Photo of Federal Reserve Bank of New York President John Williams from newyorkfed.org

Many economists consider the three most influential people at the Federal Reserve to be the chair of the Board of Governors, the vice-chair of the Board of Governors, and the president of the Federal Reserve Bank of New York. The influence of the New York Fed president is attributable in part to being the only president of a District Bank to be a voting member of the Federal Open Market Committee (FOMC) every year and to the New York Fed being the location of the Open Market Desk, which is charged with implementing monetary policy. The Open Market Desk undertakes open market operations—buying and selling Treasury securities—and conducts repurchase agreements (repos) and reverse repurchase agreements (reverse repos) with the aim of keeping the federal funds rate within the target range specified by the FOMC. (We discuss the mechanics of how monetary policy is conducted in Macroeconomics, Chapter 15, Economics, Chapter 25, and Money, Banking, and the Financial System, Chapter 15.)

John Williams has served as president of the New York Fed since 2018. Given his important role in the formulation and execution of monetary policy, investors pay close attention to his speeches and other public remarks looking for clues about the likely future path of monetary policy. As we noted yesterday in a post discussing the latest jobs report, Fed watchers were uncertain as to whether the FOMC would cut its target for the federal funds rate at its next meeting on December 9–10.

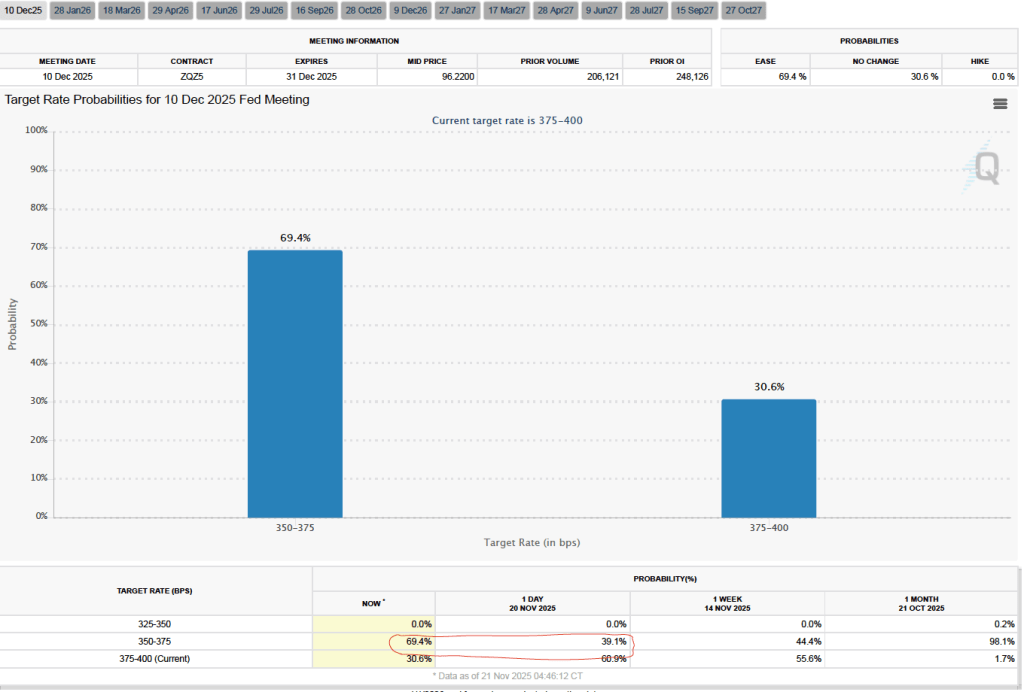

Yesterday morning, investors who buy and sell federal funds futures contracts assigned a probability of 39.6 percent to the FOMC cutting its target range for the federal funds rate by 0.25 percentage point (25 basis points) from 3.75 percent to 4.00 to 3.50 percent to 3.75 percent. Today in a speech delivered at the Central Bank of Chile, John Williams stated that:”I still see room for a further adjustment in the near term to the target range for the federal funds rate to move the stance of policy closer to the range of neutral, thereby maintaining the balance between the achievement of our two goals” of maximum employment and price stability.

Investors interpreted this statement as indicating that Williams would support cutting the target range for the federal funds rate at the December FOMC meeting. Given his position on the committee, it seemed unlikely that Williams would have publicly supported a rate cut unless he believed that a majority of the committee would also support it. As the following figure shows, after the text of Williams’s speech was released this morning, investors in the federal funds futures market increased the probability they assigned to a rate cut to 69.4 percent. That movement in the federal funds futures market was a recognition of the important role the president of the New York Fed plays in formulating monetary policy.