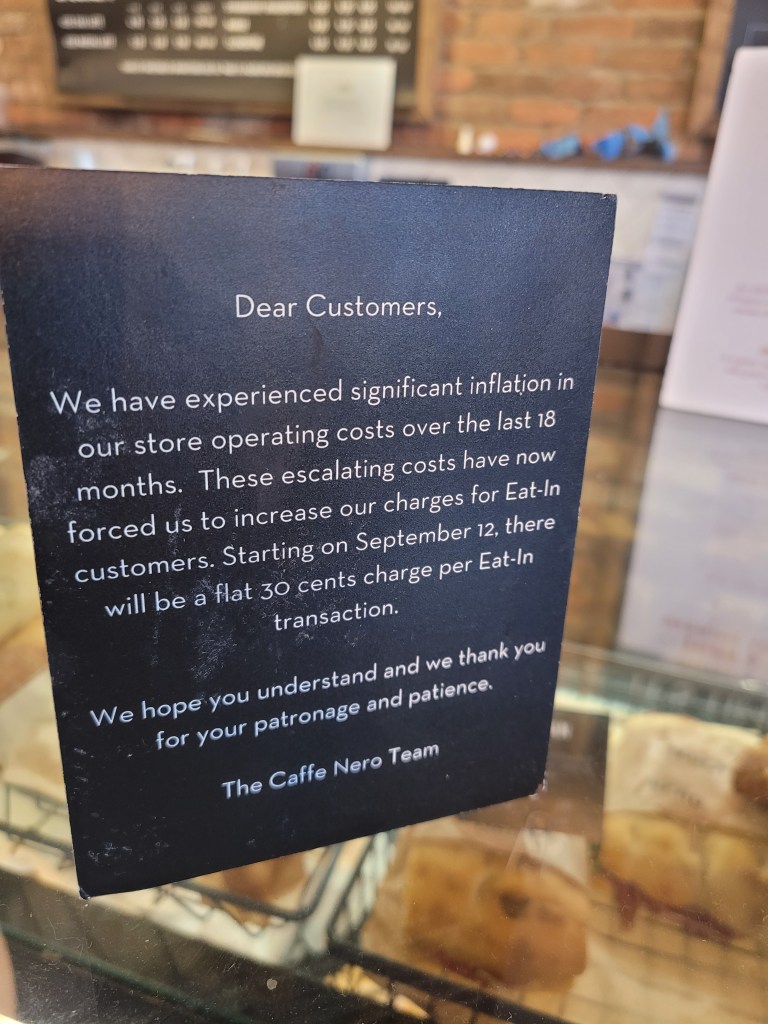

Photo courtsey of Lena Buonanno.

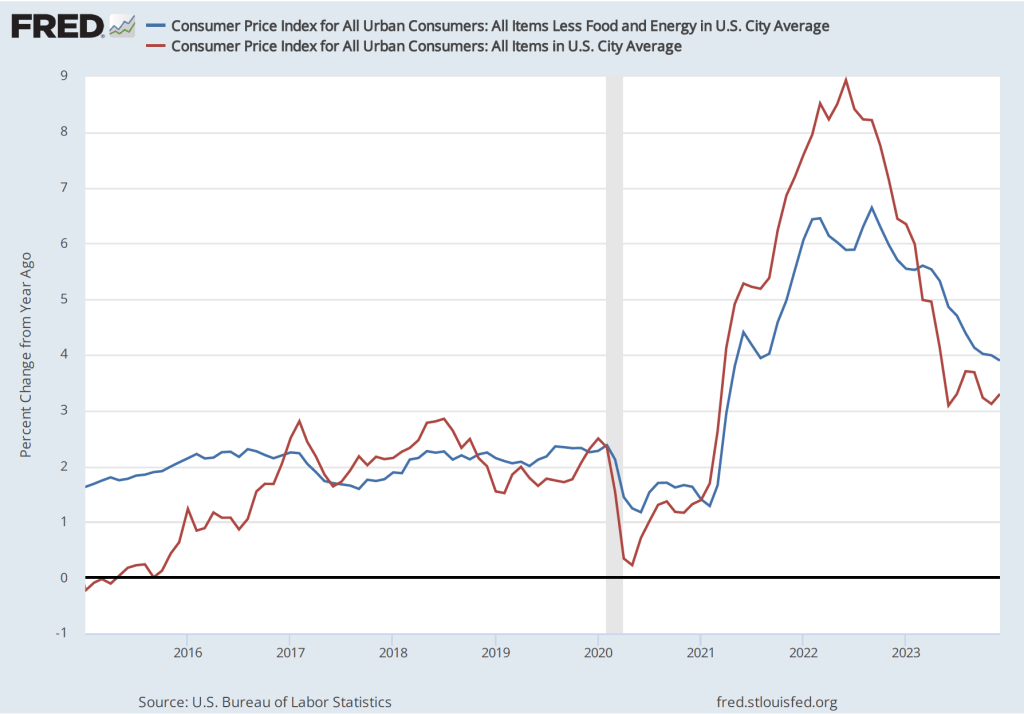

On the morning of January 11, 2024, the Bureau of Labor Statistics released its report on changes in consumer prices during December 2023. The report indicated that over the period from December 2022 to December 2023, the Consumer Price Index (CPI) increased by 3.4 percent (often referred to as year-over-year inflation). “Core” CPI, which excludes prices for food and energy, increased by 3.9 percent. The following figure shows the year-over-year inflation rate since Januar 2015, as measured using the CPI and core CPI.

This report was consistent with other recent reports on the CPI and on the personal consumption expenditures (PCE) price index—the measure the Fed uses to gauge whether it is achieving its target of 2 percent annual inflation—in showing that inflation has declined substantially from its peak in mid-2022 but is still above the Fed’s target.

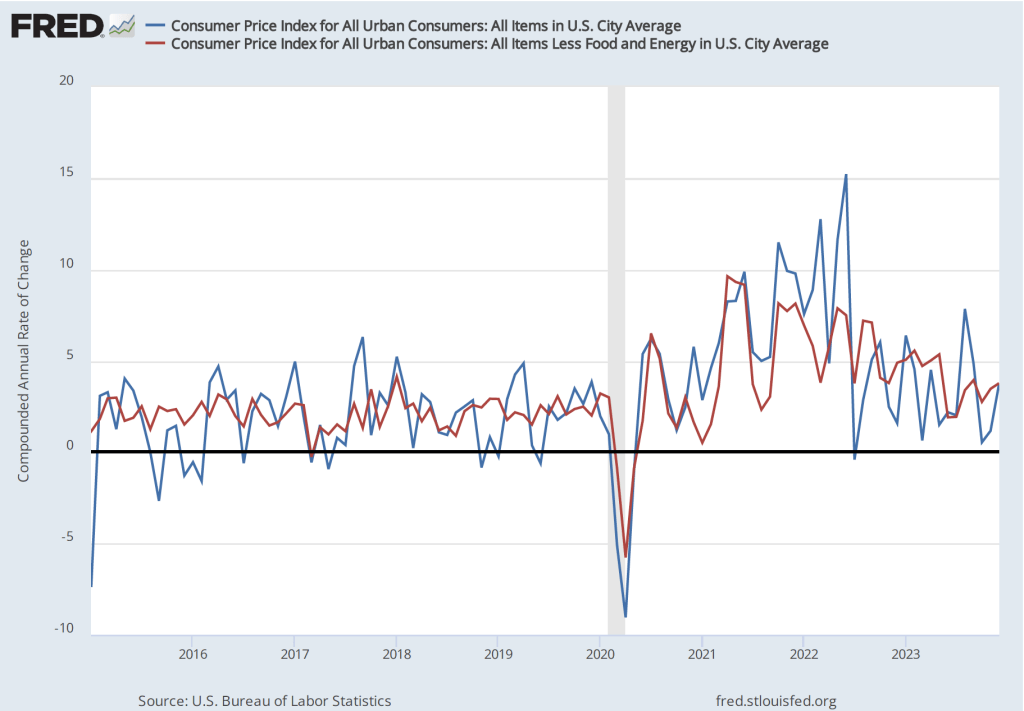

We get a similar result if we look at the 1-month inflation rate—that is the annual inflation rate calculated by compounding the current month’s rate over an entire year—as the following figure shows. The 1-month CPI inflation rate has moved erratically but has generally trended down. The 1-month core CPi inflation rate has moved less erratically, making the downward trend since mid-2022 clearer.

The headline on the Wall Street Journal article discussing this BLS report was: “Inflation Edged Up in December After Rapid Cooling Most of 2023.” The headline reflected the reaction of Wall Street investors who had hoped that the report would unambiguously show further slowing in inflation.

Overall, the report was middling: It didn’t show a significant acceleration in inflation at the end of 2023 but neither did it show a signficant slowing of inflation. At its next meeting on January 30-31, the Fed’s Federal Open Market Committee (FOMC) is expected to keep its target for the federal funds rate unchanged. There doesn’t appear to be anything in this inflation report that would be likely to affect the committee’s decision.