Image generated by GTP-4o illustrating labor productivity

Several articles in the business press have discussed the recent increases in labor productivity. For instance, this article appeared in this morning’s Wall Street Journal (a subscription may be required).

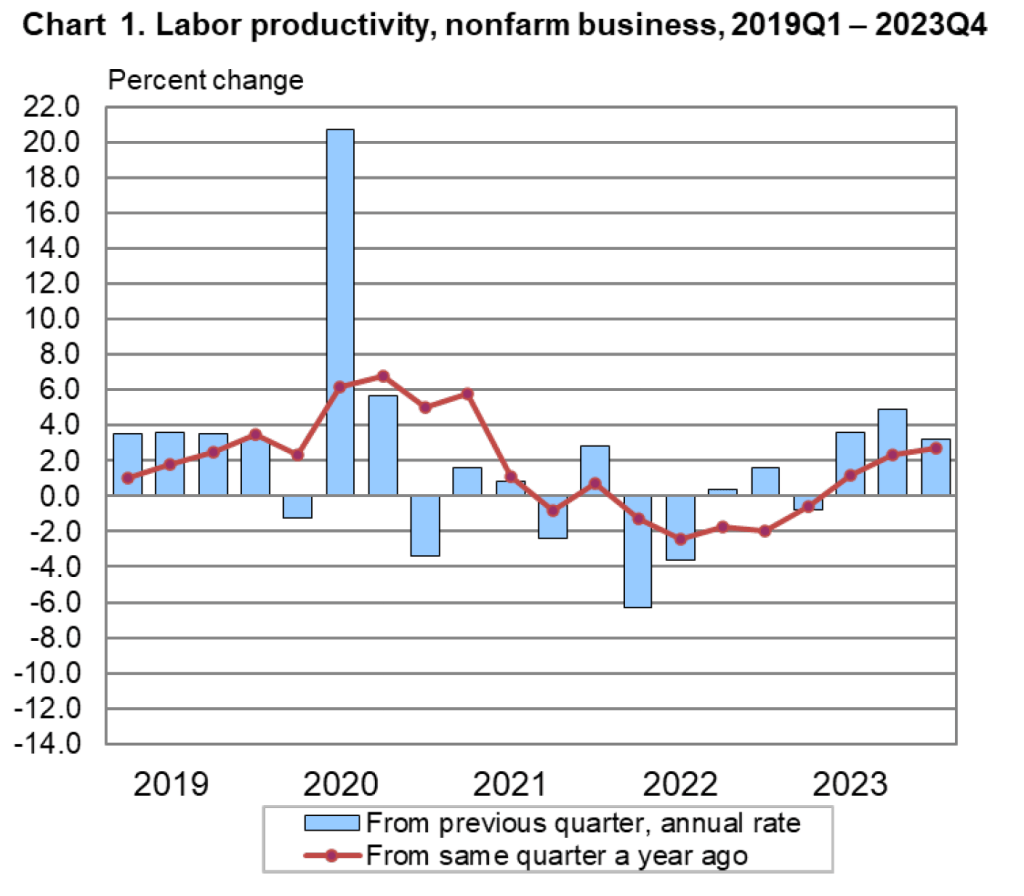

The most widely used measure of labor productivity is output per hour of work in the nonfarm business sector. The BLS calculates output in the nonfarm business sector by subtracting from GDP production in the agricultural, government, and nonprofit sectors. (The definitions used by the Bureau of Labor Statistics (BLS) in estimating labor productivity are discussed in the “Technical Notes” that appear at the end of the BLS’s quarterly “Productivity and Costs” releases.) The blue line in the following figure shows the annual growth rate in labor productivity in the nonfarm business sector as measured by the percentage change from the same quarter in the previous year. The green line shows labor productivity growth in manufacturing.

As the figure shows, both labor productivity growth in the nonfarm business sector and labor productivity growth in manufacturing are volatile. The business press has focused on the growth of productivity in the nonfarm business sector during the period from the third quarter of 2023 through the third quarter of 2024. During this time, labor productivity has grown at an average annual rate of 2.5 percent. That growth rate is notably higher than the growth rate that many economists are expecting over the next 10 years. For instance, the Congressional Budget Office (CBO) has forecast that labor productivity will grow at an average annual rate of only 1.6 percent over the period from 2025 to 2034.

The CBO forecasts that the total numbers of hours worked in the economy will grow at an average annual rate of 0.5 percent. Combining that estimate with a 2.5 percent annual rate of growth of labor productivity results in output per person—a measure of the standard of living—increasing by 34 percent by 2034. If labor productivity increases at a rate of only 1.6 percent, then output per person will have increased by only 23 percent by 2034.

The standard of living of the average person in United States increasing 11 percent more would make a noticeable difference in people’s lives by allowing them to consume and save more. Higher rates of labor productivity growth leading to a faster growth rate of income and output would also increase the federal government’s tax revenues, helping to decrease federal budget deficits that are currently forecast to be historically large. (We discuss the components of long-run economic growth in Macroeconomics, Chapter 16, Section 16.7; Economics, Chapter 26, Section 26.7, and the economics of long-run growth in Macroeconomics, Chapter 11; Economics, Chapter 21.)

Can the recent growth rates in labor productivity be maintained over the next 10 years? There is an historical precedent. Labor productivity in the nonfarm business sector grew at an average annual rate of 2.6 percent between 1950 and 1973. But growth rates that high have proven difficult to achieve in more recent years. For instance, from 2008 to 2023, labor productivity grew at an average annual rate of only 1.5 percent. (We discuss the debate over future growth rates in Macroeconomics, Chapter 11, Section 11.3; Economics, Chapter 21, Section 21.3.)

The Wall Street Journal article we cited earlier provides an overview of some of the factors that may account for the recent increase in labor productivity growth rates. The 2020 Covid pandemic may have led to some increases in labor productivity. Workers who temporarily or permanently lost their jobs as businesses closed during the height of the pandemic may have found new jobs that better matched their skills, making them more productive. Similarly, businesses that were forced to operate with fewer workers, may have found ways to restore their previous levels of output with lower levels of employment. These changes may have led to one-time increases in labor productivity at some firms, but are unlikely to result in increased rates of labor productivity growth in the future.

Some businesses have used newly available generative artificial intelligence (AI) software to increase labor productivity by, for instance, using software to replace workers who previously produced marketing materials or responded to customer questions or complaints. It will take at least several years before generative AI software spreads throughout the economy, so it seems too early for it to have had a broad enough effect on the economy to be visible in the productivity data.

Note also that, as the green line in the figure above shows, manufacturing productivity has been lagging recently. From the third quarter of 2023 to the third quarter of 2024, labor productivity in manufacturing has increased at an annual average rate of only 0.4 percent. This slowdown is surprising given that over the long run productivity in manufacturing has typically increased faster than has productivity in the overall economy. It seems unlikely that labor productivity in the overall economy can sustain its recent growth rates if labor productivity growth in manufacturing continues to lag.

Finally, the productivity data are subject to revision as better estimates of output and of hours worked become available. It’s possible that what appear to be rapid rates of productivity growth during the last five quarters may turn out to have been less rapid following data revisions.

So, while the recent increase in the growth rate of labor productivity is an encouraging sign of the strength of the U.S. economy, it’s too soon to tell whether we have entered a sustained period of higher productivity growth.