Federal Reserve Chair Jerome Powell (Photo from Bloomberg News via the Wall Street Journal.)

Economists, policymakers, and Wall Street analysts have been waiting for macroeconomic data to confirm that the Federal Reserve has brought the U.S. economy in for a soft landing, with inflation arrving back at the Fed’s target of 2 percent without the economy slipping into a recession. Fed officials have been cautious about declaring that they have yet seen sufficient data to be sure that a soft landing has actually been achieved. Accordingly, they are not yet willing to begin cutting their target for the federal funds rate.

For instance, on March 6, in testifying before the Commitee on Financial Services of the U.S. House of Representatives, Fed Chair Jerome Powell stated that the Fed’s Federal Open Market Committee (FOMC) “does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” (Powell’s statement before his testimony can be found here.)

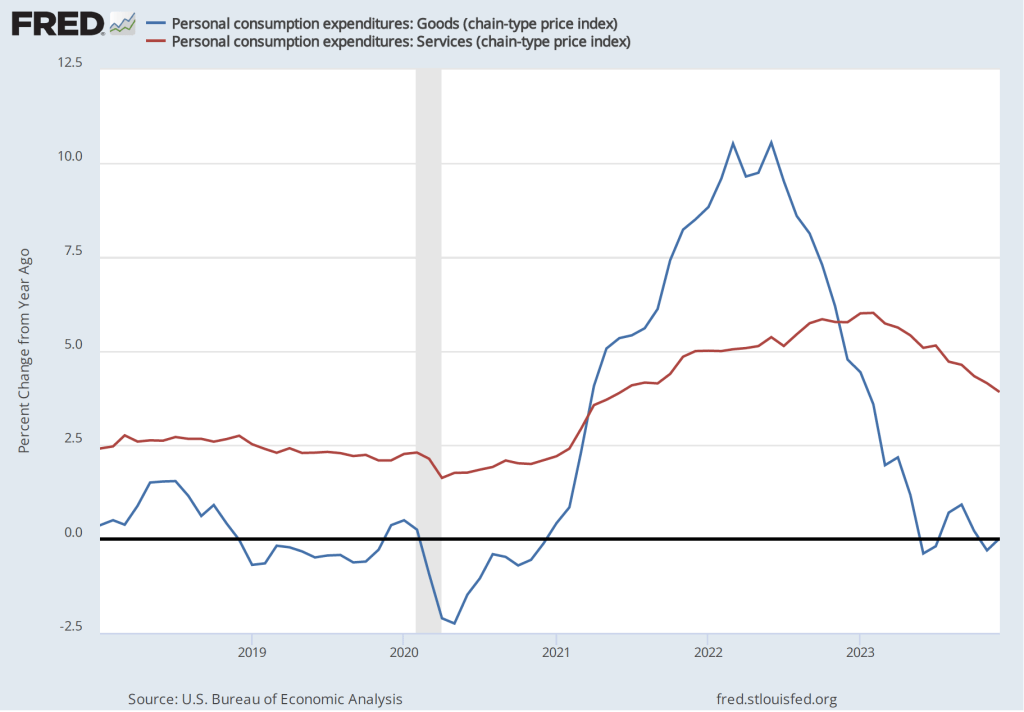

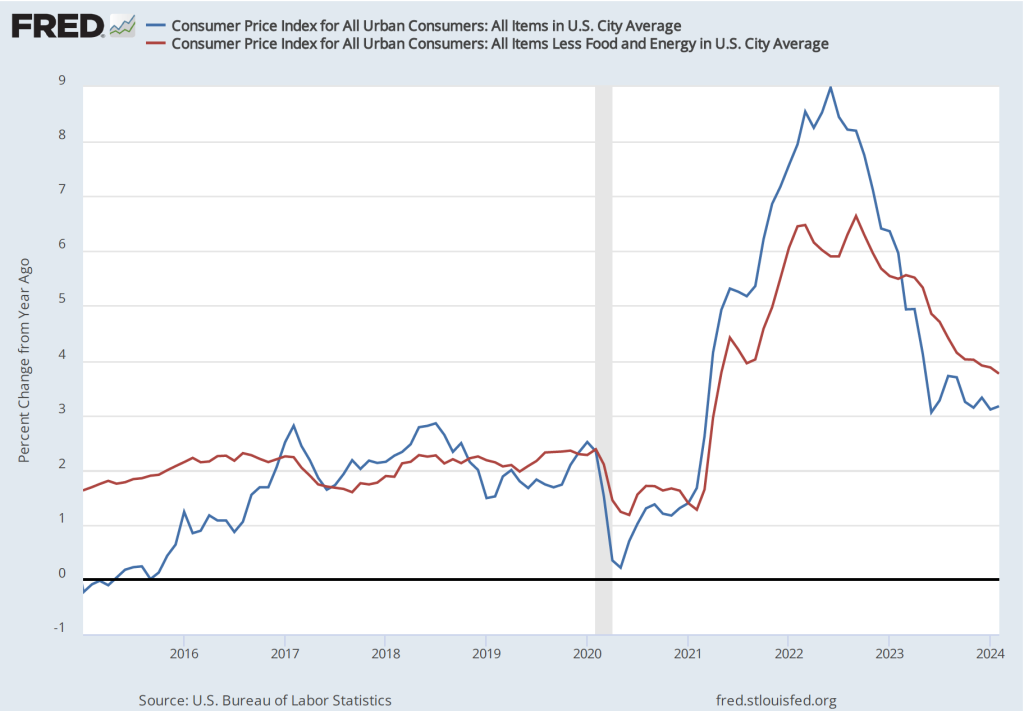

The BLS’s release today (March 12) of its report on the consumer price index (CPI) (found here) for February indicated that inflation was still running higher than the Fed’s target, reinforcing the cautious approach that Powell and other members of the FOMC have been taking. The increase in the CPI that includes the prices of all goods and services in the market basket—often called headline inflation—was 3.2 percent from the same month in 2023, up slightly from 3.1 In January. (We discuss how the BLS constructs the CPI in Macroeconomics, Chapter 9, Section 19.4, Economics, Chapter 19, Section 19.4, and Essentials of Economics, Chapter 3, Section 13.4.) As the following figure shows, core inflation—which excludes the prices of food and energy—was 3.8 percent, down slightly from 3.9 percent in January.

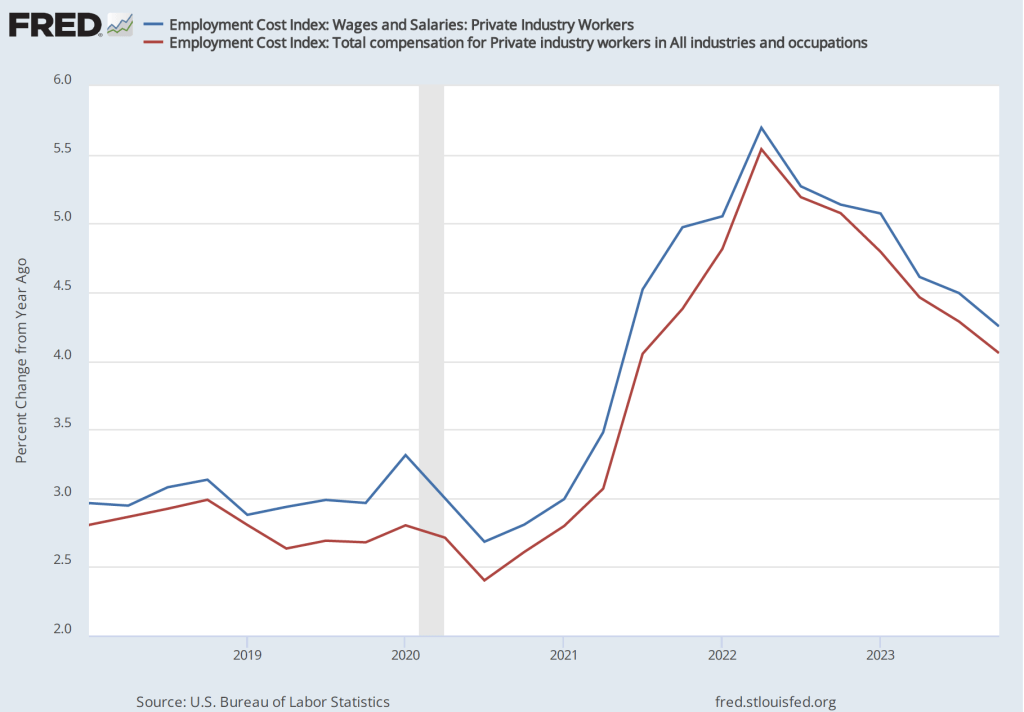

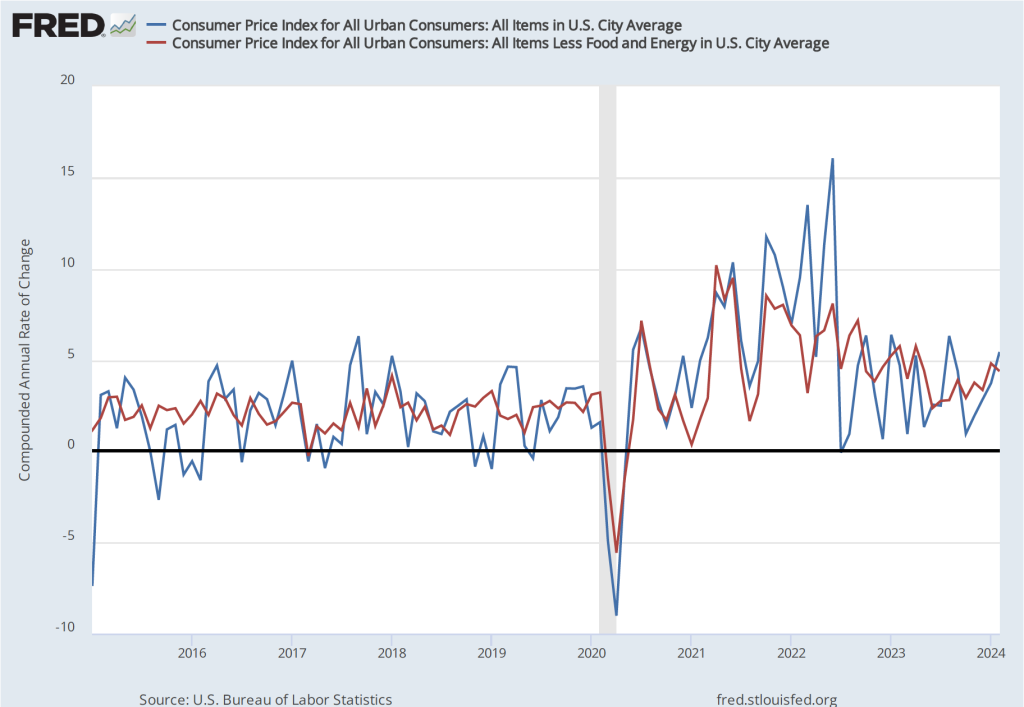

If we look at the 1-month inflation rate for headline and core inflation—that is the annual inflation rate calculated by compounding the current month’s rate over an entire year—the values are more concerning, as indicated in the following figure. Headline CPI inflation is 5.4 percent (up from 3.7 percent in January) and core CPI inflation is 4.4 percent (although that is down from 4.8 percent in January). The Fed’s inflation target is measured using the personal consumption expenditures (PCE) price index, not the CPI. But CPI inflation at these levels is not consistent with PCE inflation of only 2 percent.

Even more concerning is the path of inflation in the prices of services. As we’ve noted in earlier posts, Chair Powell has emphasized that as supply chain problems have gradually been resolved, inflation in the prices of goods has been rapidly declining. But inflaion in services hasn’t declined nearly as much. Last summer he stated the point this way:

“Part of the reason for the modest decline of nonhousing services inflation so far is that many of these services were less affected by global supply chain bottlenecks and are generally thought to be less interest sensitive than other sectors such as housing or durable goods. Production of these services is also relatively labor intensive, and the labor market remains tight. Given the size of this sector, some further progress here will be essential to restoring price stability.”

The following figure shows the 1-month inflation rate in services prices and in services prices not included including housing rent. Some economists believe that the rent component of the CPI isn’t well measured and can be volatile, so it’s worthwhile to look at inflation in service prices not including rent. The figure shows that inflation in all service prices has been above 4 percent in every month since July 2023. Although inflation in service prices declined from January, it was still a very high 5.8 percent in February. Inflation in service prices not including housing rent was even higher at 7.5 percent. Such large increases in the prices of services, if they were to continue, wouldn’t be consistent with the Fed meeting its 2 percent inflation target.

Finally, some economists and policymakers look at median inflation to gain insight into the underlying trend in the inflation rate. If we listed the inflation rate in each individual good or service in the CPI, median inflation is the inflation rate of the good or service that is in the middle of the list—that is, the inflation rate in the price of the good or service that has an equal number of higher and lower inflation rates. As the following figure shows, although median inflation declined in February, it was still high at 4.6 percent and, although median inflation is volatile, the trend has been generally upward since July 2023.

The data in this month’s BLS report on the CPI reinforces the view that the FOMC will not move to cut its target for the federal funds rate in the meeting next week and makes it somewhat less likely that the committee will cut its target at the following meeting on April 30-May 1.