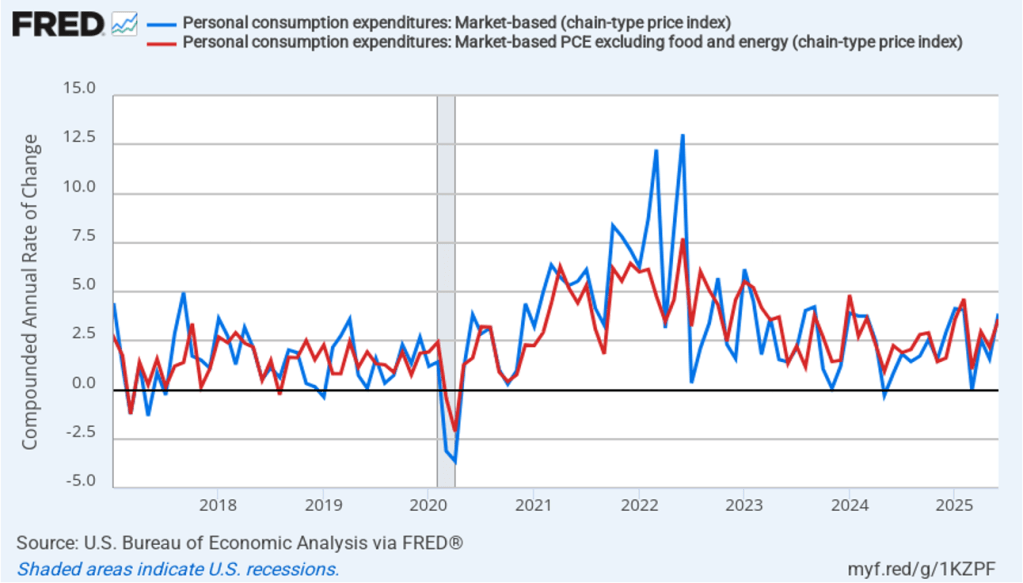

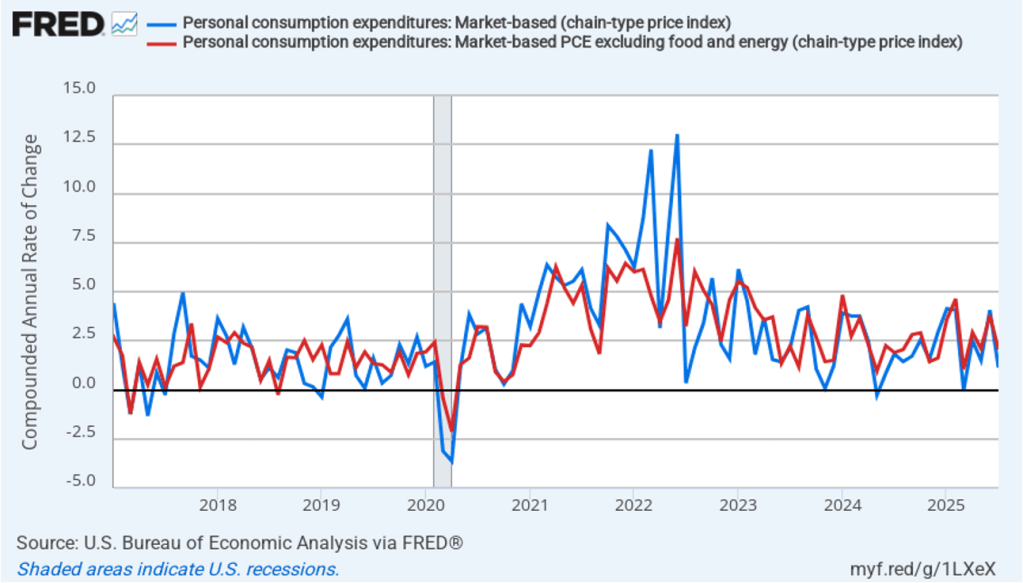

In the following figure, we look at 1-month inflation using these measures. One-month headline market-based inflation declined sharply to 1.1 percent in July from 4.1 percent in June. One-month core market-based inflation also declined sharply to 2.1 percent in July from 3.8 percent in June. As the figure shows, the 1-month inflation rates are more volatile than the 12-month rates, which is why the Fed relies on the 12-month rates when gauging how close it is coming to hitting its target inflation rate. Still, looking at 1-month inflation gives us a better look at current trends in inflation, which these data indicate is slowing significantly.

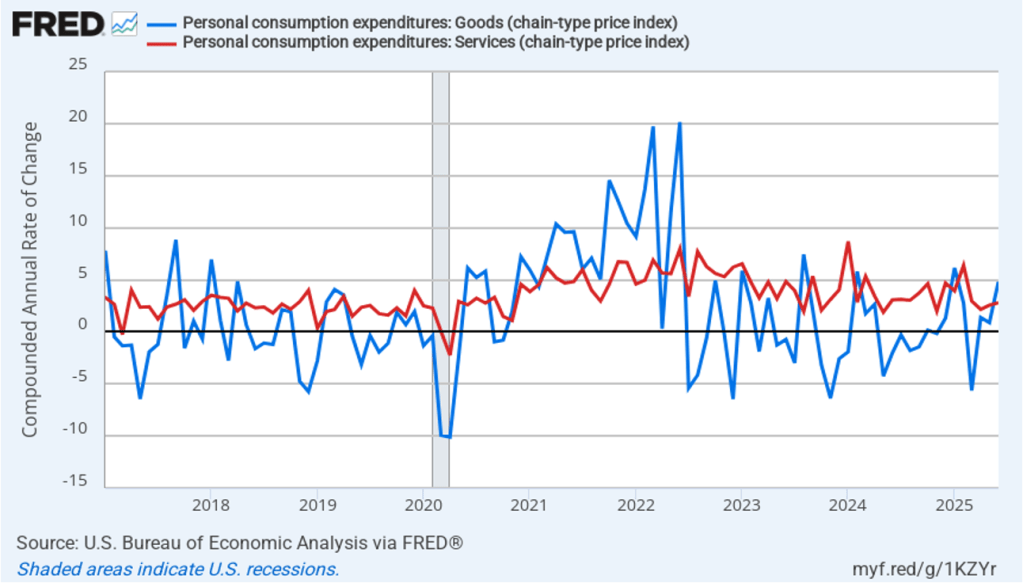

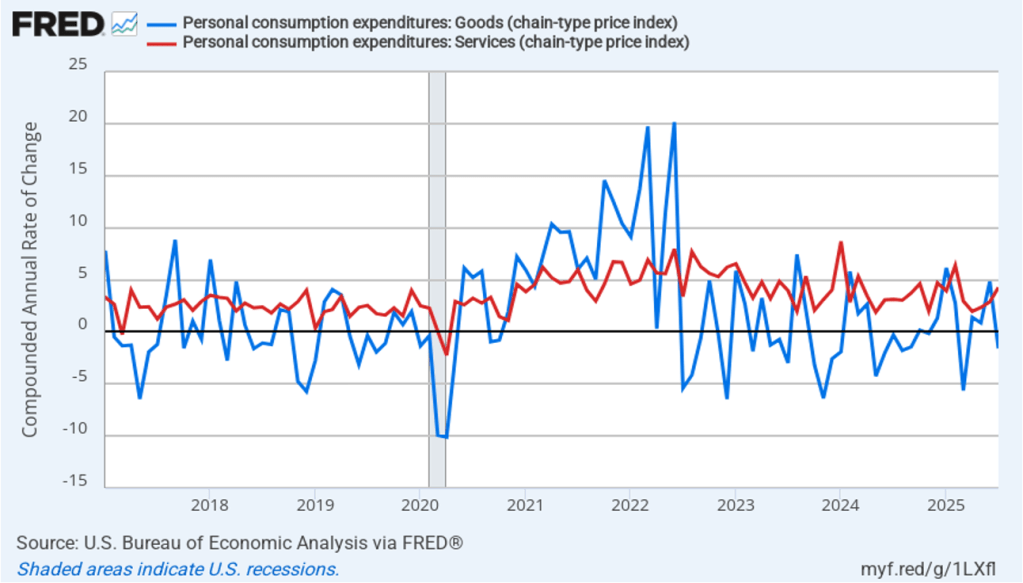

As we noted earlier, some of the increase in inflation is likely attributable to the effects of tariffs. The effect of tariffs are typically seen in goods prices, rather than in service prices because tariffs are levied primarily on imports of goods. As the following figure shows, one-month inflation in goods prices jumped in June to 4.8 percent, but then declined sharply to –1.6 in July. One-month inflation in services prices increased from 2.9 percent in June to 4.3 percent in July. Clearly, the 1-month inflation data—particularly for goods—are quite volatile.

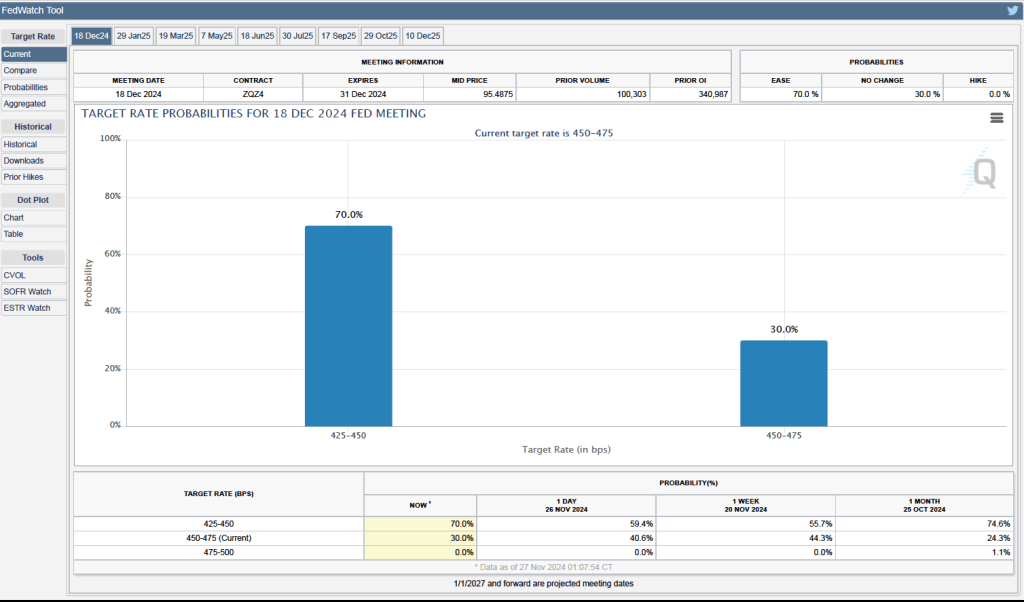

Finally, these data had little effect on the expectations of investors trading federal funds rate futures. Investors assign an 86.4 percent probability to the Federal Open Market Committee (FOMC) cutting its target for the federal funds rate at its meeting on September 16–17 by 0.25 percentage point (25 basis points) from its current range of 4.25 percent to 4.5o percent. There has been some speculation in the business press that the FOMC might cut its target by 50 basis points at that meeting, but with inflation remaining above target, investors don’t foresee a larger cut in the target range happening.