Image created by ChatGTP

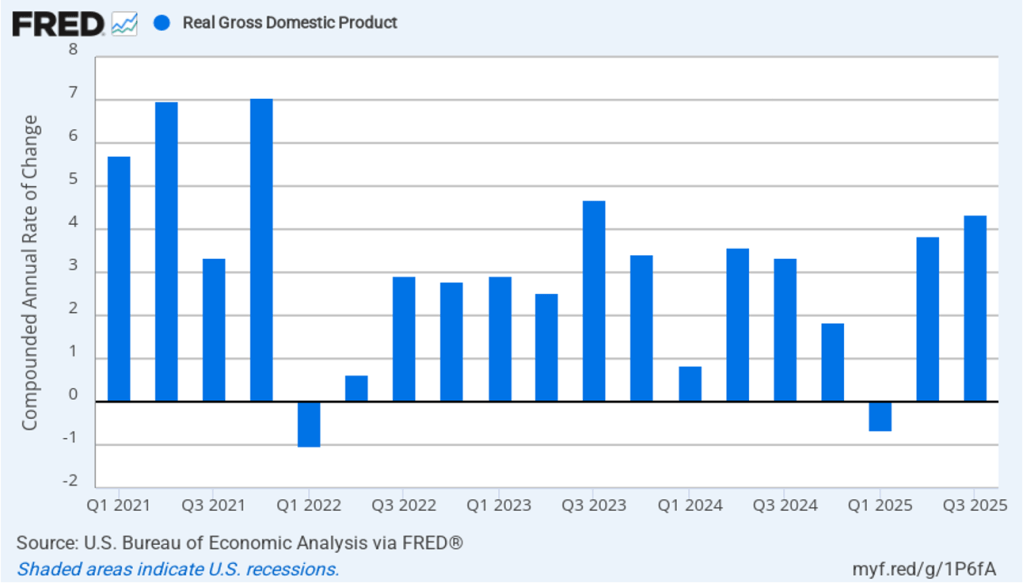

This morning (December 23), the Bureau of Economic Analysis (BEA) released its initial estimate of real GDP for the third quarter of 2025. (The report can be found here.) The BEA estimates that real GDP increased in the third quarter by 4.3 percent measured at an annual rate. Economists surveyed by FactSet had forecast a 3.2 percent increase. Real GDP experienced strong growth for the second quarter in a row, following an estimated 0.6 percent decline in the first quarter of 2025. The following figure shows the estimated rates of GDP growth in each quarter beginning with the first quarter of 2021.

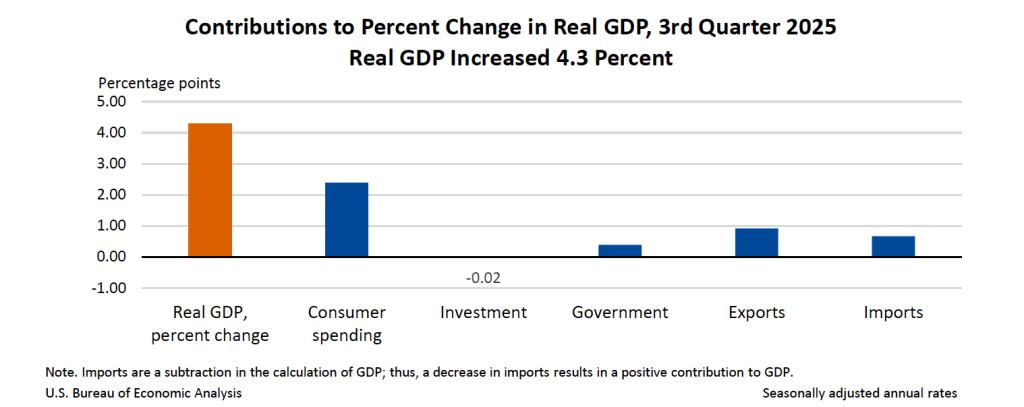

As the following figure—taken from the BEA report—shows, the growth in consumer spending in the third quarter was the most important factor contributing to the increase in real GDP. Increases in net exports and in government spending also contributed to GDP growth, while investment spending declined.

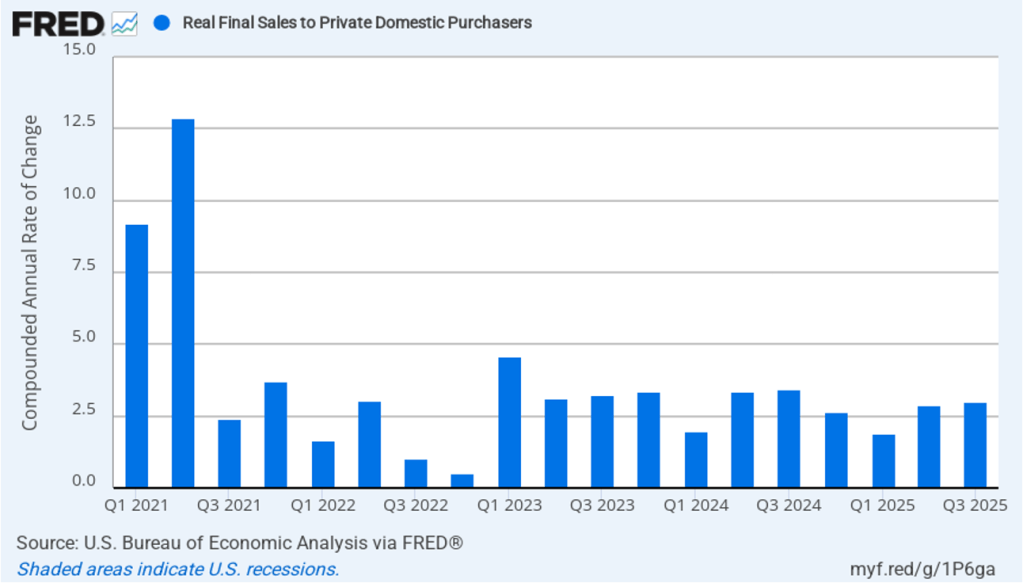

To better gauge the state of the economy, policymakers often prefer to strip out the effects of imports, inventory investment, and government purchases—which can be volatile—by looking at real final sales to private domestic purchasers, which includes only spending by U.S. households and firms on domestic production. As the following figure shows, real final sales to domestic purchasers increased by 3.0 percent at an annual rate in the third quarter, which was below the 4.3 percent increase in real GDP but still well above the U.S. economy’s expected long-run annual growth rate of 1.8 percent. Note also that real final sales to private domestic purchasers grew by 1.9 percent in the first quarter, during which real GDP declined. So this measure of output indicates solid growth during the first three quarters of the year.

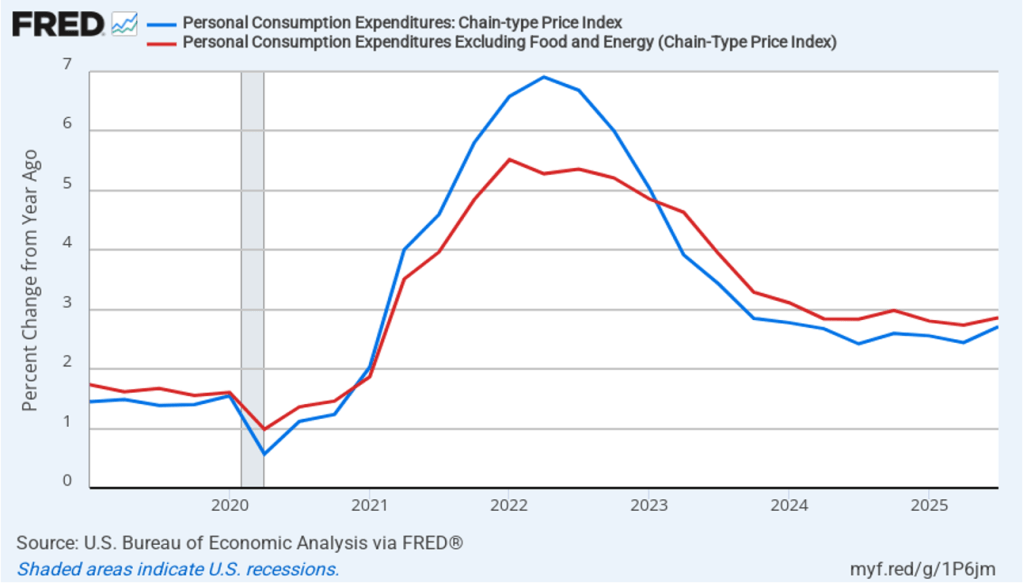

The BEA report this morning included quarterly data on the personal consumption expenditures (PCE) price index. The Fed relies on annual changes in the PCE price index to evaluate whether it’s meeting its 2 percent annual inflation target. The following figure shows headline PCE inflation (the blue line) and core PCE inflation (the red line)—which excludes energy and food prices—for the period since the first quarter of 2019, with inflation measured as the percentage change in the PCE from the same quarter in the previous year. In the third quarter, headline PCE inflation was 2.7 percent, up from 2.4 percent in the second quarter. Core PCE inflation in the third quarter was 2.9 percent, up from 2.7 percent in the second quarter. Both headline PCE inflation and core PCE inflation remained well above the Fed’s 2 percent annual inflation target.

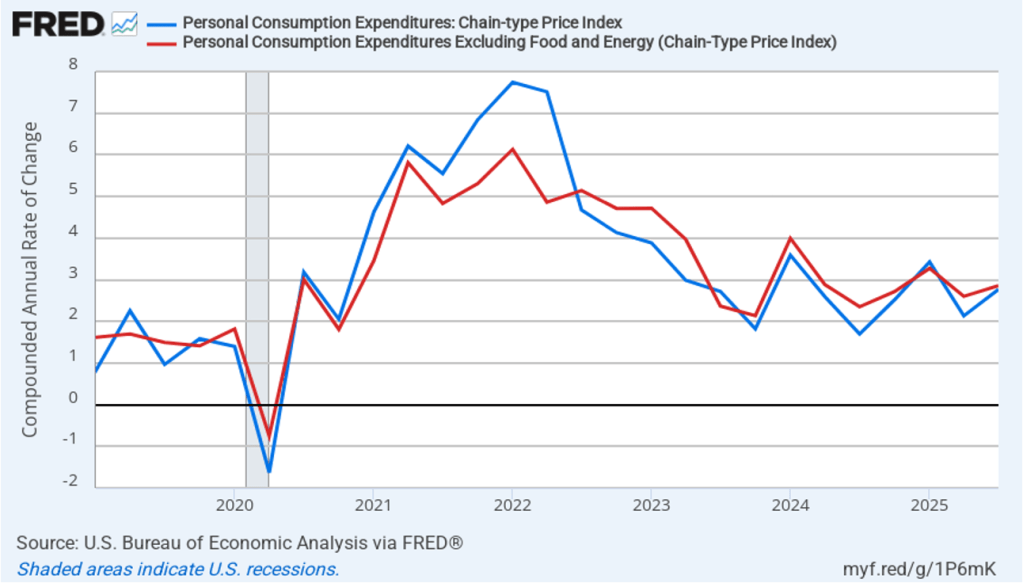

The following figure shows quarterly PCE inflation and quarterly core PCE inflation calculated by compounding the current quarter’s rate over an entire year. Measured this way, headline PCE inflation increased to 2.8 percent in the third quarter of 2025, up from to 2.1 percent in the second quarter. Core PCE inflation increased to 2.9 percent in the third quarter of 2025 from 2.6 percent in the second quarter. Measured this way, both core and headline PCE inflation were well above the Fed’s target.

The relatively strong growth and above-target inflation data from today’s report contrast with last week’s mixed but somewhat weak employment data (which we discuss here) and CPI data that showed inflation significantly slowing (which we discuss here). Note, though, that the employment data were affected by the unusually large decline in federal government employment and the CPI report relied on incomplete data. And, of course, both the employment and GDP data are subject to revision.

In guiding monetary policy, the Federal Reserve’s policymaking Federal Open Market Committee (FOMC) will look for further indications as to whether today’s data showing strong real GDP growth and inflation stuck above the Fed’s target or last week’s data showing both employment growth and inflation slowing are giving a more accurate picture of the state of economy. The FOMC meets next on January 27–28.