Photo courtesy of Lena Buonanno.

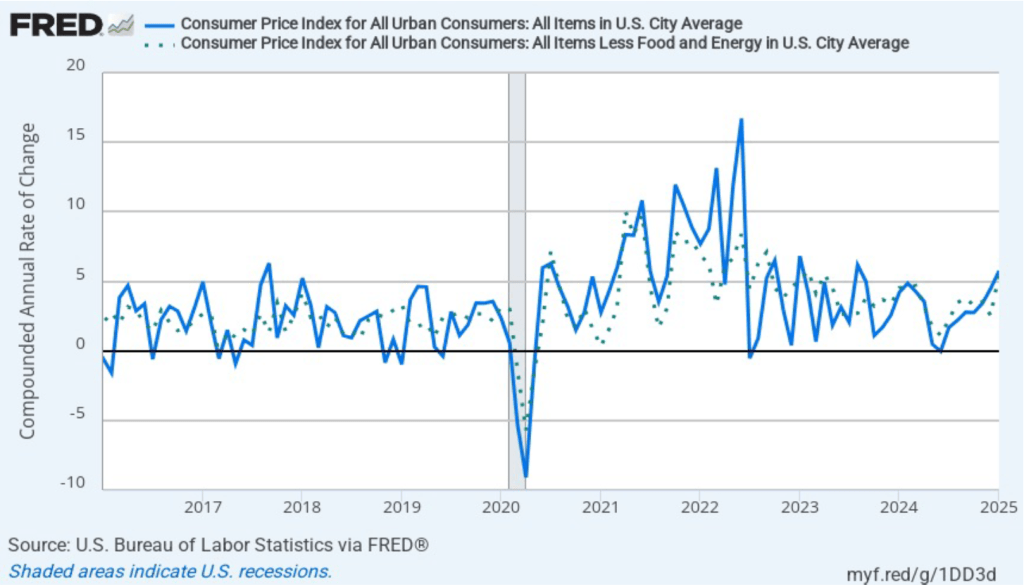

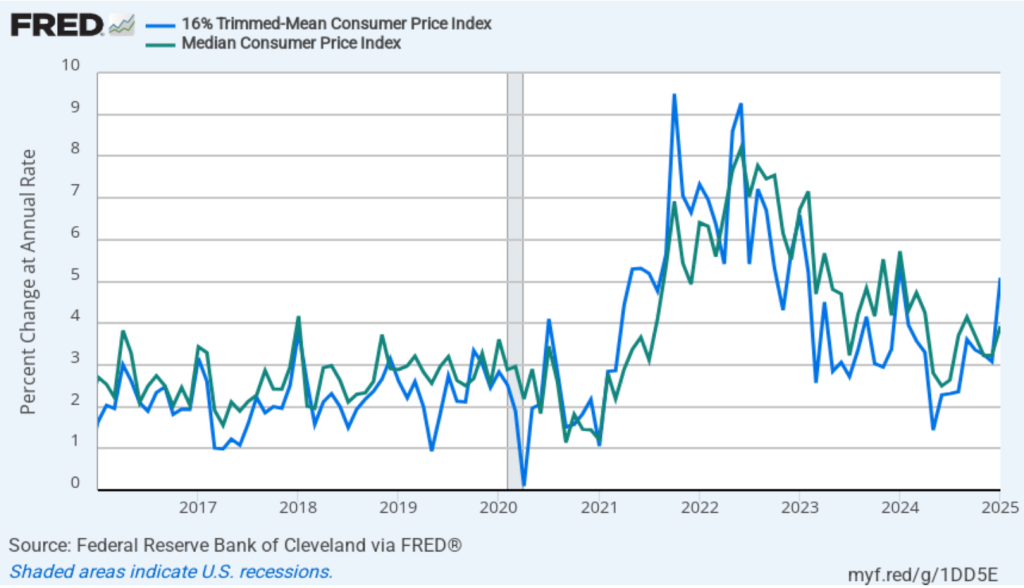

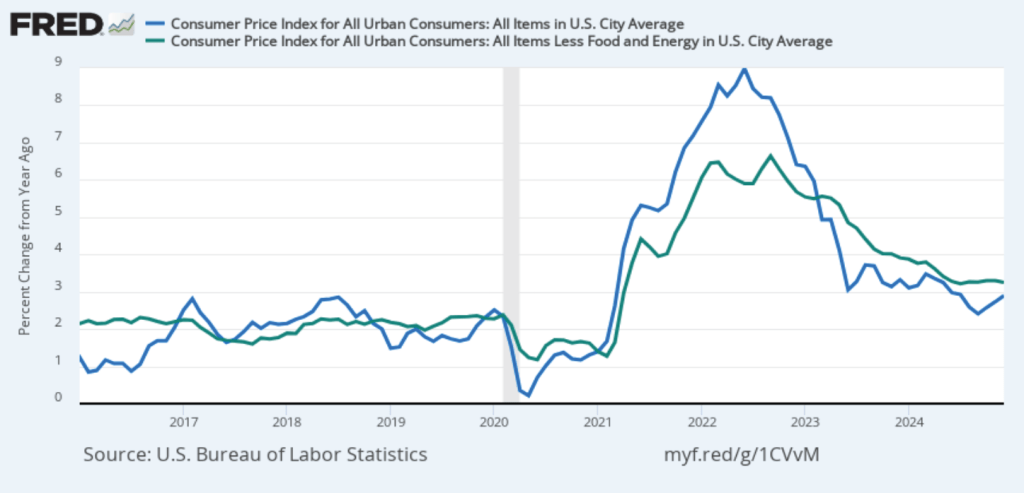

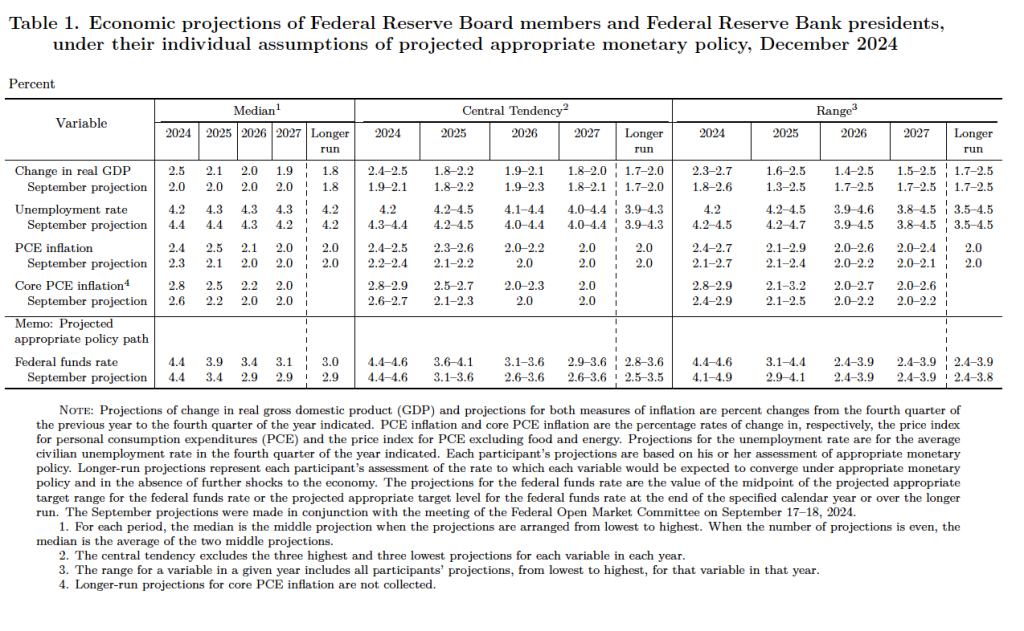

Today (March 12), the Bureau of Labor Statistics (BLS) released its monthly report on the consumer price index (CPI). The following figure compares headline inflation (the blue line) and core inflation (the green line).

- The headline inflation rate, which is measured by the percentage change in the CPI from the same month in the previous year, was 2.8 percent in February—down from 3.0 percent in January.

- The core inflation rate, which excludes the prices of food and energy, was 3.1 percent in February—down from 3.3 percent in January.

Both headline inflation and core inflation were slightly below what economists surveyed had expected.

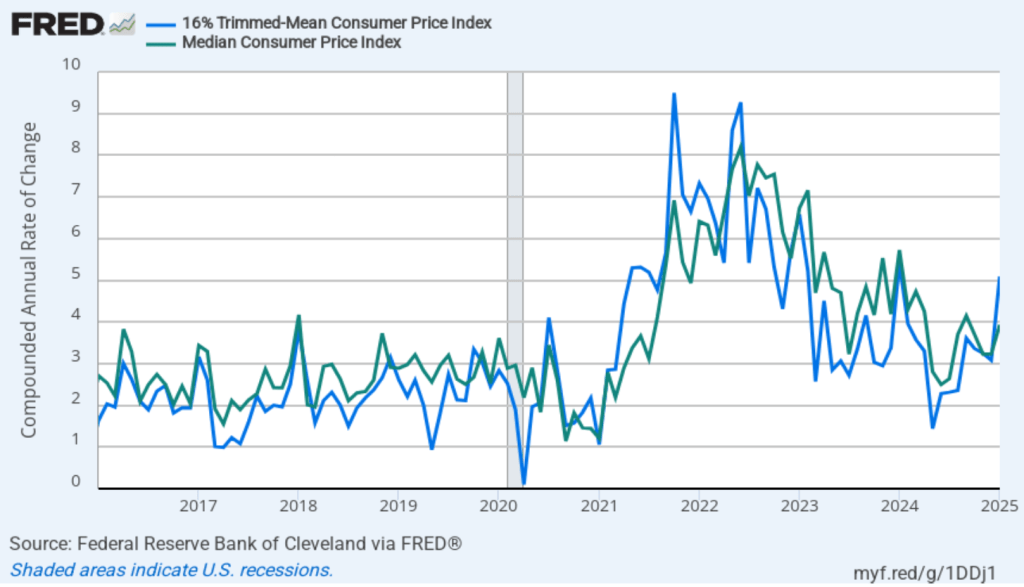

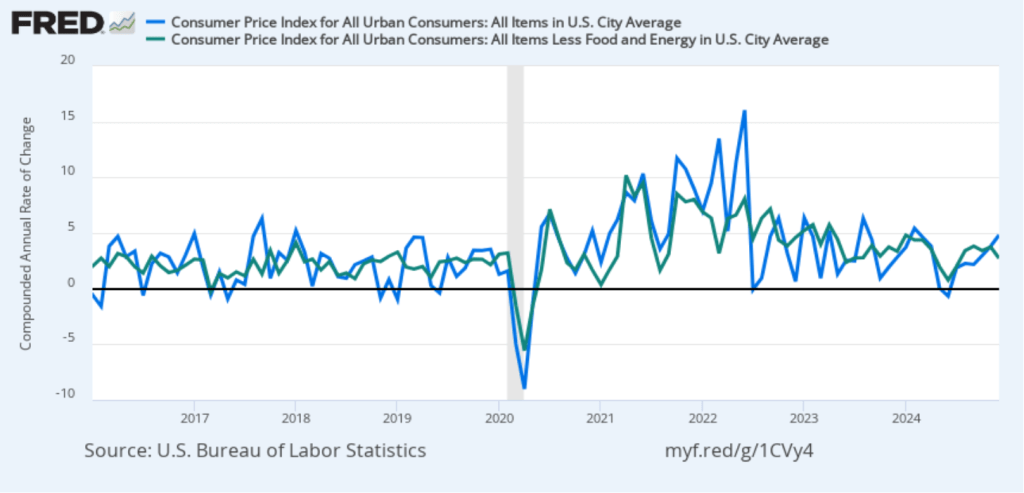

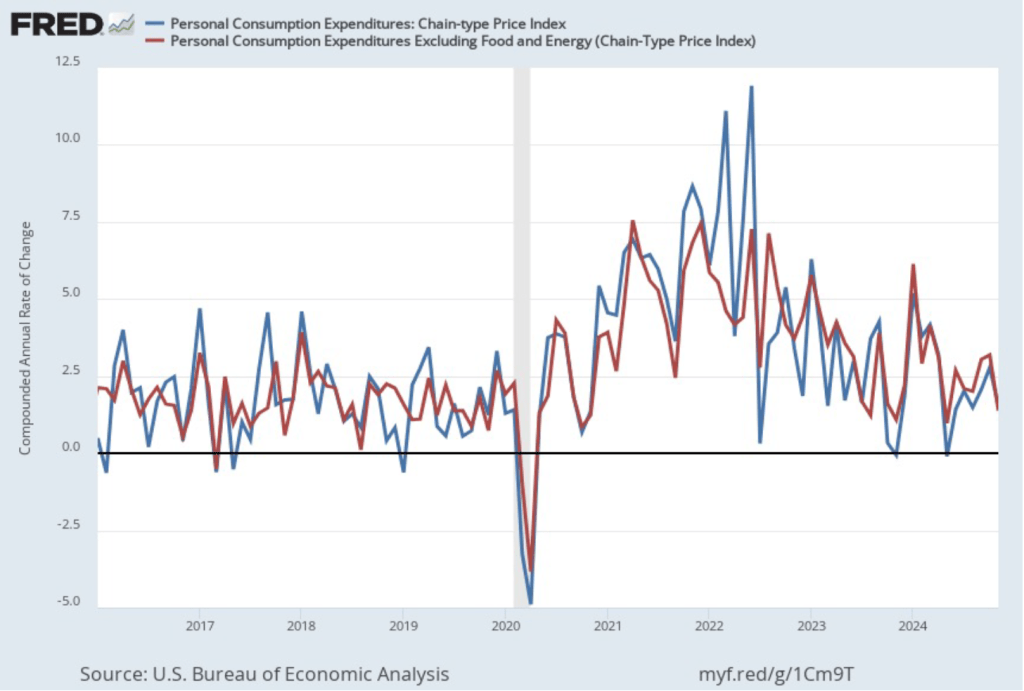

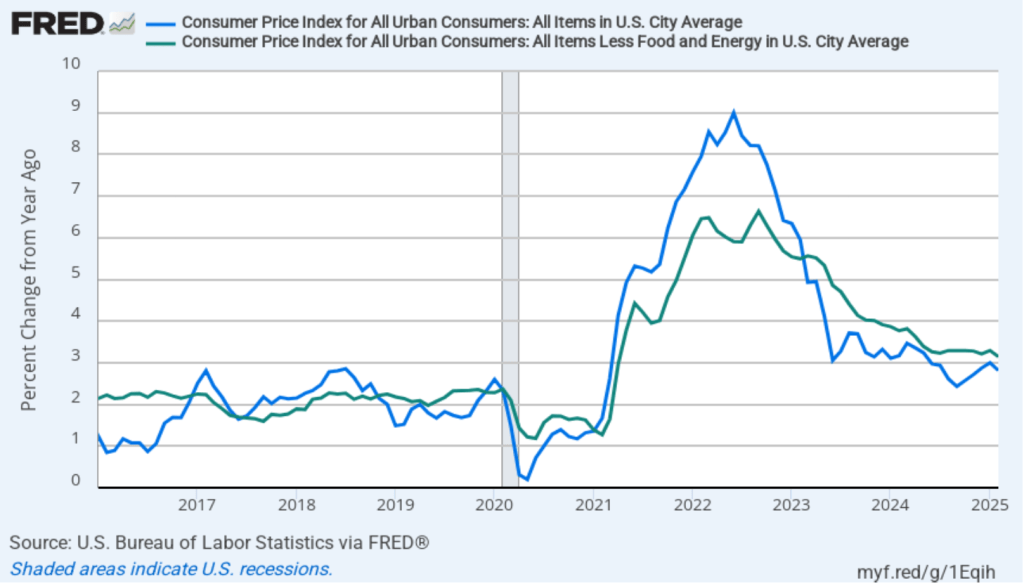

In the following figure, we look at the 1-month inflation rate for headline and core inflation—that is the annual inflation rate calculated by compounding the current month’s rate over an entire year. Calculated as the 1-month inflation rate, headline inflation (the blue line) fell sharply from 5.7 percent in February to 2.6 percent in January. Core inflation (the green line) decreased from 5.5 percent in January to 2.8 percent in January.

Overall, considering 1-month and 12-month inflation together, the most favorable news is the sharp decline in both the headline and the core 1-month inflation rats. But inflation is still running ahead of the Fed’s 2 percent annual inflation target.

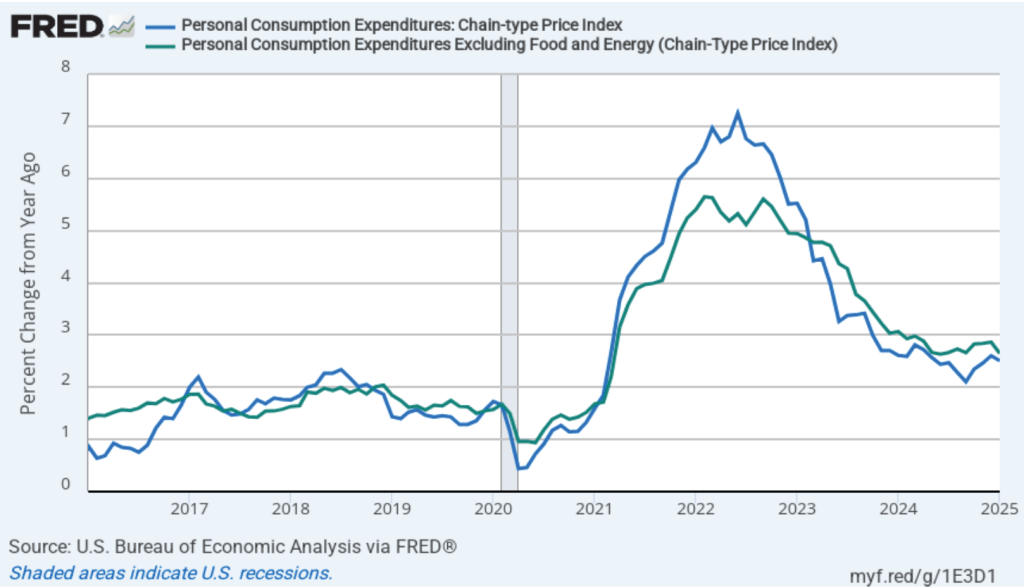

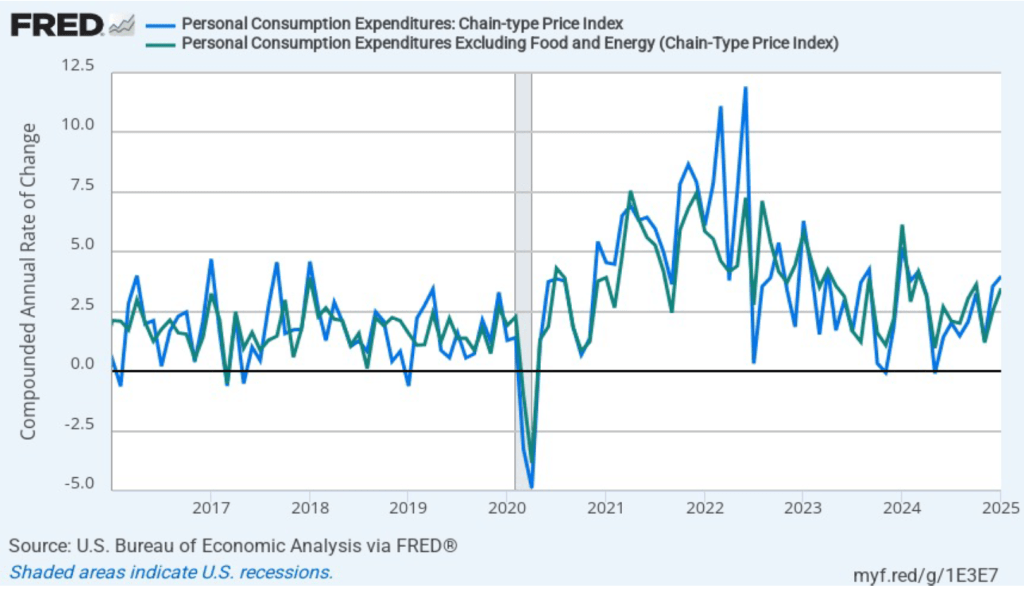

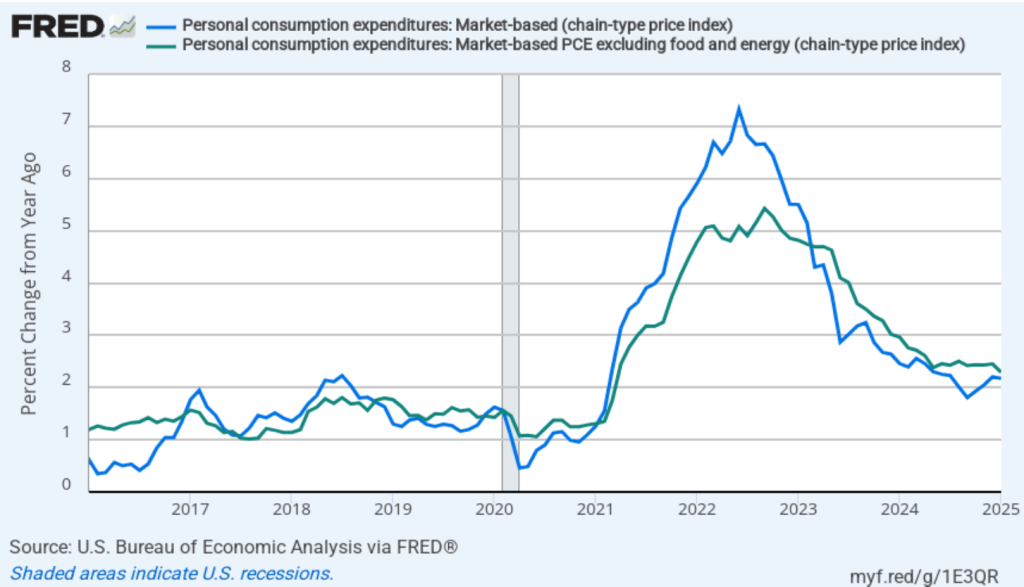

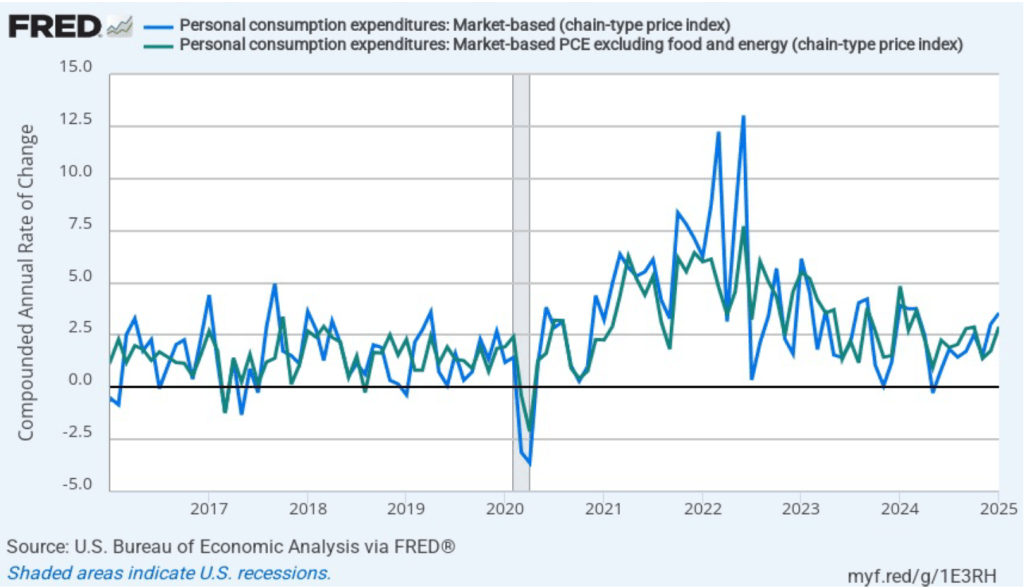

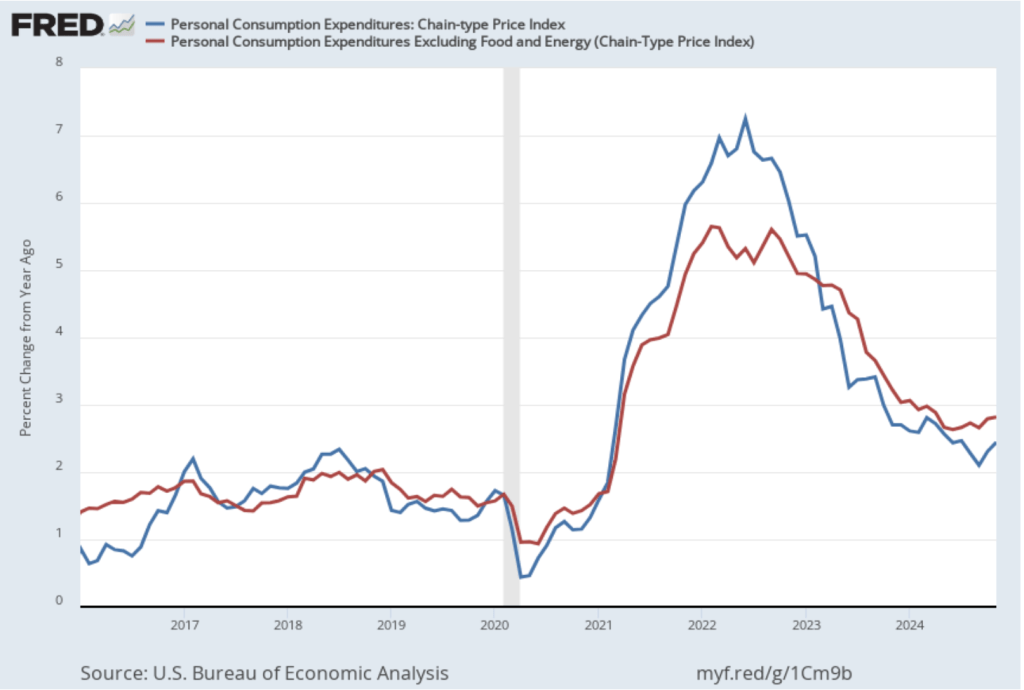

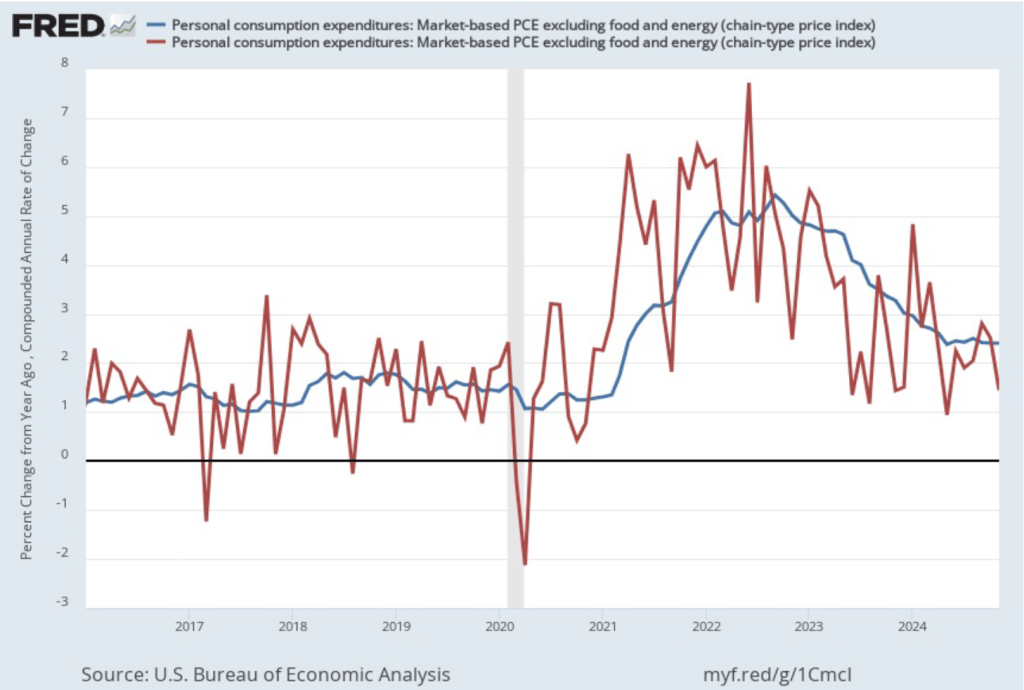

Of course, it’s important not to overinterpret the data from a single month. The figure shows that 1-month inflation is particularly volatile. Also note that the Fed uses the personal consumption expenditures (PCE) price index, rather than the CPI, to evaluate whether it is hitting its 2 percent annual inflation target.

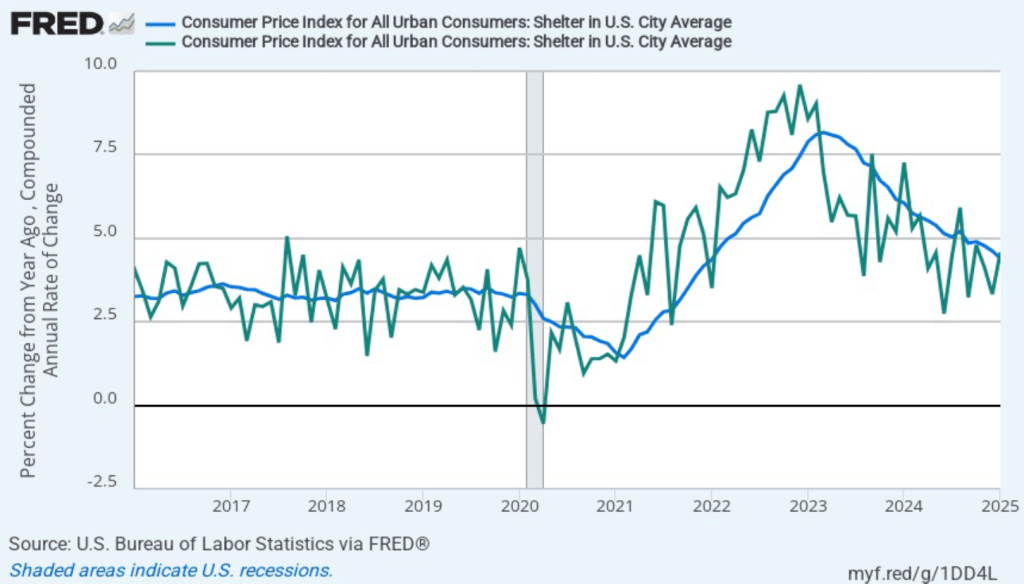

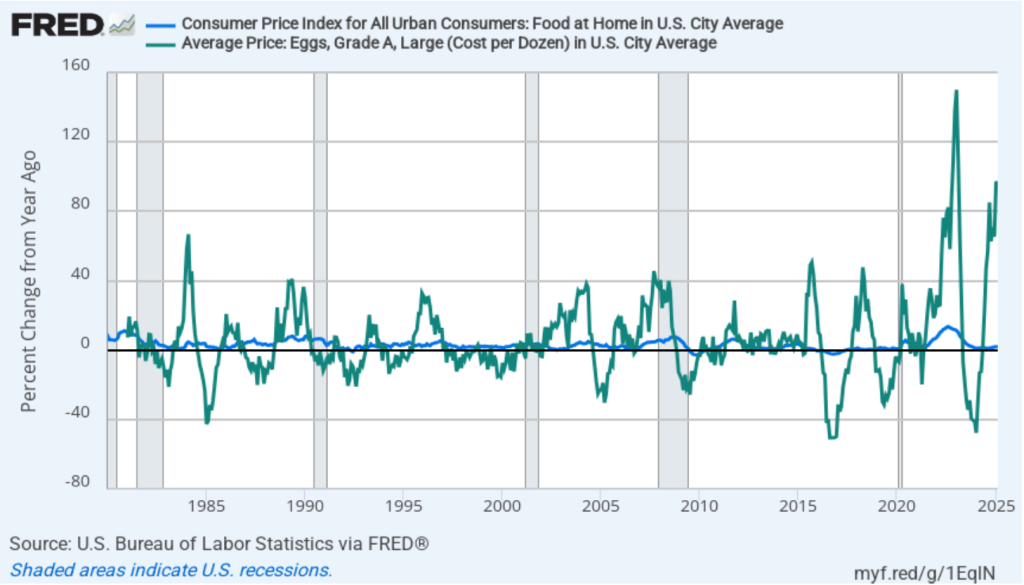

There’s been considerable discussion in the media about continuing inflation in grocery prices. In the following figure the blue line shows inflation in the CPI category “food at home,” which is primarily grocery prices. Inflation in grocery prices was 1.8 percent in February and has been below 2 percent every month since November 2023. Although on average grocery price inflation has been low, there have been substantial increases in the prices of some food items. For instance, egg prices—shown by the green line—increased by 96.8 percent in February. But, as the figure shows, egg prices are usually quite volatile month-to-month, even when the country is not dealing with an epidemic of bird flu.

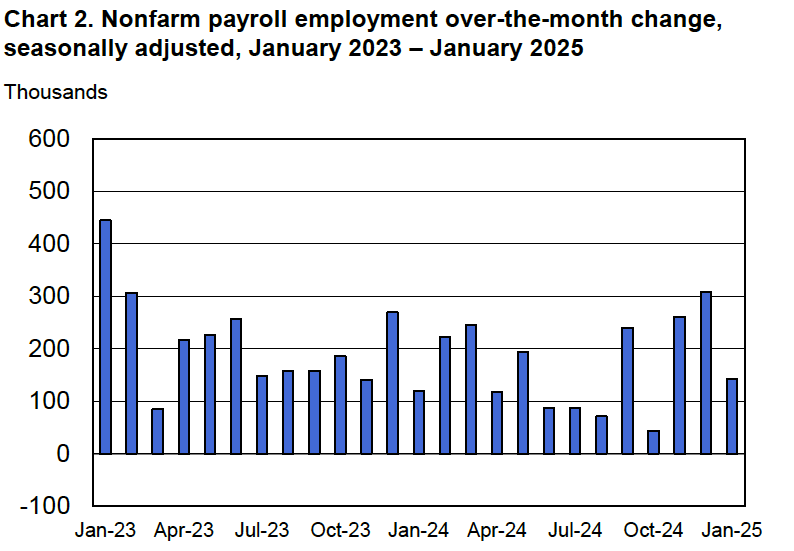

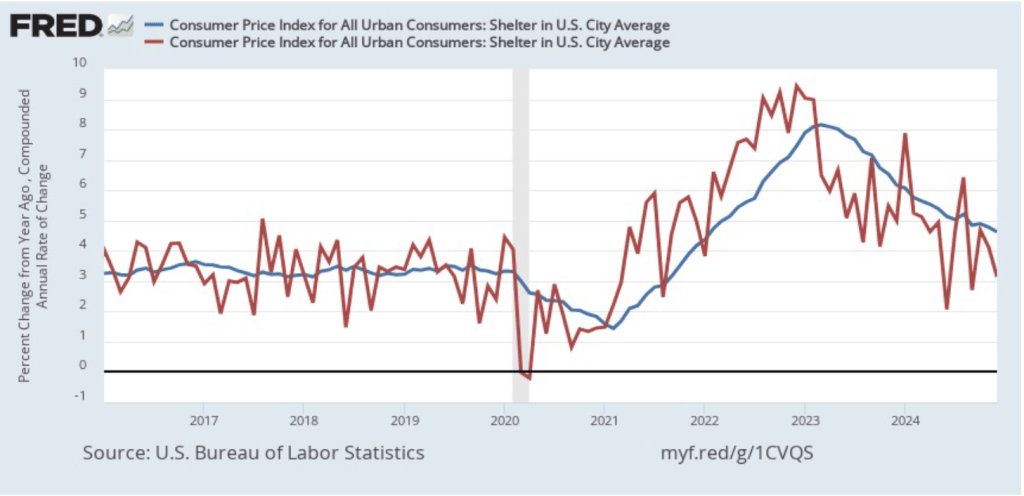

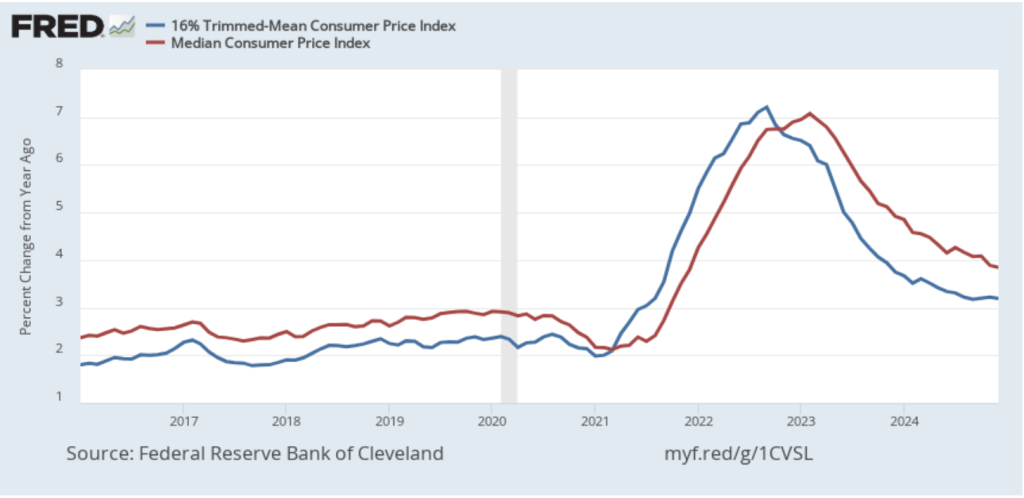

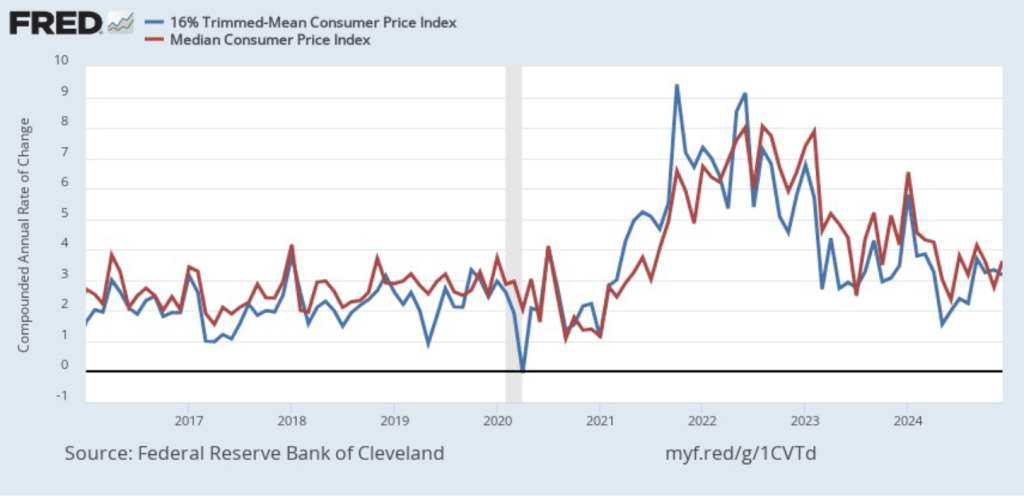

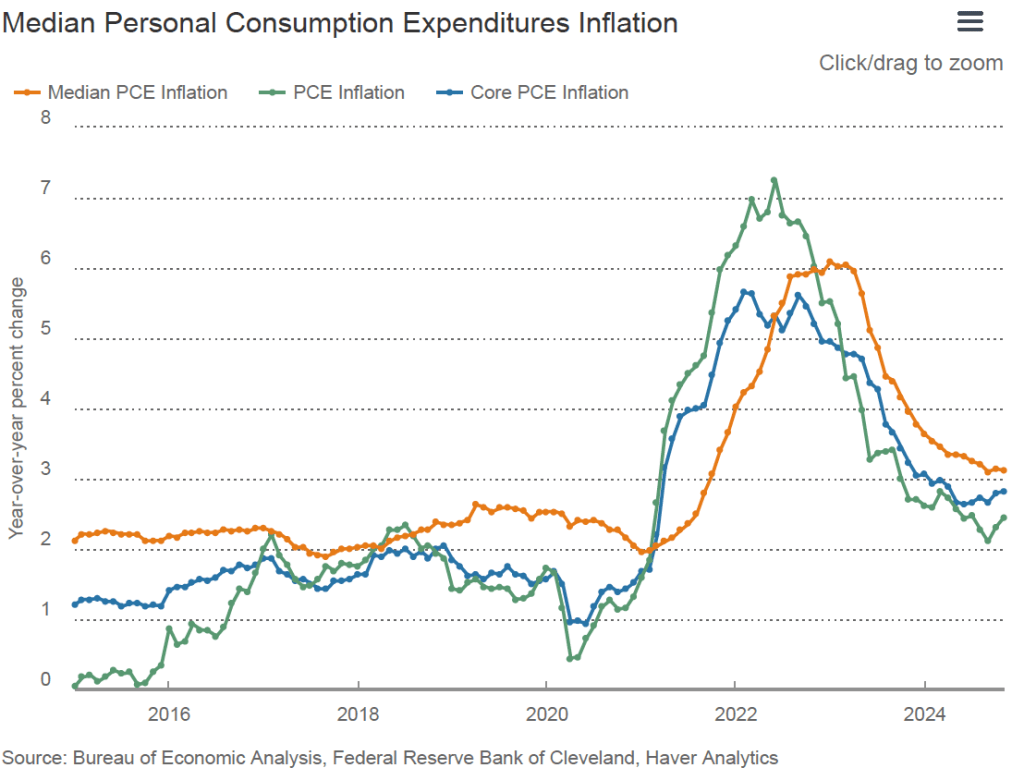

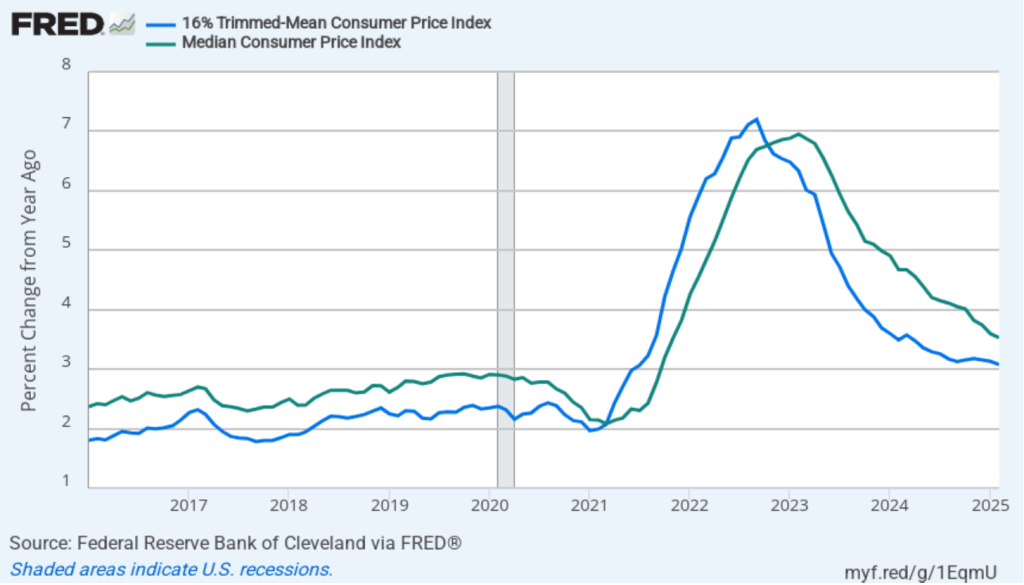

To better estimate the underlying trend in inflation, some economists look at median inflation and trimmed mean inflation.

- Median inflation is calculated by economists at the Federal Reserve Bank of Cleveland and Ohio State University. If we listed the inflation rate in each individual good or service in the CPI, median inflation is the inflation rate of the good or service that is in the middle of the list—that is, the inflation rate in the price of the good or service that has an equal number of higher and lower inflation rates.

- Trimmed-mean inflation drops the 8 percent of goods and services with the highest inflation rates and the 8 percent of goods and services with the lowest inflation rates.

The following figure shows that 12-month trimmed-mean inflation (the blue line) was 3.1 percent in February, unchanged from January. Twelve-month median inflation (the green line) declined slightly from 3.6 percent in January to 3.5 percent in February.

The following figure shows 1-month trimmed-mean and median inflation. One-month trimmed-mean inflation fell from 5.1 percent in January to 3.3. percent in February. One-month median inflation from 3.9 percent in January to 3.5 percent in February. These data provide confirmation that (1) CPI inflation at this point is likely running higher than a rate that would be consistent with the Fed achieving its inflation target, and (2) inflation slowed somewhat from January to February.

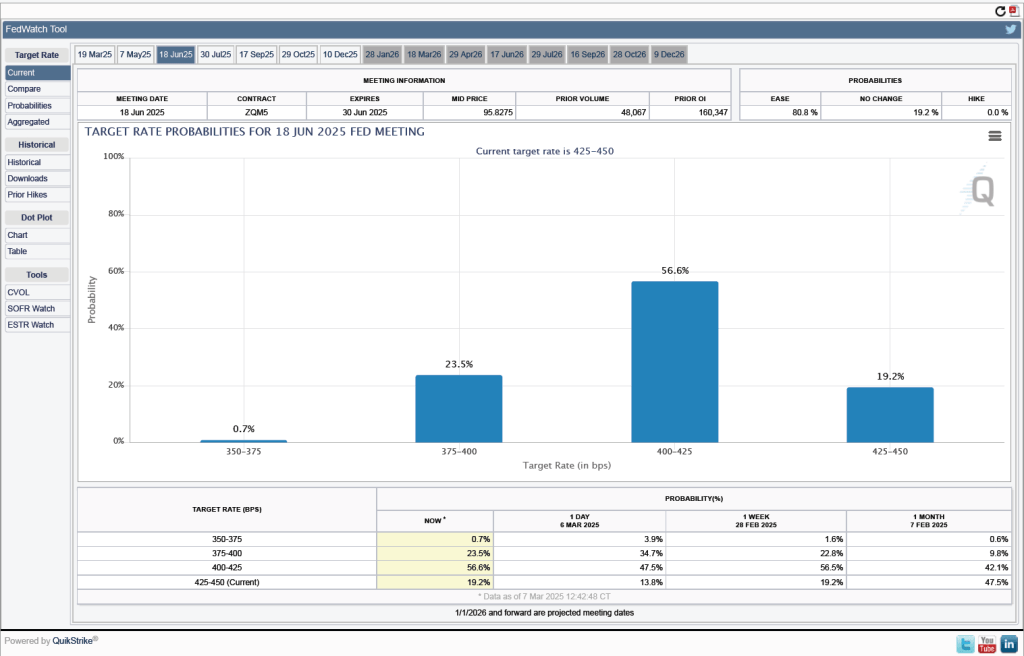

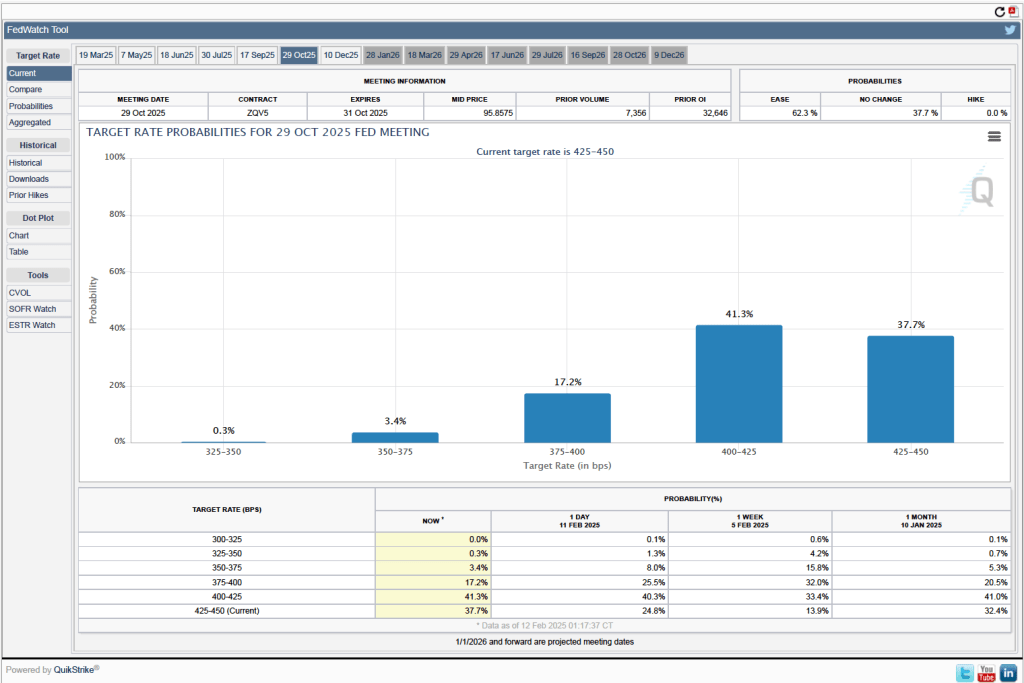

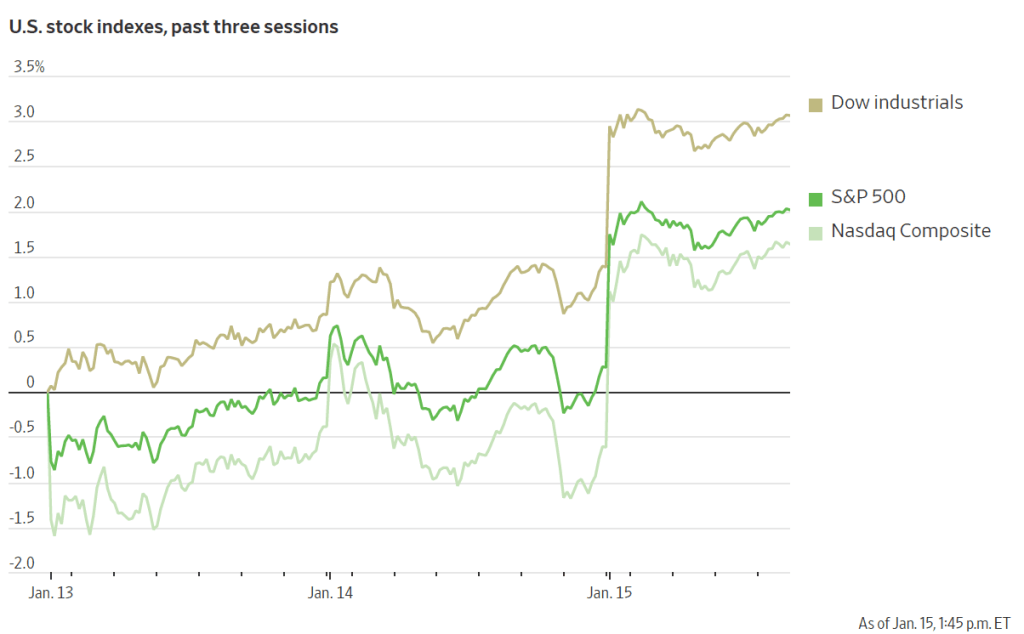

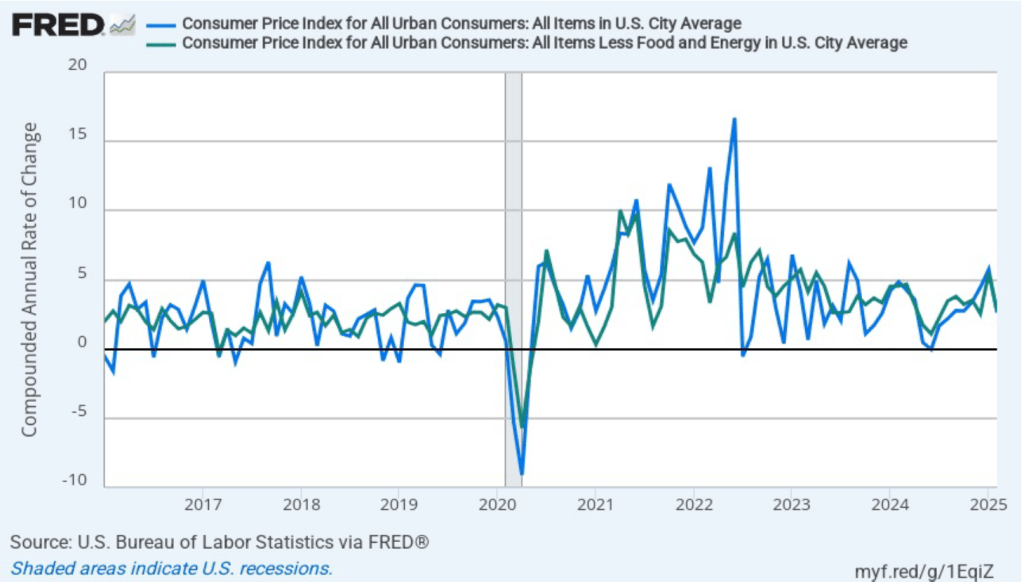

What are the implications of this CPI report for the actions the FOMC may take at its next several meetings? The major stock market indexes rose sharply at the beginning of trading this morning, but then swung back and forth between losses and gains. Inflation being lower than expected may have increased the probability that the FOMC will cut its target for the federal funds rate sooner rather than later. Lower inflation and lower interest rates would be good news for stock prices. But investors still appear to be worried about the extent to which a trade war might both slow economic growth and increase the price level.

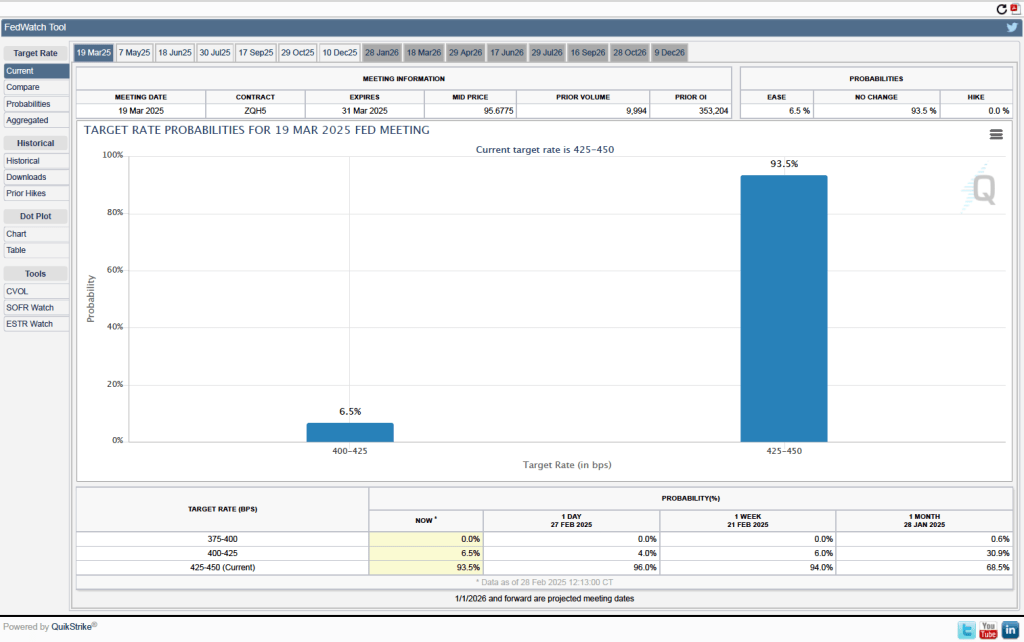

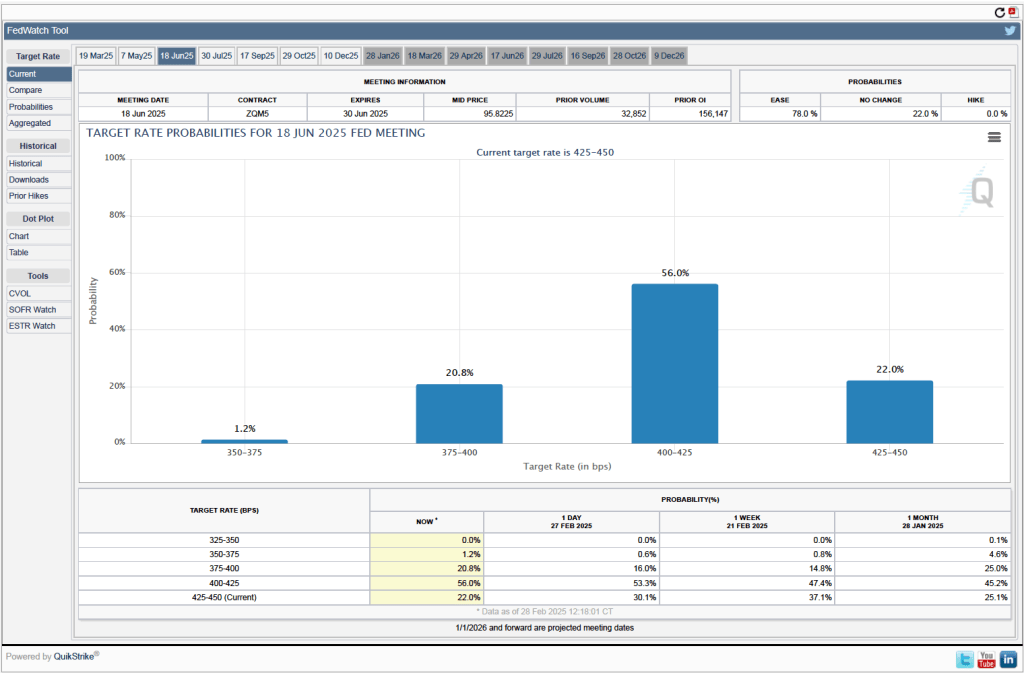

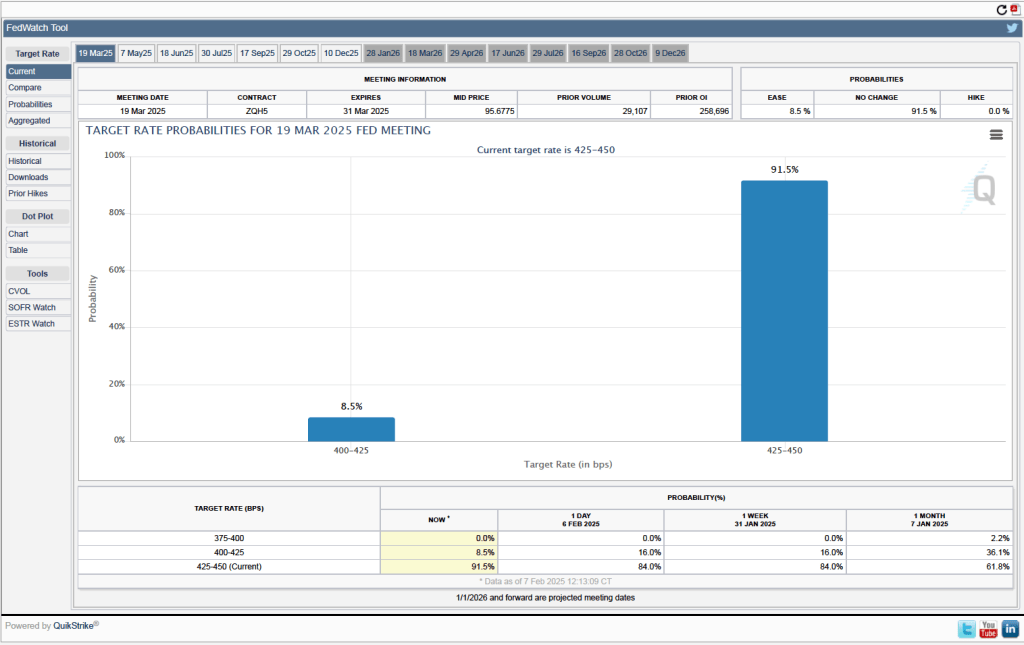

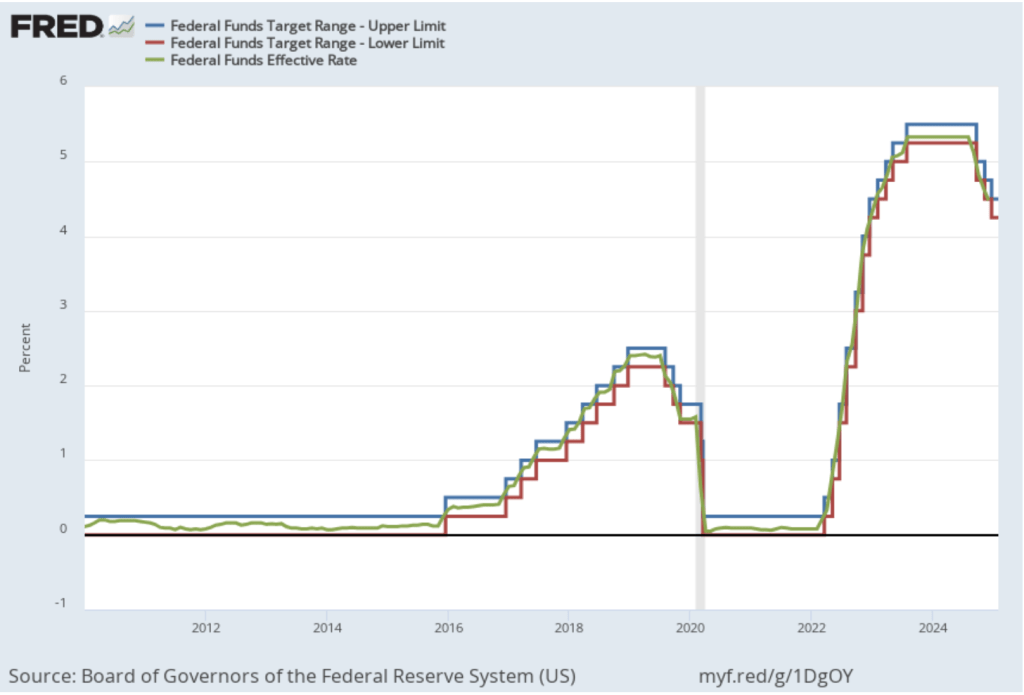

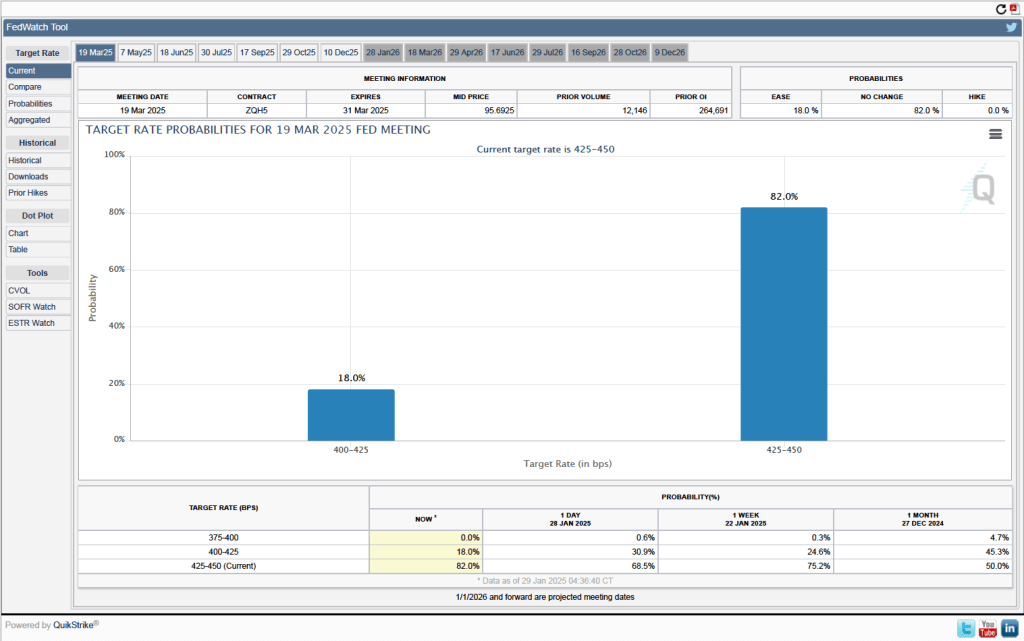

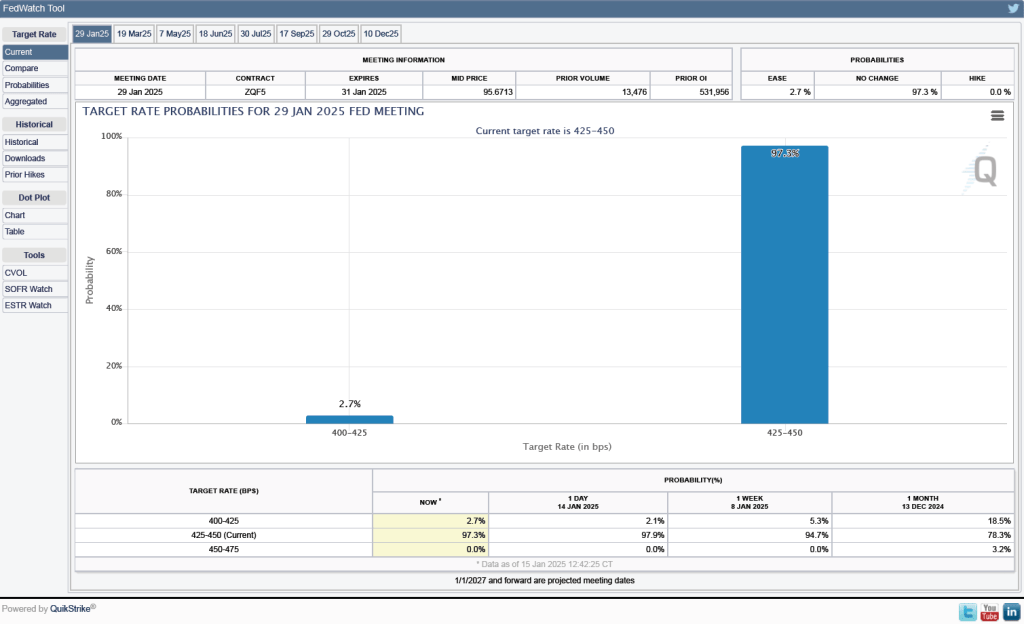

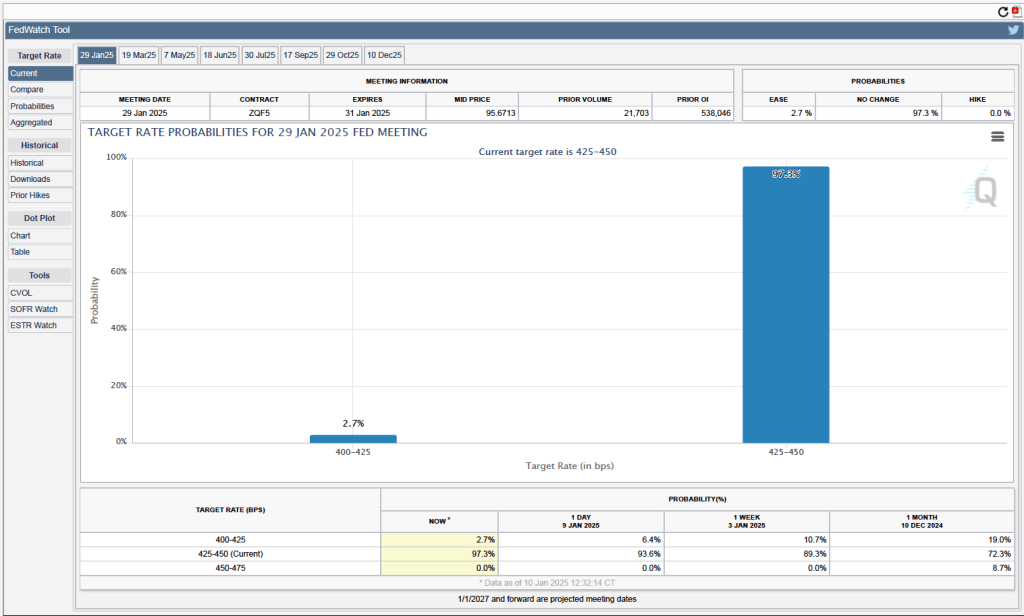

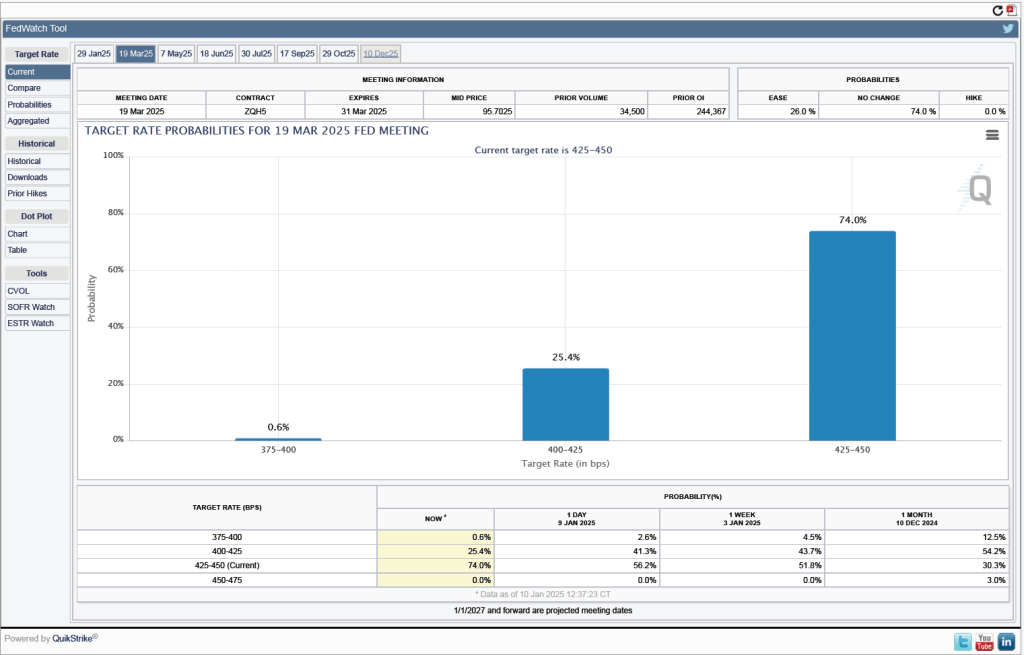

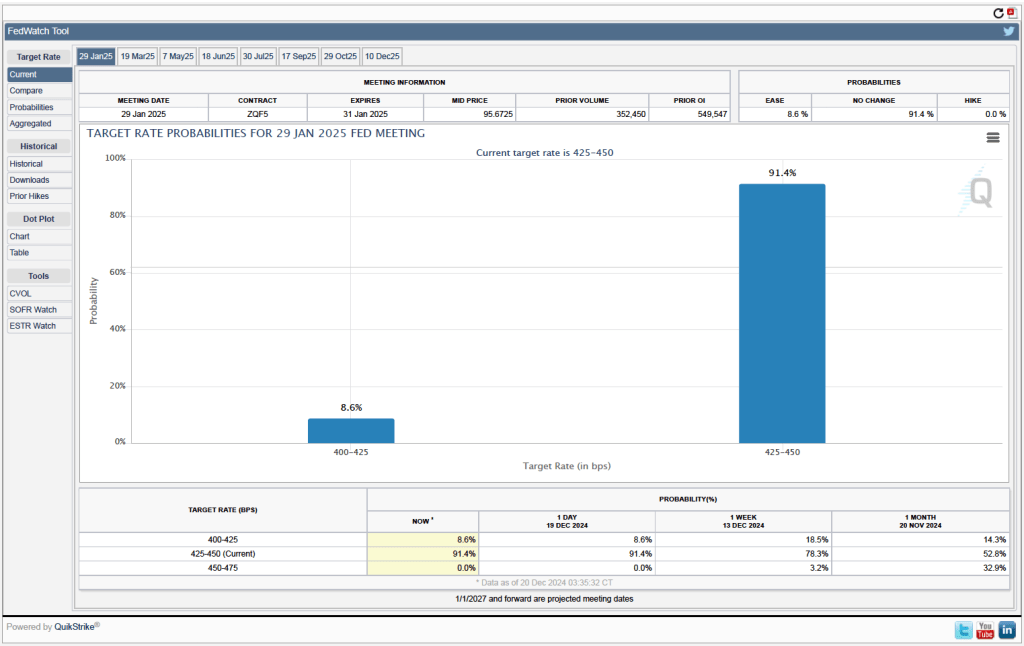

Investors who buy and sell federal funds futures contracts still do not expect that the FOMC will cut its target for the federal funds rate at its next two meetings. (We discuss the futures market for federal funds in this blog post.) Today, investors assigned only a 1 percent probability that the Fed’s policymaking Federal Open Market Committee (FOMC) will cut its target from the current 4.25 percent to 4.50 percent range at its meeting next week. Investors assigned a probability of 33.3 percent that the FOMC would cut its target after its meeting on May 6–7. Investors today assigned a probability of 78.6 percent that the committee will cut its target after its meeting on June 17–18. That probability has fallen slightly over the past week.

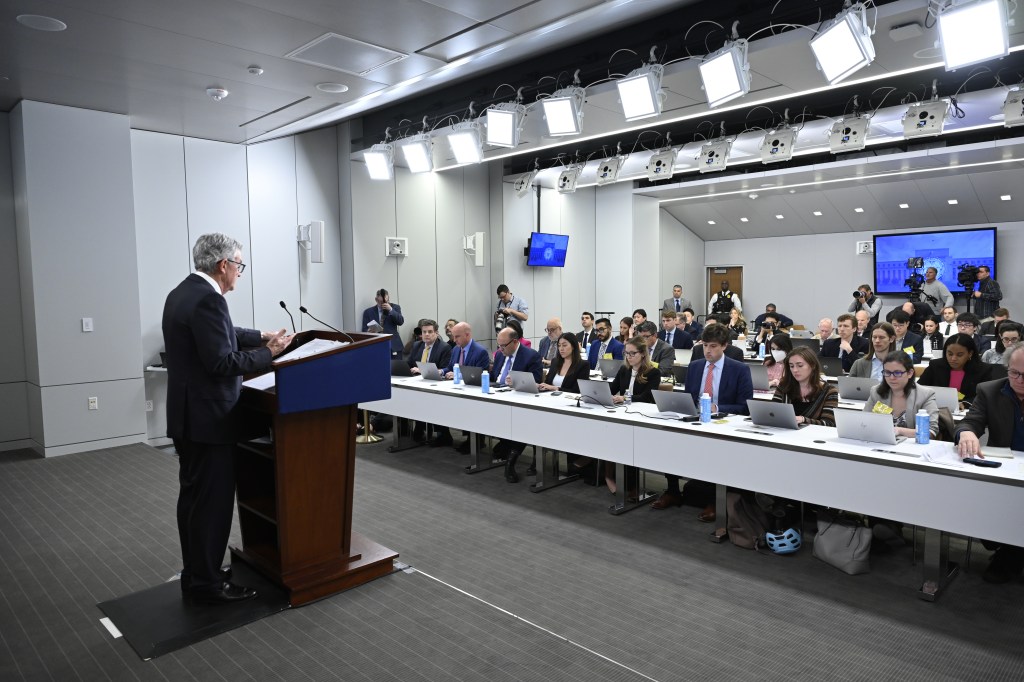

At his press conference after next Wednesday’s FOMC meeting, Fed Chair Jerome Powell will give his thoughts on the current economic situation.