Supports: Econ (Chapter 9 – Comparative Advantage & the Gains from International Trade); Micro (Chapter 9): Macro (Chapter 7); Essentials: Chapter 19.

Is the Second Golden Age of Globalization Over?

In the past 150 years, international trade and international financial flows rapidly expanded during two periods that are sometimes called the Golden Ages of Globalization. The first began in 1870 and ended in 1914, when the outbreak of World War I caused a sharp reduction in international trade. The second began in 1948 with the establishment of the General Agreement on Tariffs and Trade (GATT) under which 23 countries, including the United States, agreed to reduce tariffs from the very high levels they had reached during the 1930s. Will the coronavirus pandemic end the Second Golden Age of Globalization?

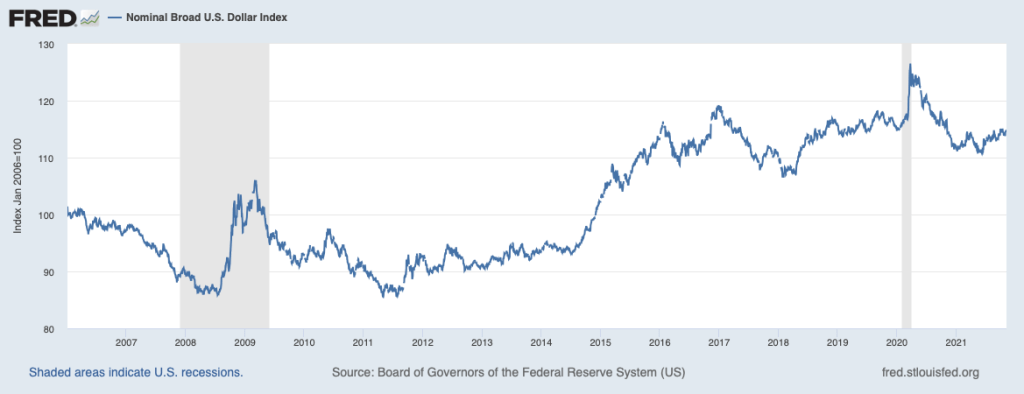

The coronavirus pandemic that spread around the world during early 2020 resulted in a sharp decline in international trade as governments in many countries shut down businesses. For example, exports of goods from the United States declined by more than 20 percent during the first quarter of 2020, even though the virus only began to have a major effect on the world economy during the second half of the quarter.

The Debate over Importing Medical Supplies During a Pandemic

Some policymakers and economists were concerned that goods critical to responding to the pandemic were not being produced in the United States. For example, most pharmaceuticals sold in the United States are produced in other countries or rely on ingredients that are produced in other countries. The same is true of personal protective equipment (PPE), such as facemasks, protective clothing, and face shields. As more than 75 countries, including France, Germany, South Korea, and Brazil restricted or banned exports of medical supplies and hospital equipment, U.S.-based firms struggled to meet surging demand for these goods. Some policymakers argued that the coronavirus pandemic and fears of future pandemics meant that the United States should stop importing pharmaceuticals and PPE. They urged that the supply chains for those goods be relocated to the United States so that the entire quantity of the goods demanded by U.S. households and firms—particularly under pandemic conditions—could be produced domestically.

The G-20 is an organization of 20 large countries. At a G-20 meeting of trade ministers in March 2020, U.S. Trade Representative Robert Lightizer stated that “we are learning in this crisis that over-dependence on other countries as a source of cheap medical production has created a strategic vulnerability to our economy.” Some policymakers noted that China supplies more than 40 percent of world imports of PPE and also produces a substantial fraction of generic pharmaceuticals, including penicillin.

Some economists noted two important problems countries may encounter if they move to no longer relying on importing some or all medical supplies:

- Comparative Advantage. If countries move to produce all critical medical supplies domestically rather than relying on imports from countries with a comparative advantage in producing those goods, the cost of the goods would rise.

- Retaliatory Tariffs. It was unclear whether relocating production of medical supplies to domestic factories might result in retaliation—such as tariff increases—by countries that formerly exported those goods.

Other Threats to the World Trading System Resulting from the Pandemic

The World Trade Organization (WTO) is an international organization that replaced the GATT in 1995 and that oversees international trade agreements. WTO rules allow countries to impose tariffs on imports of goods that foreign governments have subsidized. During the pandemic, many governments, including the U.S. federal government, subsidized firms to help them survive the loss of revenue resulting from social distancing policies. If countries take advantage of the WTO rules to impose tariffs on imports produced by firms that had received subsidies from their governments, the result could further reduce international trade. In 2019, international trade had already declined from its level in 2018, partly as a result of a trade war between the United States and China.

Some countries, including the United States, suspended immigration and barred visitors from certain countries. If such restrictions remain in place after the pandemic has ended, they could impede international trade, which requires businesspeople to freely travel among countries.

What Can We Learn from the End of the First Golden Age of Globalization?

In the spring of 2020, it was unclear whether the disruptions to global trade from the pandemic were temporary or whether they indicated that a possible end to the Second Golden Age of Globalization. During the decades since the GATT began in 1948, many countries, including the United States, benefited from the reduction in tariffs and other barriers to trade in goods, as well as the elimination of many obstacles to the flow of funds and physical investments across borders. Countries were better able to pursue their comparative advantage in producing goods and services, thereby raising incomes. Developing countries, in particular, were able to use global financial markets to finance investment in real capital projects, such as factories, and gain access to current technologies through foreign direct investment. (In Chapter 9, Section 9.3, we discuss how countries gain from international trade and which groups within a country may lose increased international trade.)

In fact, the greatest beneficiaries of the Second Golden Age of Globalization were developing countries, such as South Korea, Taiwan, Singapore, China, and India. By relying on the global economic system, these countries were able to greatly increase economic growth, which lifted hundreds of millions of their citizens out of poverty. If the path these countries followed to increasing economic growth and rising incomes is disrupted by a new wave of tariffs and other restrictions on the international movement of goods and investment, those most likely to be hurt are low-income countries in sub-Saharan Africa, Latin America, and Asia where economic growth rates remain low.

What followed the end of the First Golden Age of Globalization helps us understand the potential consequences from disrupting trade. Kevin O’Rourke of University College Dublin, Alan Taylor of the University of California, Davis, Jeffrey Williamson of Harvard, and colleagues have documented the rapid increase in globalization—increasing foreign trade and investment—during the years between 1870 and 1913. As a fraction of world GDP, exports of goods increased by more than 70 percent between those years. This increase in world trade resulted from the following developments:

- A reduction of about 50 percent in the cost of shipping goods across oceans following the introduction of steamships

- Improved communications resulting from the spread of telegraphs and the telephones

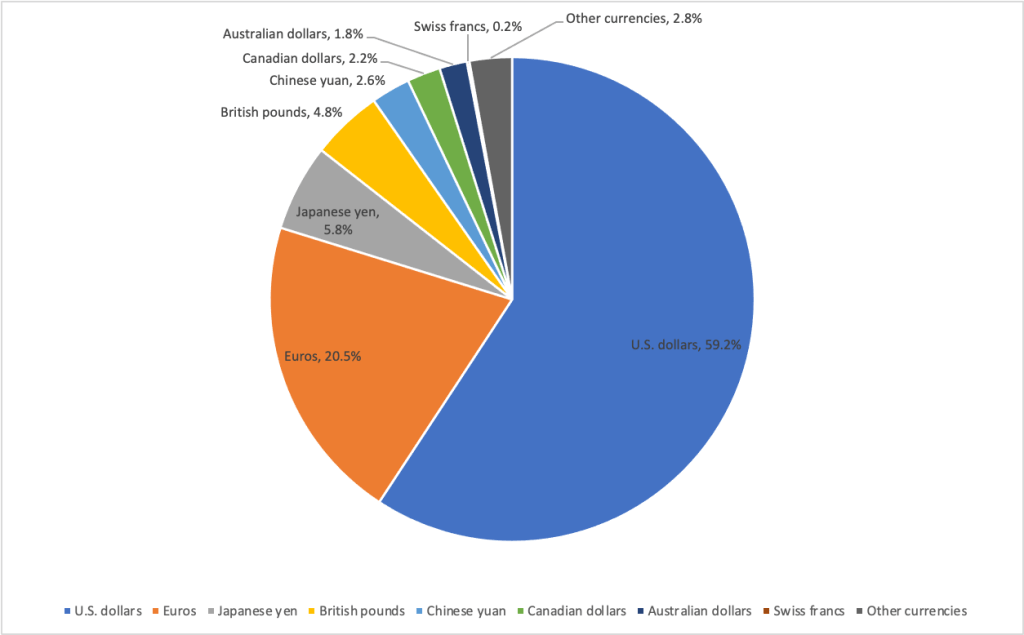

- Adoption of the gold standard by most countries, which reduced exchange rate uncertainty and the transactions costs of having to convert currencies when engaging in international trade

International investment flows also grew, with foreign-owned assets, such as bonds and factories, increasing from 7 percent of world GDP in 1870 to 20 percent of world GDP in 1914. These investment flows made it possible for entrepreneurs in many countries to borrow from foreign investors and also allowed technologies to spread from high-income countries, such as the United Kingdom and the United States, to lower income countries in Latin America and Asia.

International trade and foreign financial investment contributed to rising incomes during these years throughout most of western and northern Europe, the United States, Canada, Australia, New Zealand, Argentina, Chile, Uruguay, Japan, and South Africa. In addition, during these years millions of people were able to improve their living standards by migrating to other countries. The immigrants made themselves better off while also increasing the labor forces of the countries they settled in and, therefore, economic growth in those countries. Between 1870 and 1914, more than 25 million people immigrated to the United States. Argentina, Canada, and Australia, among other countries, also received large numbers of immigrants. Because these immigrants were, on average, more productive in the countries they arrived in than in the—usually lower-income—countries they left, immigration increased world GDP relative to what it would have been without this immigration.

If the First Golden Age of Globalization hadn’t ended with the beginning of World War I in 1914, other countries might have used international trade and foreign investment to increase economic growth and raise living standards. In fact, though, the world economy was entering a 30-year period of reduced trade and foreign investment. During the 1920s, several countries including the United States, raised tariffs, many countries left the gold standard, leading to instability in exchange rates, and the cost of ocean shipping actually rose. In the Great Depression of the 1930s, many countries, again including the United States, raised tariffs, and international trade declined sharply. By the end of World War II in 1945, many countries had imposed capital controls that made foreign investment difficult. In 1950, exports as a percentage of world GDP were 30 percent lower than they had been in 1913. Foreign assets as a percentage of world GDP collapsed by 75 percent between 1914 and 1945. They did not regain their 1914 level until 1980.

The problems in the global economy during this 30-year period led policymakers in many developing countries to conclude that relying on exports and foreign investment was not an effective strategy for increasing economic growth. Instead, policies of protectionism and import substitution became popular as countries imposed high tariffs to keep out foreign imports and capital controls to limit foreign investment. Government subsidies and tax breaks were used to encourage the establishment of import-competing firms, particularly in heavy industries such as steel and automobiles. Economists and policymakers who supported this approach argued that, having been given government aid and having been protected from foreign competition, domestic industries would flourish, allowing for rapid economic growth without a reliance on international trade. Sebastian Edwards of the University of California, Los Angeles has described the acceptance of these policies in Latin America: “By the late 1940s and early 1950s protectionist policies based on import substitution were well entrenched and constituted, by far, the dominant perspective.”

Unfortunately, these polices moved countries away from pursuing their comparative advantage. Many of the industries being supported were inefficient and produced goods at much higher costs than foreign producers. As a result, consumers in these countries had to pay higher prices for goods than did consumers in higher income countries where during these years import tariffs were being gradually reduced. Most countries pursuing policies of import substitution experienced slow economic growth in part because local firms, shielded from foreign competition, were much less efficient than firms in countries that still participated in the global economy. Countries in Latin America, in particular, didn’t turn away from a strategy of import substitution and begin to reopen their economies to international trade and foreign investment until the 1980s.

The decline in international trade and foreign investment that began in 1914 and persisted for 30 years reduced incomes in nearly every country relative to what they would have been if the First Golden Age of Globalization had continued. What began as a temporary reduction in trade and investment attributable to the effects of World War I persisted for various reasons long after the war had ended. Today, some economists and policymakers are concerned that the disruptions to the global economy from the coronavirus pandemic might also persist after the immediate effects of the pandemic have faded.

Sources: Greg Ip, “Globalization Is Down but Not Out Yet,” Wall Street Journal, April 28, 2020; Zachary Karabell, “Will the Coronavirus Bring the End of Globalization? Don’t Count on It,” Wall Street Journal, March 20, 2020; “Has Covid-19 Killed Globalisation?” Economist, May 14, 2020; King Abdullah II, “It’s Time to Return to Globalization. But This Time Let’s Do It Right,” Washington Post, April 27, 2020; Chad P. Brown, “COVID-19 Could Bring Down the Trading System,” Foreign Affairs, May/June, 2020; Antoni Estevadeordal, Brian Frantz, and Alan M. Taylor, “The Rise and Fall of World Trade, 1870-1939,” Quarterly Journal of Economics, Vol. 118, No. 2, May 2003, pp. 359-407; Kevin H. O’Rourke and Jeffrey G. Williamson, “When Did Globalization Begin?” European Review of Economic History, Vol. 6, No. 1, April 2002, pp. 23-50; Kevin H. O’Rourke, “The European Grain Invasion, 1870-1913,” Journal of Economic History, Vol. 57, No. 4, December 1997, pp. 775-801; Michael D. Bordo, Alan M. Taylor, and Jeffrey G. Williamson, eds., Globalization in Historical Perspective, Chicago: The University of Chicago Press, 2003; Sebastian Edwards, “Trade and Industrial Policy Reform in Latin America,” Nation Bureau of Economic Research Working Paper No. 4772, June 1994; U.S. Bureau of Economic Analysis; and U.S. Census Bureau.

Question:

There are both positive and normative aspects to the debate over whether the United States should become less reliant on imports of pharmaceuticals, medical devices, and personal protective equipment (PPE) by taking steps to relocate production of these goods to the United States.

- Briefly identify what you think are the key positive and normative aspects of this debate.

- What economic statistics would be most useful in evaluating the positive aspects of this debate?

- Assuming that the statistics you identified in b. are available or could be determined, are they likely to resolve the normative issues in this debate? Briefly explain.

For Economics Instructors that would like the approved answers to the above questions, please email Christopher DeJohn from Pearson at christopher.dejohn@pearson.com and list your Institution and Course Number.