Photo of Kevin Warsh from Bloomberg News via the Wall Street Journal

This morning, President Trump ended the suspense over who he would nominate for Chair of the Board of Governors of the Federal Reserve by choosing Kevin Warsh. Warsh was considered one of the four finalists, along with Kevin Hassett, director of the National Economic Council, Fed Governor Christopher Waller, and Rick Rieder, who is an executive at BlackRock, an investment firm.

Warsh had been appointed to the Board of Governors in 2006 by President George W. Bush. Warsh was the youngest person ever appointed to the Board and served from 2006 to 2011. He is generally credited with having been heavily involved in formulating policy during the Great Financial Crisis of 2007–2009. He, along with Fed Chair Ben Bernanke, Fed Governor Donald Kohn, and New York Fed President Timothy Geithner were labeled the “four musketeers” of monetary policy during that period. (We discuss the reasons why during that period Bernanke relied on a small group for policymaking in Money, Banking, and the Financial System, Chapter 13.)

Warsh had been considered an inflation hawk, which would indicate that he would be in favor of keeping the target for the federal funds relatively high until inflation returns to the Fed’s 2 percent annual target and would also want to shrink the Fed’s balance sheet by continuing quantitative tightening (QT). Warsh’s current views are summarized in an op-ed he wrote for the Wall Street Journal in November titled” The Federal Reserve’s Broken Leadership” (a subscription may be required). In that op-ed, Warsh seems to advocate that the Federal Open Market Committee (FOMC) should be lowering its target for the federal funds rate more quickly. Presumably, Warsh’s views on appropriate monetary policy will be discussed at his confirmation hearing.

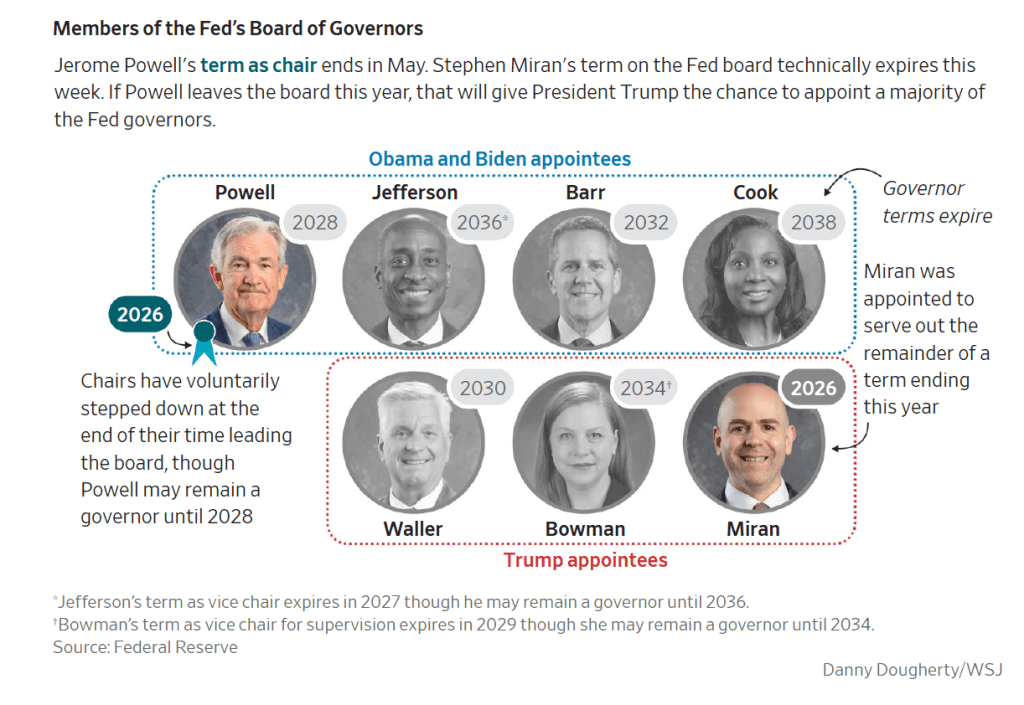

Assuming that Warsh has sufficient support in the Senate to be confirmed there remains the question of which seat on the Board of Governors he will fill. Current Chair Jerome Powell’s term as chair expires on May 15, 2026. If Powell follows recent precedent, he will step down when his term as chair ends, providing an open seat that Warsh can fill. But Powell’s term as a Fed governor doesn’t end until January 31, 2028, so he could chose to remain on the board until that time. If Powell doesn’t step down, Warsh would presumably fill the seat currently occupied by Stephen Miran, whose term technically ends tomorrow (January 31). Miran will likely remain on the board until Warsh is confirmed.

The Wall Street Journal printed a useful graphic showing the current membership of the board. Powell is listed with the Presidents Obama and Biden’s appointees because he was first appointed to the board by President Obama in 2012. But Powell was appointed as Fed chair by President Trump in 2018. He was reappointed as chair by President Biden in 2022. If Powell steps down from the board when Warsh is confirmed and if Miran is appointed to another term, or if he steps down and President Trump appoints someone else to that seat, President Trump will have appointed a majority of board members. It’s worth remembering that 5 Fed District Bank presidents vote at each meeting of the FOMC (all 12 District Bank presidents attend each meeting) and that District Bank presidents are not appointed by the U.S. president.