A trader on the New York Stock Exchange listtening to Fed Chair Jerome Powell (from Reuters via the New York Times)

Accounting for movements in the market prices of stocks and bonds is not an exact exercise. Accounts in the Wall Street Journal and on other business web sites often attribute movements in stock and bond prices to the Fed having acted in a way that investors didn’t expect.

The decision by the Fed’s Federal Open Market Committee (FOMC) at its meeting on September 20-21, 2023 to hold its target for the federal funds rate constant at a range of 5.25 percent to 5.50 percent wasn’t a surprise. Fed Chair Jerome Powell had signaled during his press conference on July 26 following the FOMC’s previous meeting that the FOMC was likely to pause further increases in the federal funds rate target. (A transcript of Powell’s July 26 press conference can be found here.)

In advance of the September meeting, some other members of the FOMC had also signaled that the committee was unlikely to increase its target. For instance, an article in the Wall Street Journal quoted Susan Collins, president of the Federal Reserve Bank of Boston, as stating that: “The risk of inflation staying higher for longer must now be weighed against the risk that an overly restrictive stance of monetary policy will lead to a greater slowdown than is needed to restore price stability.” And in a speech in August, Raphael Bostic, president of the Federal Reserve Bank of Atlanta, explained his position on future rate increases: “Based on current dynamics in the macroeconomy, I feel policy is appropriately restrictive. I think we should be cautious and patient and let the restrictive policy continue to influence the economy, lest we risk tightening too much and inflicting unnecessary economic pain.”

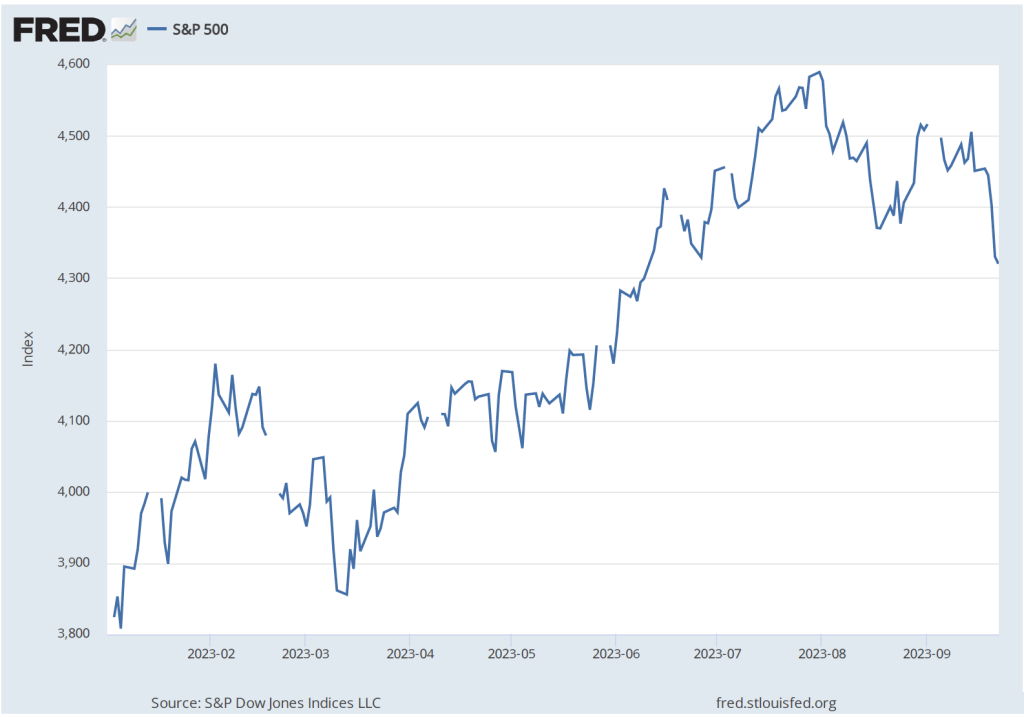

Although it wasn’t a surprise that the FOMCdecided to hold its target for the federal funds rate constant, after the decision was announced, stock and bond prices declined. The following figure shows the S&P 500 index of stock prices. The index declined 2.8 percent from September 19—the day before the FOMC meeting—to September 22—two days after the meeting. (We discuss indexes of stock prices in Macroeconomics, Chapter 6, Section 6.2; Economics, Chapter 8, Section 8.2; and Essentials of Economics, Chapter 8, Section 8.2.)

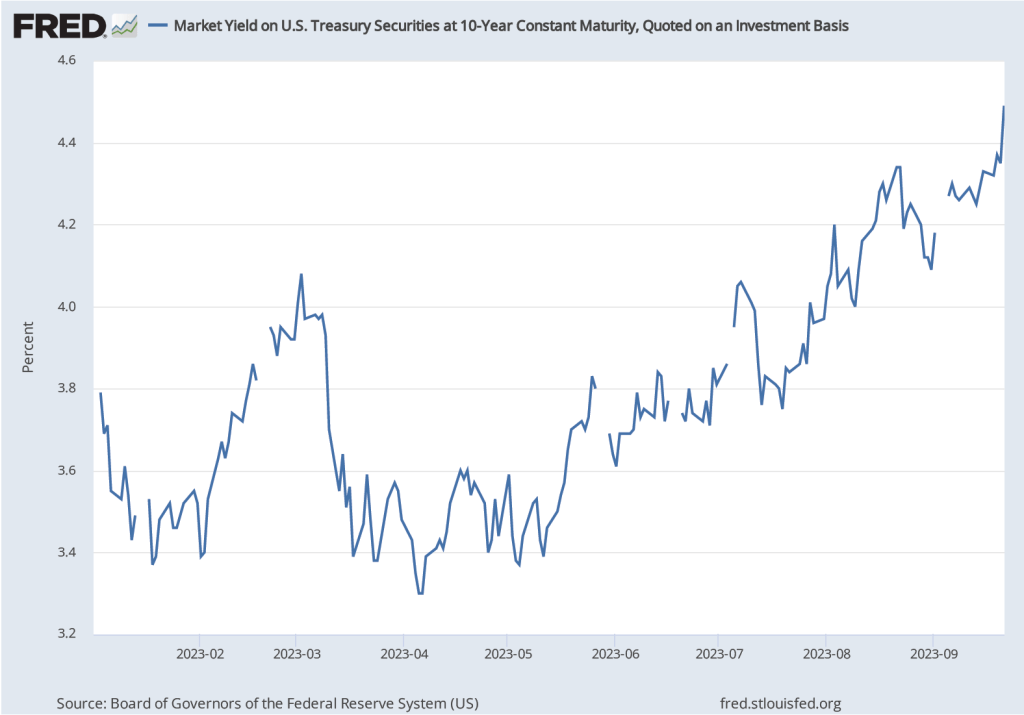

We see a similar pattern in the bond market. Recall that when the price of bonds declines in the bond market, the interest rates—or yields—on the bonds increase. As the following figure shows, the interest rate on the 10-year Treasury note rose from 4.37 percent on September 19 to 4.49 percent on September 21. The 10-year Treasury note plays an important role in the financial system, influencing interest rates on mortgages and corporate bonds. So, the yield on the 10-year Treasury note increasing from 3.3 percent in the spring of 2023 to 4.5 percent following the FOMC meeting has the effect of increasing long-term interest rates throughout the U.S. economy.

What explains the movements in the prices of stocks and bonds following the September FOMC meeting? Investors seem to have been surprised by: 1) what Chair Powell had to say in his news conference following the meeting; and 2) the committee members’ Summary of Economic Projections (SEP), which was released after the meeting.

Powell’s remarks were interpreted as indicating that the FOMC was likely to increase its target for the federal funds rate at least once more in 2023 and was unlikely to cut its target before late 2024. For instance, in response to a question Powell said: “We need policy to be restrictive so that we can get inflation down to target. Okay. And we’re going to need that to remain to be the case for some time.” Investors often disagree in their interpretations of what a Fed chair says. Fed chairs don’t act unilaterally because the 12 voting members of the FOMC decide on the target for the federal funds rate. So chairs tend to speak cautiously about future policy. Still, their seemed to be a consensus among investors that Powell was indicating that Fed policy would be more restrictive (or contractionary) than had been anticipated prior to the meeting.

The FOMC releases the SEP four times per year. The most recent SEP before the September meeting was from the June meeting. The table below shows the median of the projections, or forecasts, of key economic variables made by the members of the FOMC at the June meeting. Note the second row from the bottom, which shows members’ median forecast of the federal funds rate.

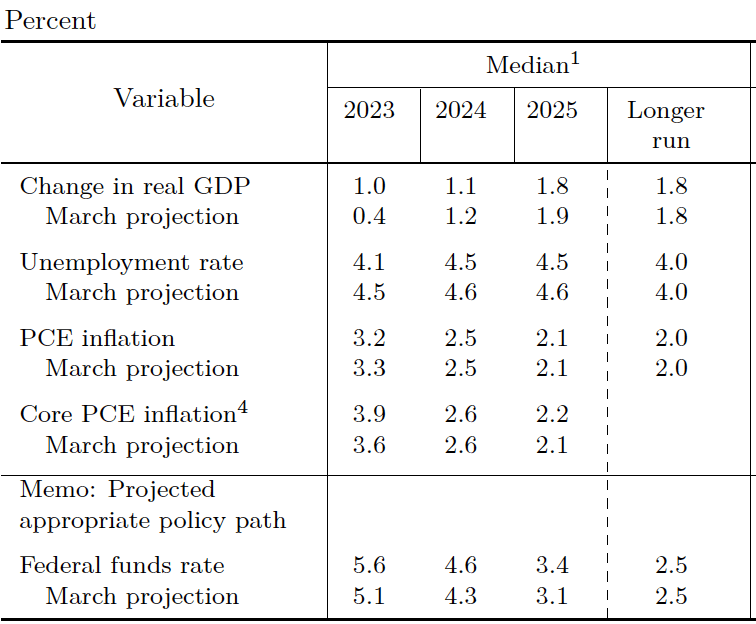

The following table shows the median values of members’ forecast at the September meeting. Look again at the next to last row. The members’ forecast of the federal funds rate at the end of 2023 was unchanged. But their forecasts for the federal funds rate at the end of 2024 and 2025 were both 0.50 percent higher.

Why were members of the FOMC signaling that they expected to hold their target for the federal funds rate higher for a longer period? The other economic projections in the tables provide a clue. In September, the members expected that real GDP growth would be higher and the unemployment rate would be lower than they had expected in June. Stronger economic growth and a tighter labor market seemed likely to require them to maintain a contractionary monetary policy for a longer period if the inflation rate was to return to their 2.0 percent target. Note that the members didn’t expect that the inflation rate would return to their target until 2026.