Kevin Hassett, director of the National Economic Council (photo from the AP via the Wall Street Journal)

Jerome Powell’s second term as chair of the Federal Reserve’s Board of Governor ends on May 15,2026. (Although his term as a member of the Board of Governors doesn’t end until January 31, 2028, Fed chairs have typically resigned their seats on the Board at the time that their term as chair ends.) President Trump has been clear that he won’t renominate Powell to a third term. Who will he nominate?

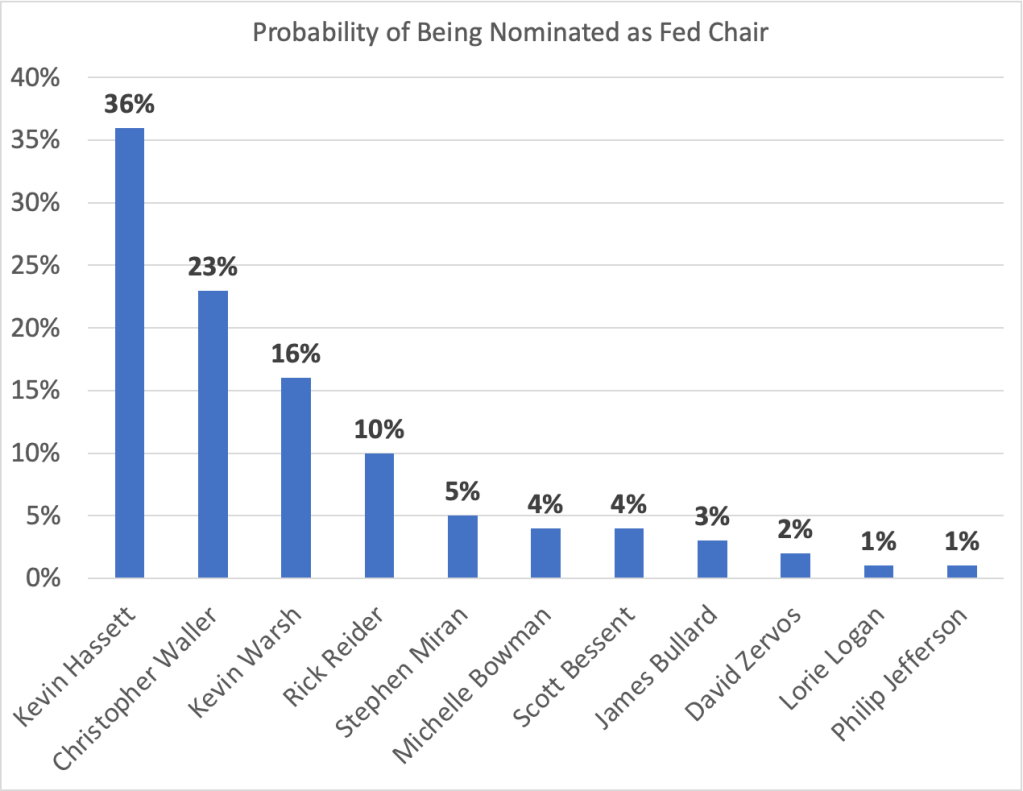

Polymarket is a site on which people can bet on political outcomes, including who President Trump will choose to nominate as Fed chair. The different amounts wagered on each candidate determine the probabilities bettors assign to that candidate being nominated. The following table shows each candidate with a probability of least 1 percent of being nominated as of 5 pm eastern time on October 27.

Kevin Hassett, who is currently the director of the National Economic Council, has the highest probability at 36 percent. Fed Governor Christopher Waller, who was nominated to the Board by President Trump in 2020, is second with a 23 percent probability. Kevin Warsh, who served on the Board from 2006 to 2011, and was important in formulating monetary policy during the financial crisis of 2007–2009, is third with a probability of 16 percent. Rick Reider, an executive at the investment company Black Rock, is unusual among the candidates in not having served in government. Bettors on Polymarket assign him a 10 percent probability of being nominated. Stephen Miran and Michelle Bowman are current members of the Board who were nominated by President Trump.

Scott Bessent is the current Treasury secretary and has indicated that he doesn’t wish to be nominated. James Bullard served as president of the Federal Reserve Bank of St. Louis from 2008 to 2023. David Zervos is an executive at the Jeffries investment bank and in 2009 served as an adviser to the Board of Governors. Lorie Logan is president of the Federal Reserve Bank of Dallas and Philip Jefferson is currently vice chair of the Board of Governors.

Today, Treasury Secretary Scott Bessent indicated that the list of candidates had been reduced to five—although bettors on Polymarket indicate that they believe these five are likely to be the first five candidates listed in the chart above, it appears that Bowman, rather than Miran, is the fifth candidate on Bessent’s lists. Bessent indicated that President Trump will likely make a decision on who he will nominate by the end of the year.