Image generated by ChatGPT

As we’ve noted in recent blog posts (here and here), the shutdown of the federal government has interrupted the release of government data, including the “Employment Situation” report prepared monthly by the Bureau of Labor Statistics (BLS). The federal government made an exception for the BLS report on the consumer price index (CPI) because annual cost-of-living increases in Social Security payments are determined by the average inflation rate in the CPI during July, August, and September.

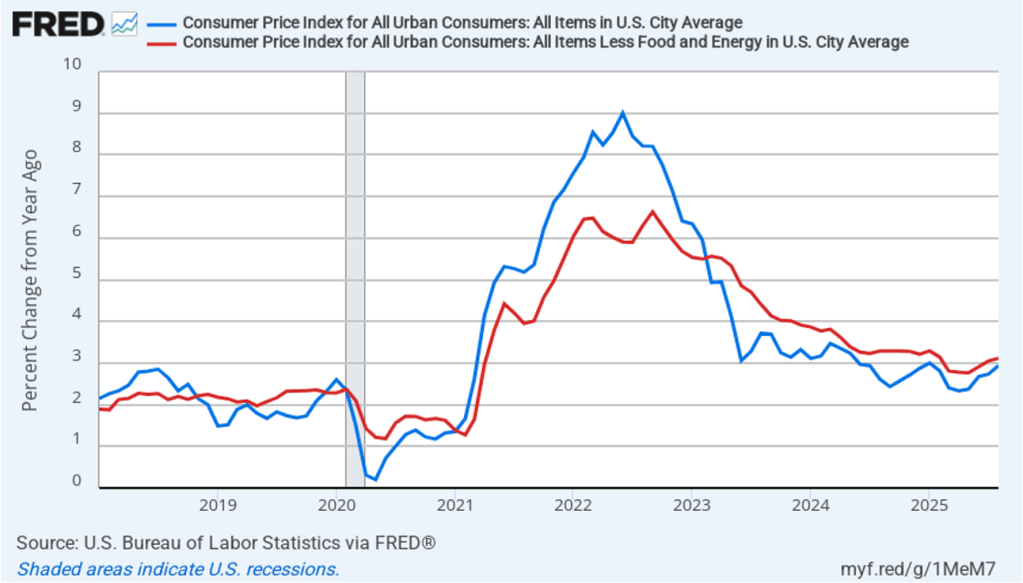

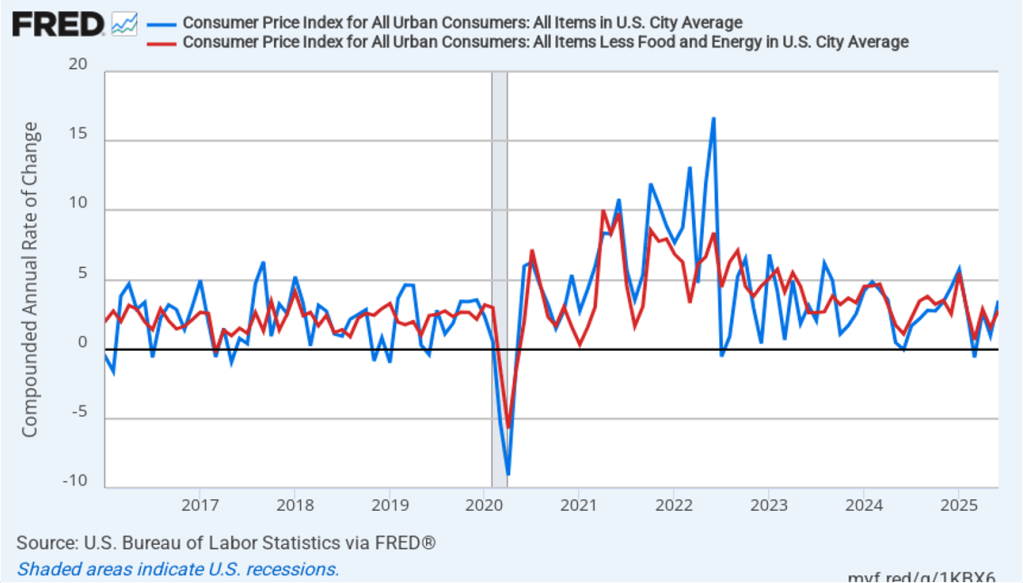

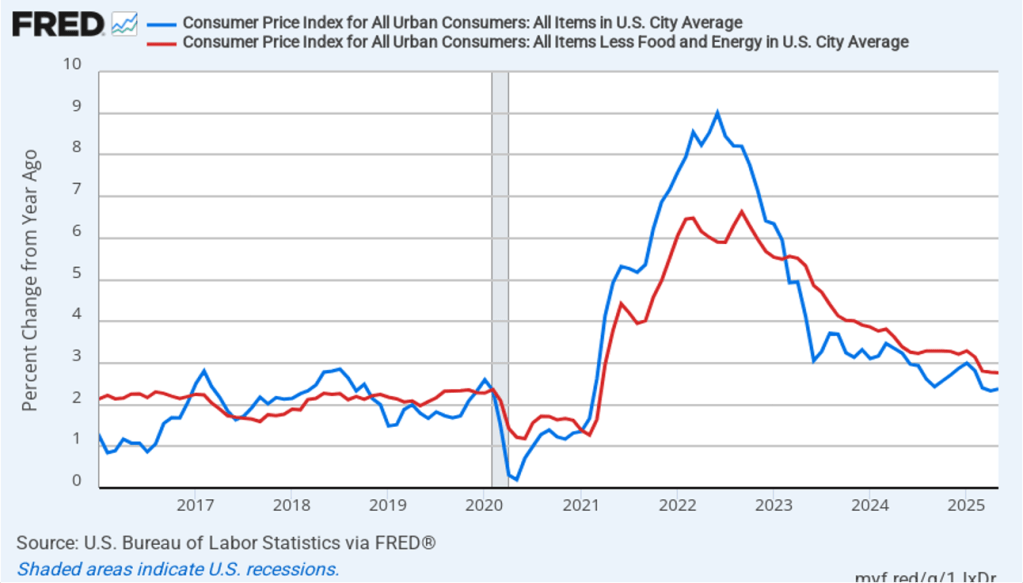

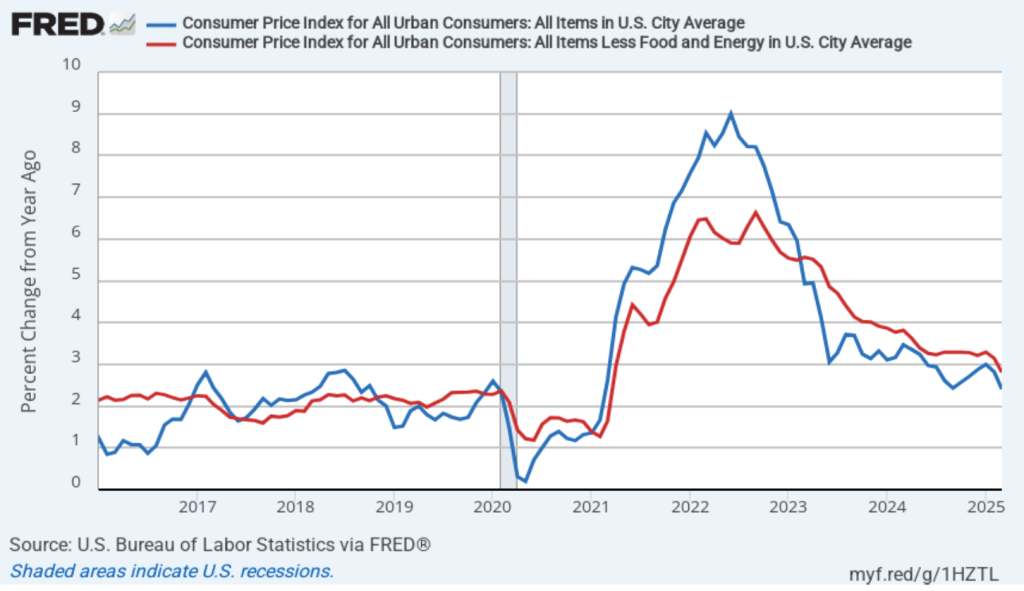

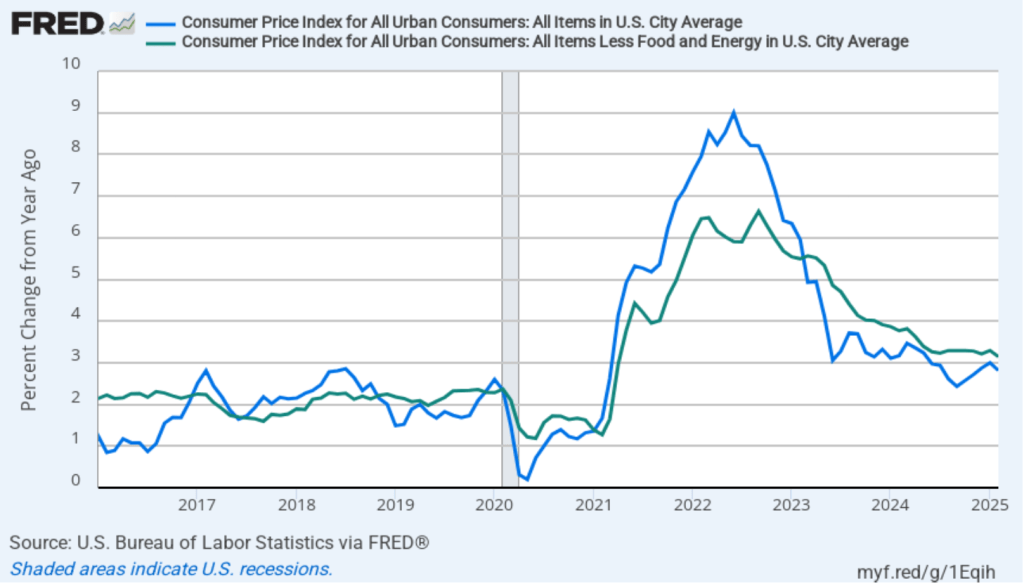

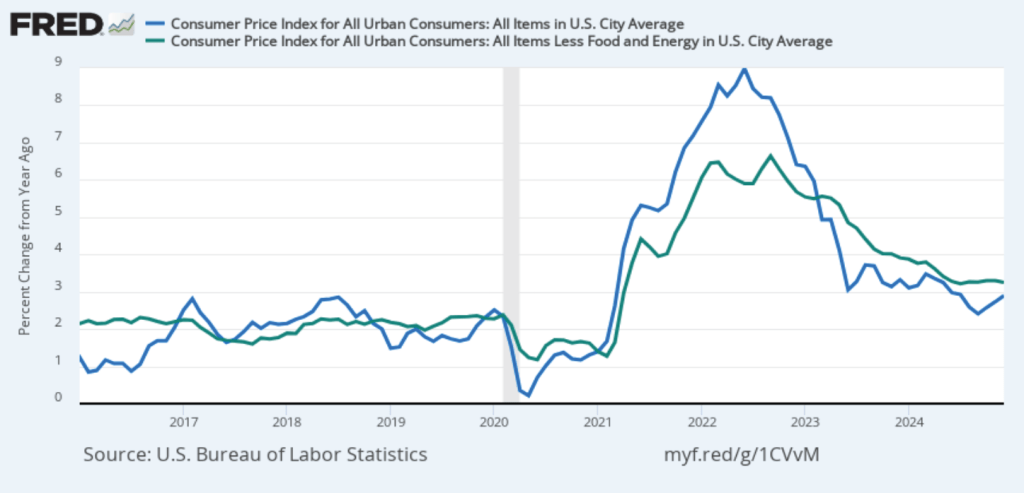

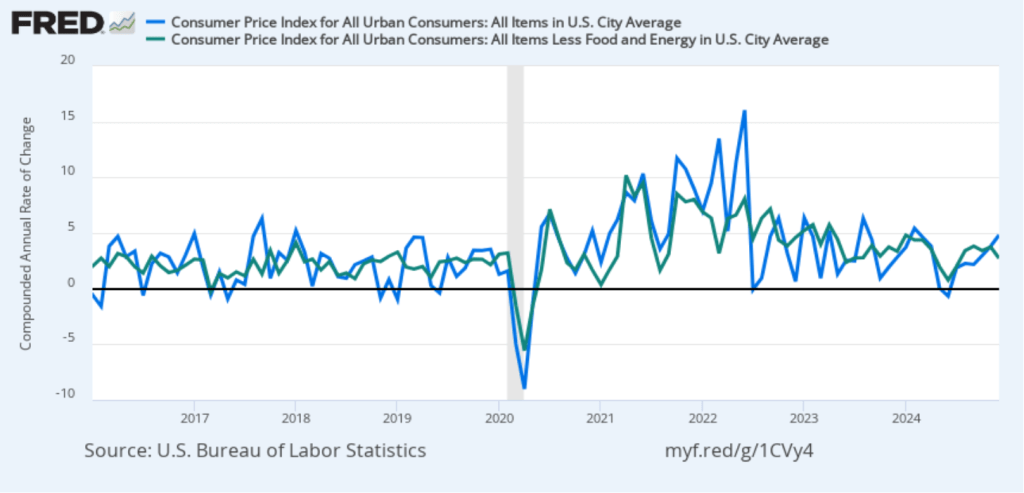

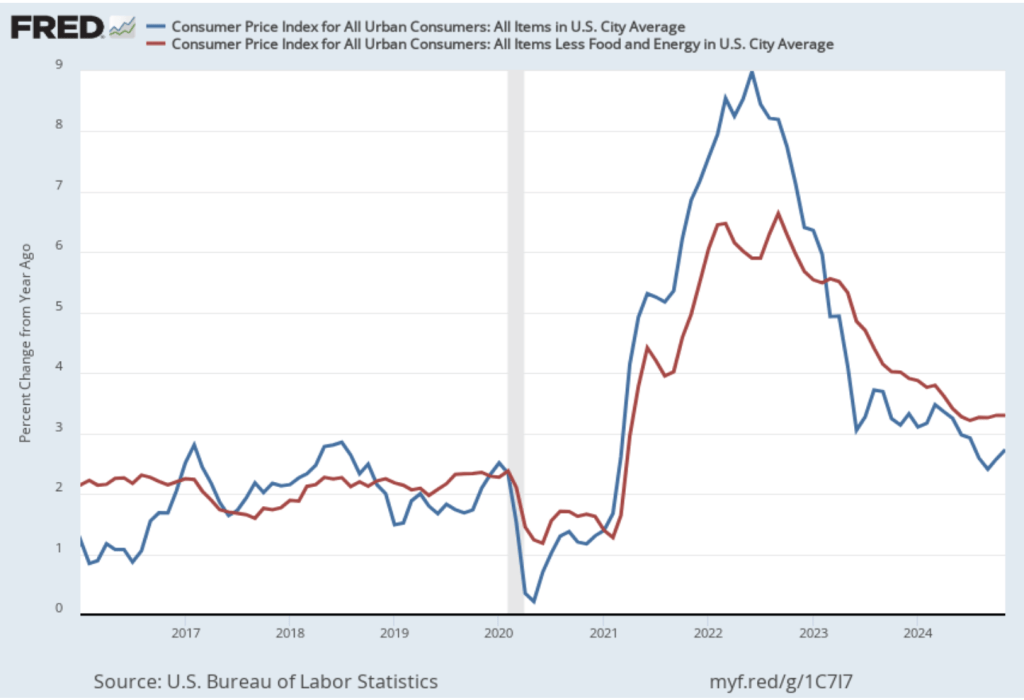

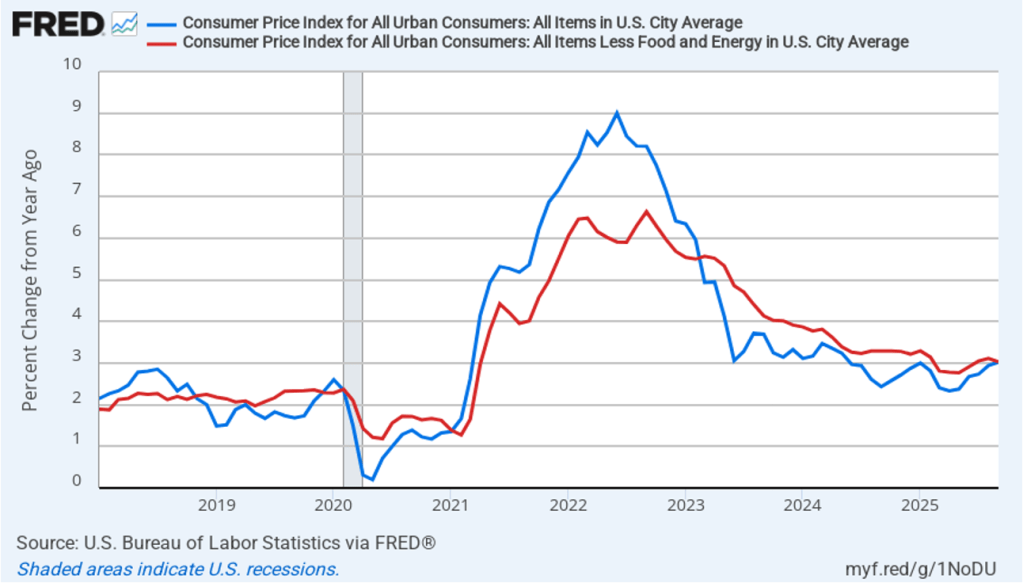

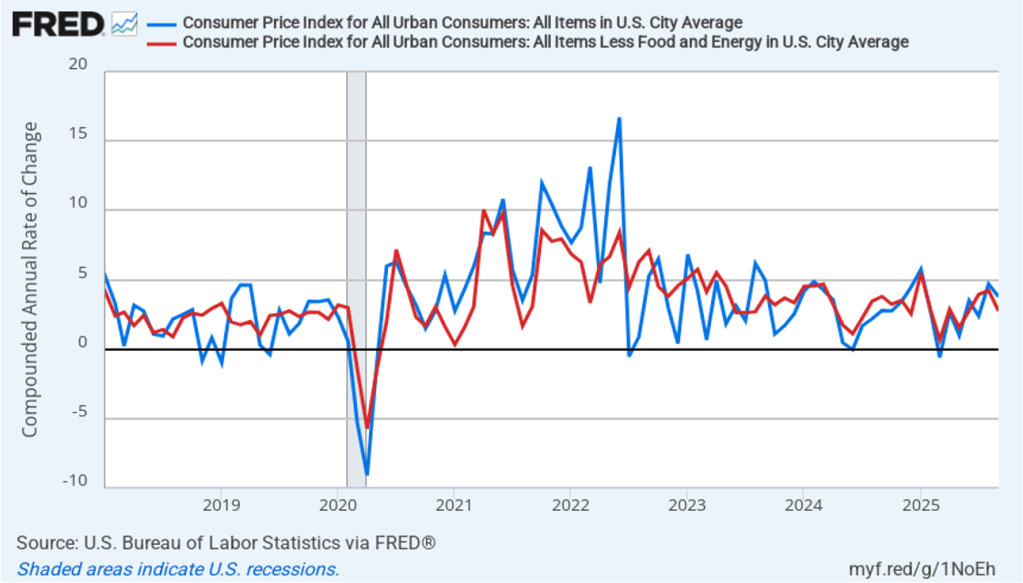

Accordingly, today (October 24), the Bureau of Labor Statistics (BLS) released its report on the consumer price index (CPI) for September. The following figure compares headline CPI inflation (the blue line) and core CPI inflation (the red line).

- The headline inflation rate, which is measured by the percentage change in the CPI from the same month in the previous year, was 3.0 percent in September, up from 2.9 percent in August.

- The core inflation rate, which excludes the prices of food and energy, was also 3.0 percent in September, down slightly from 3.1 percent in August.

Headline inflation and core inflation were both slightly lower than the 3.1 rate for both measures that economists had expected.

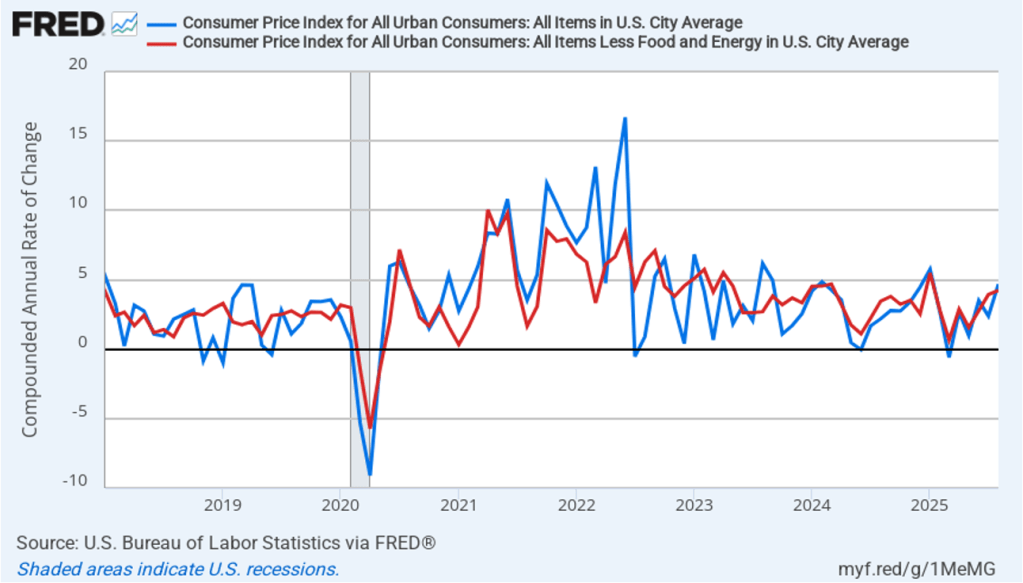

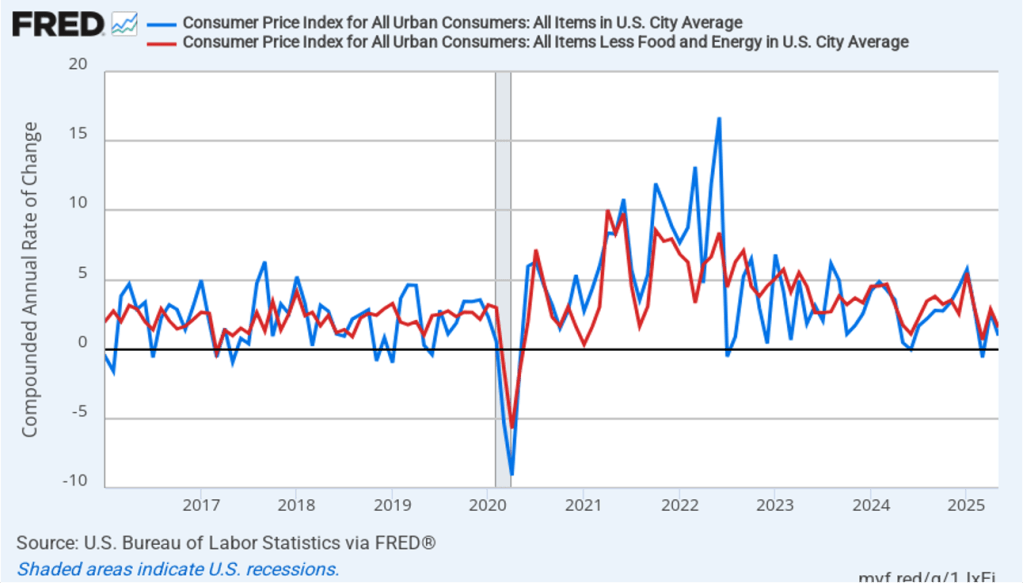

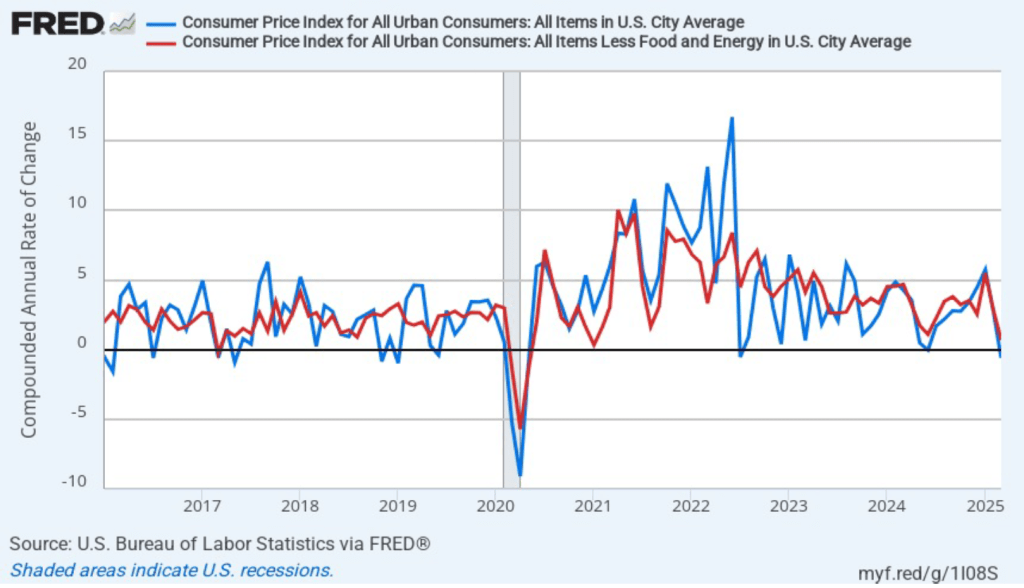

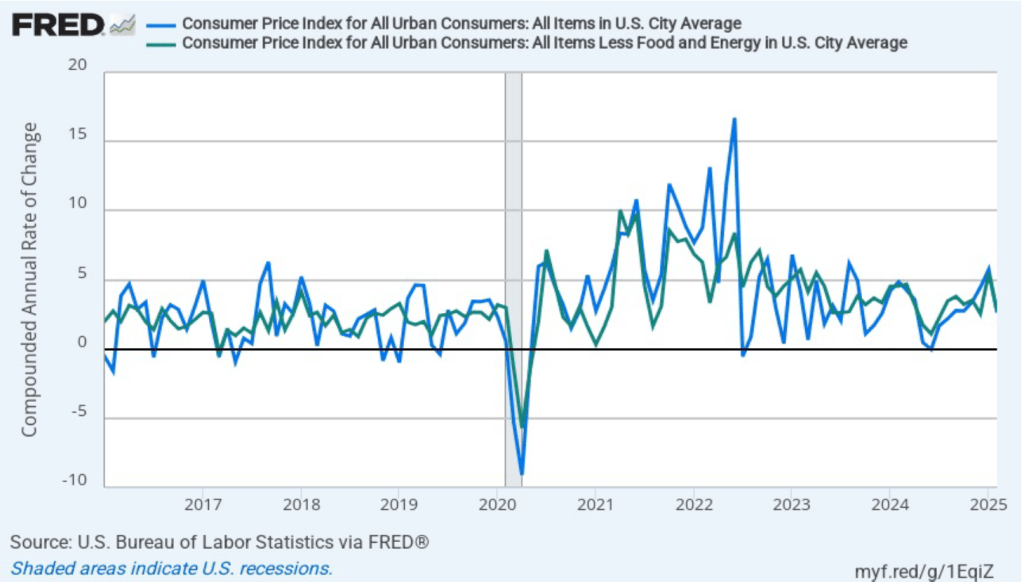

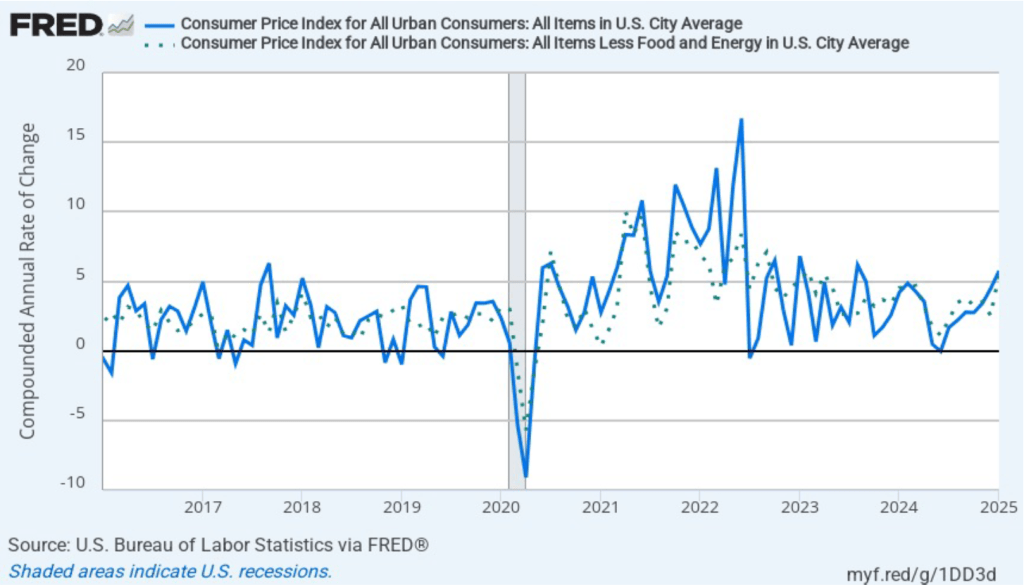

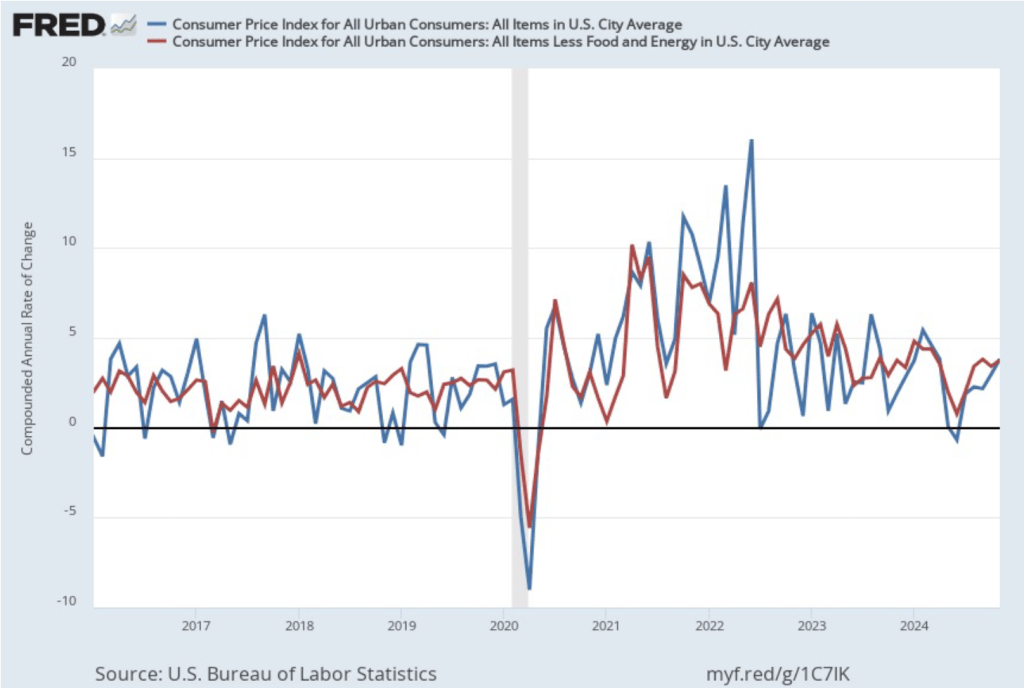

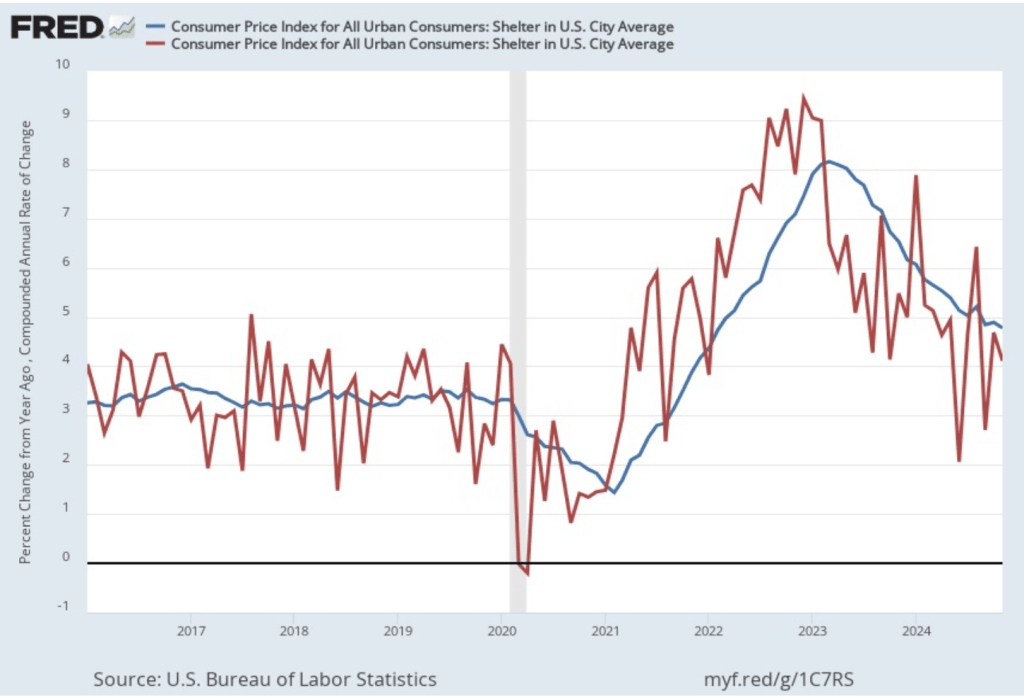

In the following figure, we look at the 1-month inflation rates for headline and core inflation—that is the annual inflation rate calculated by compounding the current month’s rate over an entire year. Calculated as the 1-month inflation rate, headline inflation (the blue line) declined from the very high rate of 4.7 percent in August to the still high rate of 3.8 percent in September. Core inflation (the red line) declined from 4.2 percent in August to 2.8 percent in September.

The 1-month and 12-month inflation rates are both indicating that inflation remains well above the Fed’s 2 percent annual inflation target in September. Core inflation—which is often a good indicator of future inflation—in particular has been running well above target during the last three months.

Of course, it’s important not to overinterpret the data from a single month. The figure shows that the 1-month inflation rate is particularly volatile. Also note that the Fed uses the personal consumption expenditures (PCE) price index, rather than the CPI, to evaluate whether it is hitting its 2 percent annual inflation target.

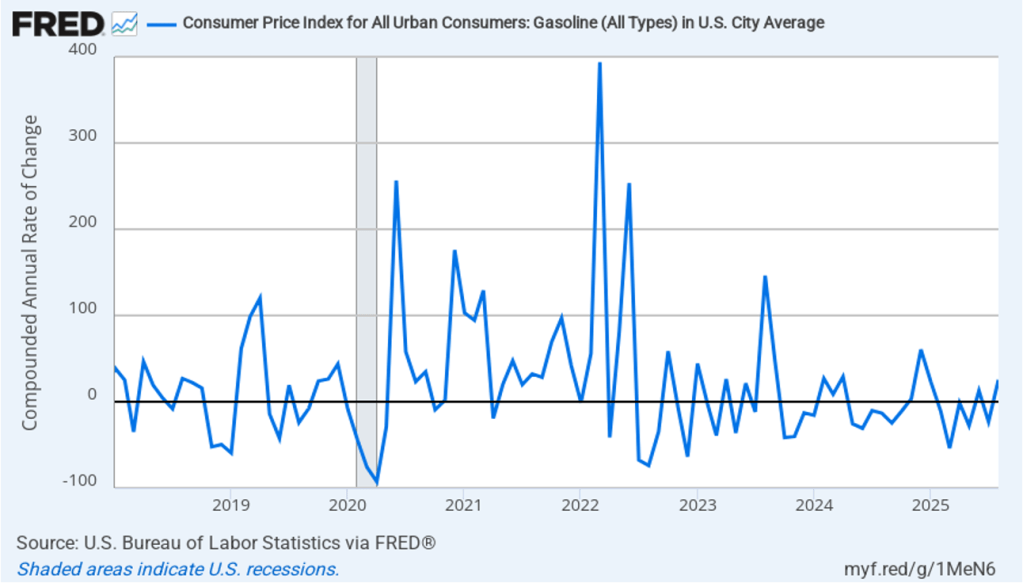

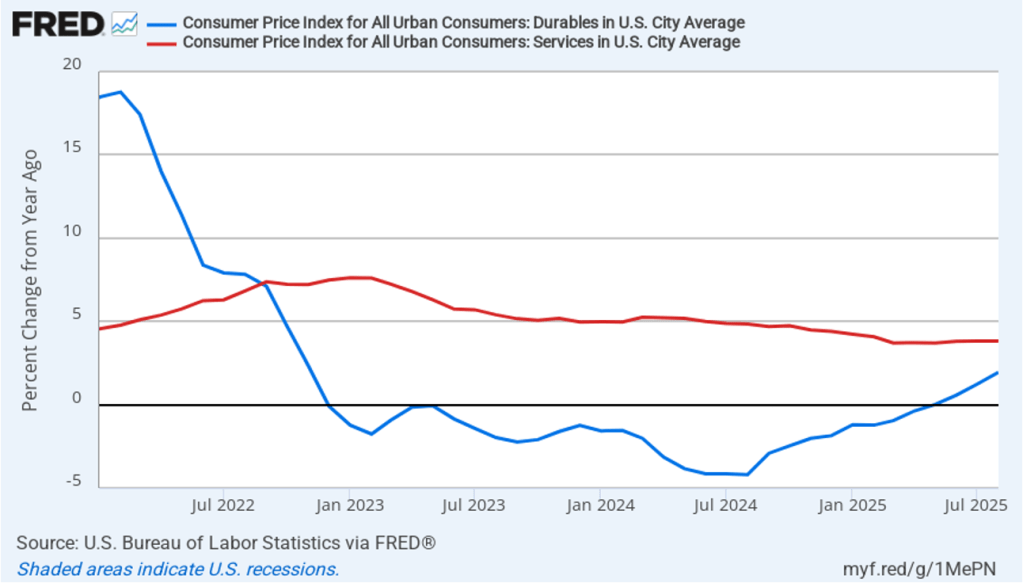

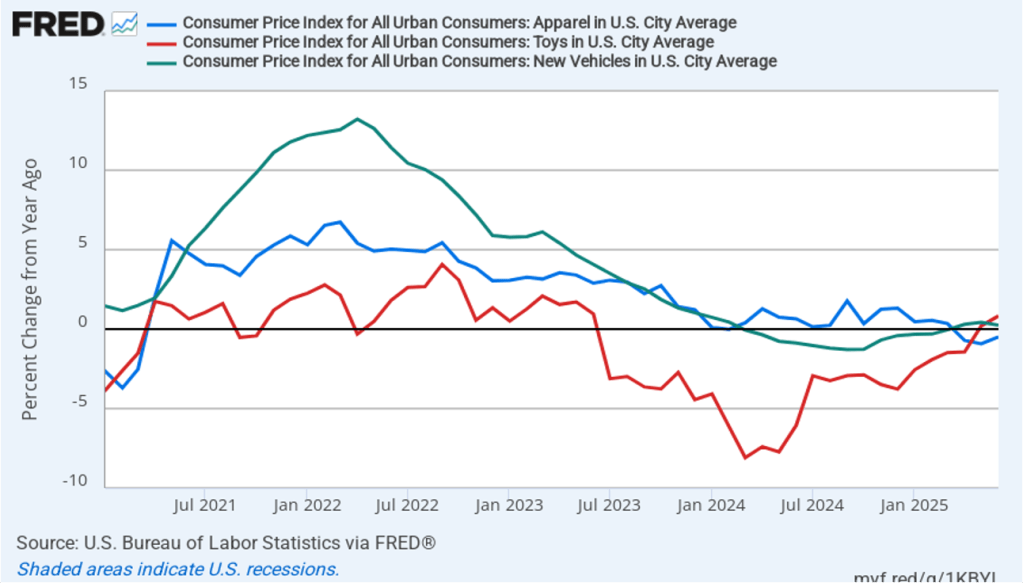

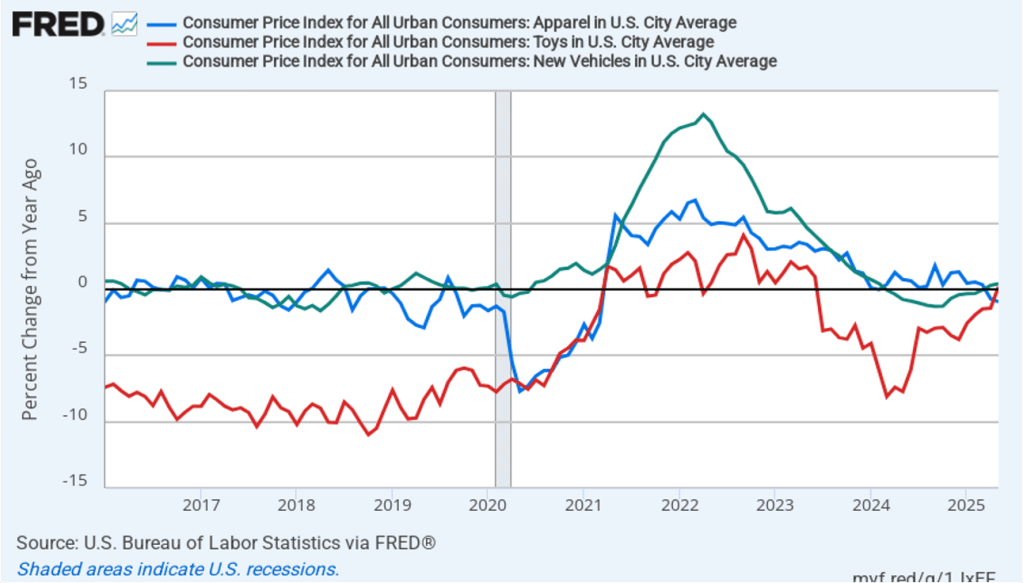

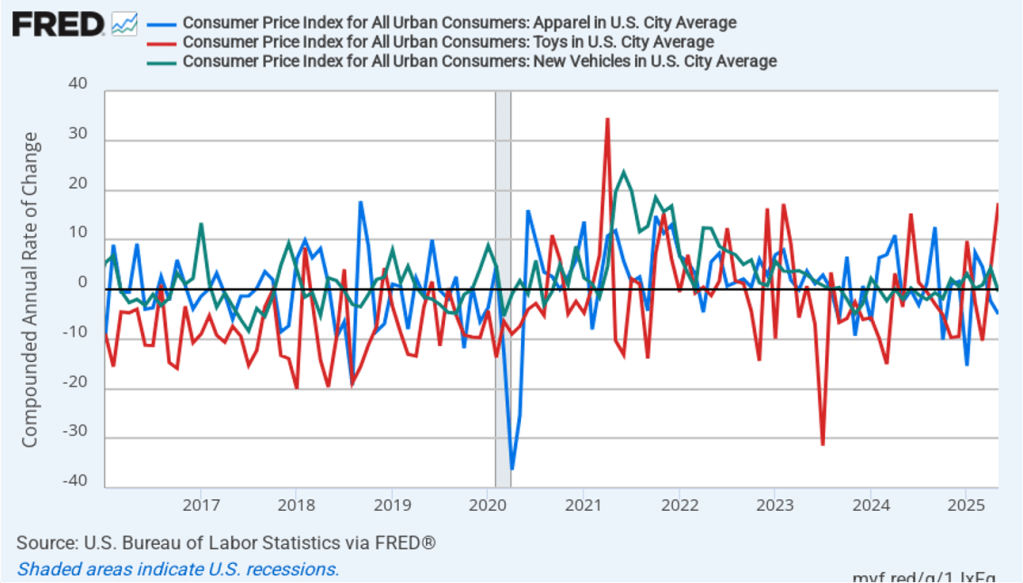

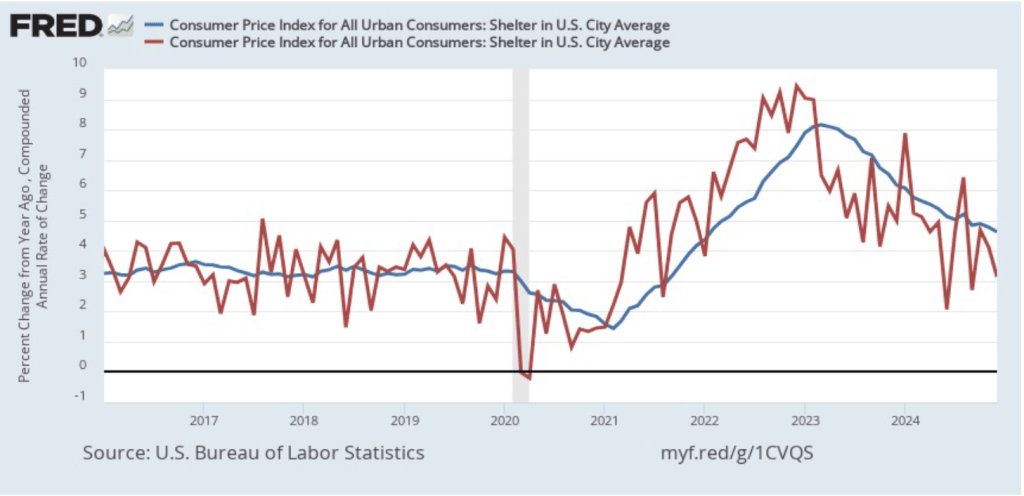

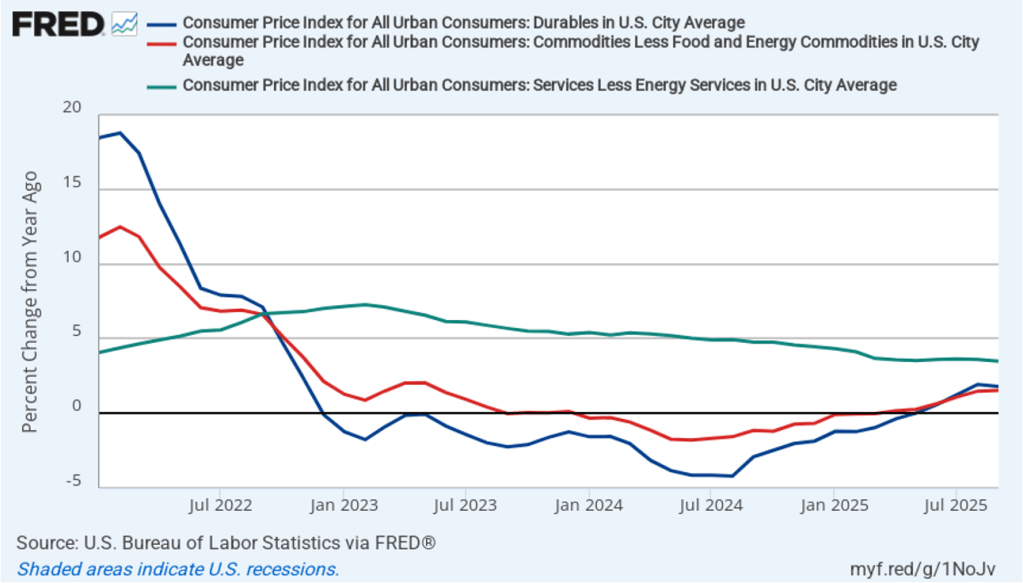

Does the increase in inflation represent the effects of the increases in tariffs that the Trump administration announced on April 2? (Note that many of the tariff increases announced on April 2 have since been reduced.) The following figure shows 12-month inflation in durable goods—such as furniture, appliances, and cars—which are likely to be affected directly by tariffs, all core goods, and core services. Services are less likely to be affected by tariffs.. To make recent changes clearer, we look only at the months since January 2022. In August, inflation in durable goods declined slightly to 1.8 percent in September from 1.9 percent in August. Inflation in core goods was unchanged in September at 1.5 percent. Inflation in core services fell slightly in September to 3.5 percent from 3.6 percent in August.

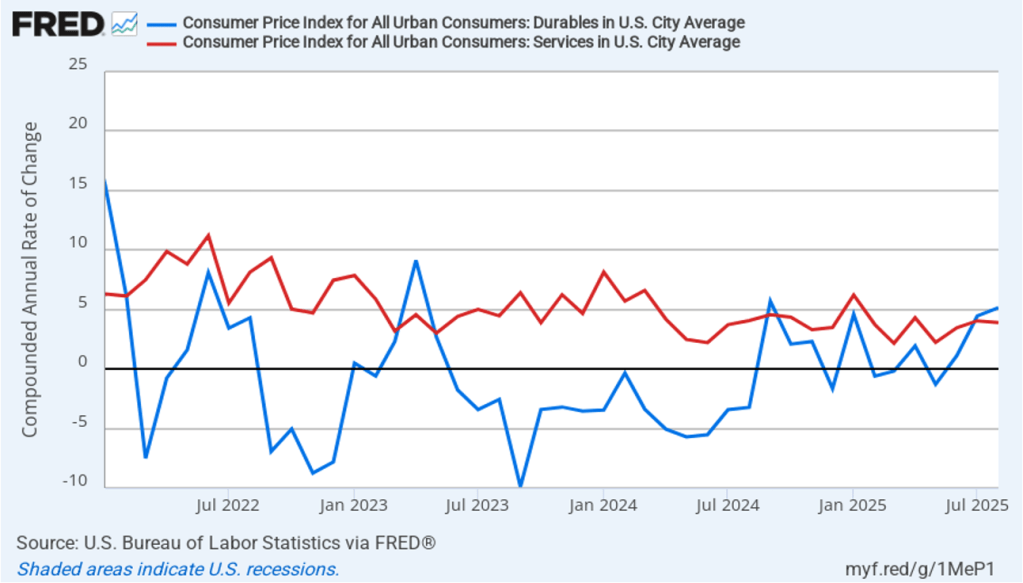

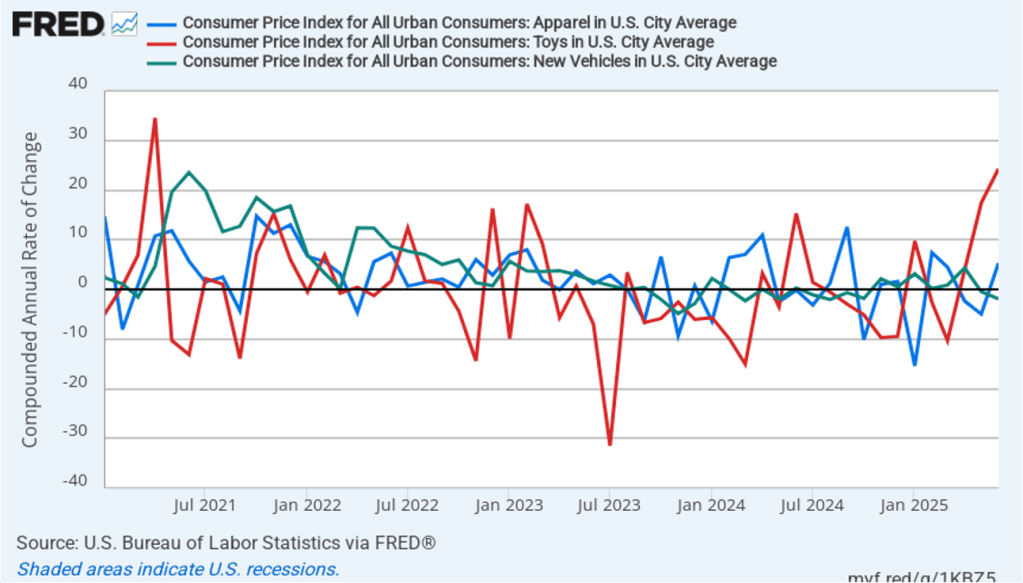

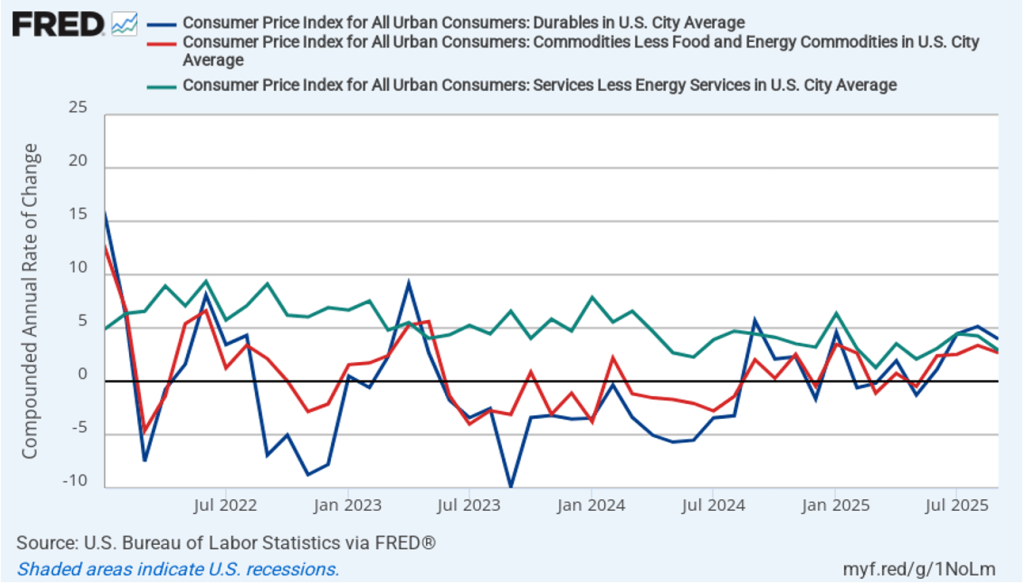

The following figure shows 1-month inflation in the prices of these products, which may makes clearer the effects of the tariff increases. In September, durable goods inflation was a high 4.0 percent, although down from 5.1 percent in August. Core goods inflation in September was 2.7 percent, down from 3.4 percent in August. Core service inflation was 2.9 percent in August, down from 4.3 percent in August.

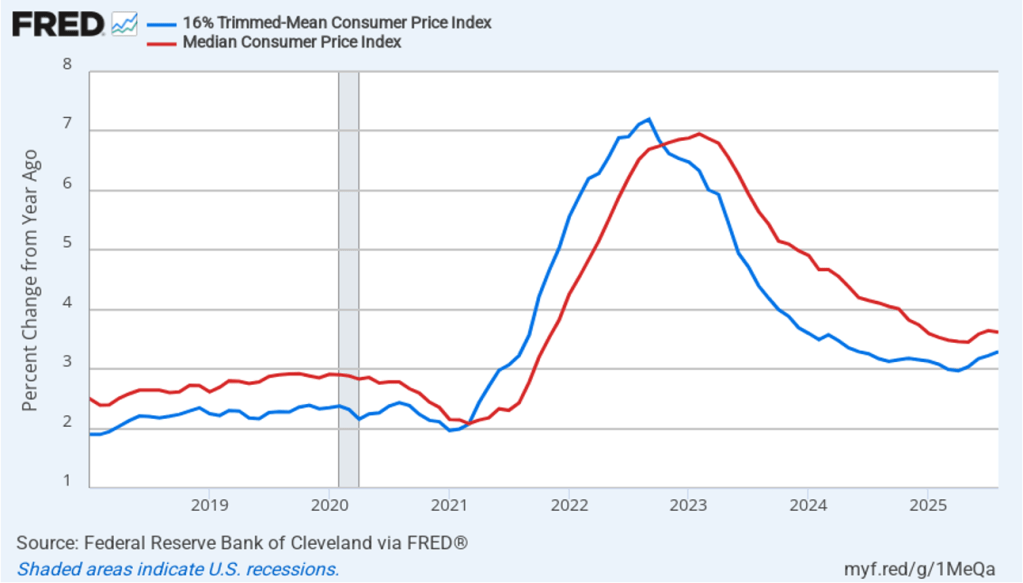

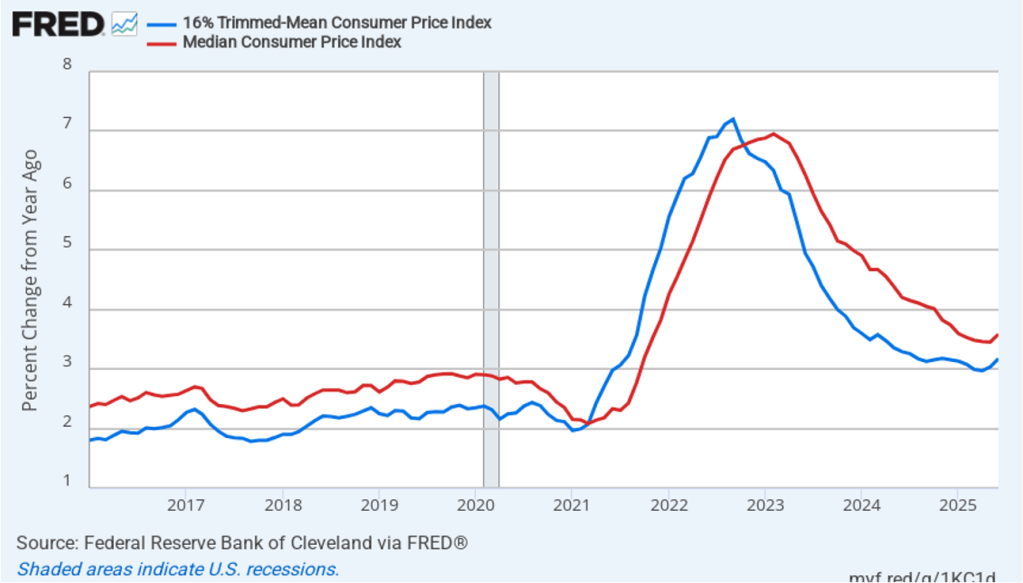

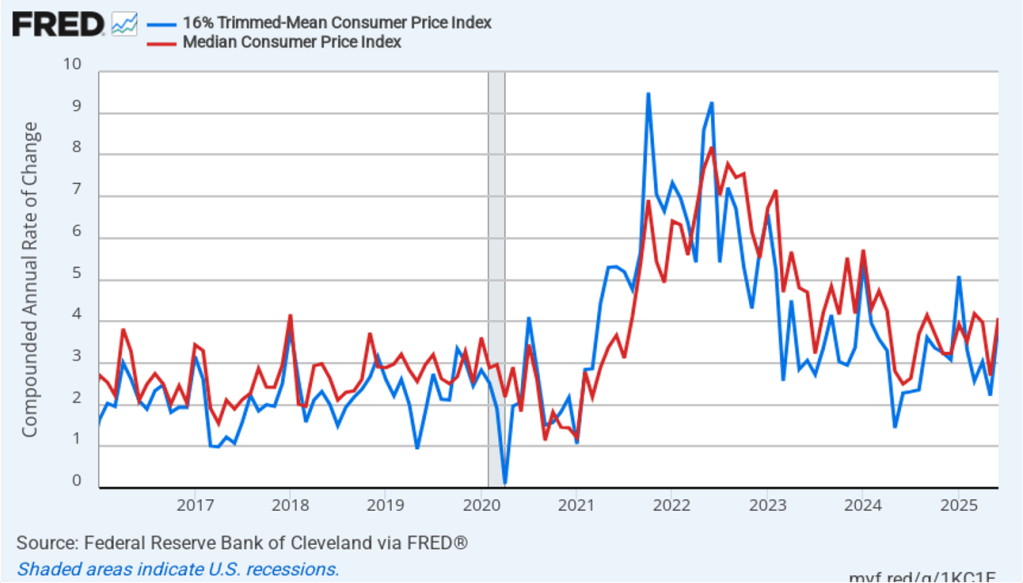

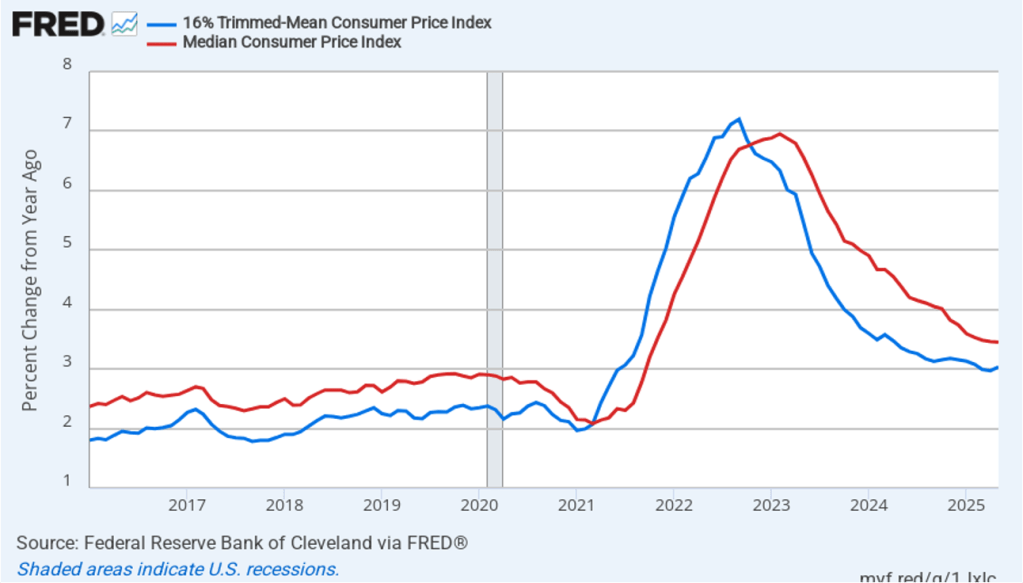

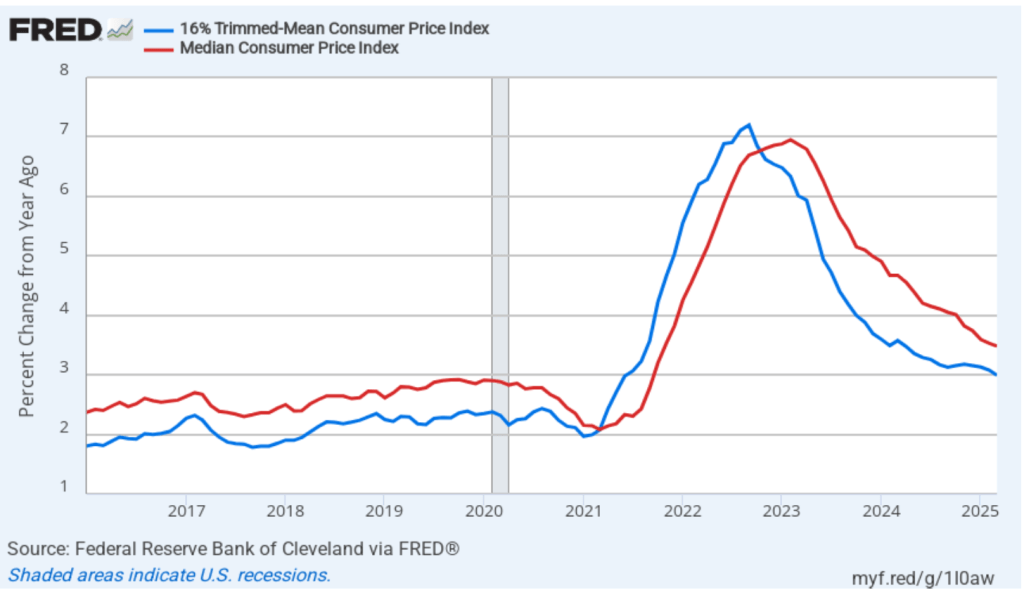

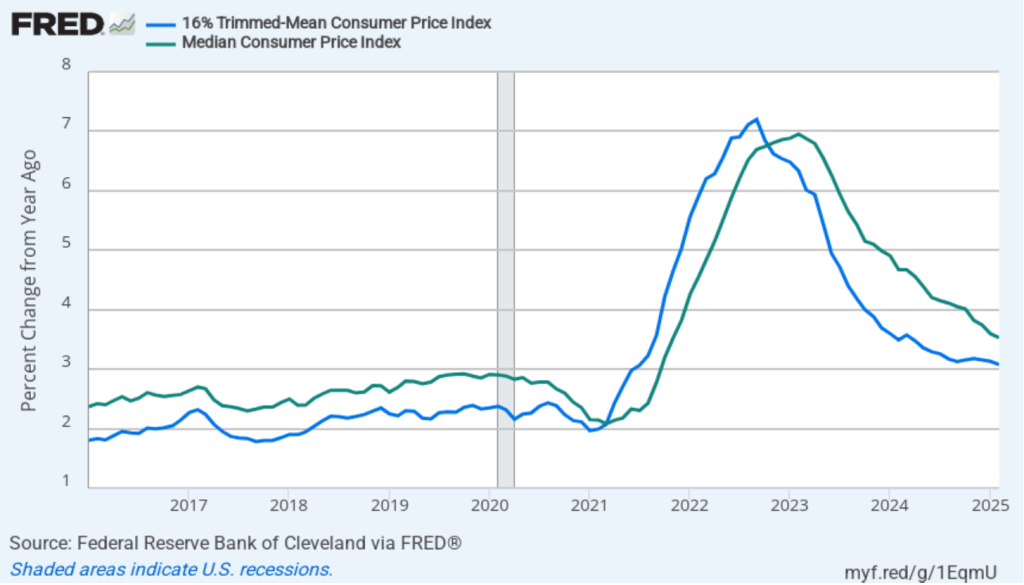

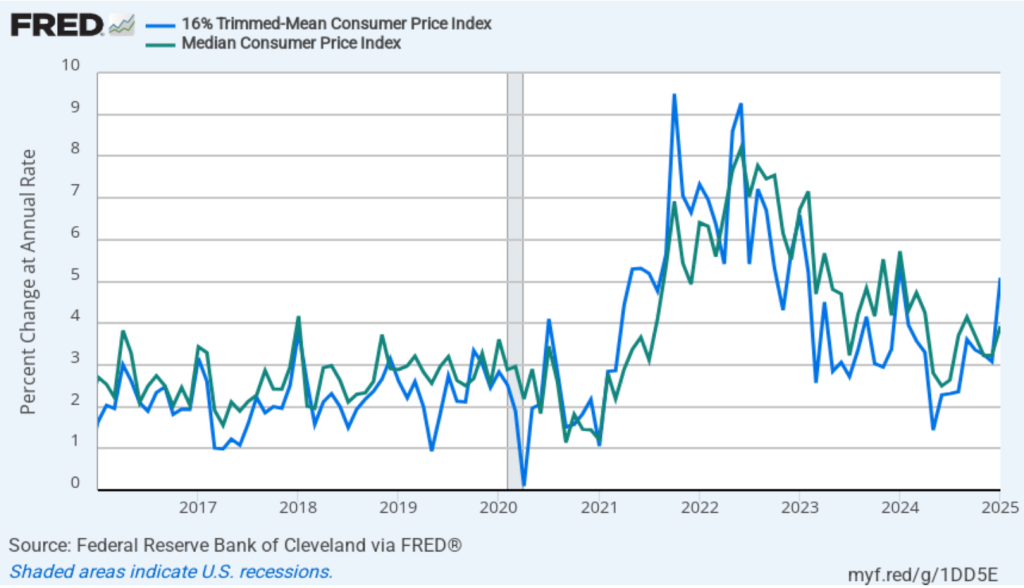

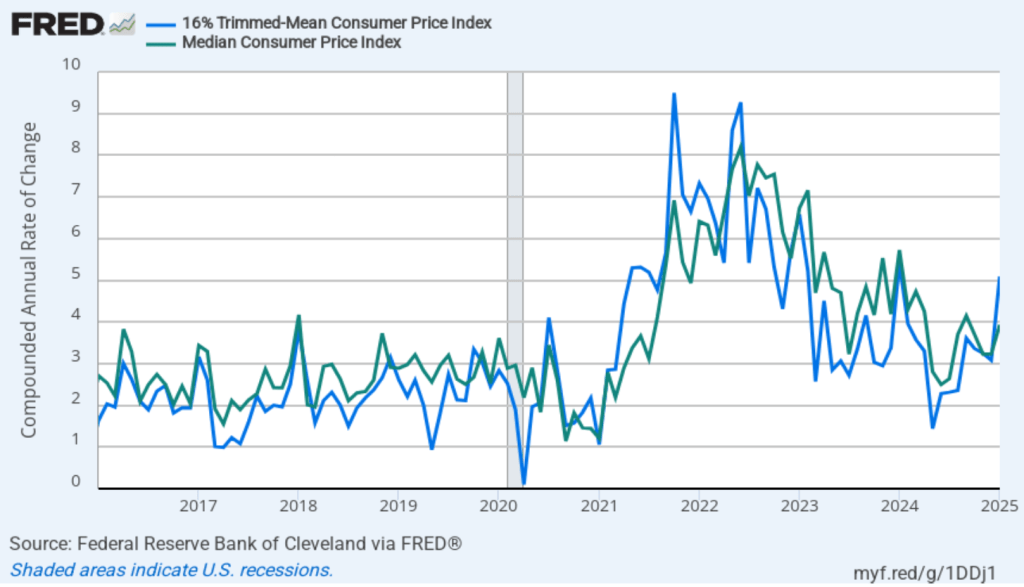

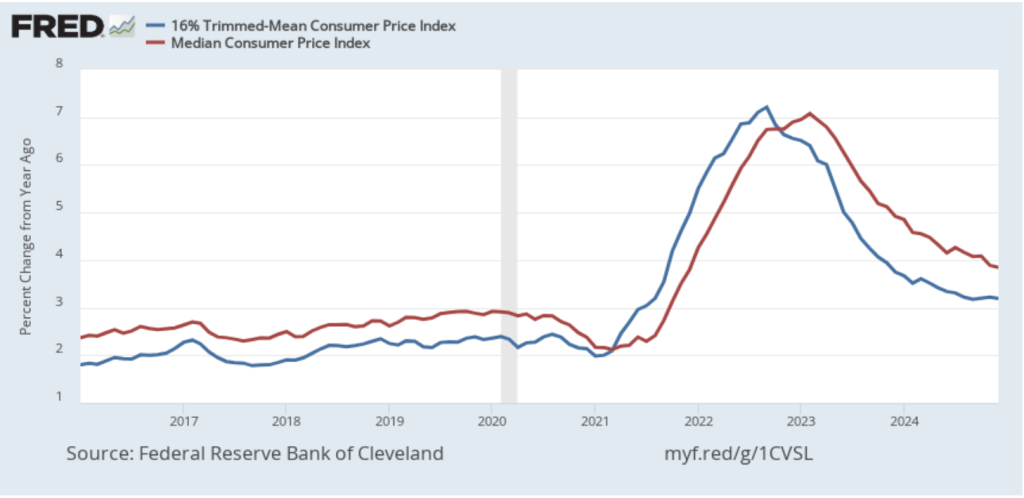

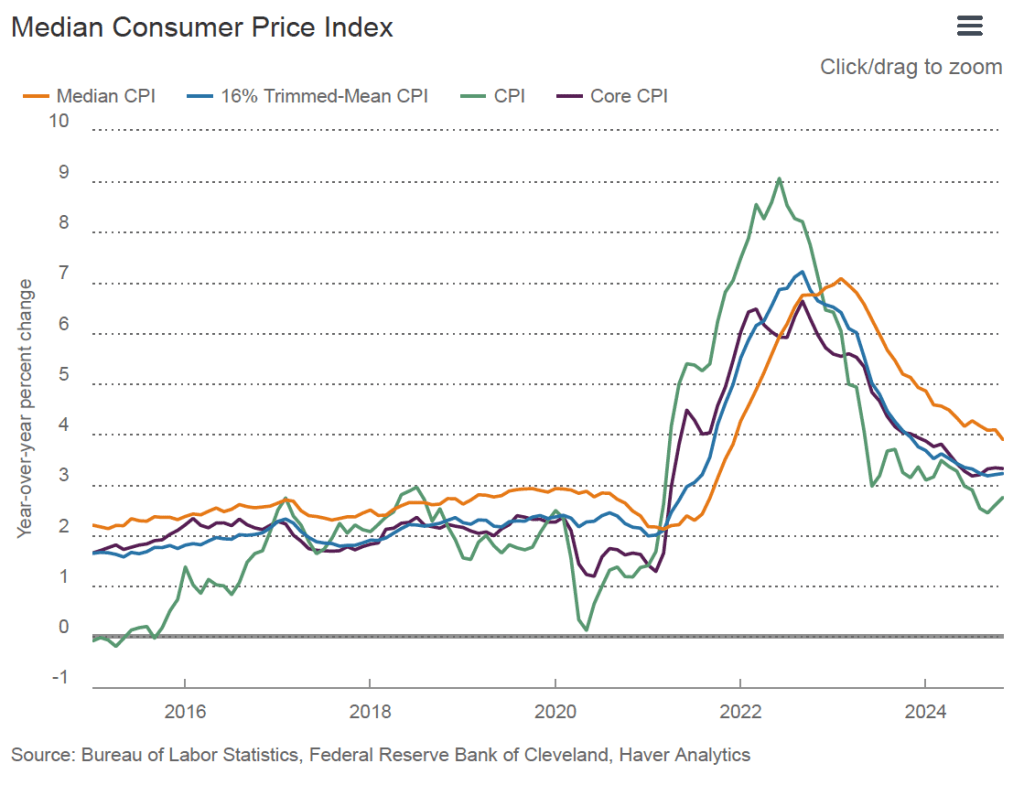

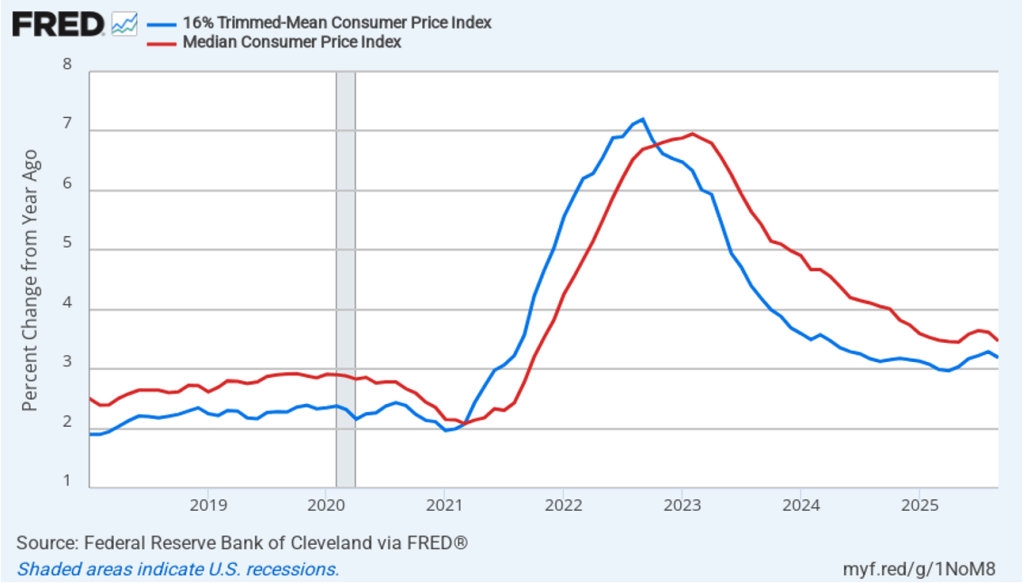

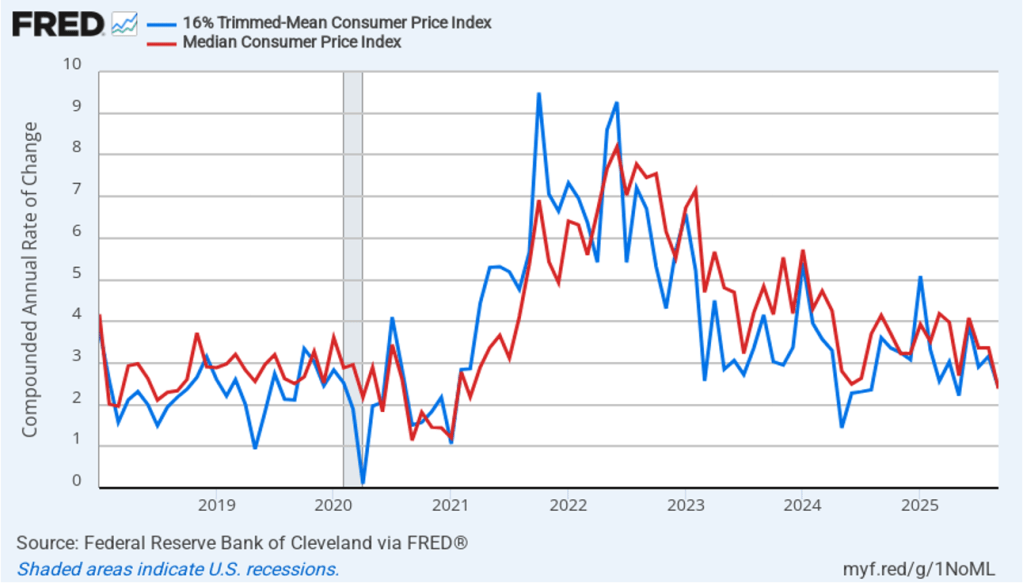

To better estimate the underlying trend in inflation, some economists look at median inflation and trimmed mean inflation.

- Median inflation is calculated by economists at the Federal Reserve Bank of Cleveland and Ohio State University. If we listed the inflation rate in each individual good or service in the CPI, median inflation is the inflation rate of the good or service that is in the middle of the list—that is, the inflation rate in the price of the good or service that has an equal number of higher and lower inflation rates.

- Trimmed-mean inflation drops the 8 percent of goods and services with the highest inflation rates and the 8 percent of goods and services with the lowest inflation rates.

The following figure shows that 12-month trimmed-mean inflation (the blue line) was 3.2 percent in September, down slightly from 3.3 August. Twelve-month median inflation (the red line) 3.5 percent in September, down slightly from 3.6 in August.

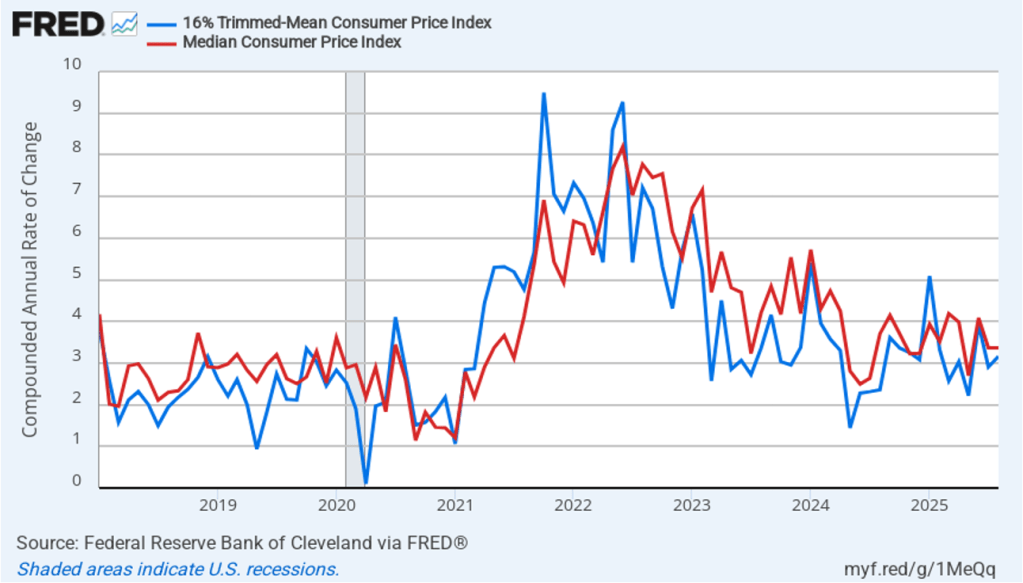

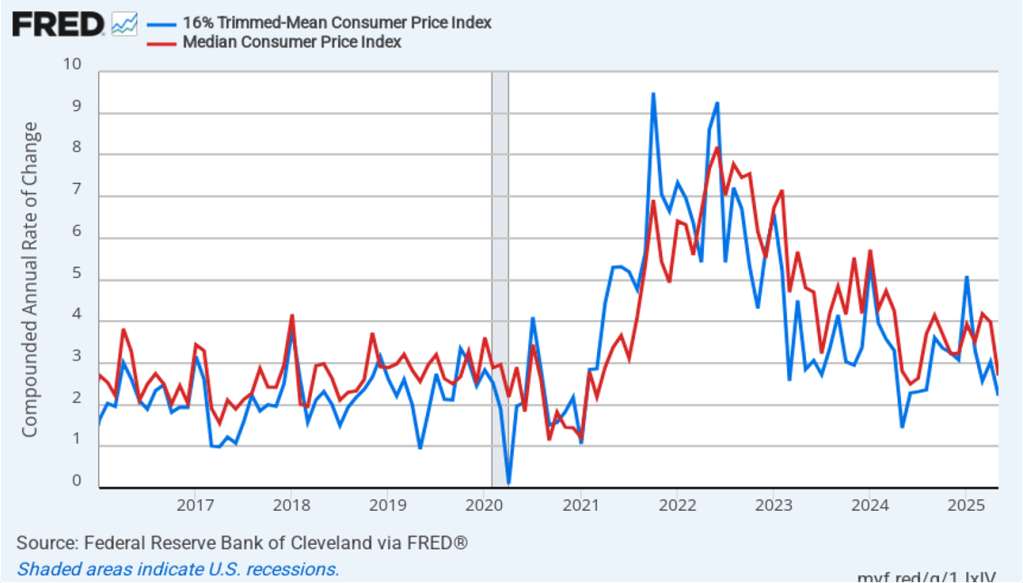

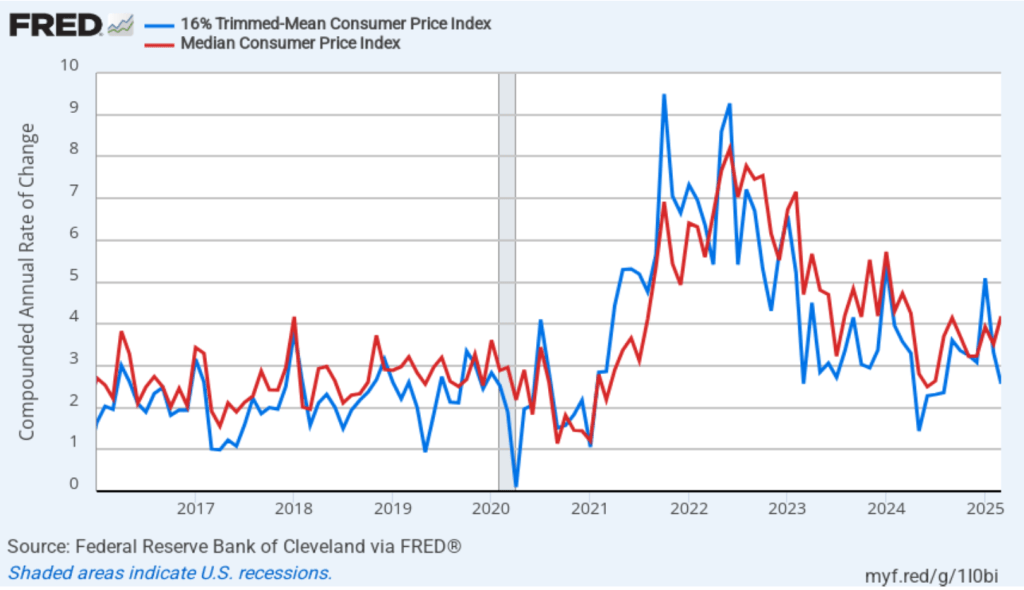

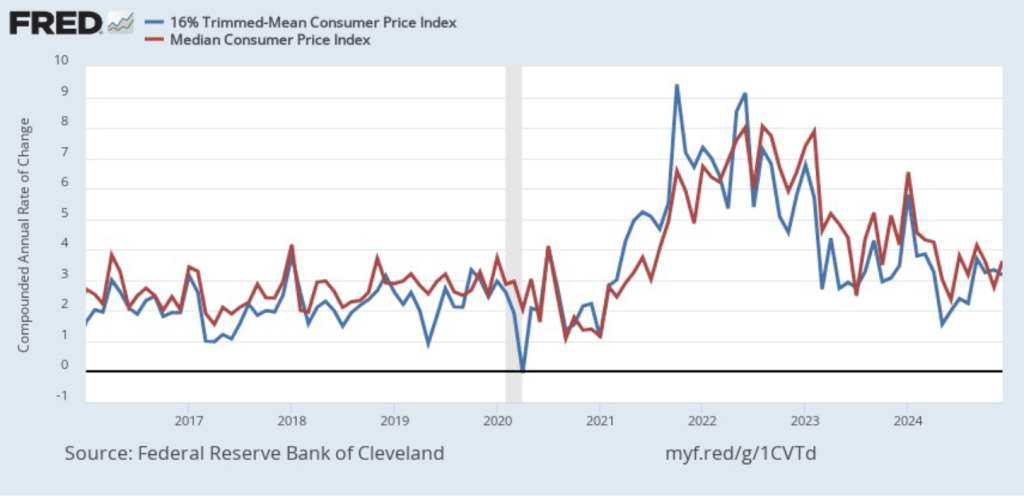

The following figure shows 1-month trimmed-mean and median inflation. One-month trimmed-mean inflation declined from 3.2 percent in August to 2.4 percent in September. One-month median inflation declined from 3.4 percent in August to 2.4 percent in September. These data are consistent with the view that inflation is still running above the Fed’s 2 percent target.

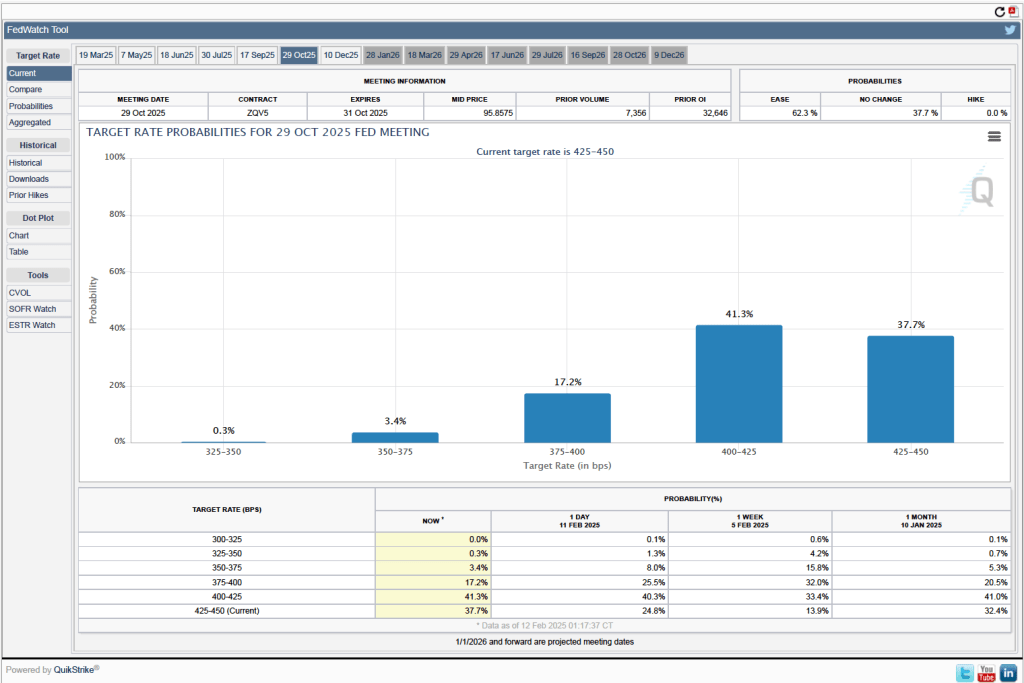

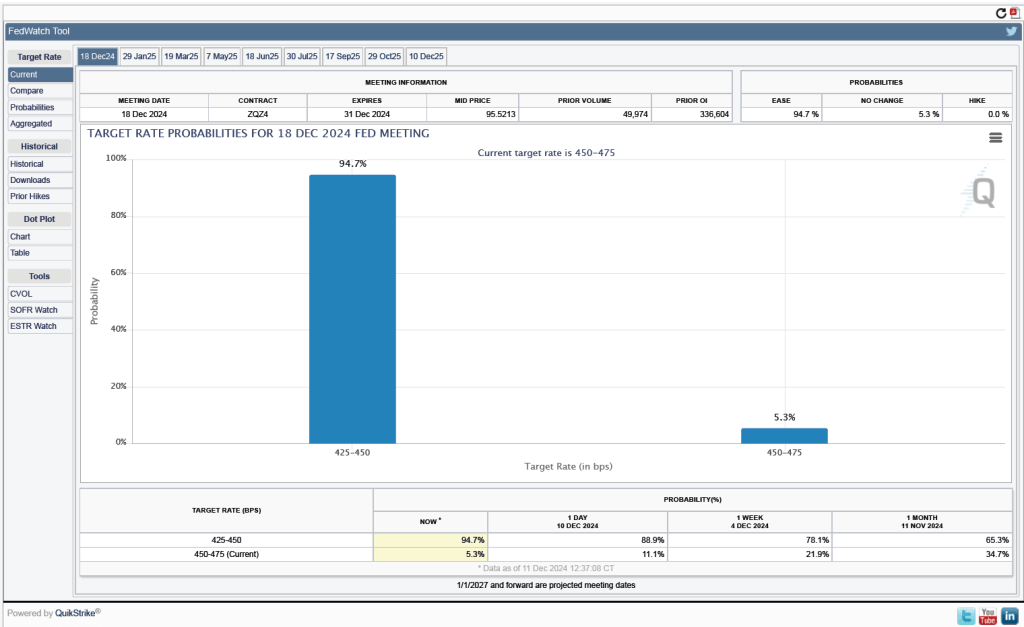

With inflation running above the Fed’s 2 percent annual target, we wouldn’t typically expect that the Fed’s policymaking Federal Open Market Committee (FOMC) would cut its target for the federal funds rate at its October 28–29 meeting. At this point, though, it seems likely that the FOMC will “look through” the higher inflation rates of the last few months because the higher rates may be largely attributable to one-time price increases caused by tariffs. Committee members have signaled that they are likely to cut their target for the federal funds rate by 0.25 percentage point (25 basis points) at the conclusion of next week’s meeting.

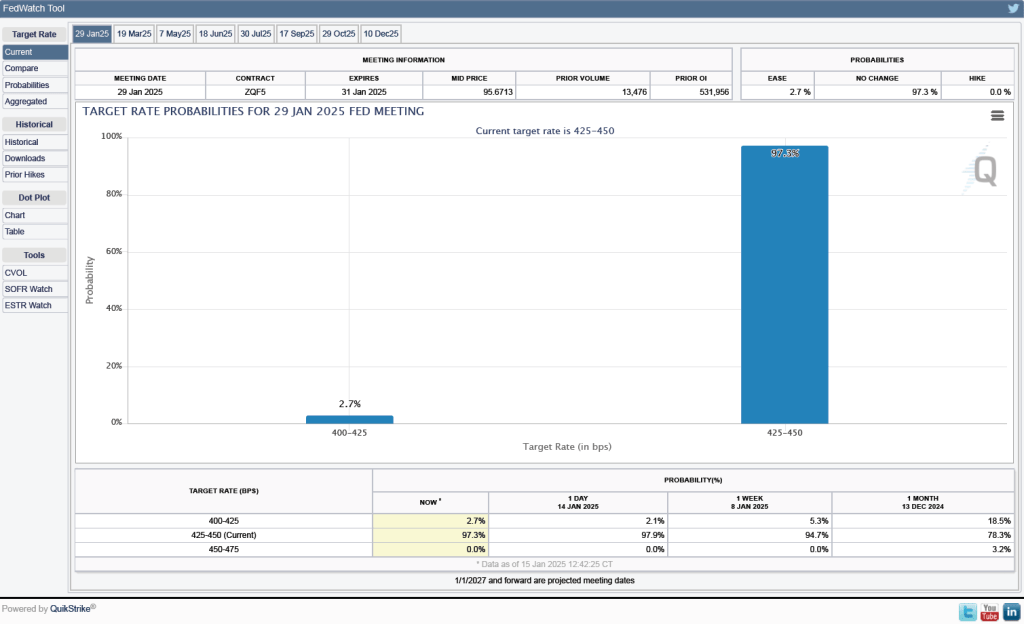

This morning, investors who buy and sell federal funds futures contracts assign a probability of 96.7 percent to the FOMC cutting its target for the federal funds rate at that meeting by 25 basis points from its current target range of 4.00 percent to 4.25 percent. Investors assign a 95.9 percent probability of the committee cutting its target by an additional 25 basis points to 3.50 percent to 3.75 percent at its December 9–10 meeting. If persistently high inflation rates reflect more than just the temporary effects of tariffs, these rate cuts will make it unlikely that the Fed will reach its 2 percent inflation target anytime soon.