Federal Reserve Chair Jerome Powell (Photo from federalreserve.gov)

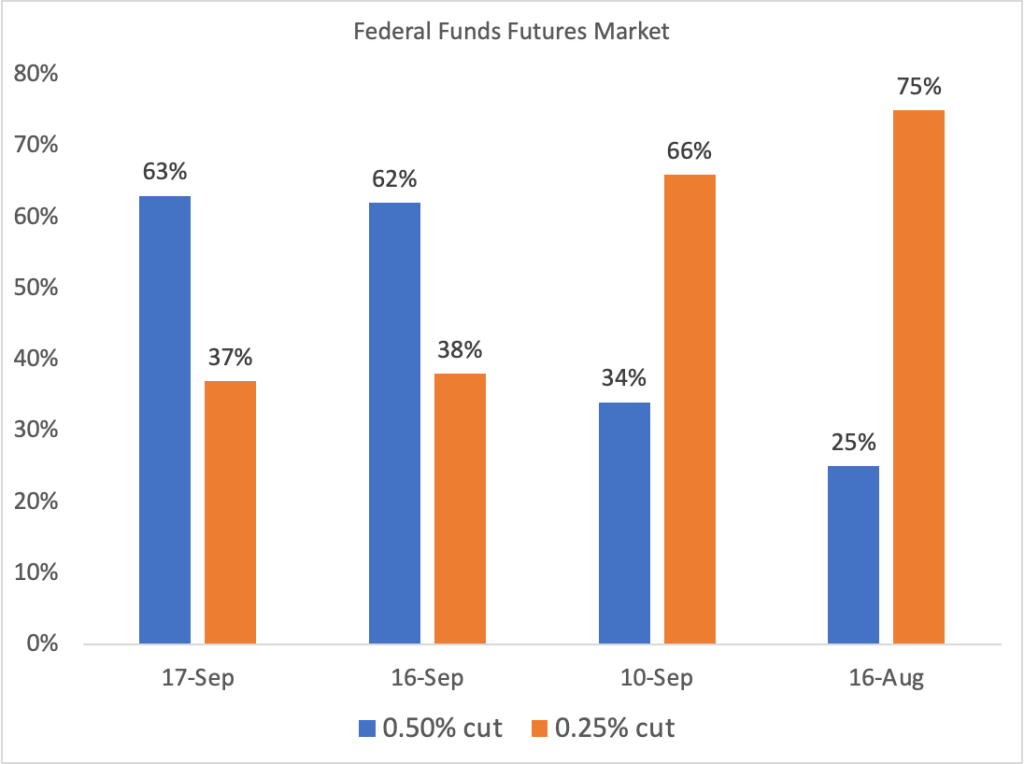

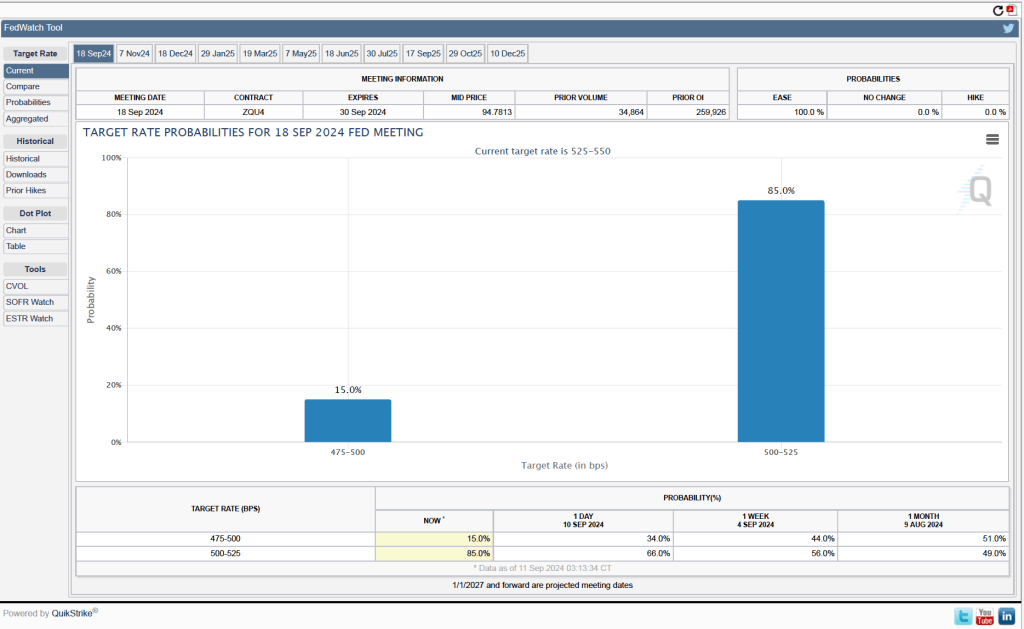

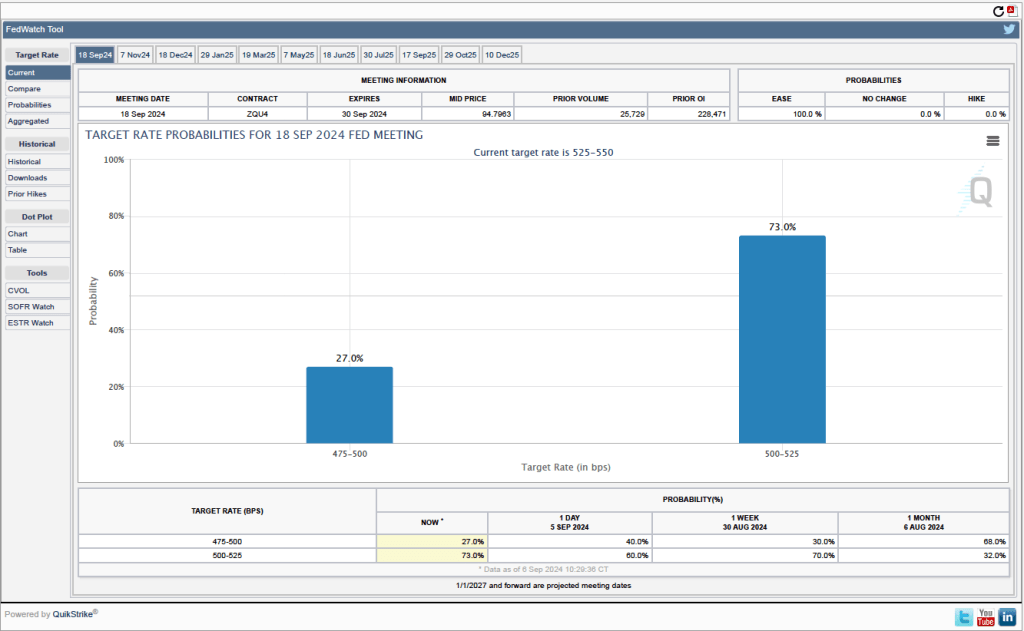

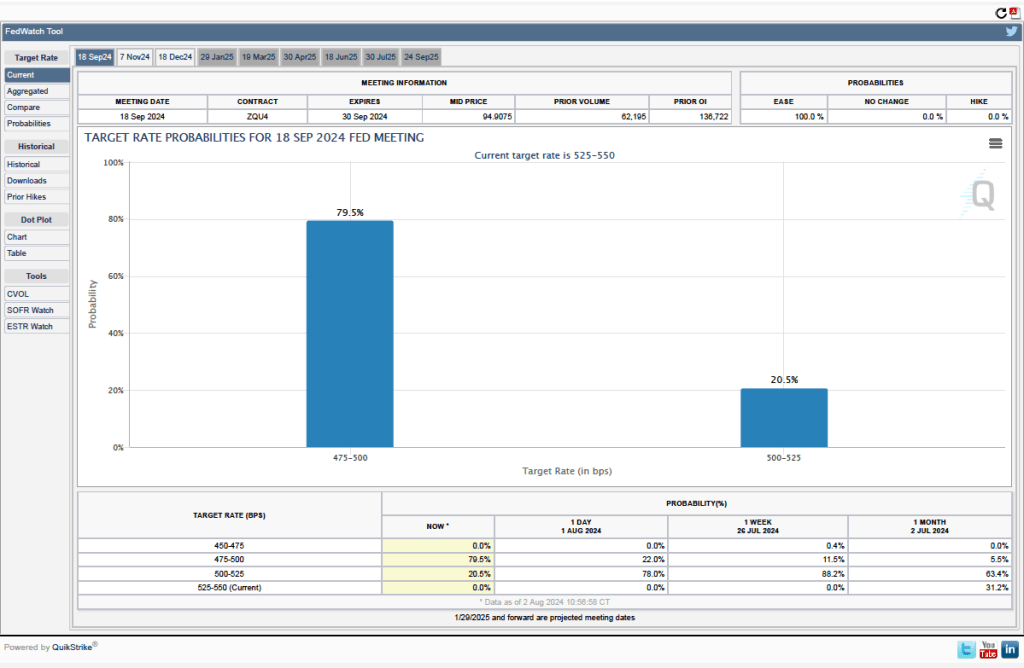

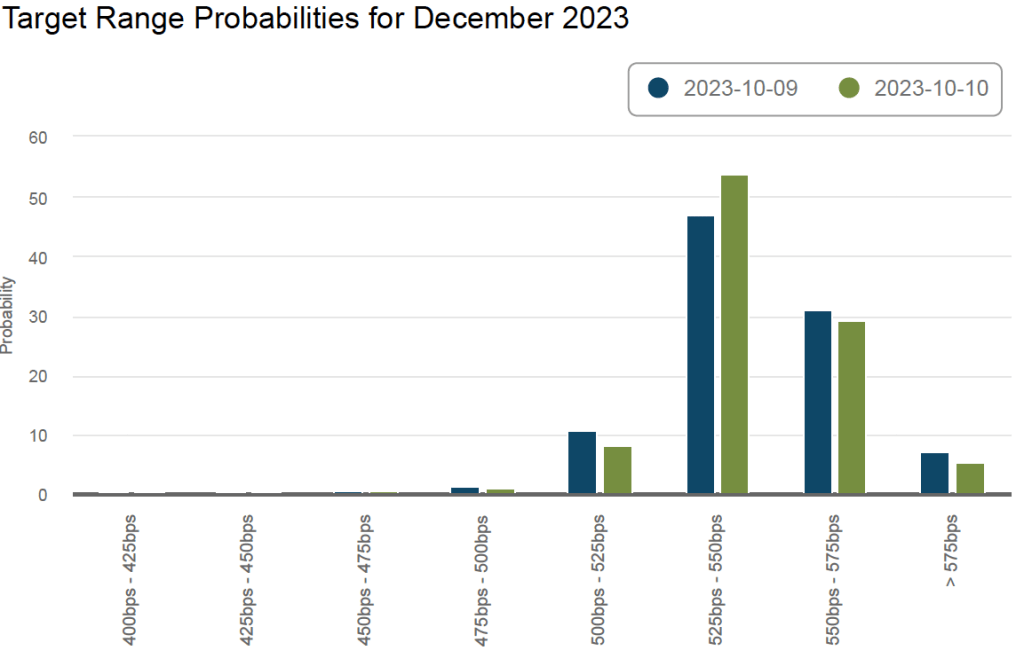

In a blog post yesterday (September 17), we noted that trading on the CME’s federal funds futures market indicated that investors assigned a probability of 63 percent to the Federal Open Market Committee (FOMC) announcing today a 0.50 percentage point (50 basis points) cut to its target range for the federal funds rate and a probability of 37 percent to a 0.25 percentage point (25 basis points) cut. (100 basis points equals 1 percentage point.) The forecast proved correct when the FOMC announced this afternoon that it was cutting its target range to 4.75 percent to 5.00 percent, from the range of 5.25 percent to 5.50 percent that had been in place since July 2023.

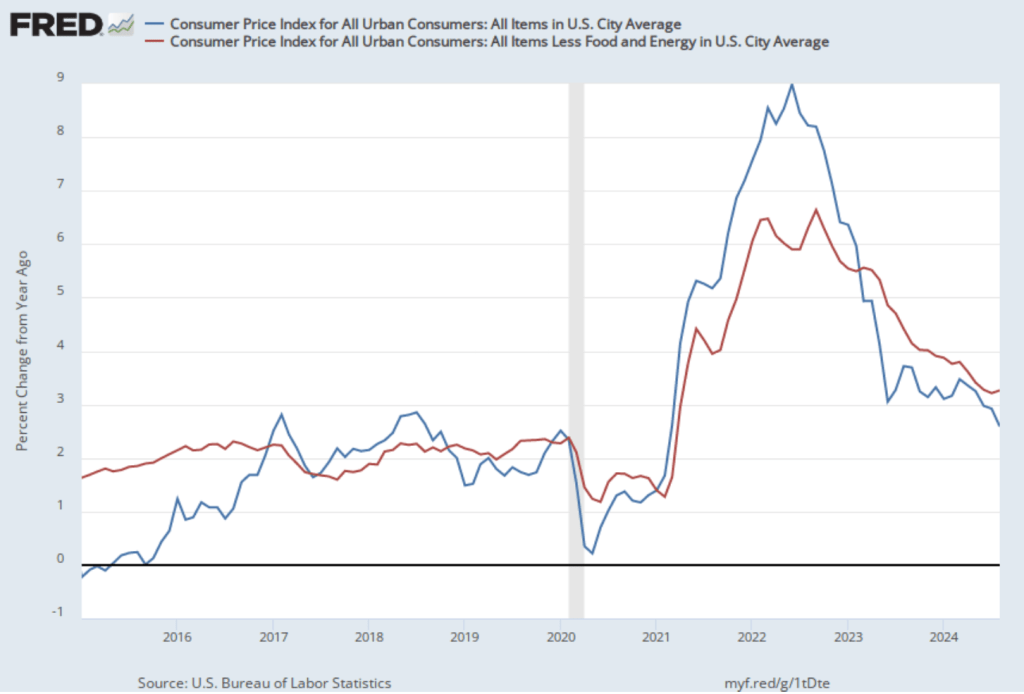

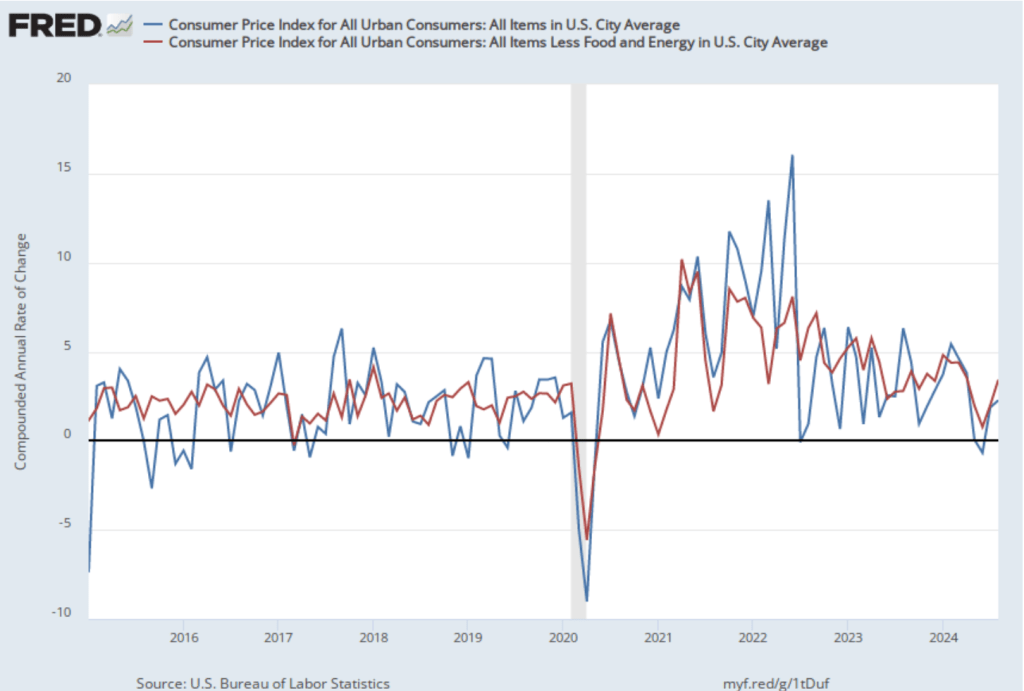

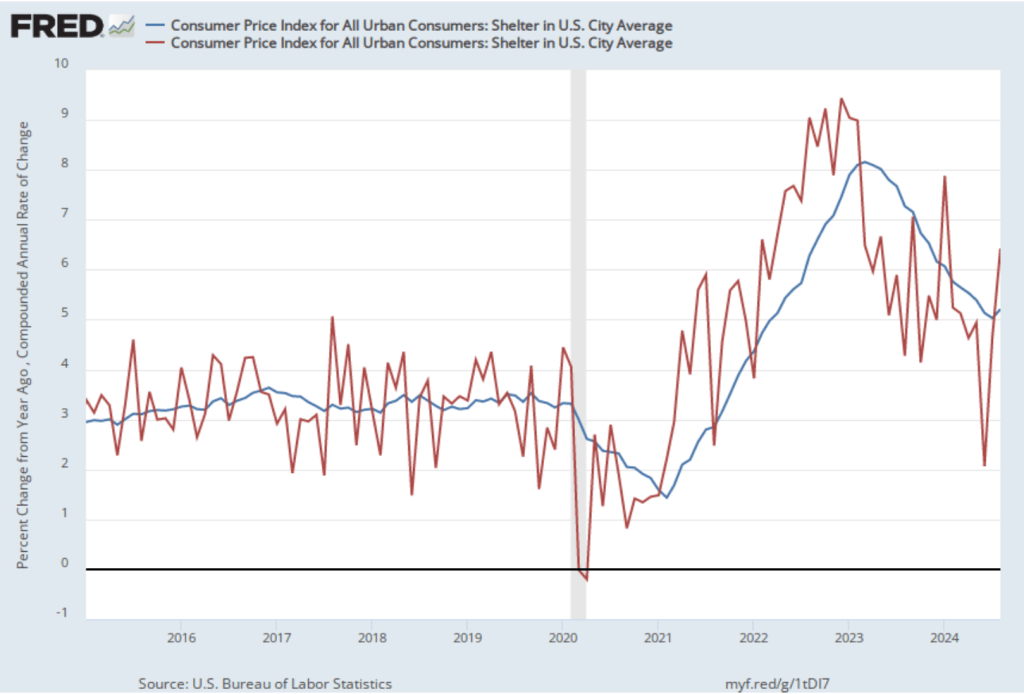

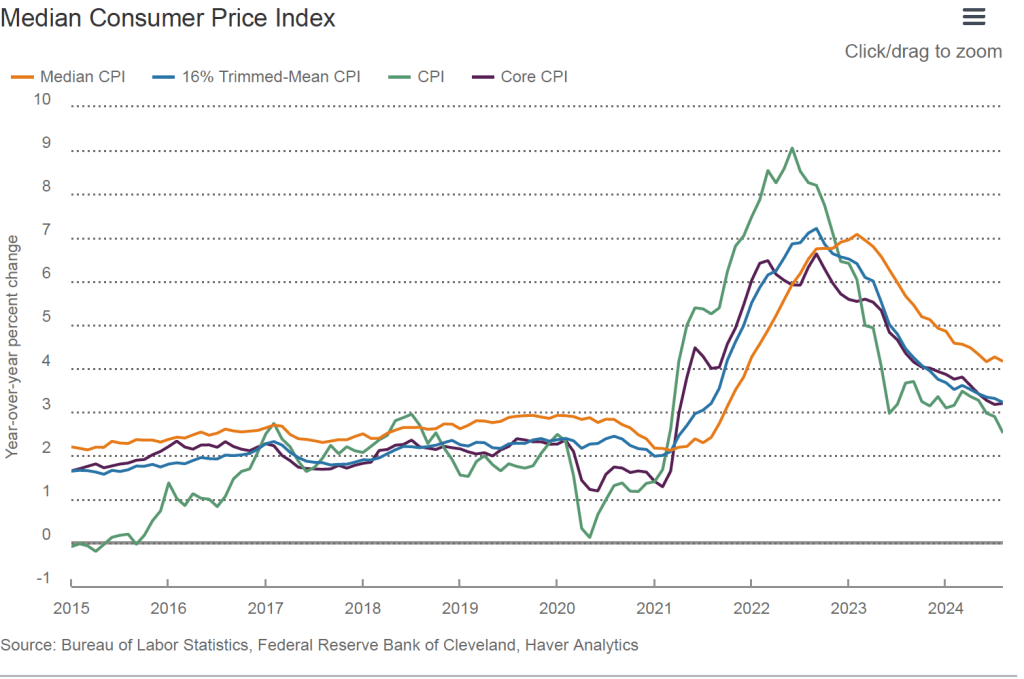

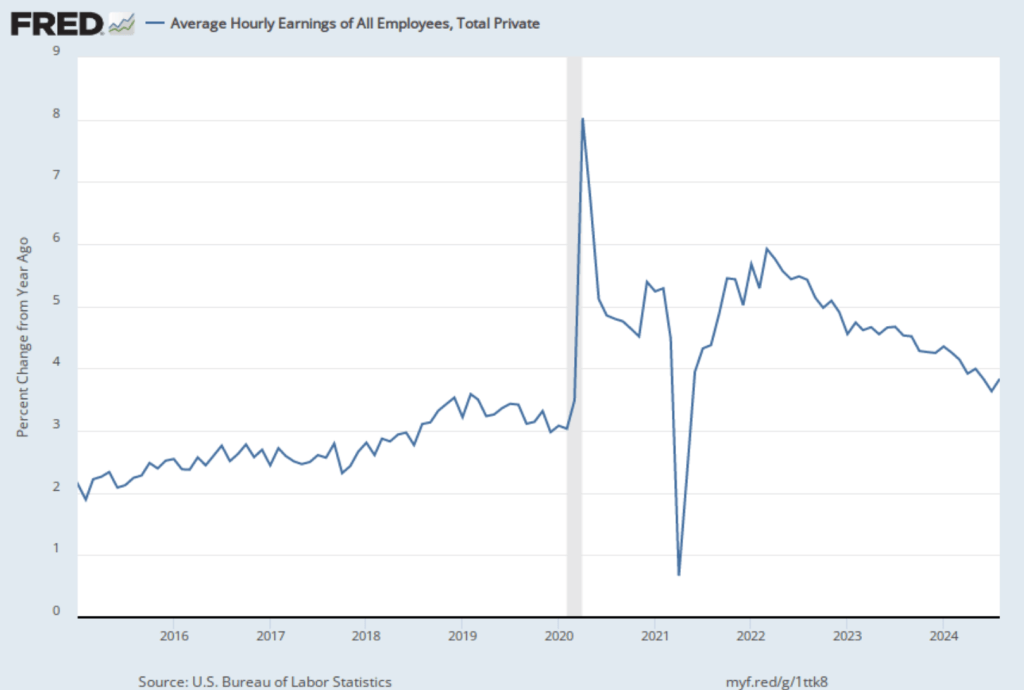

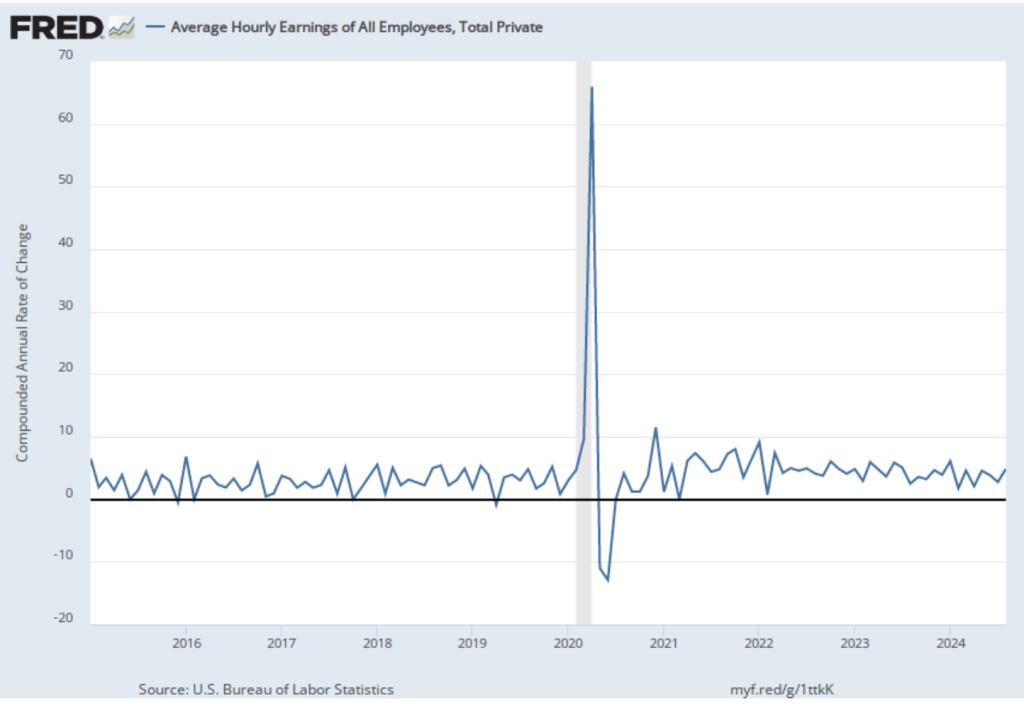

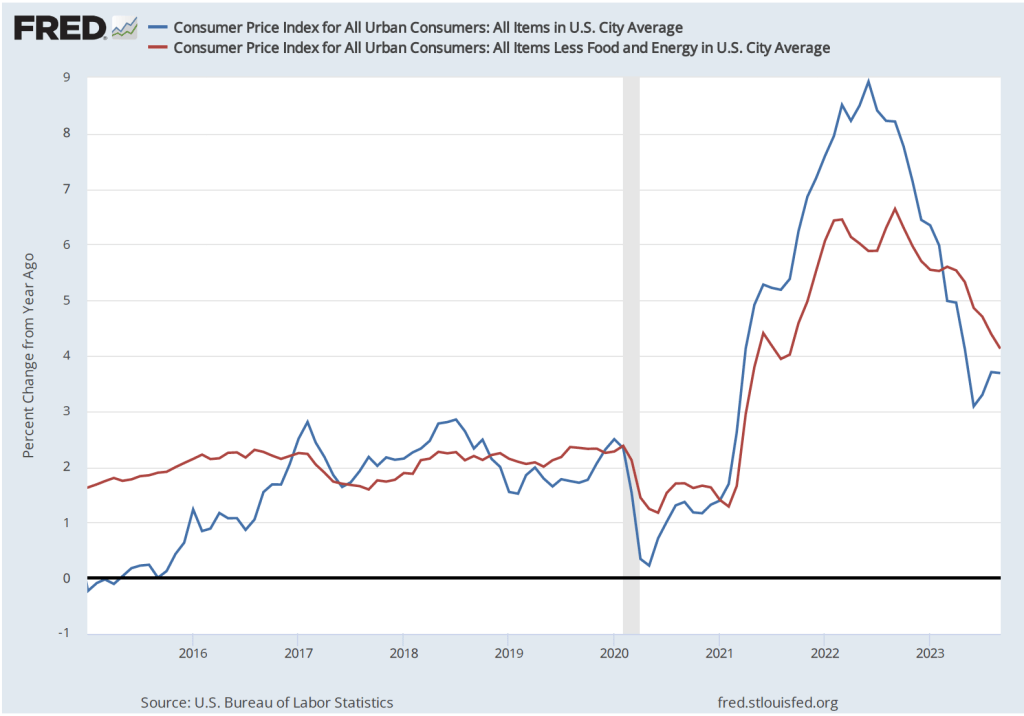

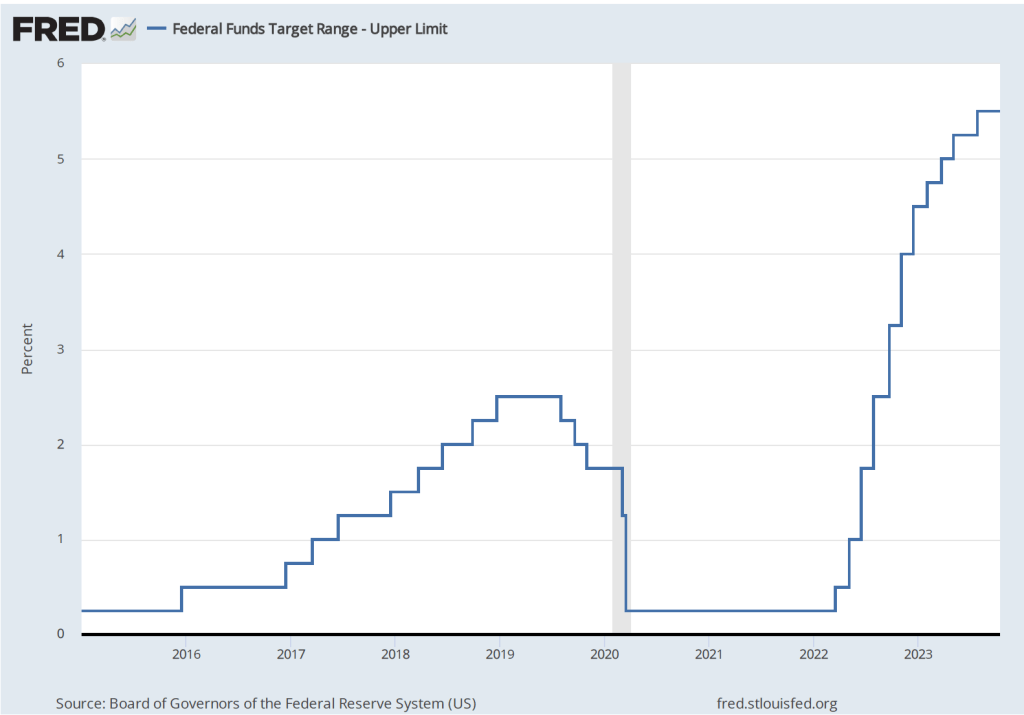

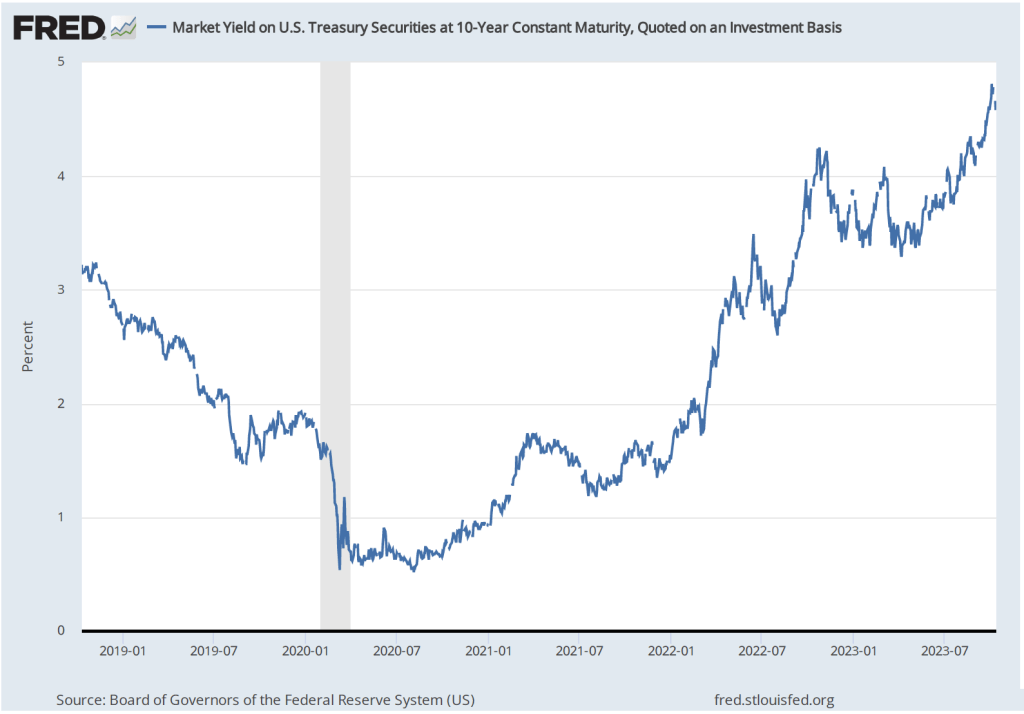

Congress has given the Fed a dual mandate to achieve maximum employment and price stability. In March 2022, the FOMC began responding to the surge in inflation that had begun in the spring of 2021 by raising its target for the federal funds rate. Up through its July 2024 meeting, the FOMC had been focused on the risk that the inflation rate would remain above the Fed’s target inflation rate of 2 percent. In the statement released after today’s meeting, the committee stated that it “has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance.”

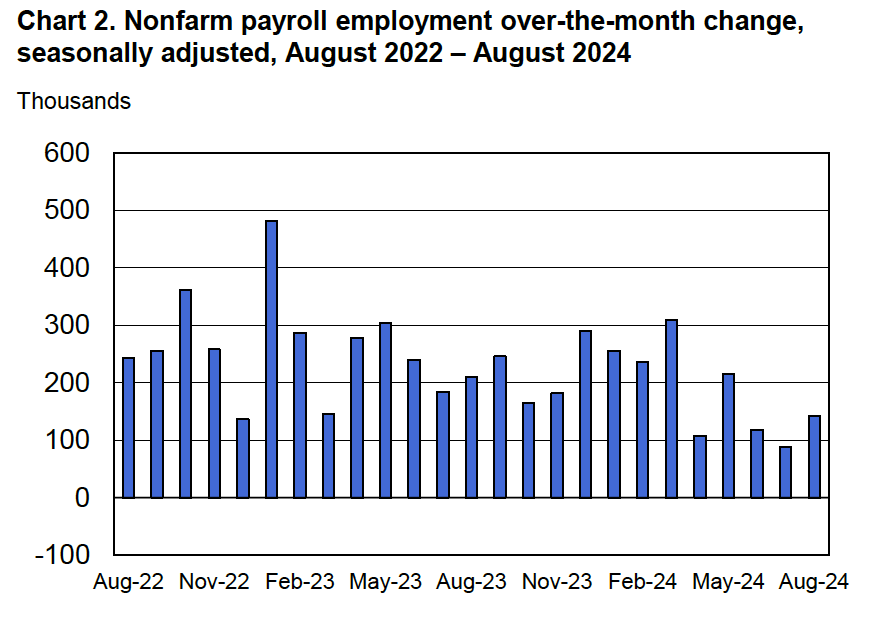

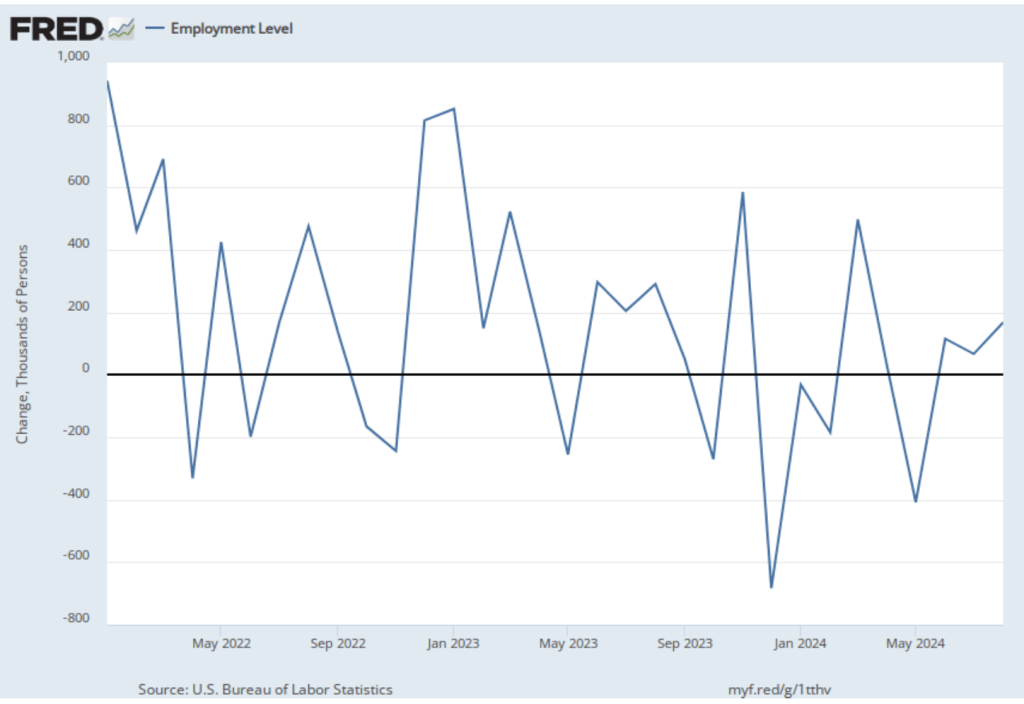

In a press conference following the meeting, Fed Chair Jerome Powell indicated that with inflation close to the 2 percent target and the labor market continuing to cool “by any measure,” the committee judged that it was time to begin normalizing its target range for the federal funds rate. Powell said that: “The U.S. economy is in a good place and our action is intended to keep it there.” When asked by a reporter whether the committee cut its target by 50 basis points today to catch up for not having cut its target at its July meeting, Powell responded that: “We don’t think we’re behind [on cutting the target range]. We think this [50 basis point cut] will keep us from falling behind.”

At the conclusion of each meeting, the committee holds a formal vote on its target for the federal funds rate. The vote today was 15-1, with Governor Michelle Bowman casting the sole negative vote. She stated that she would have preferred a 25 basis point cut. Dissenting votes have been rare in recent years.

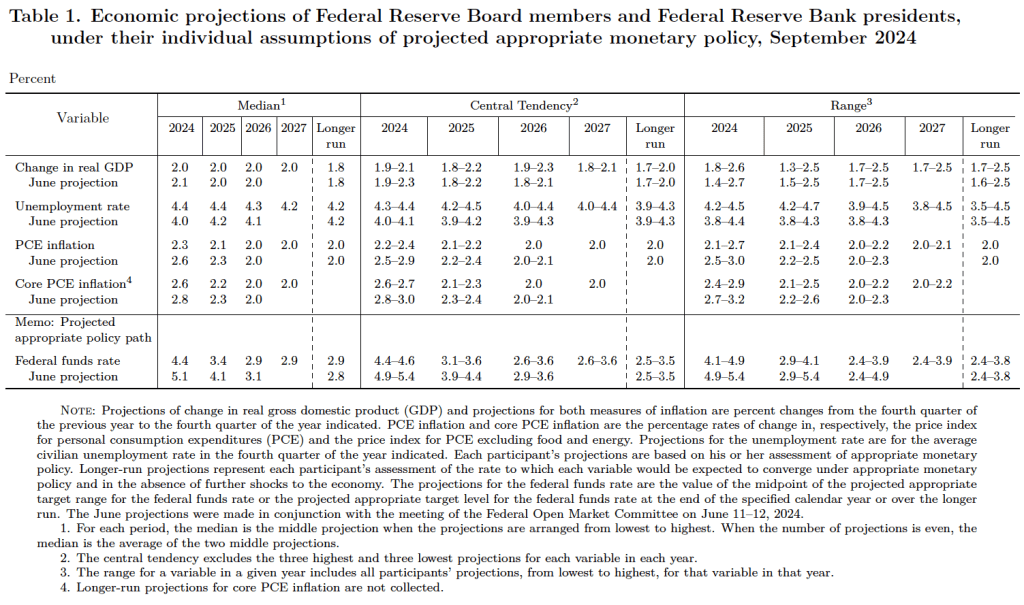

How much lower will the federal funds target range go? Typically at the FOMC’s December, March, June, and September meetings, the committee releases a “Summary of Economic Projections” (SEP), which presents median values of the committee members’ forecasts of key economic variables. The following table is from the SEP released after today’s meeting.

Looking at the values under the heading “Median” on the left side of the table, the median projection for the federal funds rate at the end of the 2024 is 4.4 percent. That projection signals that the committee will likely cut its target range by 25 basis points at each of its two remaining meetings on November 6-7 and December 17-18. The median projection for the federal funds rate at the end of 2025 is 3.4 percent, implying four additional 25 basis points cuts. In the long run, the median projection of the committee is that the federal funds rate will be 2.9 percent, which is somewhat higher than the 2.5 percent rate that the committee had projected at its December 2019 meeting before the start of the Covid pandemic.

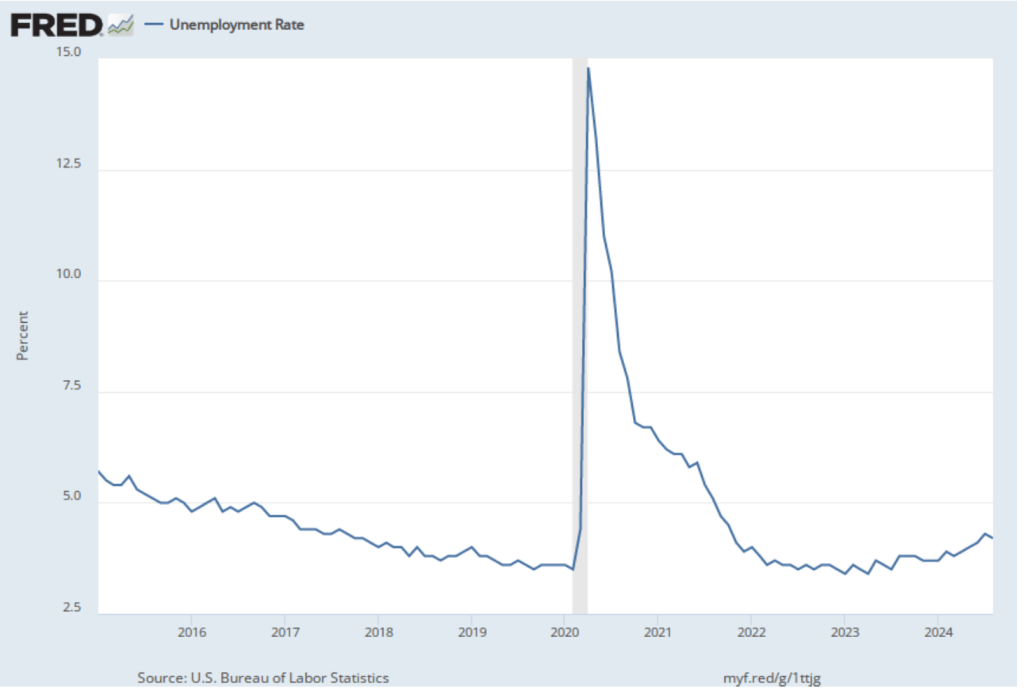

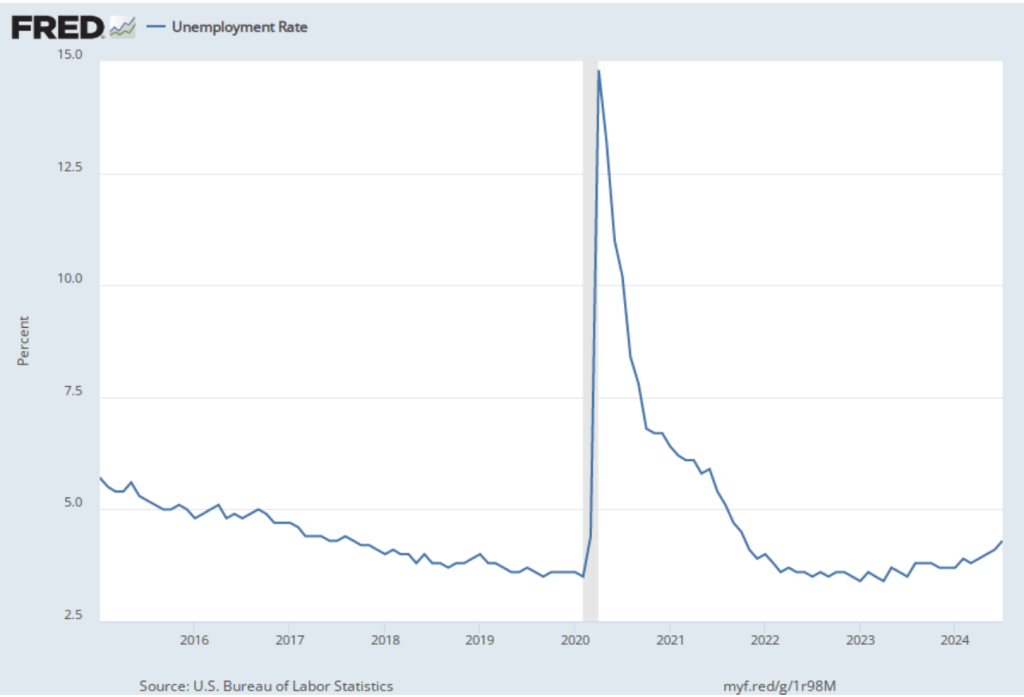

Committee members project that the unemployment rate will end the year at 4.4 percent, up from the 4.2 percent rate in August. They expect that the unemployment rate will be 4.2 percent in the long run. The long run unemployment rate is ofter referred to as the natural rate of unemployment. (We discuss the natural rate of unemployment in Macroeconomics, Chapter 9, Section 9.2 and Economics, Chapter 19, Section 19.2.)

The median projection of the committe members is that at the end of 2024 the inflation rate, as measured by the percentage change in the personal consumption expenditures (PCE) price index, will be 2.3 percent, slightly above the Fed’s target rate. Inflation will also run slightly above the Fed’s target in 2025 at 2.1 percent before retuning to 2 percent by the end of 2026. The median projections of the inflation rate at the ends of 2024 and 2025 are lower than the median projections in the SEP that was released after the FOMC meeting on June 11-12.