Image generated by ChatGPT

Ordinarily, on the first Friday of a month the Bureau of Labor Statistics (BLS) releases its “Employment Situation” report (often called the “jobs report”) containing data on the labor market for the previous month. There was no jobs report today (October 3) because of the federal government shutdown. (We discuss the shutdown in this blog post.)

The jobs report has two estimates of the change in employment during the month: one estimate from the establishment survey, often referred to as the payroll survey, and one from the household survey. As we discuss in Macroeconomics, Chapter 9, Section 9.1 (Economics, Chapter 19, Section 19.1), many economists and Federal Reserve policymakers believe that employment data from the establishment survey provide a more accurate indicator of the state of the labor market than do the household survey’s employment and unemployment data.

Economists surveyed had forecast that today’s payroll survey would have shown a net increase of 51,000 jobs in September. When the shutdown ends, the BLS will publish its jobs report for September. Until that happens, employment data collected by the private payroll processing firm Automatic Data Processing (ADP) provides an alternative measure of the state of the labor market. ADP data covers only about 20 percent of total private nonfarm employment, but ADP attempts to make its data more consistent with BLS data by weighting its data to reflect the industry weights used in the BLS data.

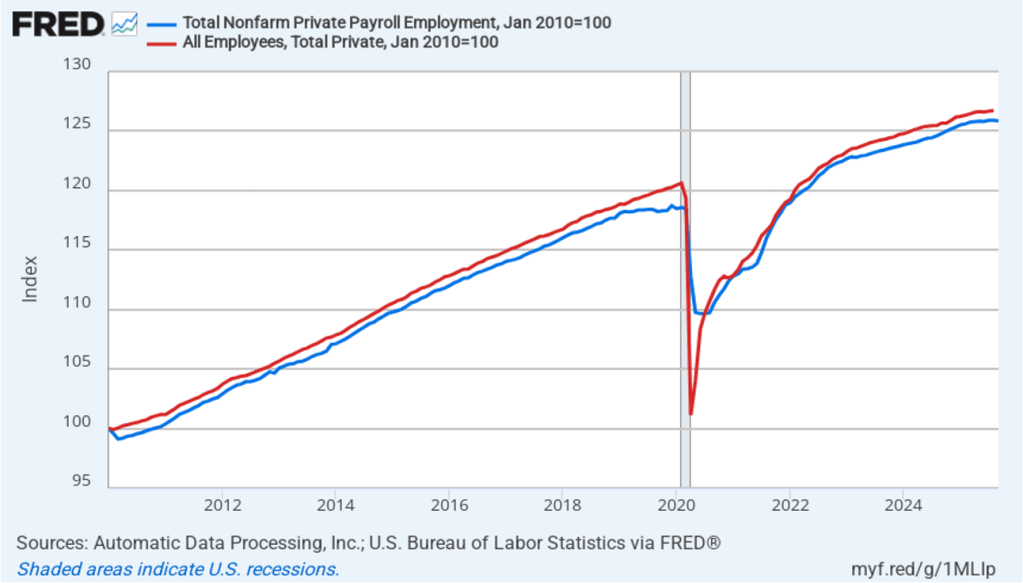

How closely does ADP employment data track BLS payroll data? The following figure shows the ADP employment series (blue line) and the BLS payroll employment data (red line) with the values for both series set equal to 100 in January 2010. The two series track well with the exception of April and May 2020 during the worst of the pandemic. The BLS series shows a much larger decline in employment during those months than does the ADP series.

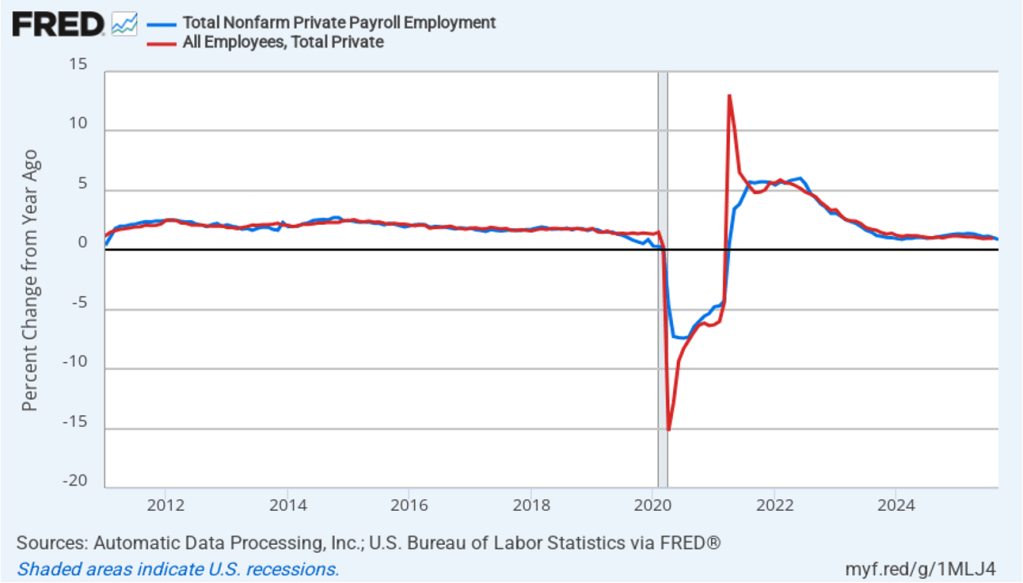

The next figure shows the 12-month percentage changes in the two series. Again, the series track fairly well except for the worst months of the pandemic and—strikingly—the month of April 2021 during the economic recovery. In that month, the ADP series increases by only 0.6 percent, while the BLS series soars by 13.1 percent.

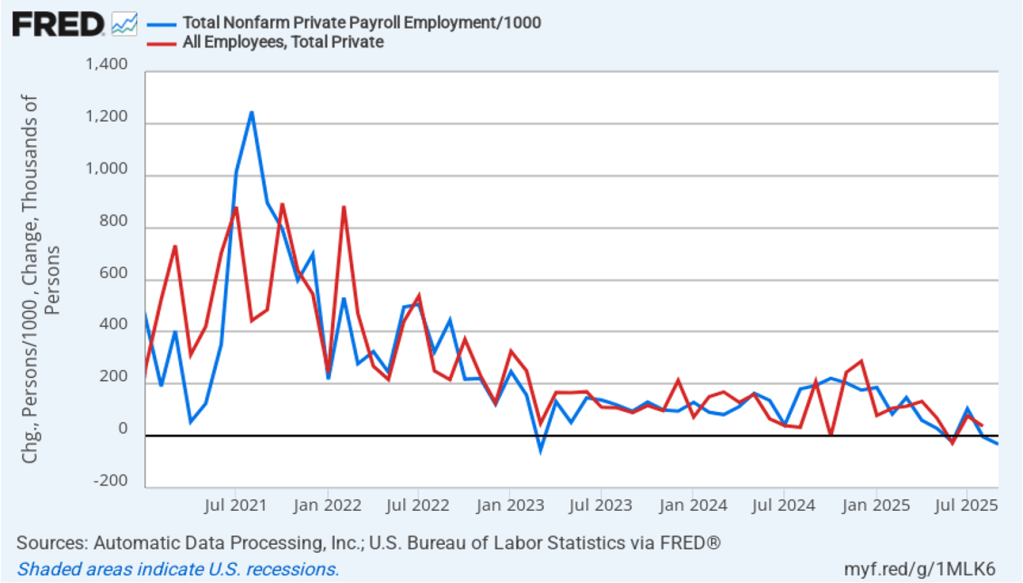

Finally, economists, policymakers, and investors usually focus on the change in payroll employment from the previous month—that is, the net change in jobs—shown in the BLS jobs report. The following figure shows the net change in jobs in the two series, starting in January 2021 to avoid some of the largest fluctuations during the pandemic.

Again, the two series track fairly well, although the BLS data is more volatile. The ADP data show a net decline of 32,000 jobs in September. As noted earlier, economists surveyed were expecting a net increase of 51,000 jobs. During the months from May through August, BLS data show an average monthly net increase in jobs of only 39,250. So, whether the BLS number will turn out to be closer to the ADP number or to the number economists had forecast, the message would be the same: Since May, employment has grown only slowly. And, of course, as we’ve seen this year, whatever the BLS’s initial employment estimate for September turns out to be, it’s likely to be subject to significant revision in coming months. (We discuss why BLS revisions to its initial employment estimates can be substantial in this post.)