Photo from Paramount Pictures via britannica.com.

Photo from Warner Brothers Pictures via insider.com.

Income and wealth are often confused. Media accounts of the “wealthy” typically switch back and forth between referring to people with high incomes and referring to people with substantial wealth. It’s possible to have a high income, but not much wealth, if you spend most of your income. It’s also possible, although less common, for someone to have substantial wealth while having a relatively low income.

As we discuss in the Don’t Let This Happen to You feature in Macroeconomics, Chapter 14 (also Economics, Chapter 24), Your income is equal to your earnings during the year, while your wealth is equal to the value of the assets you own minus the value of any debts you have. It’s also worth keeping in mind that income is a flow variable that is measured over a period of time—such as a year—while wealth is a stock variable that is measured at a particular point in time—such as the first or last day of the year.

Both income and wealth can be difficult to accurately measure. Although we typically think of a person’s income as being equal to the salary and wages the person earns, income, properly measured, also includes changes in the value of the assets the person owns. For example, suppose that at the start of the year you own shares of Apple stock worth $5,000. If at the end of the year, the price on the stock market of your Apple shares has risen to $5,500, the $500 increase is part of your income for the year. (Note that this capital gain on your stock is included in your taxable income only if you sell the stock. Whether you sell the stock or not, though, the capital gain is part of your income.)

It can be difficult to measure the wealth of someone who owns significant assets that, unlike shares of stock, aren’t regularly bought and sold in a market. For instance, if someone owns a restaurant, determining what the price the restaurant would sell for—and, therefore, how wealthy the person is—can be difficult. Although other restaurants in the area may have sold recently, every restaurant is different, which makes it possible to determine only approximately what the sales price of a particular restaurant would be. As we discuss in the Apply the Concept feature “Should the Federal Government Begin to Tax Wealth?” in Microeconomics, Chapter 17 (also Economics, Chapter 17), the difficulty of valuing some types of wealth is one complication the federal government would face in enacting a tax on wealth.

If measuring the wealth of someone in the real world is difficult, measuring the wealth of a fictional character is even more daunting. Some years ago, undergraduate students, most of whom were economics majors at Lehigh University, estimated the wealth of Bruce Wayne, the alter ego of Batman. To narrow the focus, the students based their estimate on only the information available in the three Batman films directed by Christopher Nolan. On the basis of that information, they estimate that Bruce Wayne’s wealth is $11.6 billion. At the time the films were produced, that would have made Bruce Wayne the seventy-third wealthiest person in the world—if, of course, he had been a real person! You can read the details of their estimate here.

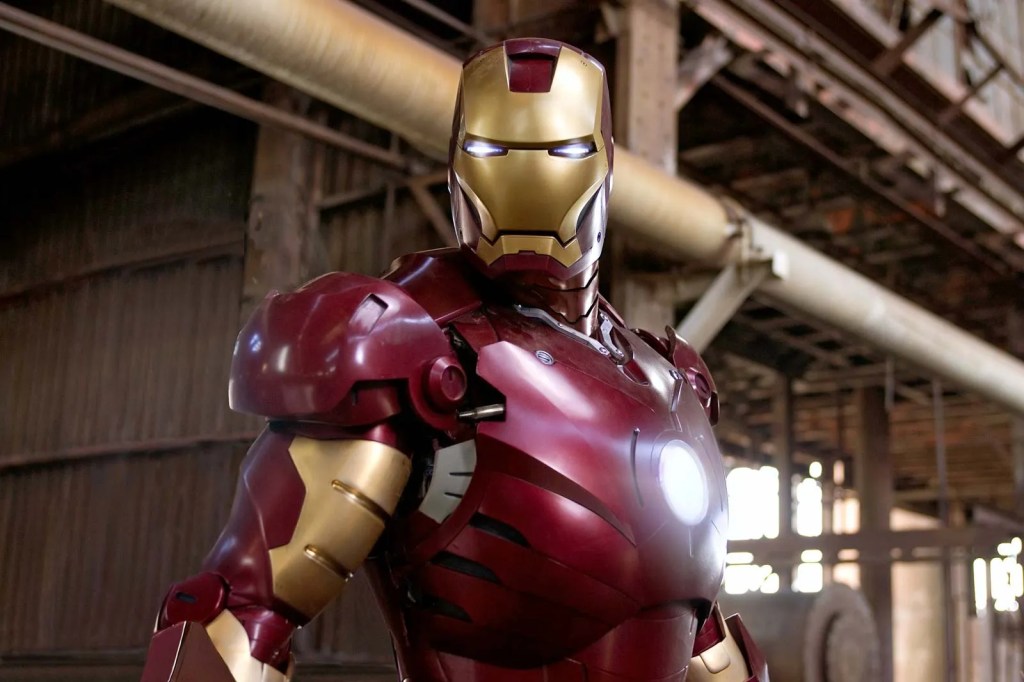

Bruce Wayne is apparently very wealthy, but is he as wealthy as Tony Stark, the alter ego of Iron Man? Apparently not, according to an estimate appearing on the business web site forbes.com. Although he doesn’t seem to give the details of how he arrived at the estimate, the author of the post values Tony Stark’s wealth at $9.3 billion, making him about 20 percent less wealthy than Bruce Wayne. Score one for the Caped Crusader!