As we discuss in the chapter, initially, bitcoin was thought of as a way to buy and sell goods and services. Some stores accepted bitcoin and allowed customers to make payment by scanning a bar code with a phone. Some websites offered merchants a way to process purchases made with bitcoins in a manner similar to the way merchants process credit card payments.

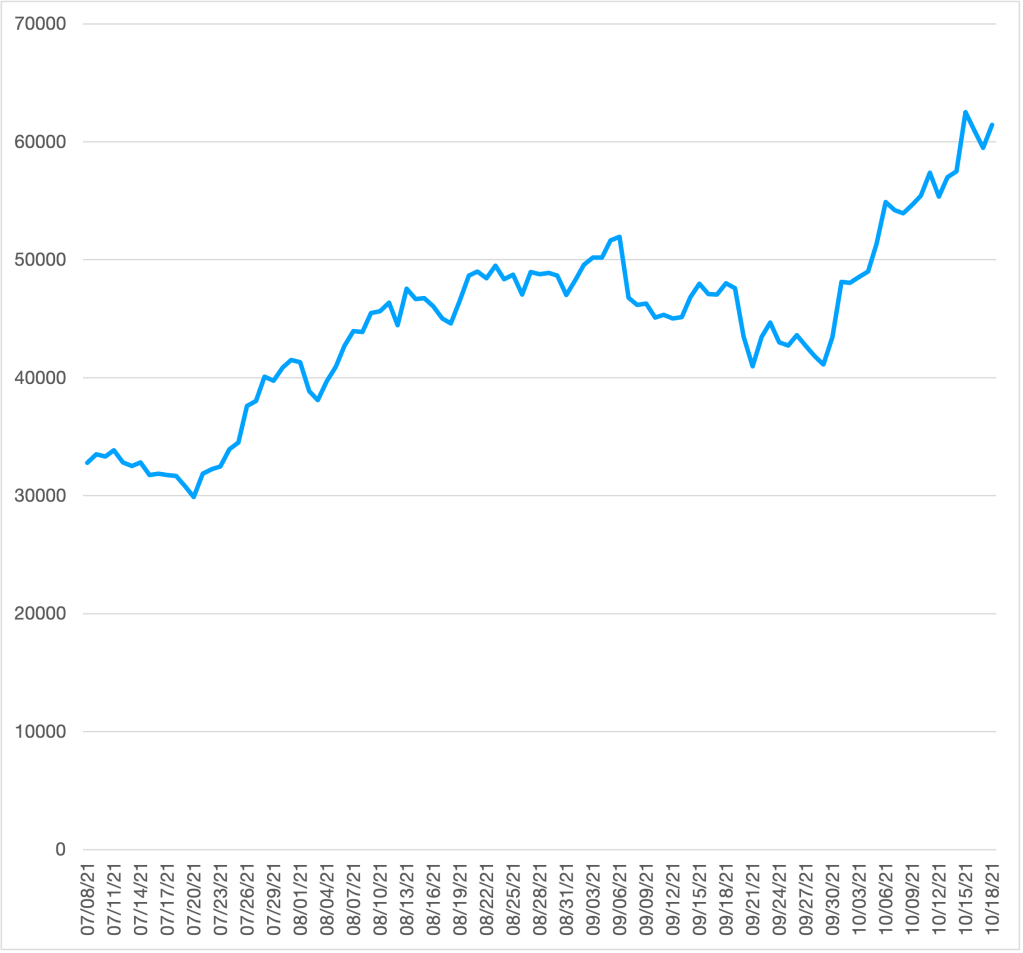

In practice, though, swings in the value of bitcoin have been much too large to make it a good substitute for cash, checks, or credit cards in everyday transactions. For instance, at the beginning of 2015, one bitcoin was worth about $300. Over the following five years, the price of bitcoin rose as high at $17,000 before falling to about $8,000 at the beginning of 2020. During 2021, the volatility of bitcoin prices increased, rising as high as $62,000 in April and falling as low as $30,000 in July before rising back above $60,000 in October. (The following chart shows movements in the price of bitcoin from early July to mid-October 2021; the vertical axis shows the price as dollars per bitcoin.)

Some economists have suggested that rather being a medium of exchange, like dollar bills, bitcoin has become a speculative asset, like gold. Bitcoin shares with gold the characteristic that ultimately its total supplied is limited. The supply of Bitcoin can’t increase beyond 21 million, a limit that is expected to be reached in 2030. The gold stock slowly increases as mines produce more gold, although the output of mines is small compared with the existing stock of gold. Some investors and speculators are reassured that, in contrast to the assets in M1 and M2 that can increase as much as the Fed chooses, gold and bitcoin have limits on how much they can increase.

Will Bitcoin Be a Good Hedge Against Inflation? Can It Be Useful in Diversifying a Portfolio?

Some investors and speculators believe that the limited quantities of gold and bitcoin available make them good hedges against inflation—that is, they believe that the prices of gold and bitcoin will reliably increase during periods of inflation. In fact, though, gold has proven to be a poor hedge against inflation because in the long run the price of gold has not reliably increased faster than the inflation rate. There is no good economic reason to expect that over the long run bitcoin would be a good inflation hedge either.

From a broader perspective than as just an inflation hedge, some economists argue that gold has a role to play in an investor’s portfolio—which is the collection of assets, such as stocks and bonds, that an investor owns. Investors can reduce the financial risk they face through diversification, or spreading their wealth among different assets. For instance, an investor who only holds Apple stock in her portfolio is subject to more risk than an investor with the same dollar amount invested in a portfolio that holds the stocks of multiple firms as well as non-stock investments. An investor obtains the benefits of diversification best by adding assets to her portfolio that are not well correlated with the assets she already owns—that is the prices of the assets she adds to her portfolio don’t typically move in the same direction as the prices of the assets she already owns.

For instance, during a typical recession sales of consumer staples, like baby diapers and laundry detergent, hold up well, while sales of consumers durables, like automobiles, usually decline significantly. So adding shares of stock in Proctor & Gamble to a portfolio that already has many shares of General Motors achieves diversification and reduces financial risk because movements in the price of shares of Proctor & Gamble are likely not to be highly correlated with movements in the price of shares of General Motors.

Studies have shown that during some periods movements in gold prices are not correlated with movements in prices of stocks or bonds. In other words, gold prices may rise during a period when stock prices are declining. As a result, an investor may want to add gold to her portfolio to diversify it. To this point, bitcoin hasn’t been around long enough to draw firm conclusions about whether adding bitcoin to a portfolio provides significant diversification, although some investors believes that it does.

Finance professionals are divided in their opinions on whether bitcoin is a good substitute for gold in a financial portfolio. In an interview, billionaire investor Ray Dalio, founder of Bridgewater Associates, the world’s hedge fund, noted that while he believes that bitcoin may serve as a hedge against inflation, but if he could only hold gold or bitcoin, “I would choose gold.” His preference for gold is due in part to his belief that the federal government may increase regulation of bitcoin and that regulators might eventually even decide to ban it. A businessinsider.com survey of 10 financial experts found them divided with five preferring gold as an investment and five preferring bitcoin.

Sources: Jade Scipioni, “Bitcoin vs. Gold: Here’s What Billionaire Ray Dalio Thinks,” cnbc.com, August 4, 2021; and Isabelle Lee and Will Daniel, “Bitcoin vs. Gold: 10 Experts Told Us Which Asset They’d Rather Hold for the Next 10 Years, and Why,” businessinsider.com, February 20, 2021.