Image illustrating inflation generated by GTP-4o.

Today (September 11), the Bureau of Labor Statistics (BLS) released its monthly report on the consumer price index (CPI). This report is the last one that will be released before the Fed’s policy-making Federal Open Market Committee (FOMC) holds its next meeting on September 17-18.

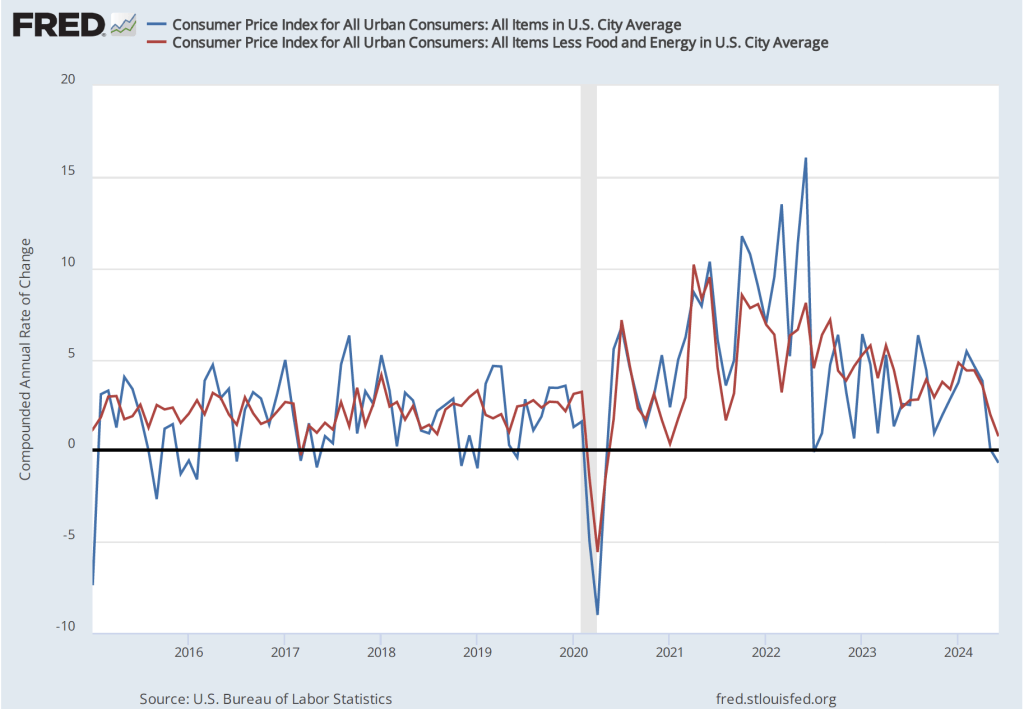

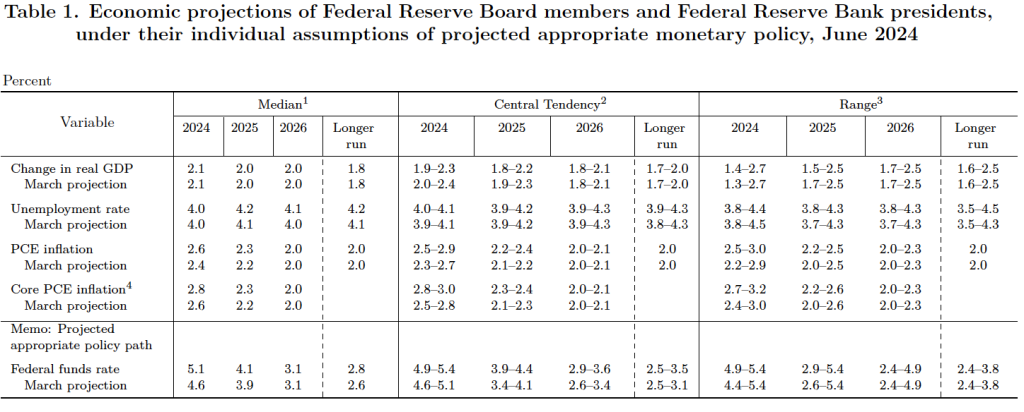

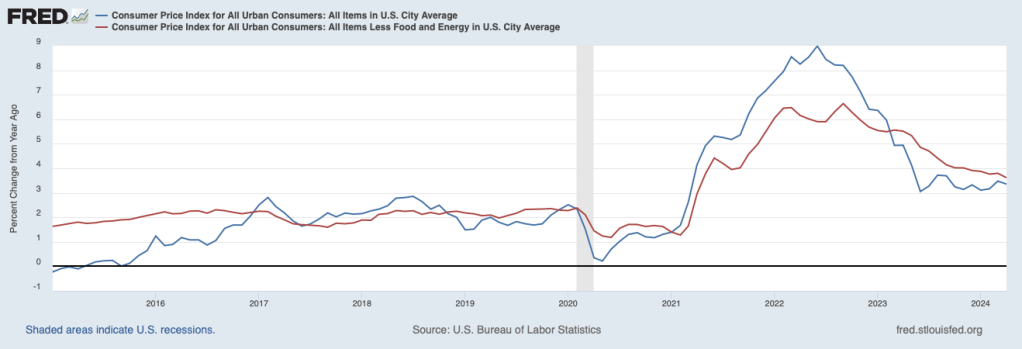

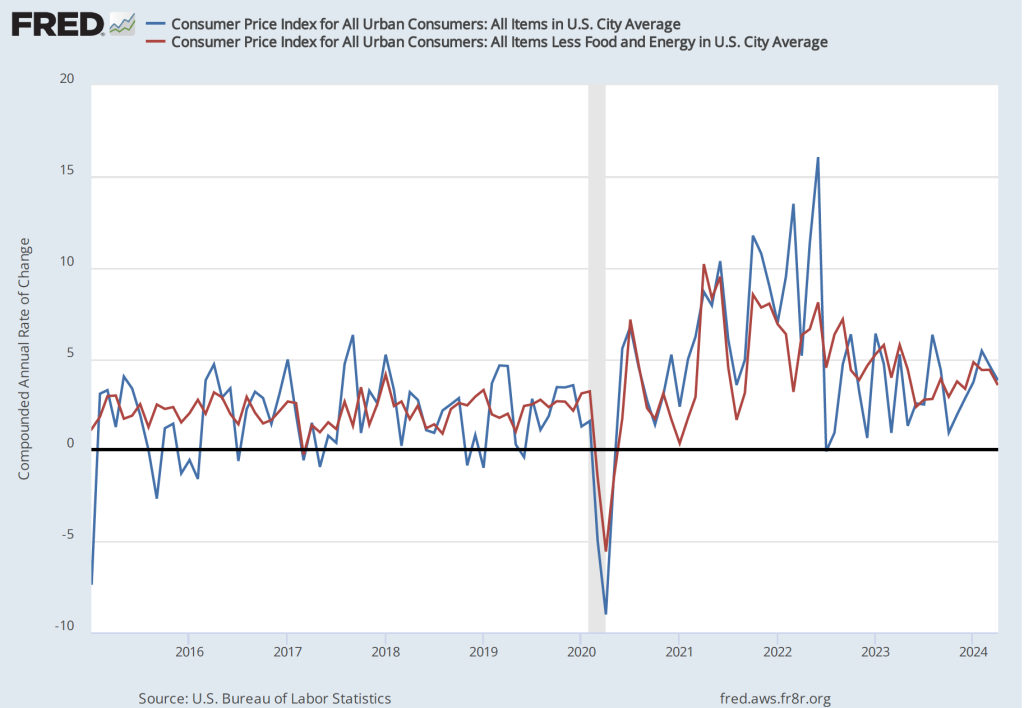

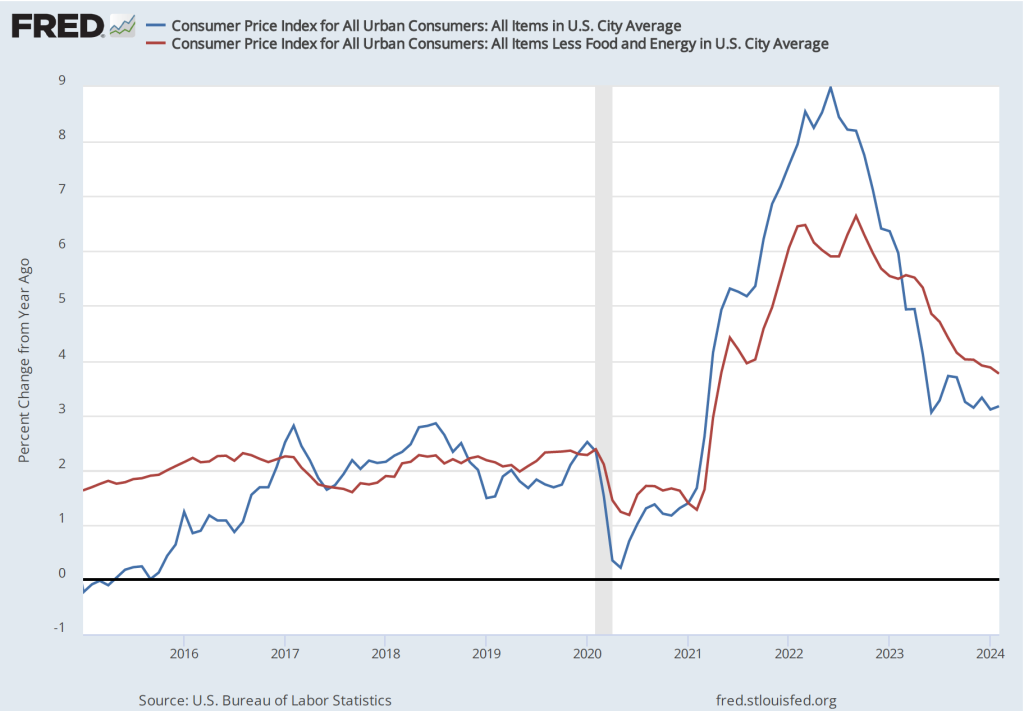

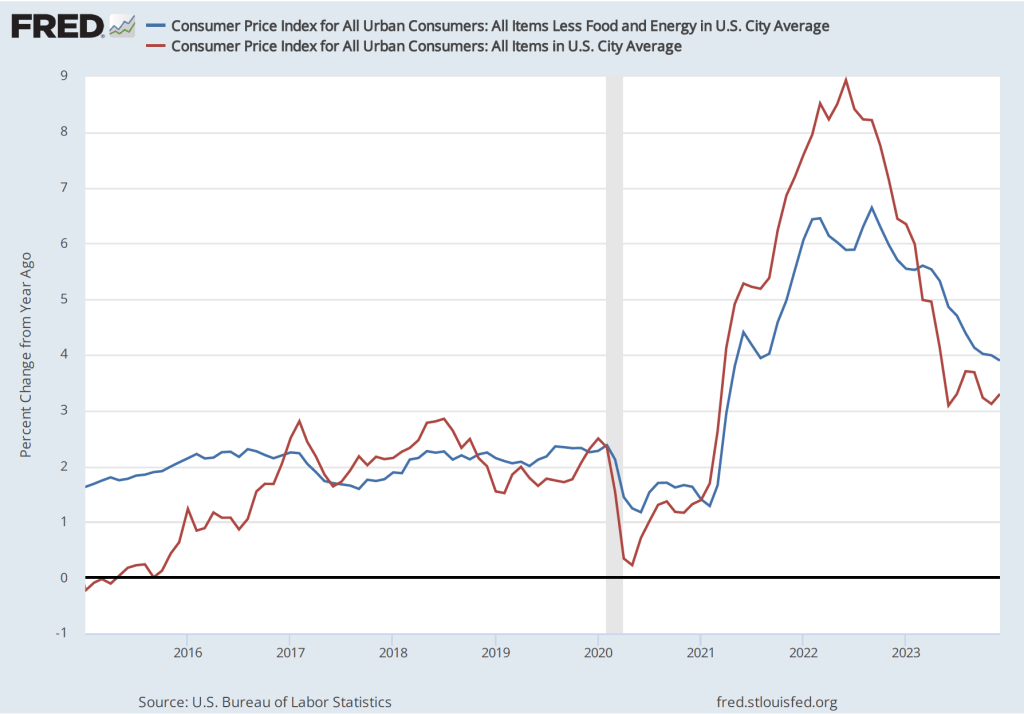

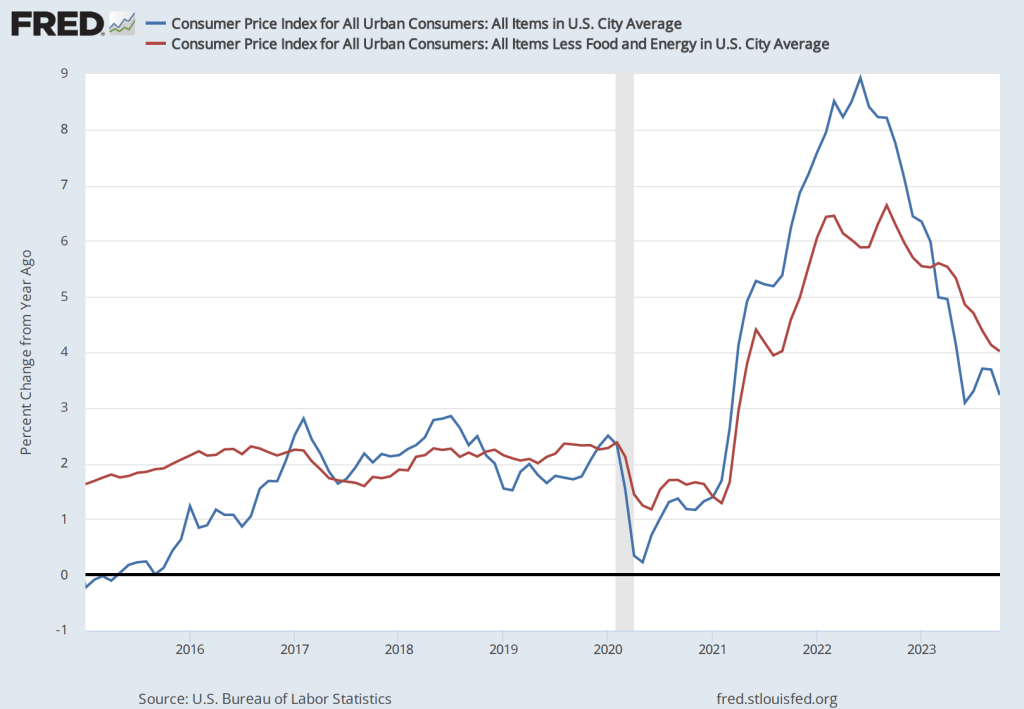

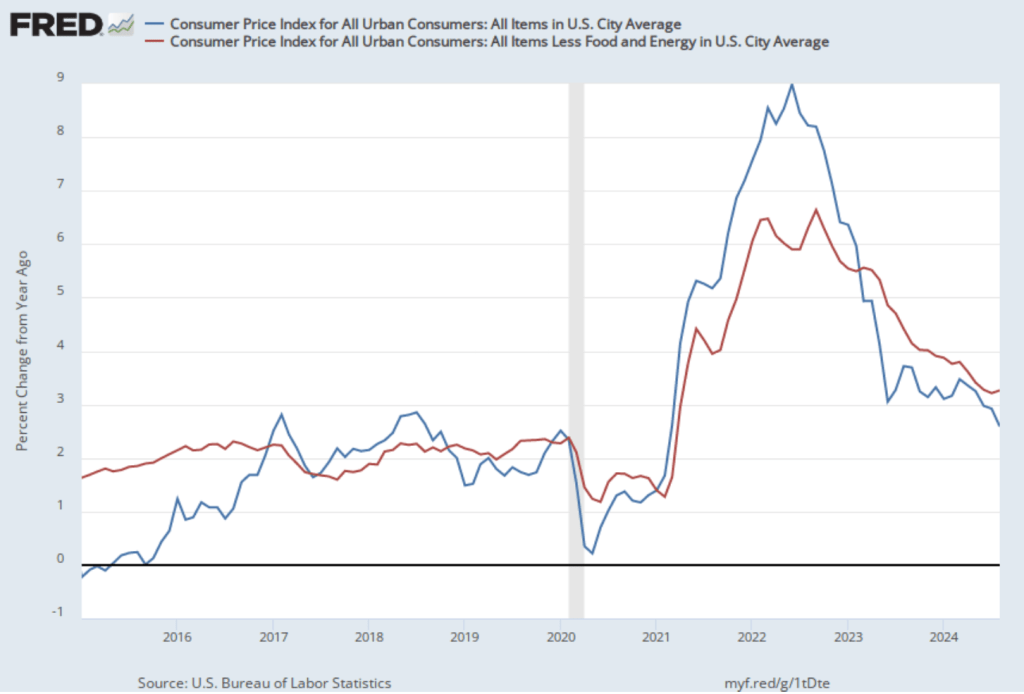

As the following figure shows, the inflation rate for August measured by the percentage change in the CPI from the same month in the previous month—headline inflation (the blue line)—was 2.6 percent down from 2.9 percent in July. Core inflation (the red line)—which excludes the prices of food and energy—increased slightly to 3.3 percent in August from 3.2 percent in July. Headline inflation was slightly below what economists surveyed by the Wall Street Journal had expected, while core inflation was slightly higher.

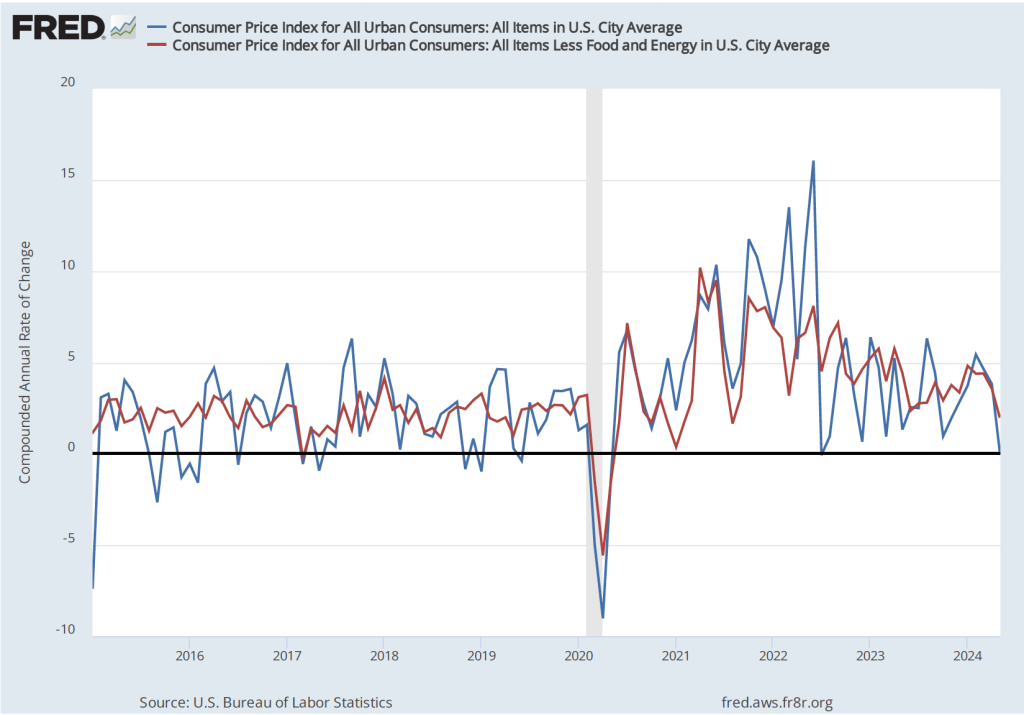

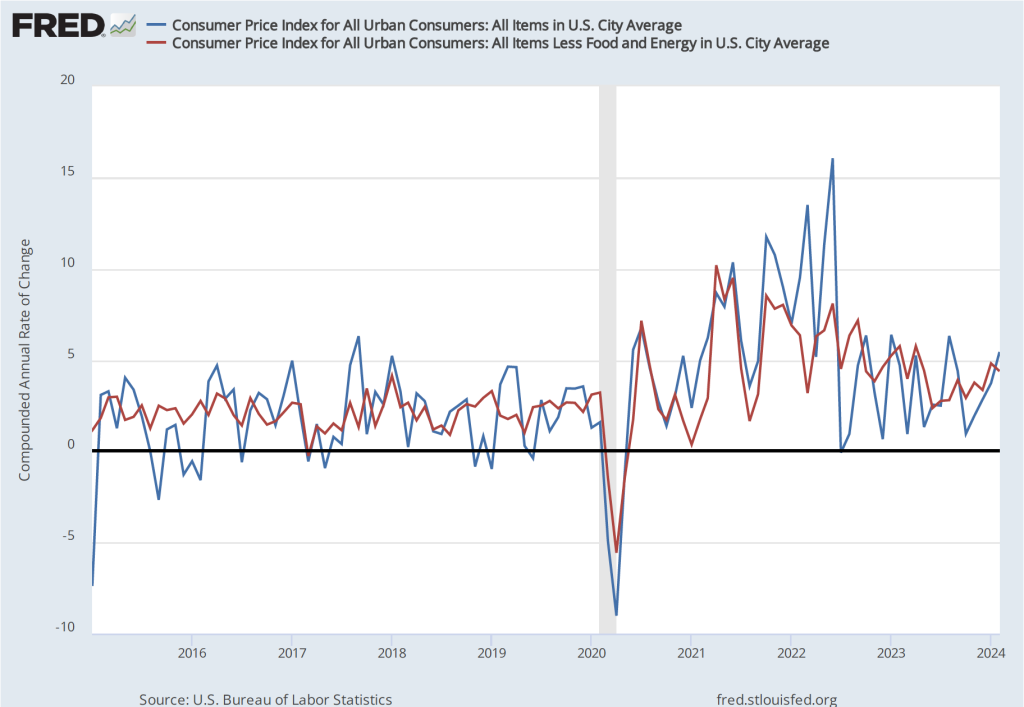

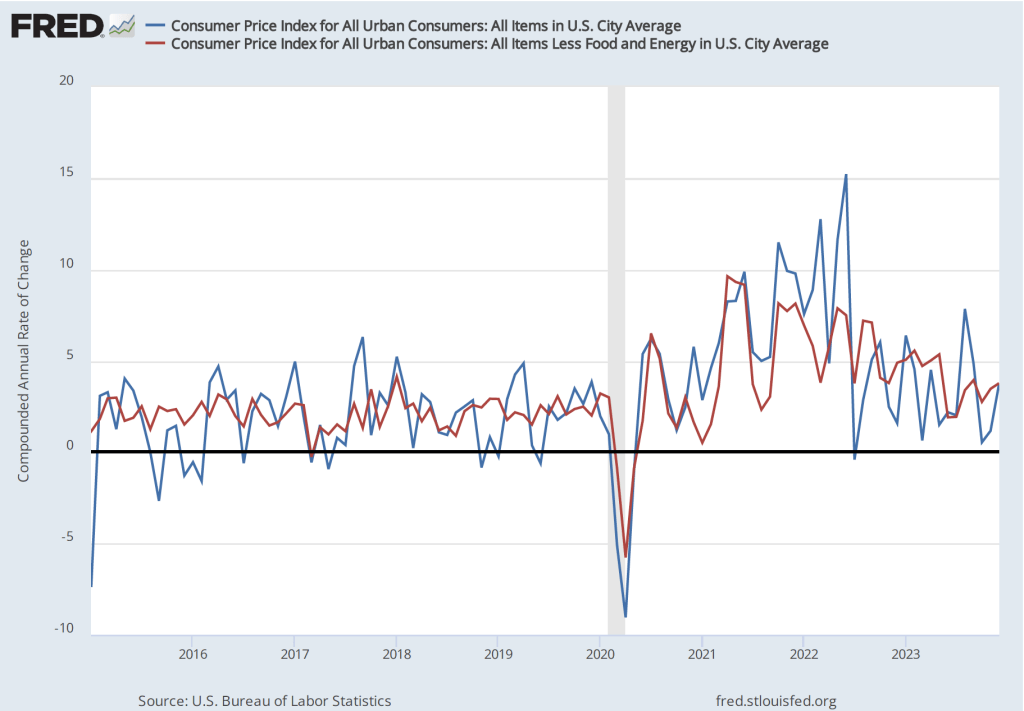

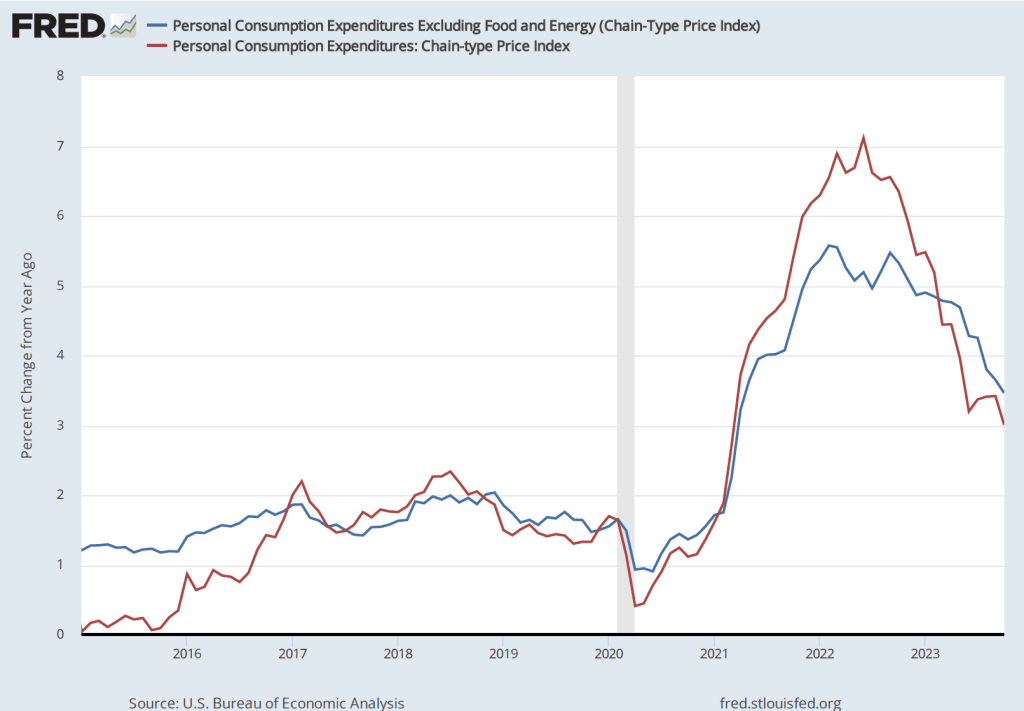

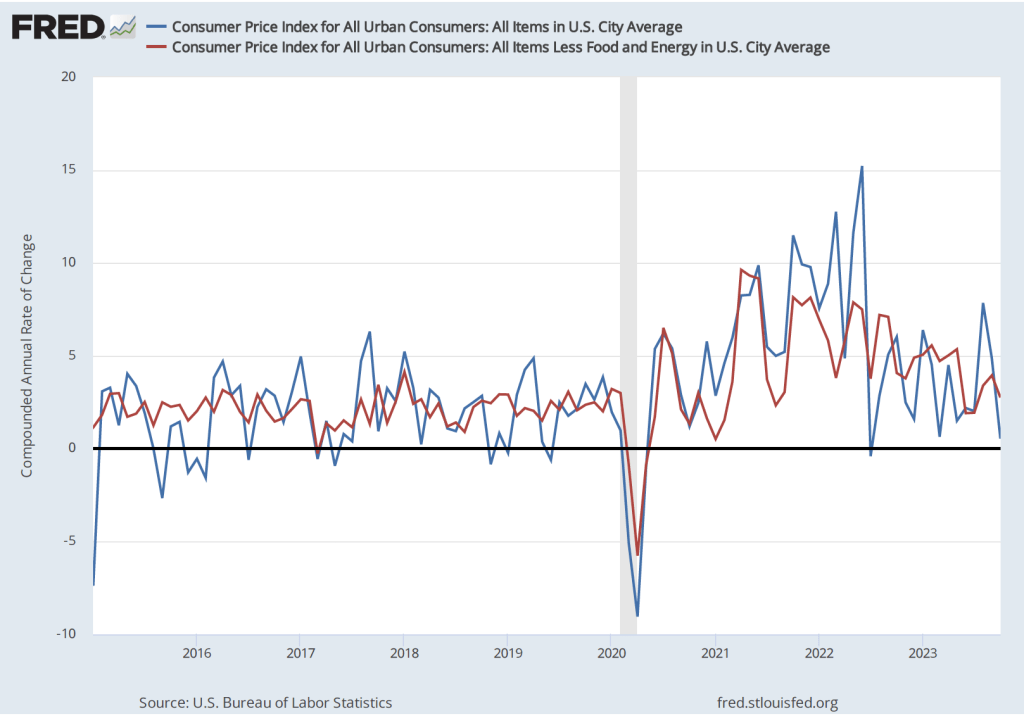

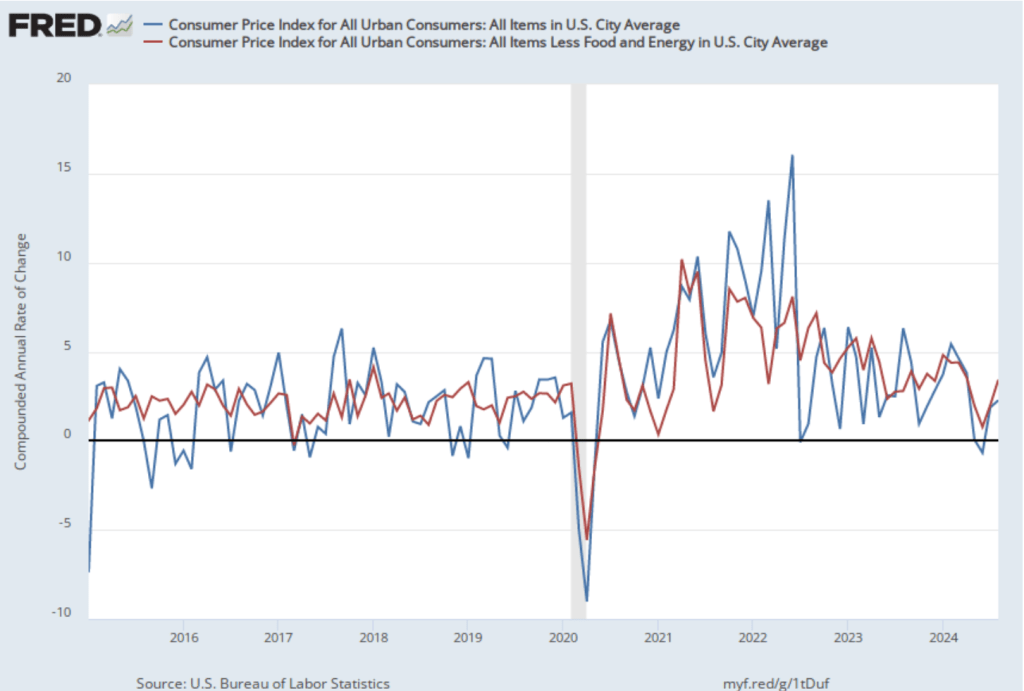

As the following figure shows, if we look at the 1-month inflation rate for headline and core inflation—that is the annual inflation rate calculated by compounding the current month’s rate over an entire year—we see that both headline and core inflation increased. Headline inflation (the blue line) increased from 1.8 percent in July to 2.3 percent in August. Core inflation (the red line) jumped from 2.0 percent in July to 3.4 percent in August. Overall, we can say that, taking 1-month and 12 month inflation together, the U.S. economy may still be on course for a soft landing—with the annual inflation rate returning to the Fed’s 2 percent target without the economy being pushed into a recession—but the increase in 1-month inflation is concerning. Of course, as always, it’s important not to overinterpret the data from a single month. (Note, also, that the Fed uses the personal consumption expenditures (PCE) price index, rather than the CPI in evaluating whether it is hitting its 2 percent inflation target.)

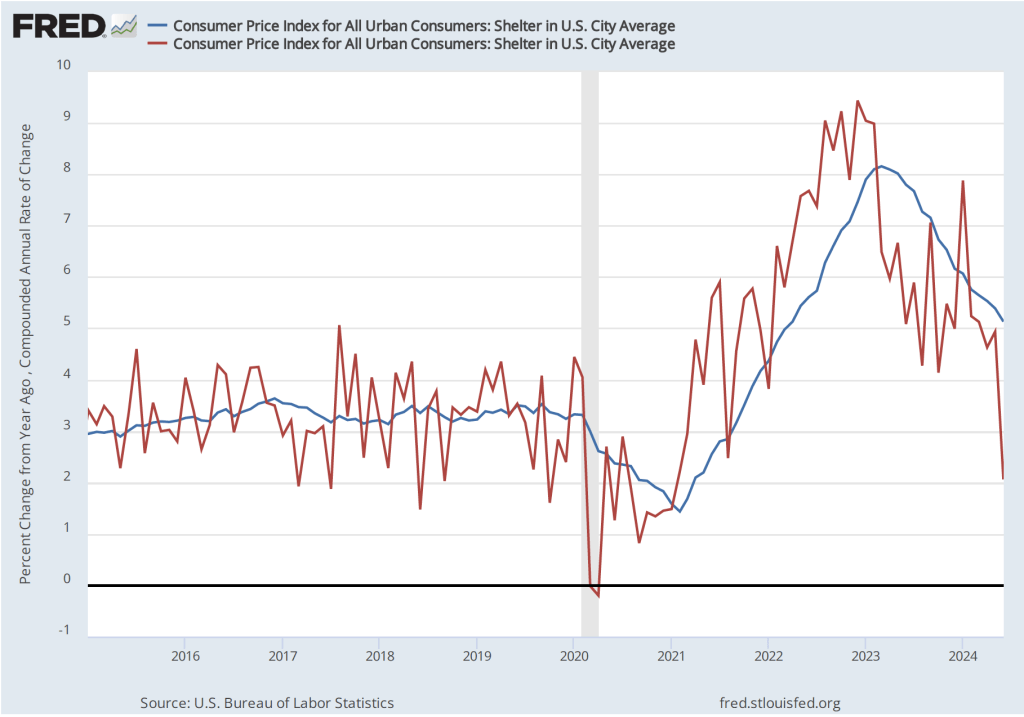

As we’ve discussed in previous blog posts, Federal Reserve Chair Jerome Powell and his colleagues on the FOMC have been closely following inflation in the price of shelter. The price of “shelter” in the CPI, as explained here, includes both rent paid for an apartment or house and “owners’ equivalent rent of residences (OER),” which is an estimate of what a house (or apartment) would rent for if the owner were renting it out. OER is included to account for the value of the services an owner receives from living in an apartment or house.

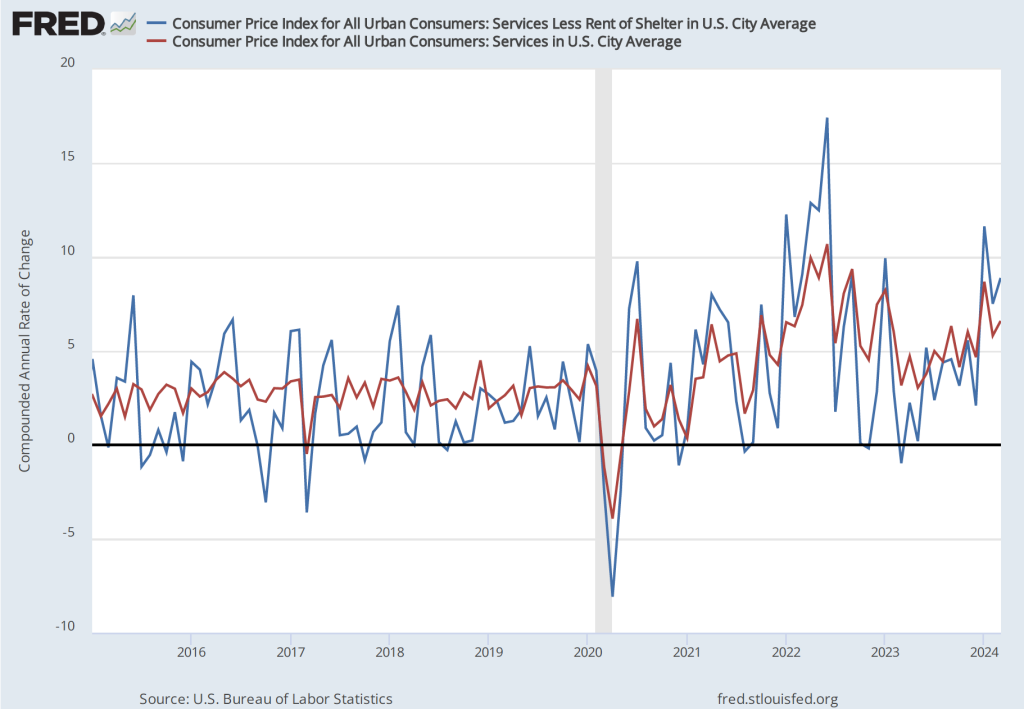

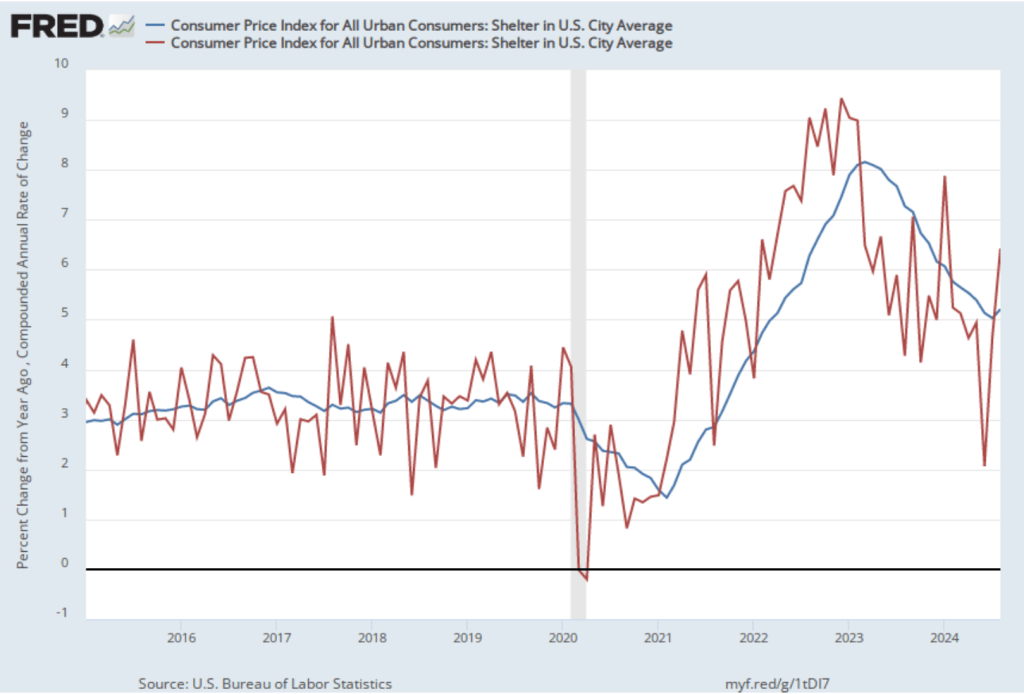

As the following figure shows, inflation in the price of shelter has been a significant contributor to headline inflation. The blue line shows 12-month inflation in shelter and the red line shows 1-month inflation in shelter. Twelve-month inflation in shelter reversed the decline that began in the spring of 2023, rising from 5.0 percent in July to 5.2 percent August. One-month inflation in shelter—which is much more volatile than 12-month inflation in shelter—increased from 4.6 percent in July to 5.2 percent in August, continuing an increase that began in June. The increase in 1-month inflation in shelter may concern the members of the FOMC, as may, to a lesser extent, the increase in 12-month inflation in shelter. Shelter has a smaller weight of 15 percent in the PCE price index that the Fed uses to gauge whether it is hitting its 2 percent inflation target in contrast with the 33 percent weight that shelter has in the CPI. But persistent shelter inflation in the 5 percent range would make a soft landing more difficult.

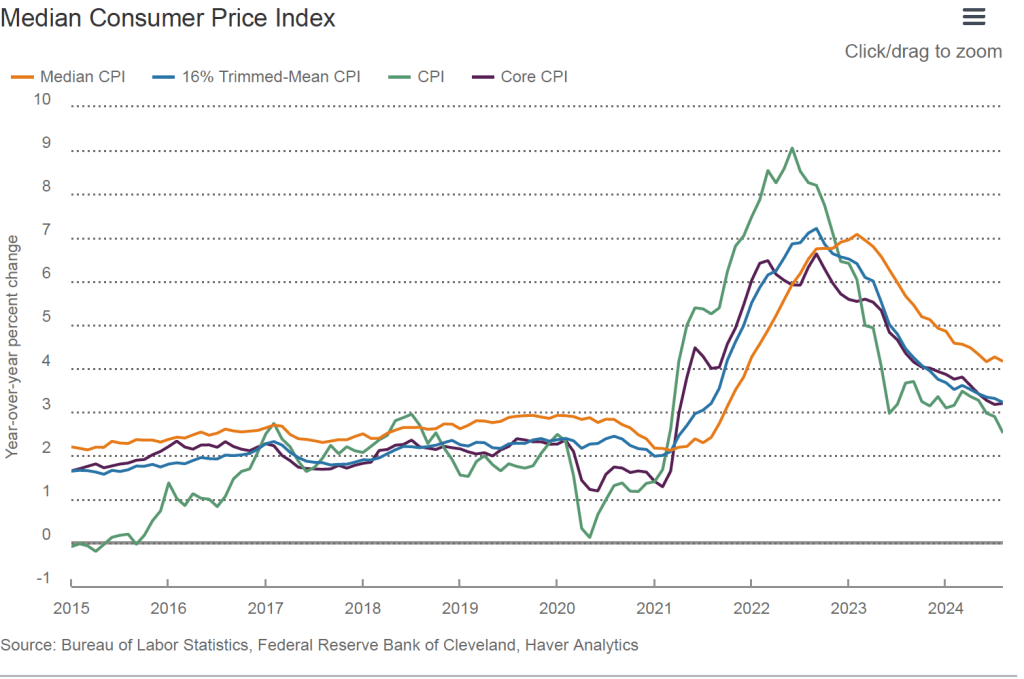

Finally, in order to get a better estimate of the underlying trend in inflation, some economists look at median inflation and trimmed mean inflation. Median inflation is calculated by economists at the Federal Reserve Bank of Cleveland and Ohio State University. If we listed the inflation rate in each individual good or service in the CPI, median inflation is the inflation rate of the good or service that is in the middle of the list—that is, the inflation rate in the price of the good or service that has an equal number of higher and lower inflation rates. Trimmed mean inflation drops the 8 percent of good and services with the higherst inflation rates and the 8 percent of goods and services with the lowest inflation rates.

As the following figure (from the Federal Reserve Bank of Cleveland) shows, median inflation (the orange line) declined slightly from 4.3 percent in July to 4.2 percent in August. Trimmed mean inflation (the blue line) also declined slightly from 3.3 in July to 3.2 percent in August. These data provide confirmation that core CPI inflation is likely running higher than a rate that would be consistent with the Fed achieving its inflation target.

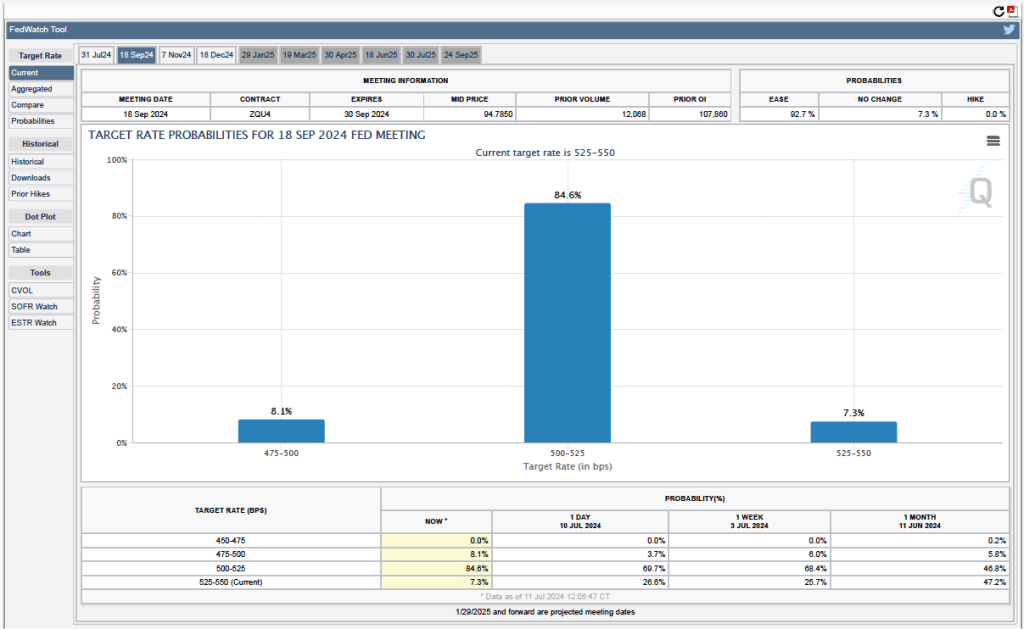

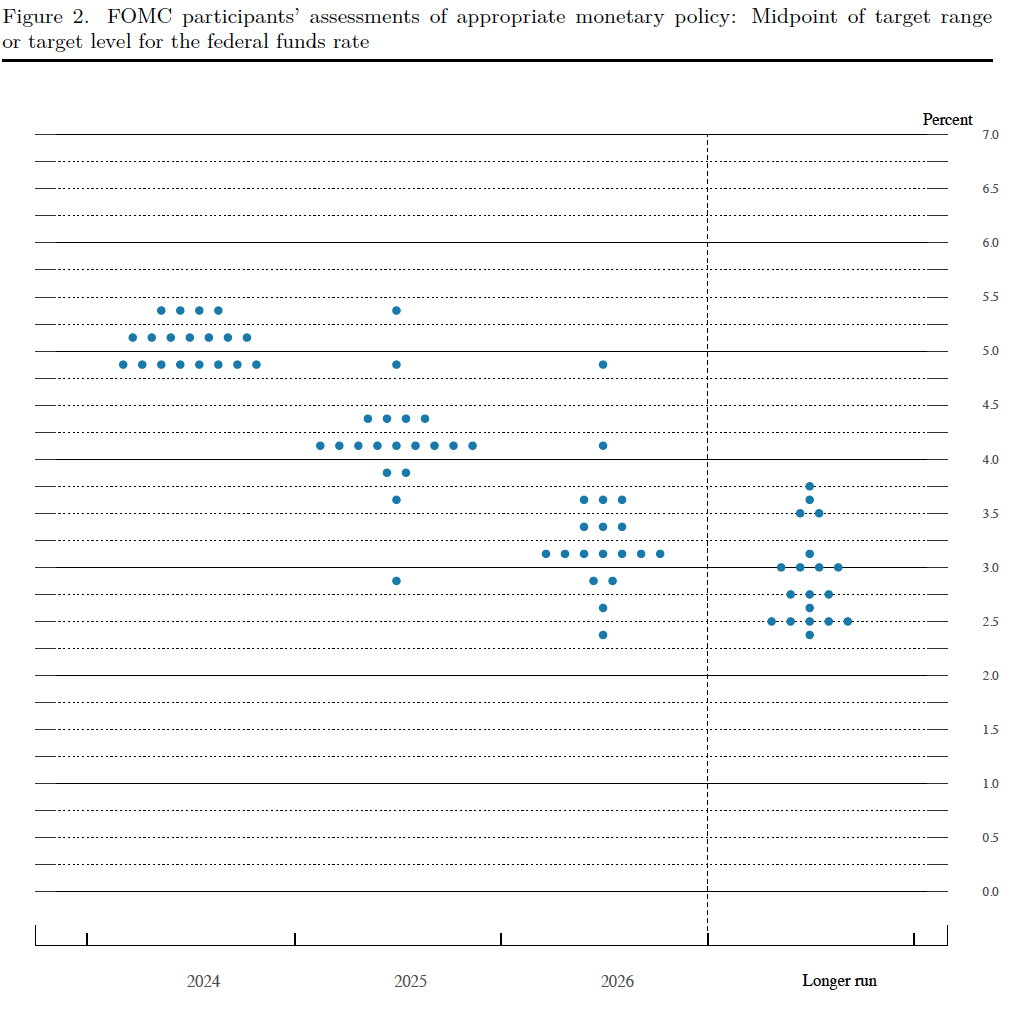

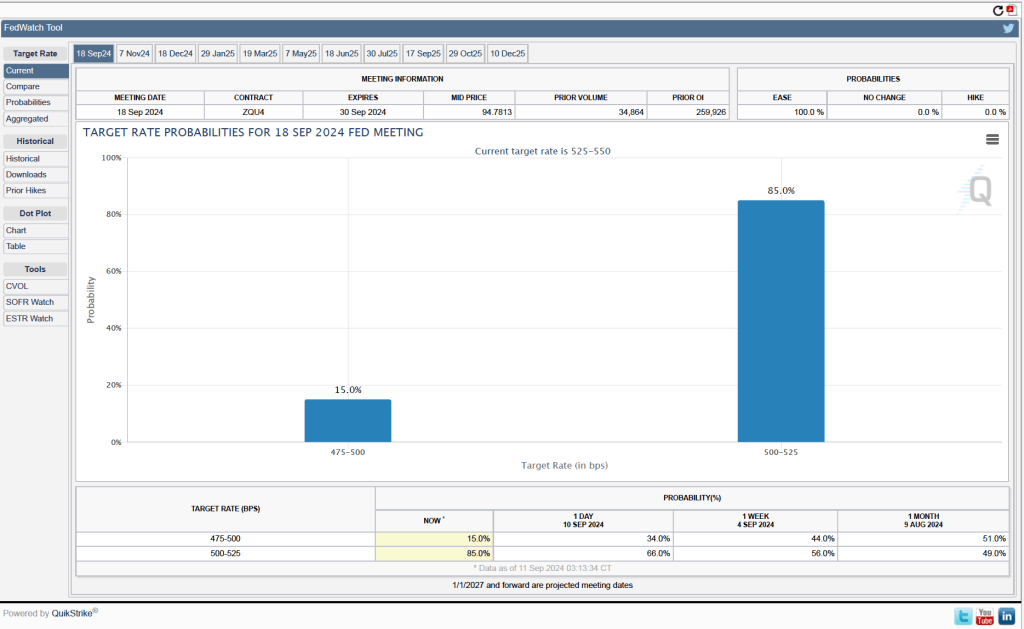

For the past few weeks Fed officials have been indicating that the FOMC is likely to cut its target for the federal funds at its next meeting on Septembe 17-18. Investors who buy and sell federal funds futures contracts expect that the FOMC will cut its target for the federal funds rate by 0.25 percentage point from the current range of 5.50 percent to 5.25 percent. (We discuss the futures market for federal funds in this blog post.) As shown in the following figure, today these investors assign a probability of 85.0 percent to the FOMC cutting its target for the federal funds rate by 0.25 percentage point at its next meeting and a probability of only 15.0 percent that the cut will be 0.50 percentage point.

The FOMC has to balance the risk of leaving its target for the federal funds rate at its current level for too long—increasing the risk of slowing demand so much that the economy slips into recession—against the risk of cutting its target too soon—increasing the risk that inflation persists above the Fed’s 2 percent target. We’ll see at the committee’s next meeting how Fed Chair Jerome Powell and the other members assess the current state of the economy as they consider when and by how much to cut their target for the federal funds rate.